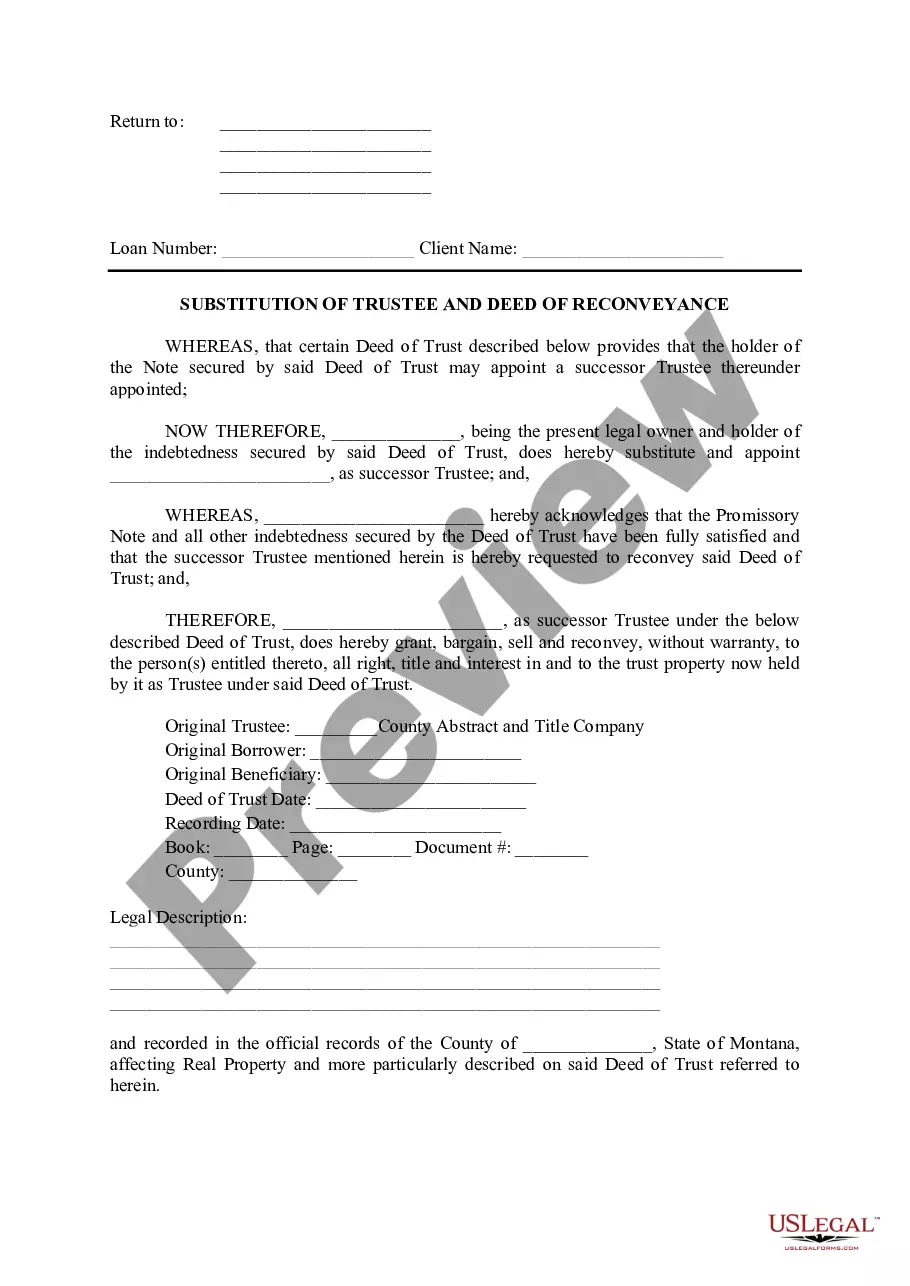

Montana Substitution of Trustee and Deed of

Description

How to fill out Montana Substitution Of Trustee And Deed Of?

Avoid pricey attorneys and find the Montana Substitution of Trustee and Deed of you want at a reasonable price on the US Legal Forms site. Use our simple categories functionality to find and obtain legal and tax documents. Read their descriptions and preview them before downloading. Moreover, US Legal Forms enables customers with step-by-step instructions on how to download and complete each and every form.

US Legal Forms customers basically must log in and obtain the particular form they need to their My Forms tab. Those, who have not got a subscription yet need to follow the tips listed below:

- Make sure the Montana Substitution of Trustee and Deed of is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you are sure the template suits you, click on Buy Now.

- If the form is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to obtain the form in PDF or DOCX.

- Click Download and find your template in the My Forms tab. Feel free to save the template to the device or print it out.

After downloading, you may fill out the Montana Substitution of Trustee and Deed of manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

A substitution of trustee is a legal document that provides public notice regarding a foreclosure. California is one of several states that allows for mortgage foreclosure through a private transaction called a trustee's sale.

The deed can be re-written to reflect changes, but it needs the consent of both parties. If you want to make substantial changes to the deed, it's typically best to get a new one written. If changes are only minor, you can enter a deed of variation.

A substitution of trustee is a legal document that provides public notice regarding a foreclosure.A substitution of trustee under a trust deed is a legal document that allows the mortgage lender to change the person or business entity that will carry out the private trustee's foreclosure sale.

The trustee will then issue a reconveyance deed, which gives the legal title of the property to you.Instead, the original trustee, or sometimes the loan servicing company, will appoint a new Substitute Trustee to handle the foreclosure. To do this, they must file an Appointment of Substitute Trustees.

Some use deeds of trust instead, which are similar documents, but they have some fundamental differences.With a deed of trust, however, the lender must act through a go-between called the trustee. The beneficiary and the trustee can't be the same person or entity.

A document known as a substitution of trustee and full reconveyance identifies the person who has the authority to reconvey the property and remove the lien.Once the document is registered, it establishes the borrower as the sole owner of the property, which is now free and clear of the previous mortgage.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

A mortgage holder issues a deed of reconveyance to indicate that the borrower has been released from the mortgage debt. The deed transfers the property title from the lender, also called the beneficiary, to the borrower. This document is most commonly used when a mortgage has been paid in full.

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.