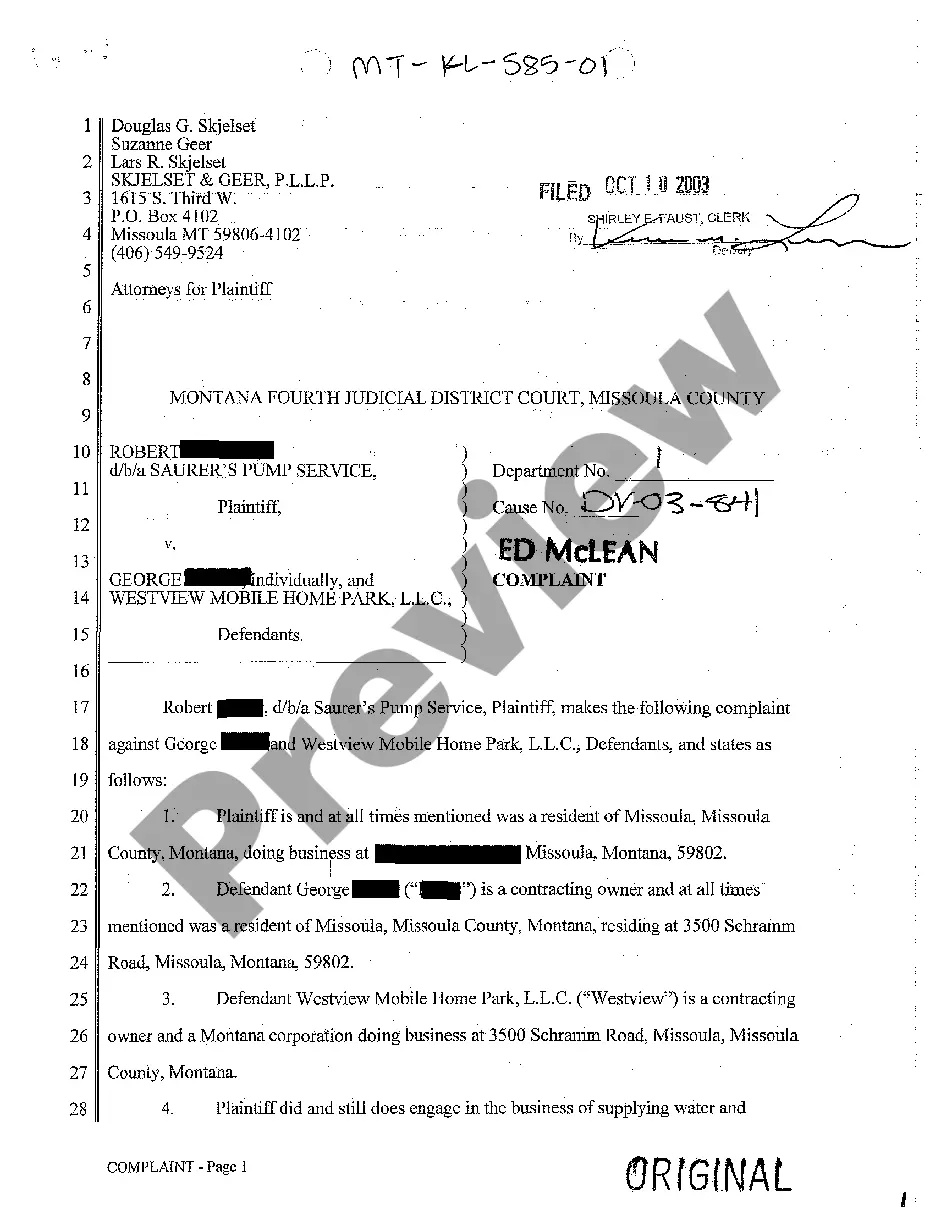

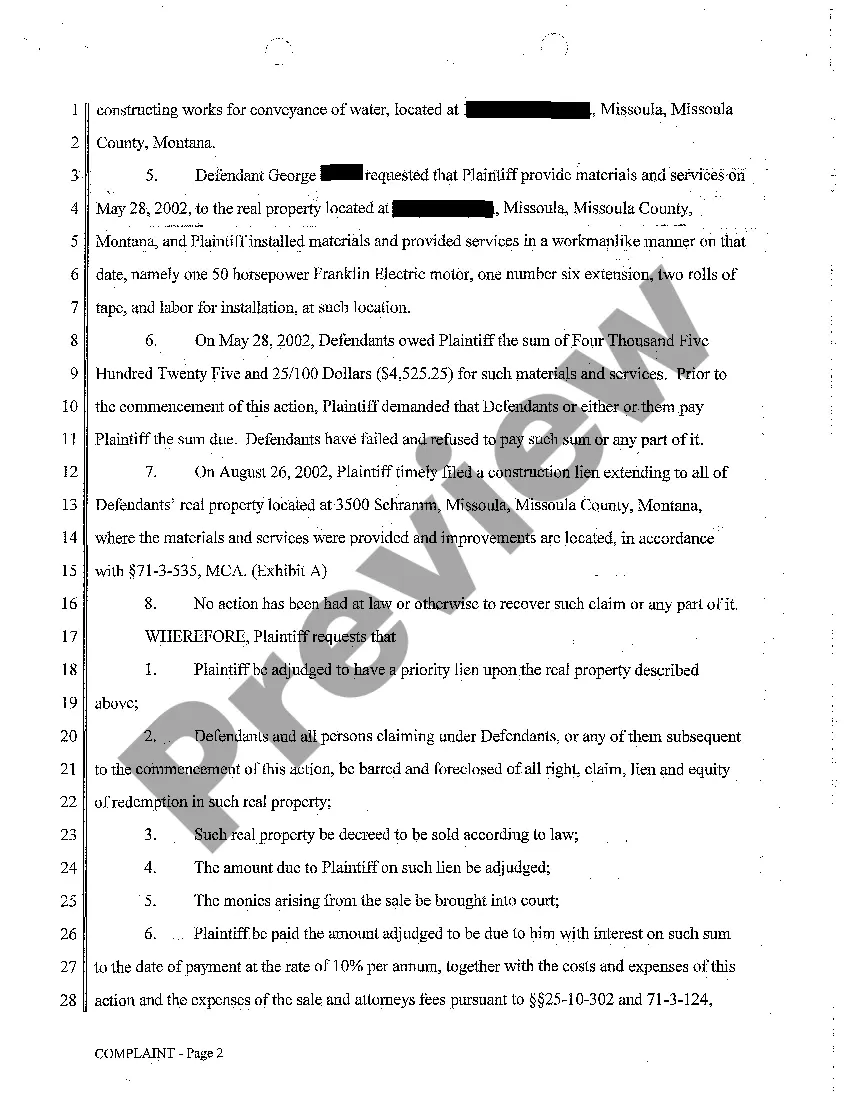

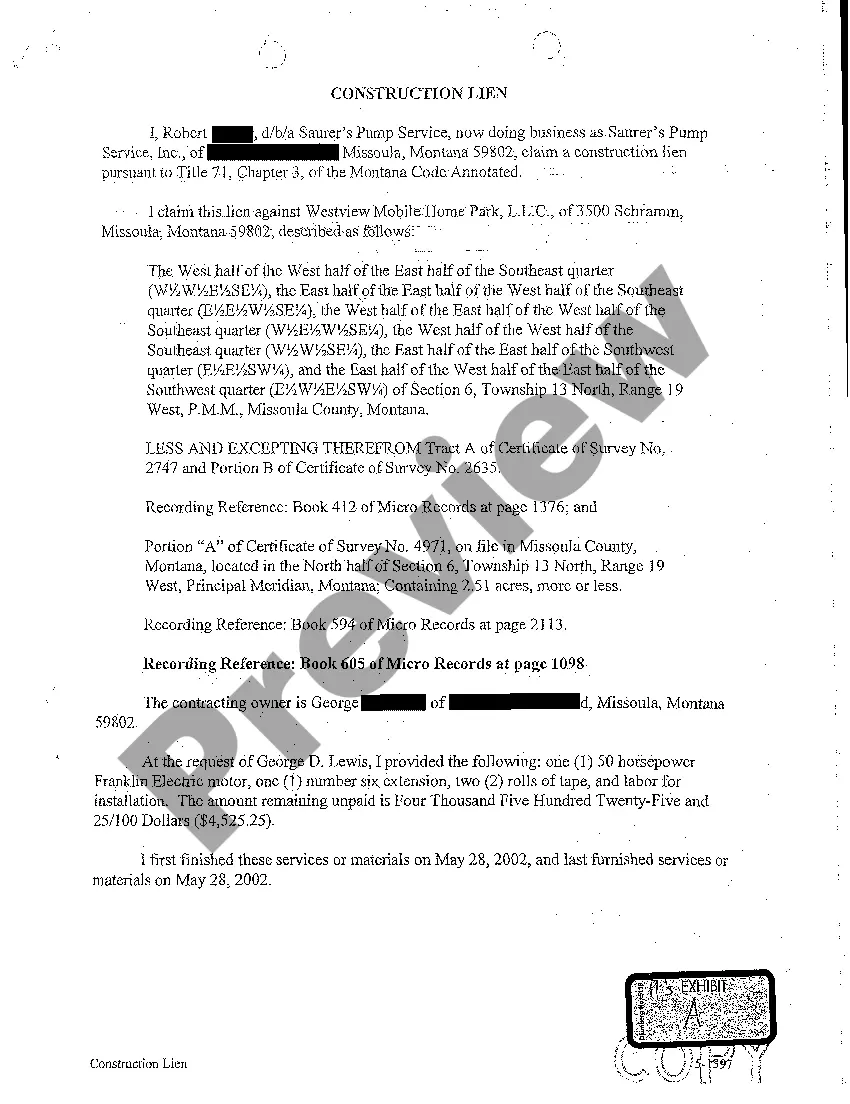

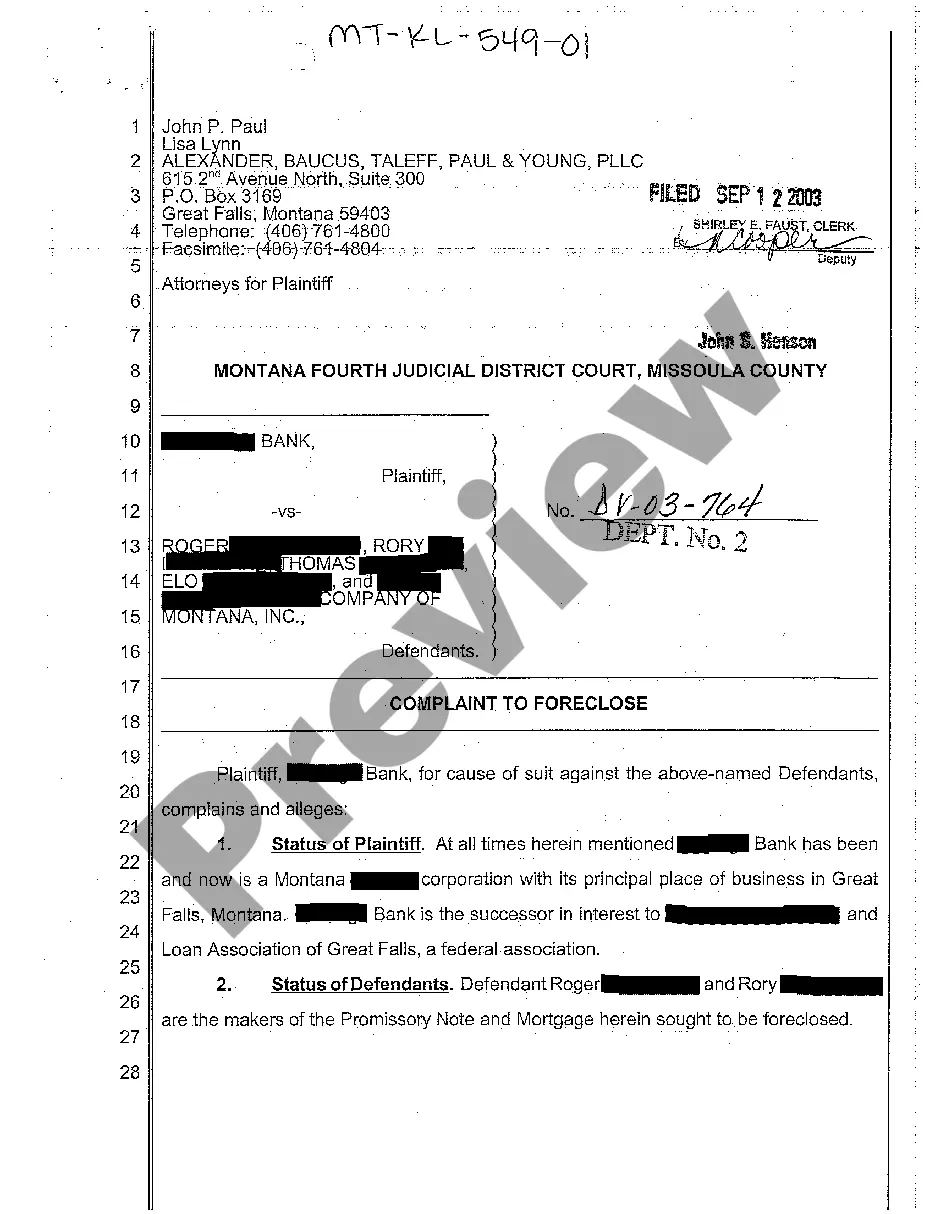

Montana Complaint for Foreclosure

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Montana Complaint For Foreclosure?

Obtain a printable Montana Complaint for Foreclosure with just a few clicks in the most comprehensive collection of legal electronic documents. Locate, download, and print professionally prepared and certified samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax documents for US citizens and residents online since 1997.

Clients with a subscription must Log In directly to their US Legal Forms account, download the Montana Complaint for Foreclosure, and find it saved in the My documents section. Users without a subscription should follow the guidelines listed below.

After you have downloaded your Montana Complaint for Foreclosure, you can complete it in any online editor or print it out and fill it out manually. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Ensure your template complies with your state’s regulations.

- If available, review the form’s description for additional information.

- If available, examine the form to explore more details.

- When you are confident the template is suitable for you, click on Buy Now.

- Create a personal account.

- Select a plan.

- Make payment via PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

Foreclosure Process OverviewMontana foreclosures are conducted either in court or out of court, depending on the existence of a power-of-sale clause in the mortgage or deed of trust. The total foreclosure process typically takes about 5-6 months.

Home mortgagesthough generally recourseare non-recourse in 12 states: Alaska, Arizona, California, Connecticut, Idaho, Minnesota, North Carolina, North Dakota, Oregon, Texas, Utah and Washington.

The following states have anti-deficiency laws: Alaska, Arizona, California, Connecticut, Hawaii Iowa, Minnesota, Montana, Nevada, New Mexico, North Carolina, North Dakota, Oregon, Washington, and Wisconsin.

In Montana, lenders may foreclose on deeds of trusts or mortgages in default using either a judicial or non-judicial foreclosure process. In judicial foreclosure, a court decrees the amount of the borrowers debt and gives him or her a short time to pay.

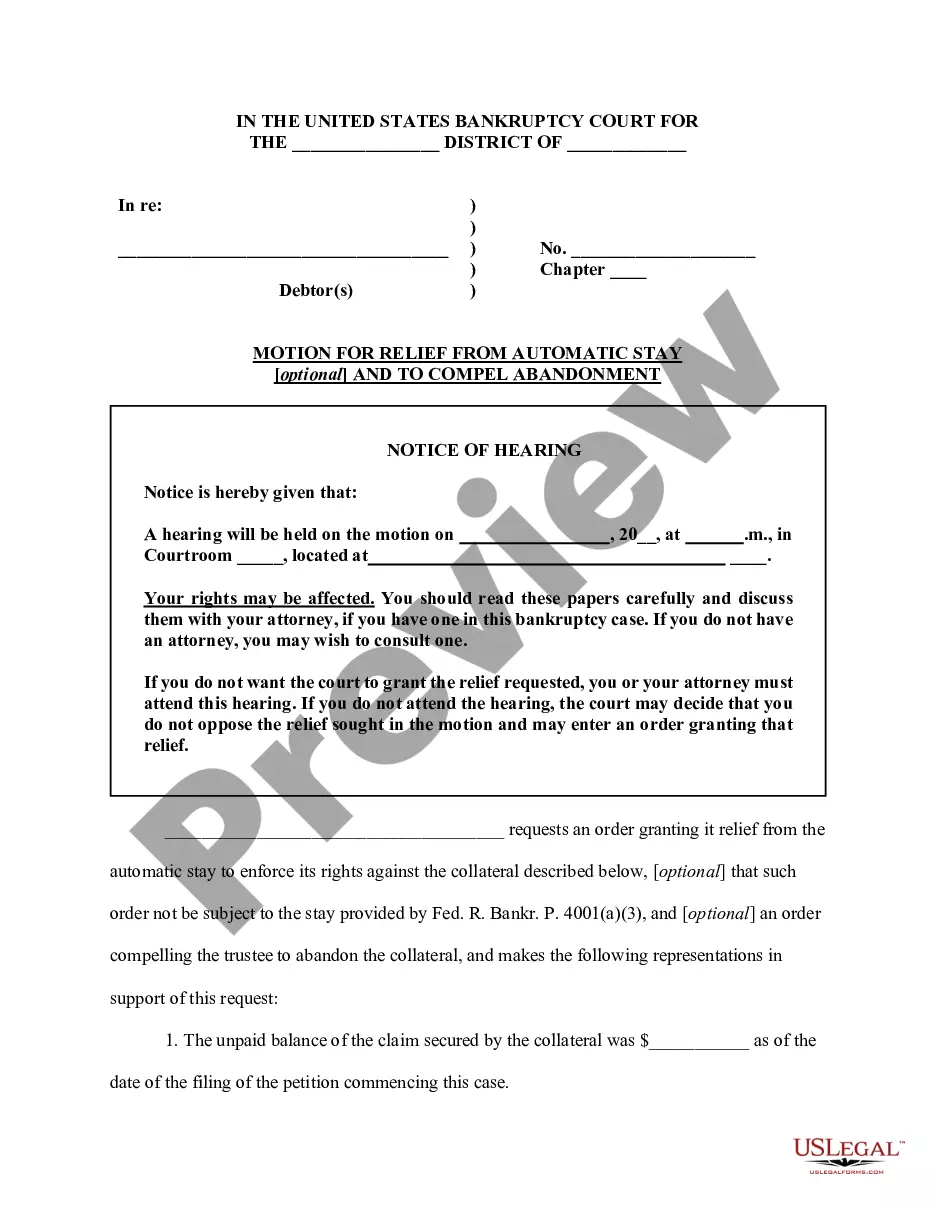

To contest a judicial foreclosure, you have to file a written answer to the complaint (the lawsuit). You'll need to present your defenses and explain the reasons why the lender shouldn't be able to foreclose. You might need to defend yourself against a motion for summary judgment and at trial.

Based on information compiled by the National Consumer Law Center (NCLC), at least 10 states can be generally classified as non-recourse for residential mortgages: Alaska, Arizona, California, Hawaii, Minnesota, Montana, North Dakota, Oklahoma, Oregon, and Washington.

Negotiate With Your Lender. If you are having financial difficulties, the worst thing that you can do is bury your head in the sand. Request a Forbearance. Modify Your Loan. Make a Claim. Get a Housing Counselor. Declare Bankruptcy. Use A Foreclosure Defense Strategy. Make Them Produce The Not.