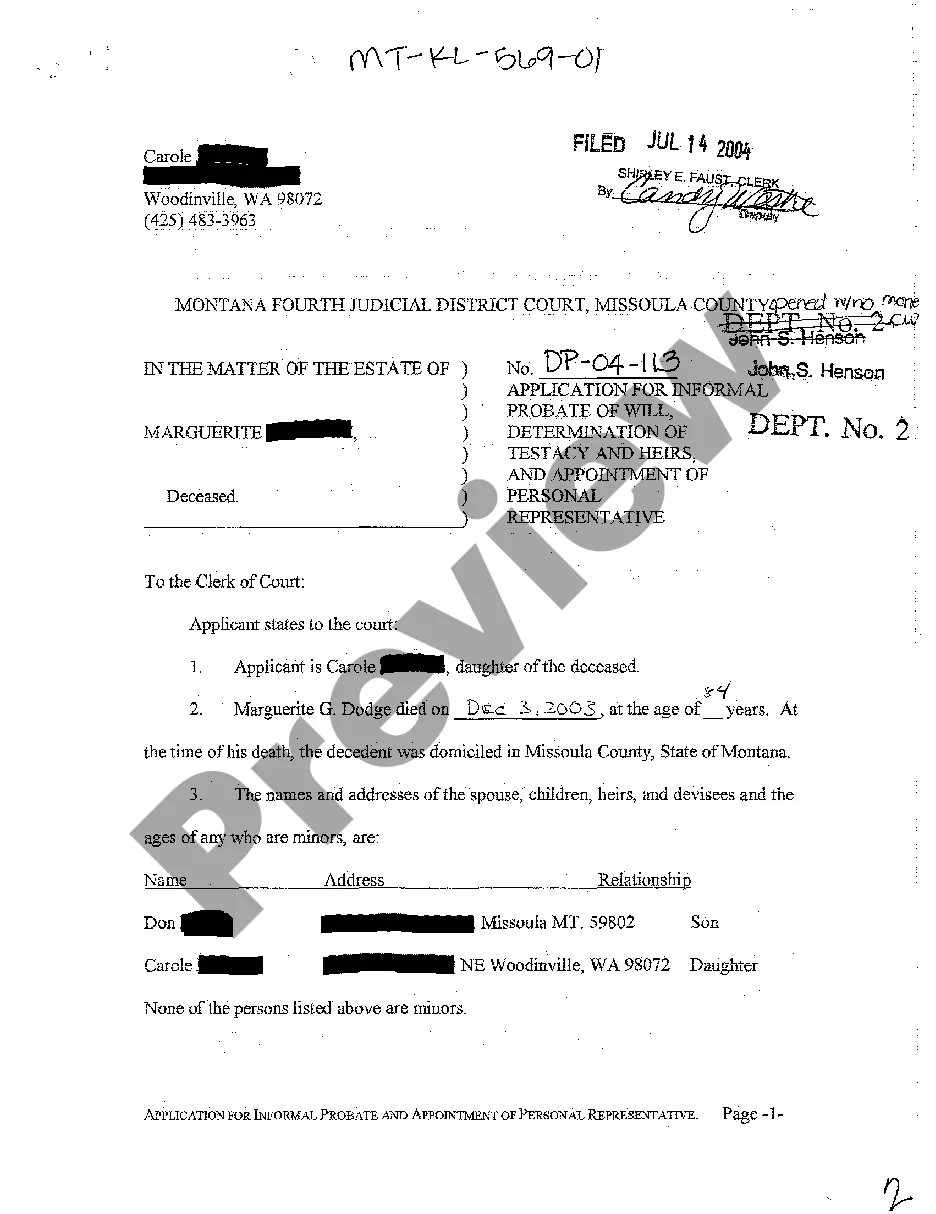

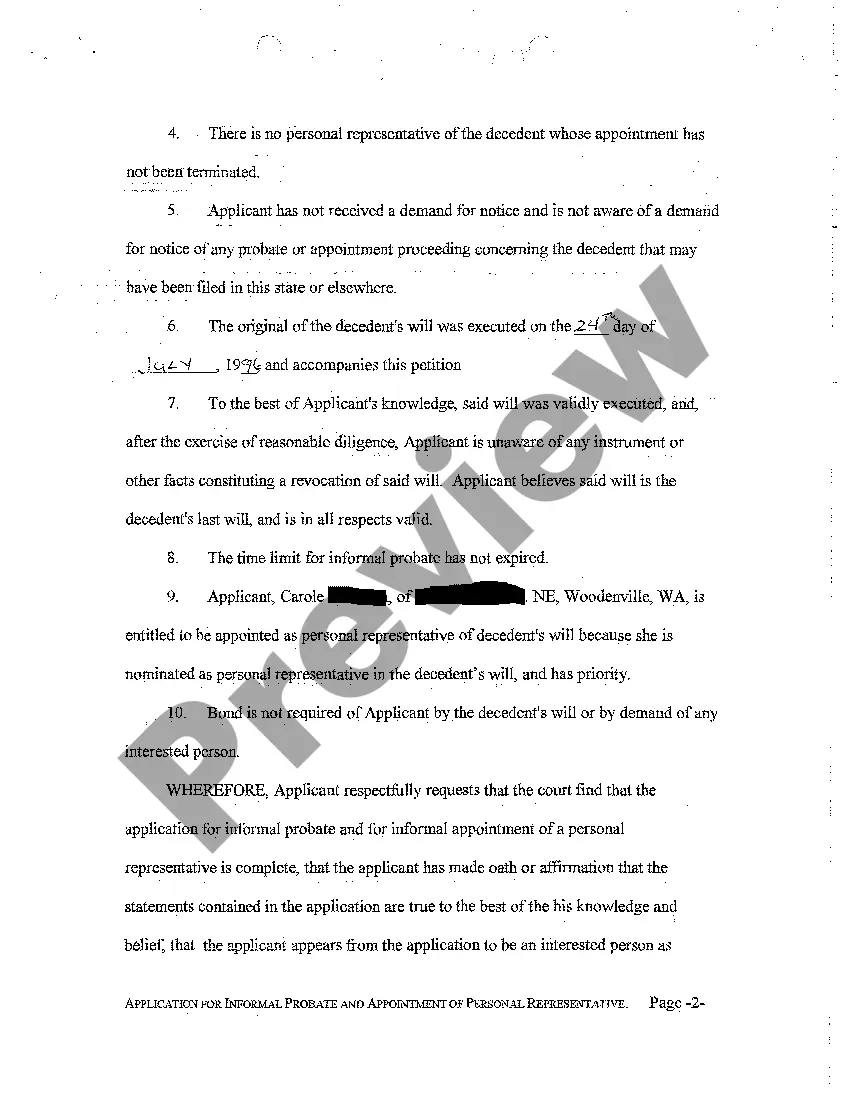

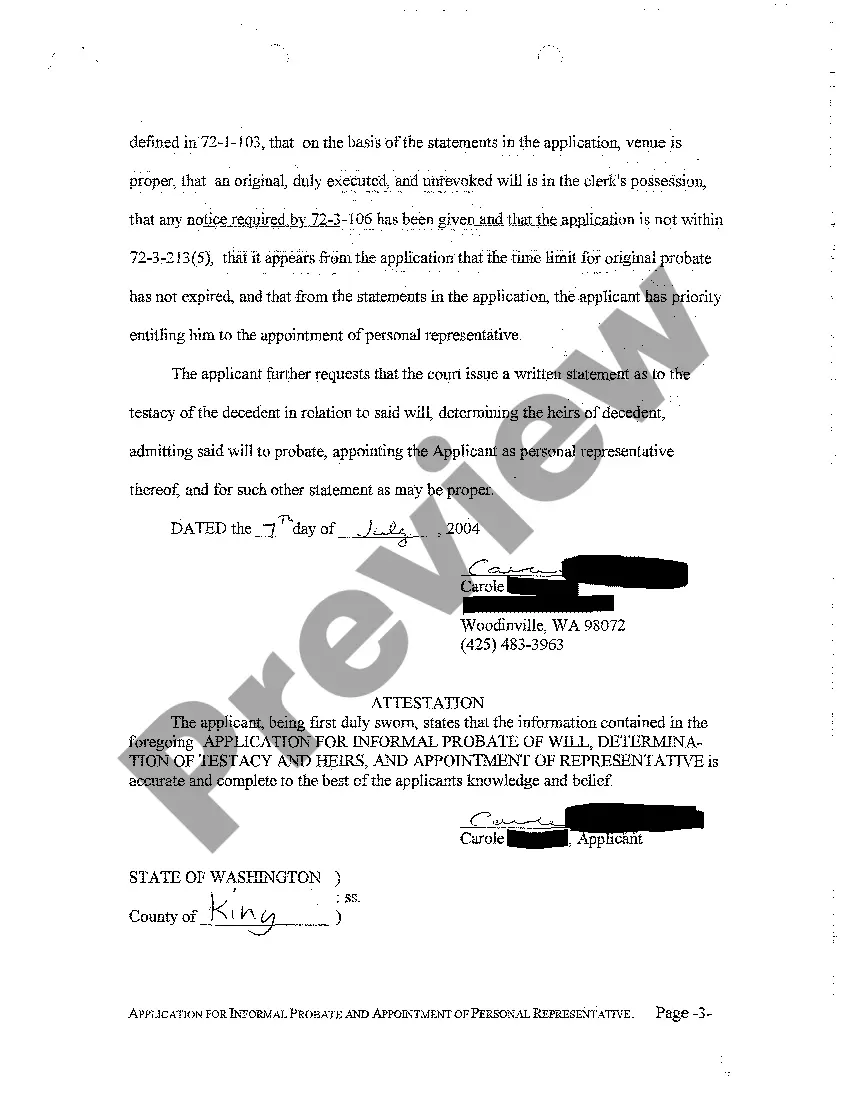

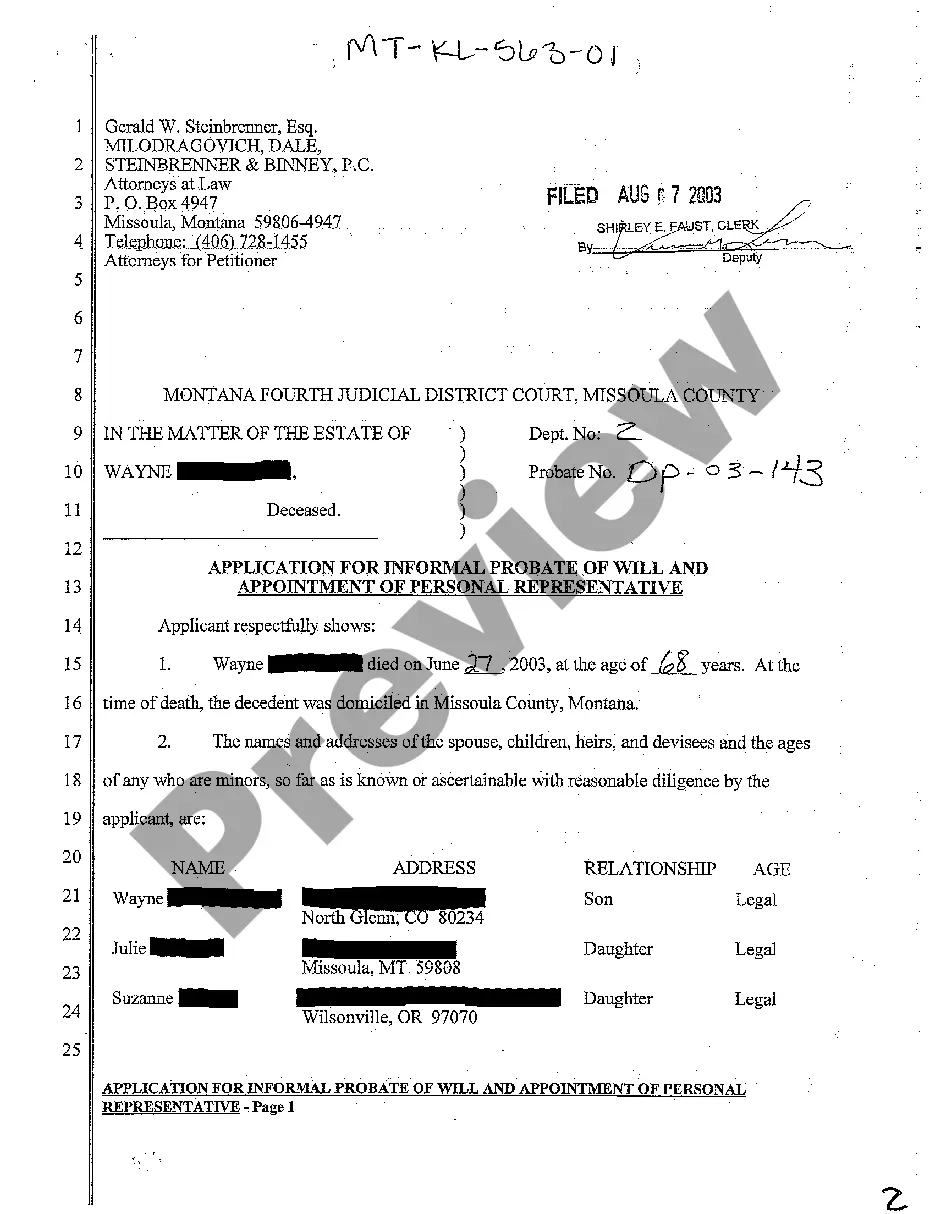

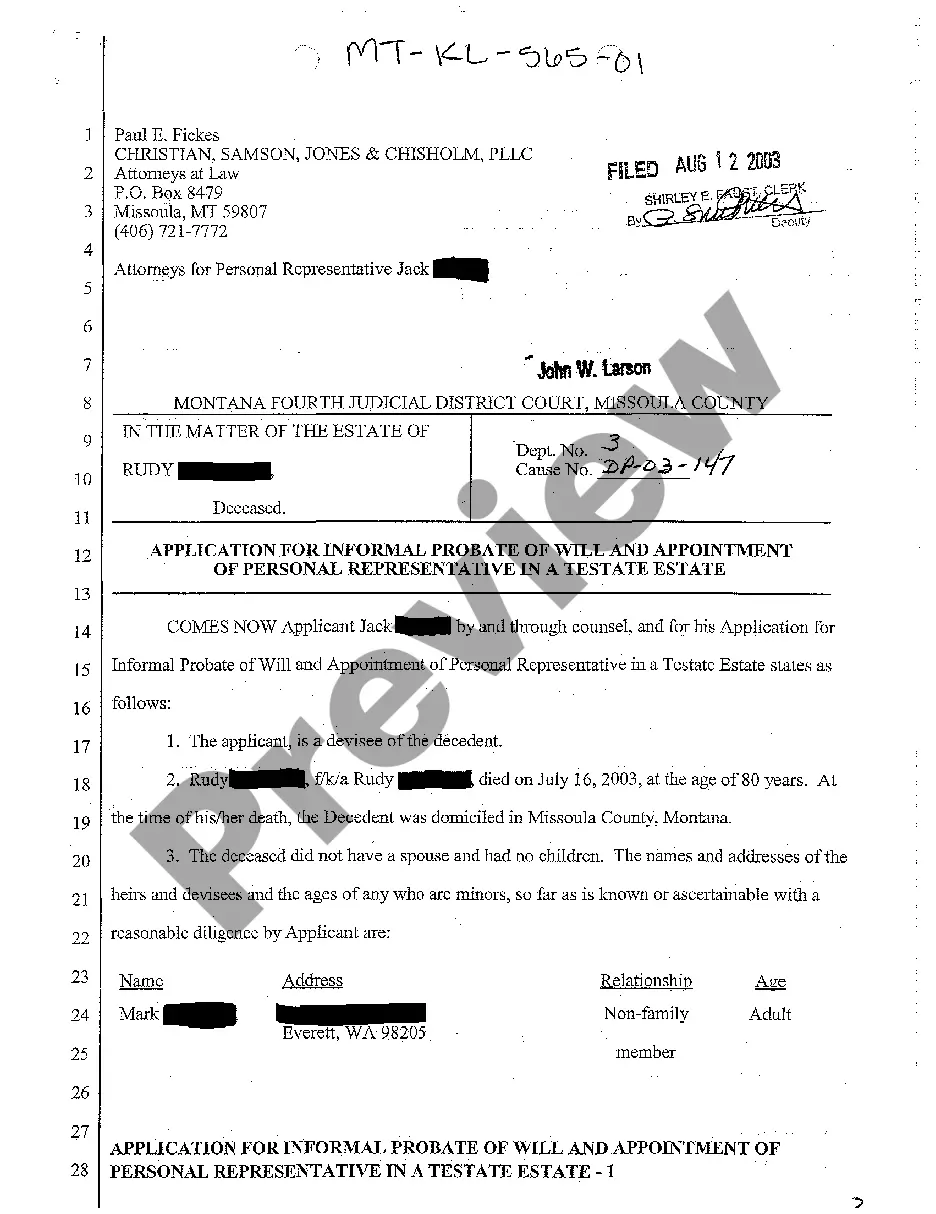

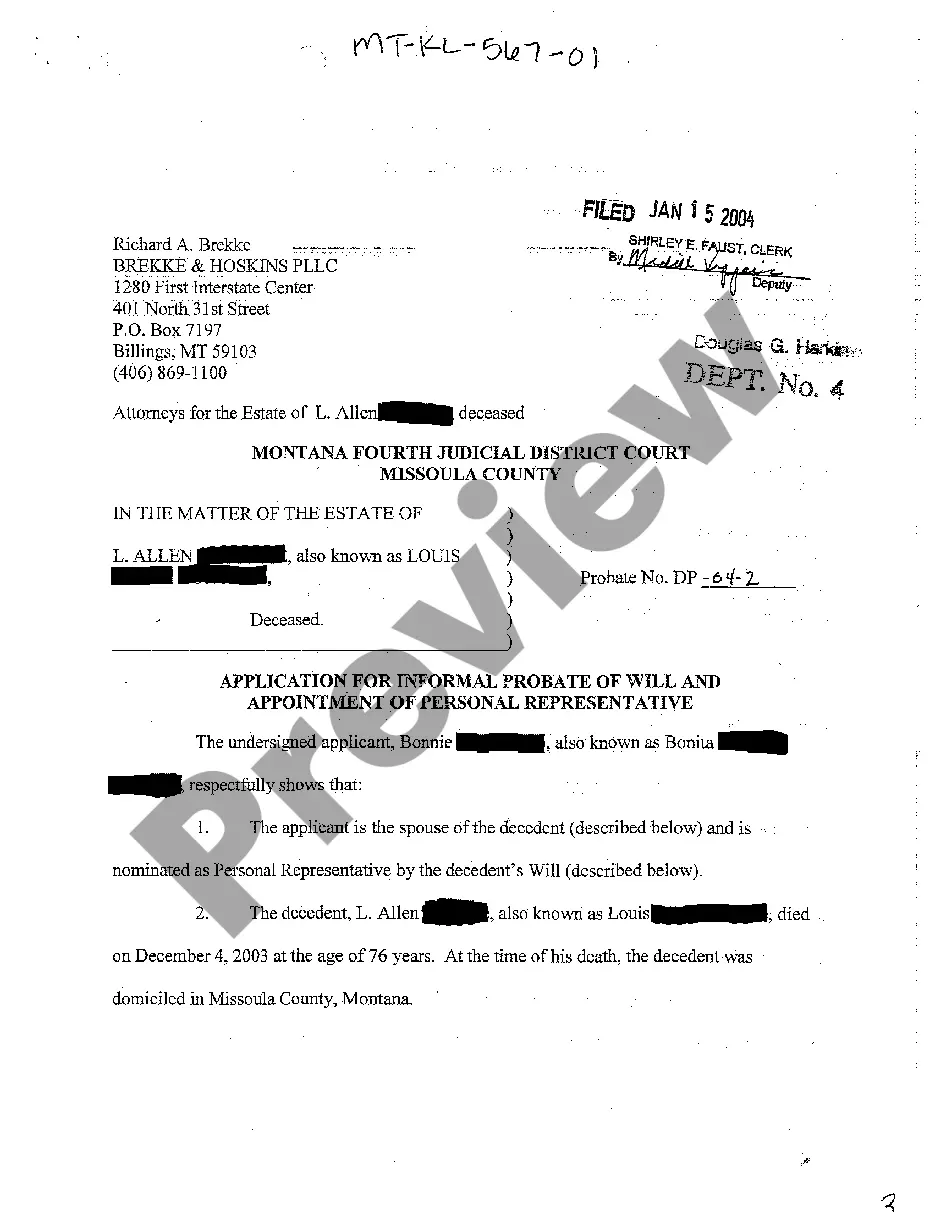

Montana Application for Informal Probate of Will, Determination of Testacy and Heirs, And Appointment of Personal Representative

Description

How to fill out Montana Application For Informal Probate Of Will, Determination Of Testacy And Heirs, And Appointment Of Personal Representative?

Get a printable Montana Application for Informal Probate of Will, Determination of Testacy and Heirs, And Appointment of Personal Representative within several clicks from the most extensive catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of affordable legal and tax forms for US citizens and residents online since 1997.

Customers who have already a subscription, must log in in to their US Legal Forms account, get the Montana Application for Informal Probate of Will, Determination of Testacy and Heirs, And Appointment of Personal Representative see it stored in the My Forms tab. Customers who don’t have a subscription are required to follow the steps below:

- Make certain your template meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If offered, review the shape to discover more content.

- Once you are confident the template meets your requirements, click on Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

When you have downloaded your Montana Application for Informal Probate of Will, Determination of Testacy and Heirs, And Appointment of Personal Representative, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

Accounts or assets with named beneficiaries may be transferred without going through the probate process. Assets with joint ownership with right of survivorship pass to the second owner when the first owner dies.

If you are named in someone's will as an executor, you may have to apply for probate. This is a legal document which gives you the authority to share out the estate of the person who has died according to the instructions in the will. You do not always need probate to be able to deal with the estate.

Simply having a last will does not avoid probate; in fact, a will must go through probate. To probate a will, the document is filed with the court, and a personal representative is appointed to gather the decedent's assets and take care of any outstanding debts or taxes.

Beneficiaries of a will must be notified after the will is accepted for probate. 3feff Moreover, probated wills are automatically placed in the public record. If the will is structured to avoid probate, there are no specific notification requirements.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

In California, estates valued over $150,000, and that don't qualify for any exemptions, must go to probate.If a person dies and owns real estate, regardless of value, either in his/her name alone or as a "tenant in common" with another, a probate proceeding is typically required to transfer the property.

There is no requirement that a will or property go through probate, but if the decedent owned property that is not arranged specifically to avoid probate, there is no way for the beneficiaries to obtain legal ownership without it.

Probate is required to transfer property out of a deceased individual's name and into the name of a living beneficiary when the asset is not set up to transfer directly by operation of law.