Mississippi Form of Parent Guaranty

Description

How to fill out Form Of Parent Guaranty?

Have you been in a place the place you require files for possibly organization or specific functions almost every working day? There are plenty of authorized papers layouts available on the net, but getting types you can depend on is not easy. US Legal Forms provides 1000s of kind layouts, just like the Mississippi Form of Parent Guaranty, that are created in order to meet federal and state demands.

When you are already knowledgeable about US Legal Forms web site and get a free account, basically log in. Afterward, you may acquire the Mississippi Form of Parent Guaranty design.

If you do not offer an bank account and need to start using US Legal Forms, adopt these measures:

- Get the kind you need and ensure it is for the correct town/region.

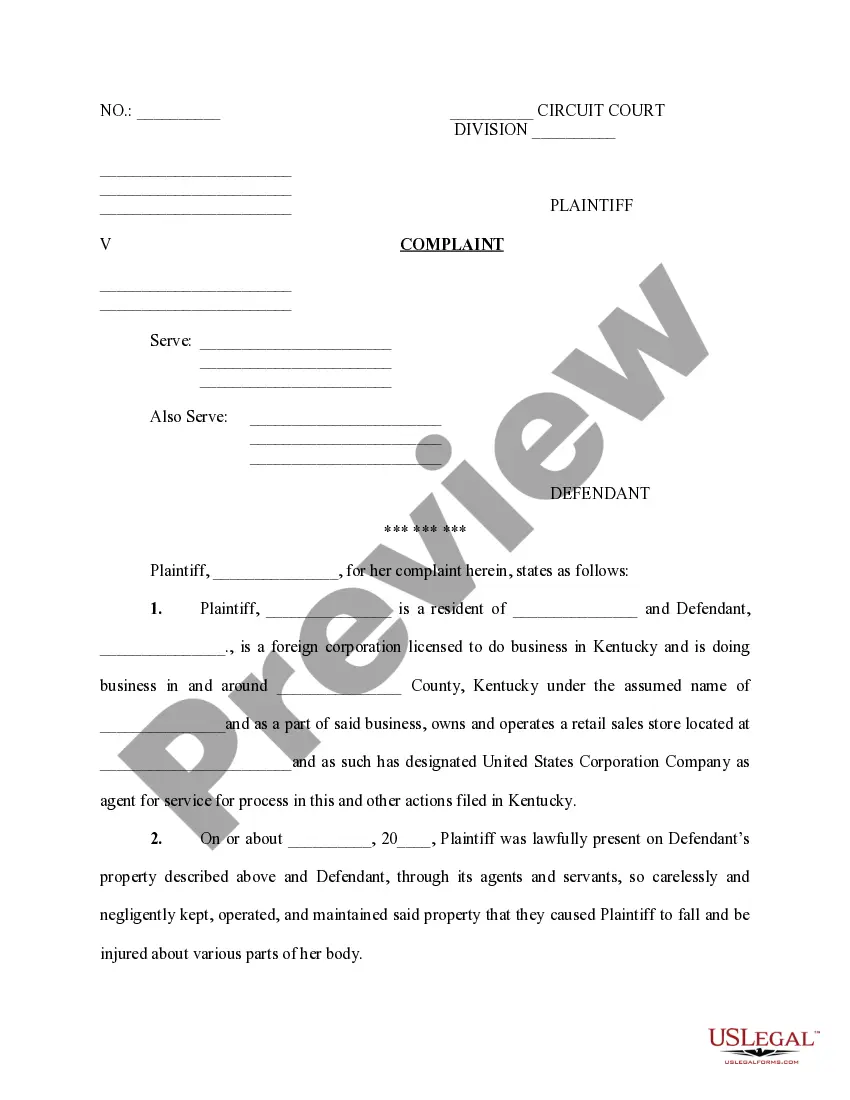

- Utilize the Preview button to analyze the shape.

- Look at the information to ensure that you have selected the proper kind.

- If the kind is not what you are seeking, take advantage of the Research area to discover the kind that suits you and demands.

- When you get the correct kind, click on Purchase now.

- Choose the rates program you desire, fill out the necessary details to produce your account, and pay money for the transaction using your PayPal or charge card.

- Select a convenient paper file format and acquire your version.

Discover every one of the papers layouts you have bought in the My Forms menu. You can aquire a more version of Mississippi Form of Parent Guaranty anytime, if required. Just go through the needed kind to acquire or printing the papers design.

Use US Legal Forms, the most considerable collection of authorized forms, to save lots of time as well as avoid blunders. The support provides expertly made authorized papers layouts that can be used for an array of functions. Create a free account on US Legal Forms and commence creating your daily life easier.

Form popularity

FAQ

A form of guaranty whereby a parent, as guarantor, assumes the responsibility for the payment or performance of an action or obligation of its subsidiary by agreeing to compensate the beneficiary in the event of such non-payment or performance.

What is a Guaranty Of Payment? A guaranty of payment is a document that guarantees the person who signs it will pay any debts or liabilities incurred by another party. For example, this agreement can be helpful when a seller needs financial assurance from a buyer.

A common example of a financial guarantee contract is a parent company providing a guarantee over its subsidiary's borrowings. Because these contracts transfer significant insurance risk, they typically meet the definition of an insurance contract.

An upstream guarantee, also known as a subsidiary guarantee, is a financial guarantee in which the subsidiary guarantees its parent company's debt.

Traditionally, a distinction is made between: Real guarantees relating to assets having an intrinsic value. Personal guarantees involving a debt obligation for one or more people. Moral guarantees that do not provide the lender with any real legal security.

Downstream guarantee (or guaranty) is a pledge placed on a loan on behalf of the borrowing party by the borrowing party's parent company or stockholder. By guaranteeing the loan for its subsidiary company, the parent company provides assurance to the lenders that the subsidiary company will be able to repay the loan.

In the event that the subsidiary is unable to make its loan repayments, the parent company commits to repay the loan on behalf of the subsidiary. On the other hand, an upstream guarantee is a form of guarantee in which a subsidiary guarantees its parent company's debts.

A Guaranty Agreement is a contract that outlines your role in the process. It supports the obligation of a borrower to a lender; in the primary contract the borrower agrees to provide the lender with something of value, like money or goods and services.