Mississippi Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

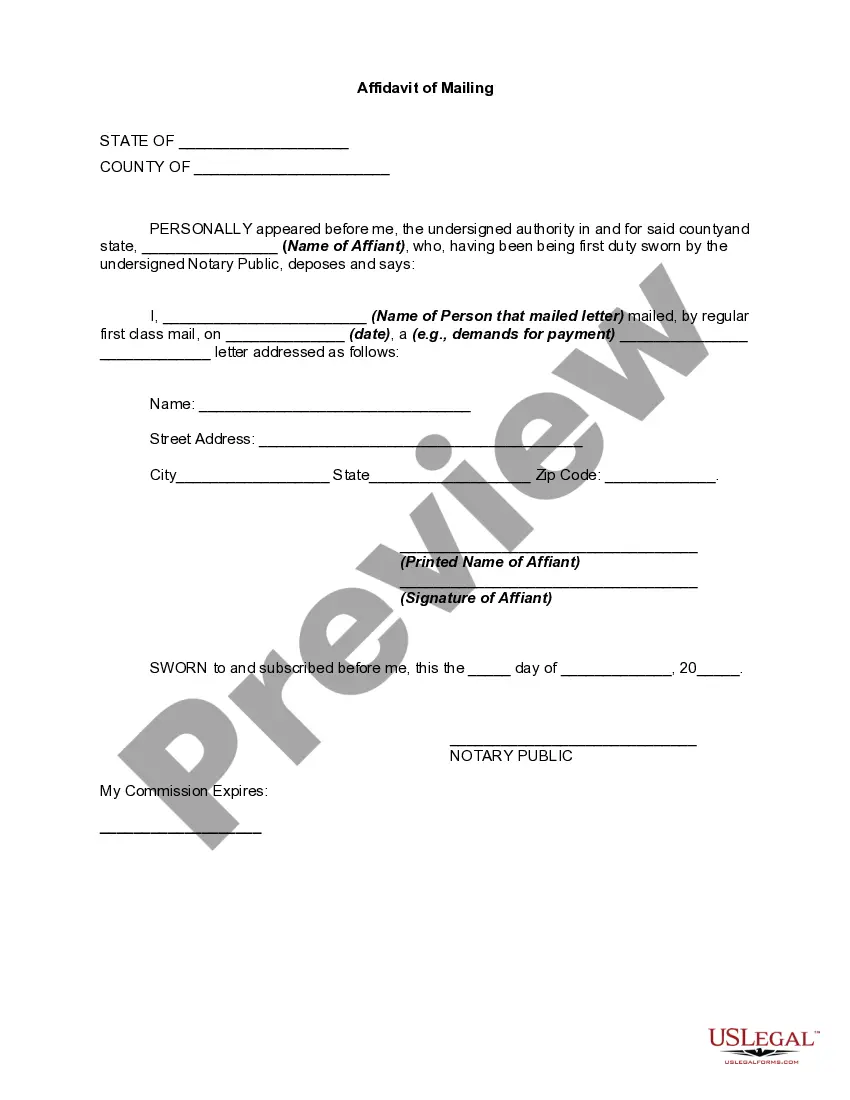

Finding the right legitimate document web template might be a struggle. Of course, there are tons of layouts accessible on the Internet, but how do you find the legitimate form you need? Use the US Legal Forms web site. The services delivers thousands of layouts, for example the Mississippi Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease, which can be used for company and private requirements. All the types are checked by pros and meet up with state and federal specifications.

In case you are currently authorized, log in to your account and click the Obtain option to obtain the Mississippi Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Make use of account to check with the legitimate types you may have bought formerly. Go to the My Forms tab of your account and acquire one more copy in the document you need.

In case you are a brand new customer of US Legal Forms, listed below are basic directions that you should follow:

- Very first, be sure you have selected the proper form for your city/region. It is possible to check out the shape utilizing the Preview option and browse the shape information to ensure it will be the best for you.

- When the form will not meet up with your needs, utilize the Seach discipline to obtain the proper form.

- When you are positive that the shape is proper, go through the Get now option to obtain the form.

- Opt for the rates strategy you want and enter in the necessary information and facts. Create your account and buy the transaction making use of your PayPal account or credit card.

- Choose the data file formatting and obtain the legitimate document web template to your system.

- Comprehensive, edit and print out and sign the obtained Mississippi Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

US Legal Forms is the most significant local library of legitimate types in which you can find a variety of document layouts. Use the company to obtain skillfully-produced files that follow condition specifications.

Form popularity

FAQ

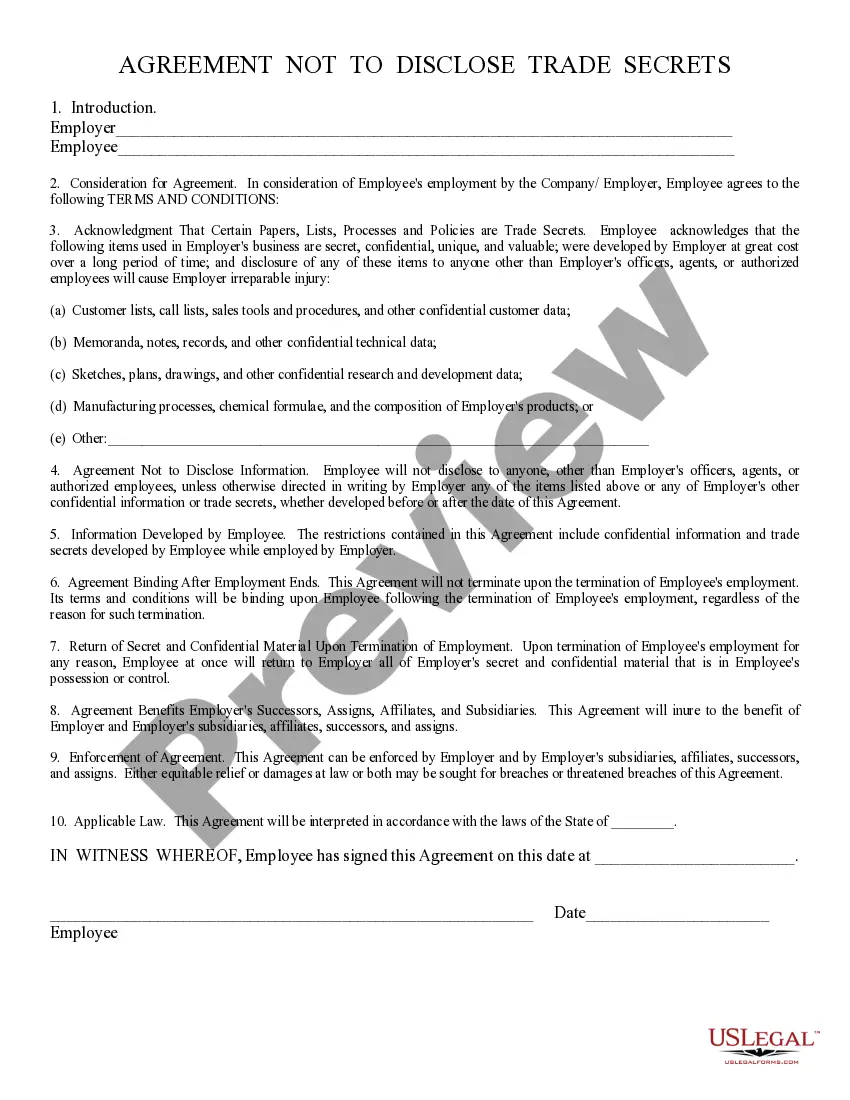

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.

Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

Mineral ownership, or mineral rights, are understood to be the property rights to exploit an area for the minerals, gas, or oil it harbors. The four types of mineral ownership are: Mineral Interest ? interest generated after the production of oil and gas after the sale of a deed or a lease.

Oil and gas royalties are typically calculated based on the value of the production. The royalty rate is negotiated between the owner of the mineral rights and the company extracting the oil and gas, and can range from 12.5% to 25% of the production value.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Non-Participating Royalty Interest (NPRI) Unlike a mineral interest owner, the NPRI owner does not have ?executive? rights, meaning they cannot sign an oil and gas lease or participate in the benefits of lease bonus or delay rentals.