Mississippi Acquisition Due Diligence Report

Description

How to fill out Acquisition Due Diligence Report?

You may spend hrs on the web attempting to find the authorized file design that meets the federal and state needs you want. US Legal Forms supplies a huge number of authorized types which can be analyzed by experts. It is possible to acquire or print the Mississippi Acquisition Due Diligence Report from my service.

If you already possess a US Legal Forms profile, it is possible to log in and click the Acquire key. Following that, it is possible to full, revise, print, or indication the Mississippi Acquisition Due Diligence Report. Each authorized file design you buy is the one you have for a long time. To acquire one more copy of the bought kind, go to the My Forms tab and click the related key.

If you use the US Legal Forms web site the first time, follow the easy instructions under:

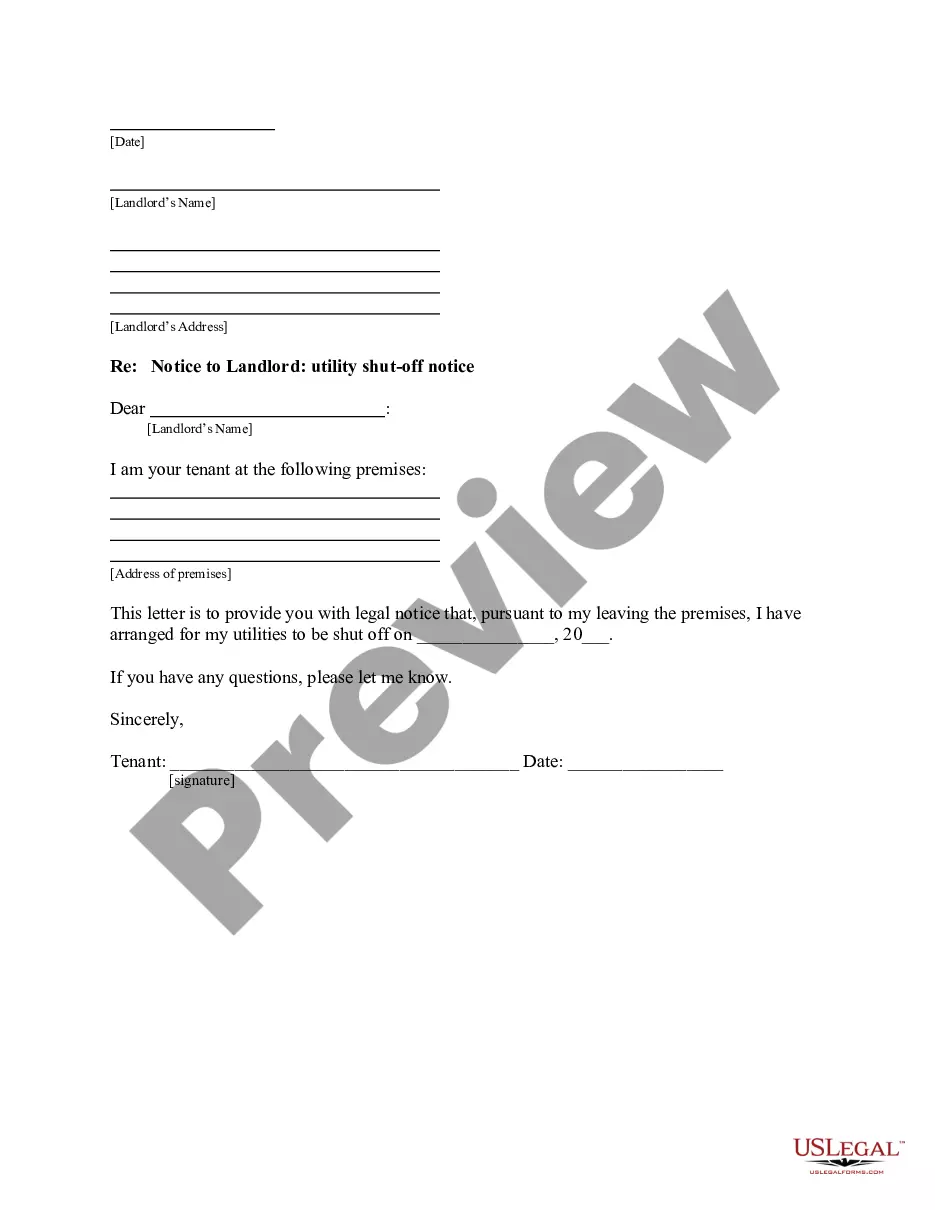

- Initially, be sure that you have chosen the right file design for your region/area that you pick. Browse the kind description to make sure you have picked the appropriate kind. If offered, utilize the Preview key to look from the file design at the same time.

- If you would like find one more model of your kind, utilize the Search industry to obtain the design that fits your needs and needs.

- After you have discovered the design you want, click Acquire now to carry on.

- Choose the rates strategy you want, type your references, and register for your account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to fund the authorized kind.

- Choose the structure of your file and acquire it in your system.

- Make adjustments in your file if necessary. You may full, revise and indication and print Mississippi Acquisition Due Diligence Report.

Acquire and print a huge number of file themes making use of the US Legal Forms site, which provides the most important collection of authorized types. Use expert and state-particular themes to take on your company or specific requires.

Form popularity

FAQ

A due diligence check involves careful investigation of the economic, legal, fiscal and financial circumstances of a business or individual. This covers aspects such as sales figures, shareholder structure and possible links with forms of economic crime such as corruption and tax evasion.

Post-offer due diligence includes hiring a building inspector, checking zoning laws, researching the title, getting an appraisal, and obtaining financing. If everything continues to check out with the property, the buyer can move to close the deal.

The due diligence guidelines for third parties involve gathering information about the third party's background, financial stability, legal and compliance history, business practices, and overall reputation.

The due diligence fee is a nonrefundable fee that a potential buyer pays directly to the seller. It gives the buyer the right to change their mind for any reason during the due diligence period.

The due diligence fee is a negotiable (by your realtor) and is typically between $500 and $2000, depending on the market competition and on the purchase price of the home. Just like the earnest money deposit discussed in our other blogs, a higher due diligence fee makes your offer more enticing to a seller.

As a non-binding orientation, which may only be regarded as a rough estimate, a rule of thumb can be used: Depending on the sale price of a company, the costs of the due diligence review are between 2 and 5 % of the total transaction amount.

The due diligence process helps stakeholders understand the synergies and potential scalability of the businesses after the merger/acquisition. During the process, all internal and external factors that create risk in the acquisition are identified and focus is driven towards key factors that drive profitability.

Ing to a recent survey, the average cost for due diligence services is around $50,000. However, these costs can vary widely depending on the specific services needed, with some firms spending as much as $150,000 on due diligence professionals. Another significant cost associated with due diligence is travel.