Mississippi Subsurface Underground Gas Storage Lease and Agreement (From a Surface Owner, With No Right to Use the Surface of the Lands being Granted)

Description

How to fill out Subsurface Underground Gas Storage Lease And Agreement (From A Surface Owner, With No Right To Use The Surface Of The Lands Being Granted)?

Discovering the right legal document design can be quite a have a problem. Naturally, there are a variety of templates available on the Internet, but how do you get the legal type you want? Utilize the US Legal Forms internet site. The assistance delivers thousands of templates, for example the Mississippi Subsurface Underground Gas Storage Lease and Agreement (From a Surface Owner, With No Right to Use the Surface of the Lands being Granted), that you can use for business and private requires. Each of the types are checked by professionals and fulfill federal and state specifications.

When you are already signed up, log in to the profile and then click the Obtain key to have the Mississippi Subsurface Underground Gas Storage Lease and Agreement (From a Surface Owner, With No Right to Use the Surface of the Lands being Granted). Use your profile to look through the legal types you might have ordered earlier. Visit the My Forms tab of your own profile and acquire another backup in the document you want.

When you are a whole new end user of US Legal Forms, listed below are simple instructions so that you can comply with:

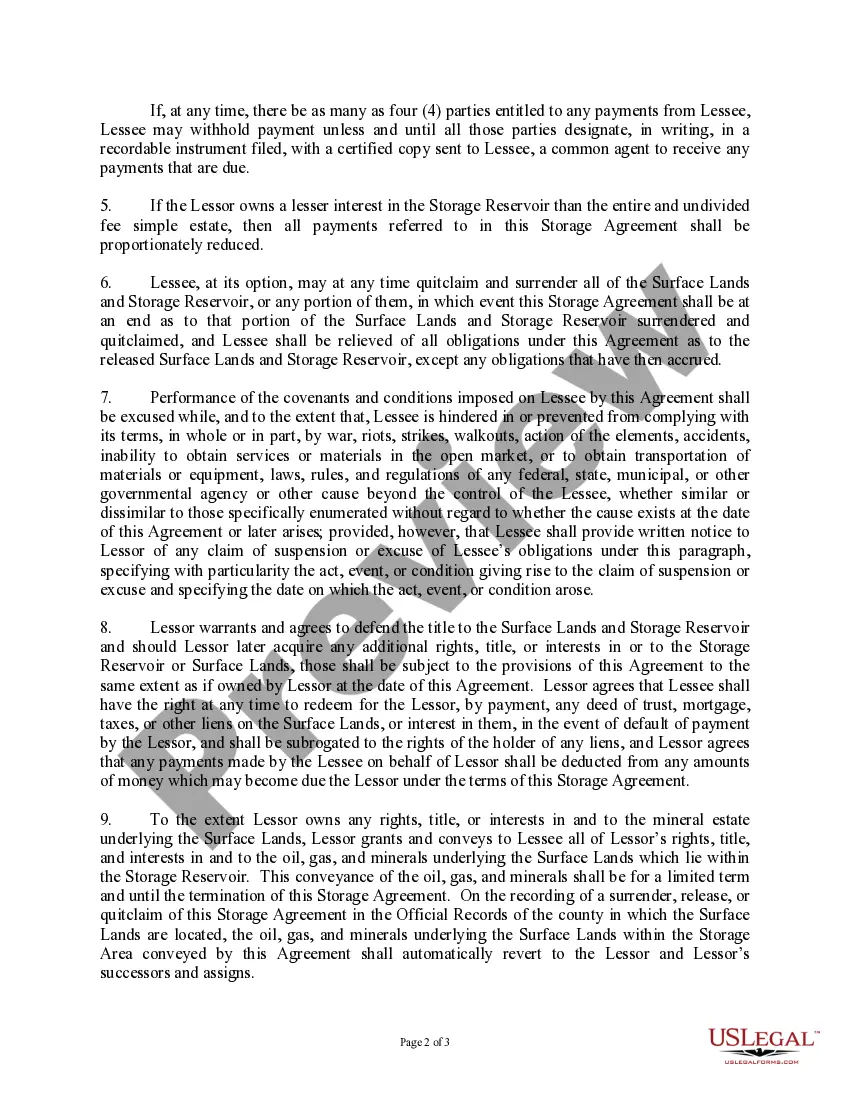

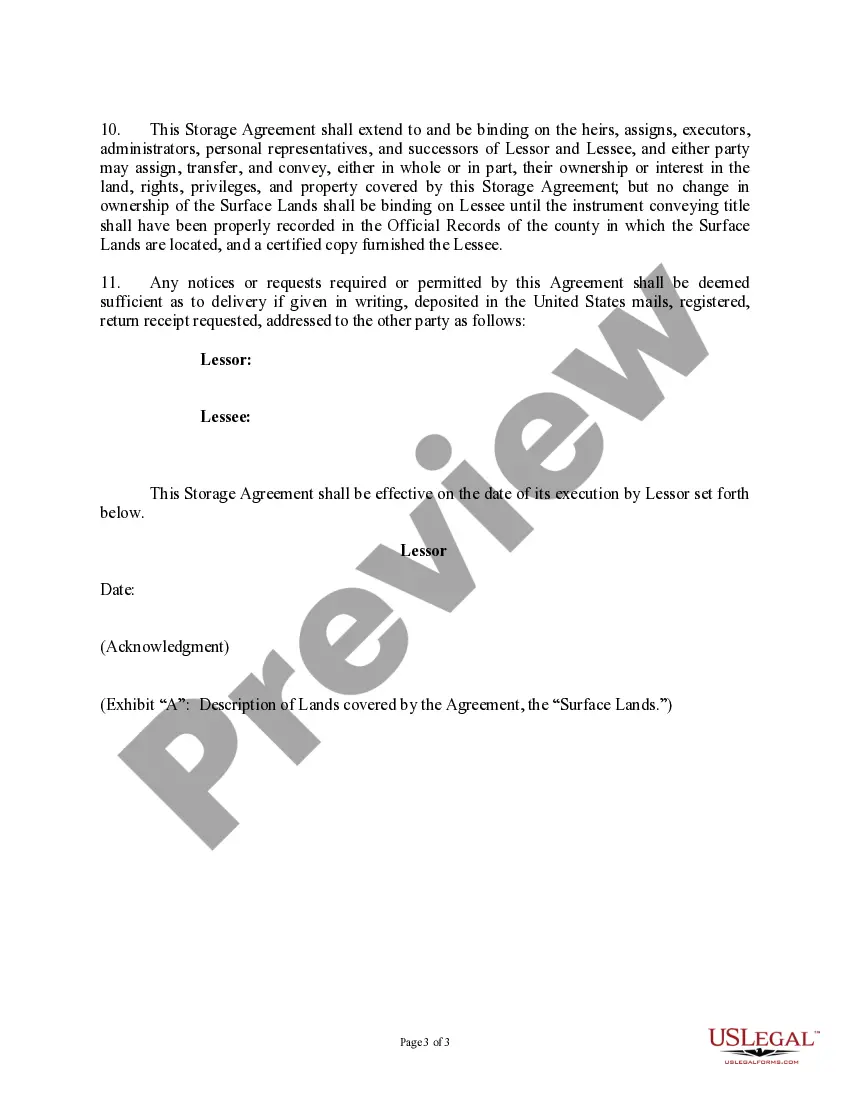

- First, make certain you have chosen the proper type for the city/area. You can look through the form while using Review key and study the form explanation to ensure it is the best for you.

- In the event the type is not going to fulfill your requirements, take advantage of the Seach area to find the correct type.

- When you are certain that the form is proper, go through the Buy now key to have the type.

- Opt for the costs strategy you would like and enter the needed info. Design your profile and pay money for the order with your PayPal profile or Visa or Mastercard.

- Pick the submit format and download the legal document design to the gadget.

- Complete, modify and print out and indication the obtained Mississippi Subsurface Underground Gas Storage Lease and Agreement (From a Surface Owner, With No Right to Use the Surface of the Lands being Granted).

US Legal Forms is definitely the greatest collection of legal types where you will find different document templates. Utilize the company to download professionally-made paperwork that comply with status specifications.

Form popularity

FAQ

Yes, subsurface rights are considered real property. This includes the rights to any minerals, oil, gas, or other natural resources that may be located beneath the surface of the land. These rights can be bought, sold, leased, or inherited like any other real property.

Conduct a title deed search at the county records office to find the owner history in the title deed. Follow the history of the property through the chain of owners. This can tell you whether the property or land was ever owned by an oil and gas company.

Transfer By Will It is also possible to transfer or pass down mineral rights by will. The right to minerals transfers at the time of death to the individuals named as beneficiaries. If no specific beneficiaries to the mineral rights are designated, ownership passes to the property and real estate heir.

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

One quick and dirty approach is the ?rule of thumb.? Those following the rule of thumb say that mineral rights are worth a multiple of three to five times the yearly income produced. For example, a mineral right that produces $1,000 a year in royalties would be worth between $3,000 and $5,000 under the rule of thumb.

The rising value of oil and minerals have increased the popularity of investing in the mineral rights but not the property rights. To research how to attain these rights, look at the county's courthouse. They typically have a deed record of mineral rights. From there you can contact the owners of the rights.