Mississippi Declaration and Power of Attorney for Patent Application

Description

How to fill out Declaration And Power Of Attorney For Patent Application?

Choosing the right lawful document web template could be a have difficulties. Of course, there are a lot of web templates available on the net, but how will you find the lawful develop you need? Utilize the US Legal Forms site. The support offers a large number of web templates, for example the Mississippi Declaration and Power of Attorney for Patent Application, which you can use for company and private needs. All the kinds are examined by experts and meet up with state and federal demands.

In case you are presently registered, log in for your accounts and then click the Download switch to obtain the Mississippi Declaration and Power of Attorney for Patent Application. Use your accounts to appear with the lawful kinds you have bought previously. Go to the My Forms tab of your respective accounts and get one more version in the document you need.

In case you are a brand new user of US Legal Forms, allow me to share straightforward recommendations so that you can comply with:

- First, be sure you have chosen the correct develop for your personal area/area. It is possible to look over the shape utilizing the Review switch and browse the shape description to guarantee it will be the best for you.

- In case the develop is not going to meet up with your preferences, take advantage of the Seach discipline to find the correct develop.

- Once you are sure that the shape would work, click the Acquire now switch to obtain the develop.

- Pick the rates program you want and enter in the essential info. Create your accounts and pay for the transaction utilizing your PayPal accounts or charge card.

- Opt for the submit format and obtain the lawful document web template for your gadget.

- Total, change and print and signal the obtained Mississippi Declaration and Power of Attorney for Patent Application.

US Legal Forms may be the most significant collection of lawful kinds that you will find different document web templates. Utilize the service to obtain appropriately-made paperwork that comply with status demands.

Form popularity

FAQ

The requirements and restrictions vary in each state; however, in Mississippi, your document will require notarization. If your agent will have the authority to manage real estate transactions, the Power of Attorney will need to be acknowledged by a notary and recorded or filed with the county.

The requirements and restrictions vary in each state; however, in Mississippi, your document will require notarization. If your agent will have the authority to manage real estate transactions, the Power of Attorney will need to be acknowledged by a notary and recorded or filed with the county.

A Mississippi tax power of attorney (Form 21-002), otherwise known as the ?Department of Revenue Power of Attorney and Declaration of Representation,? is a document you can use to designate a tax professional to act on your behalf in interactions with the Department of Revenue in Mississippi.

A Mississippi tax power of attorney (Form 21-002), otherwise known as the ?Department of Revenue Power of Attorney and Declaration of Representation,? is a document you can use to designate a tax professional to act on your behalf in interactions with the Department of Revenue in Mississippi.

Steps for Making a Financial Power of Attorney in Mississippi Create the POA Using a Form, Software or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent or Attorney-in-Fact. ... File a Copy With the Chancery Clerk's Office.

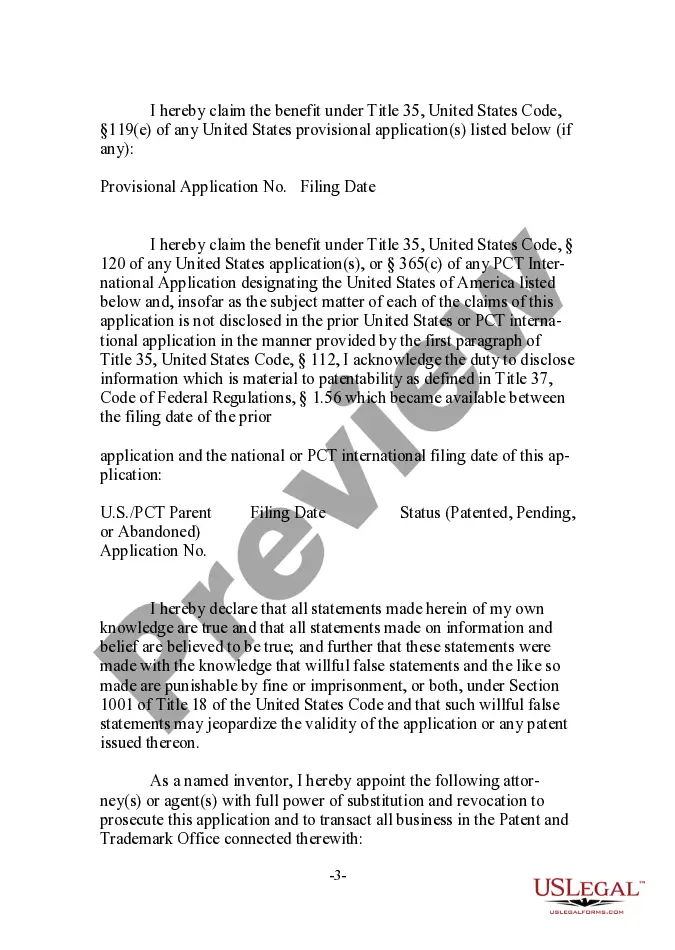

Takeaway: Failure to file a Power of Attorney in a patent application may limit a practitioner's prosecution actions. 37 C.F.R. 1.32(b) recites requirements for filing a Power of Attorney under the 2011 America Invents Act () provisions.

A Mississippi tax power of attorney form, also known as Form 21-002-13, is a document provided by the Mississippi Department of Revenue that allows residents to authorize third parties to handle their state tax filing.

Form 2848 Power of Attorney and Declaration of Representative is used to authorize an individual to represent the taxpayer/corporation/partnership before the IRS. The authorized individual must be eligible to practice before the IRS.