Mississippi Self-Employed Awning Services Contract

Description

How to fill out Self-Employed Awning Services Contract?

If you desire to finalize, acquire, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site’s user-friendly and convenient search feature to locate the documents you need. A multitude of templates for business and personal applications are categorized by types and states, or keywords.

Utilize US Legal Forms to procure the Mississippi Self-Employed Awning Services Contract with just a few clicks.

Every legal document template you obtain is yours permanently. You will have access to every form you downloaded in your account.

Click the My documents section and select a form to print or download again. Be proactive and acquire and print the Mississippi Self-Employed Awning Services Contract with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click on the Acquire button to obtain the Mississippi Self-Employed Awning Services Contract.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

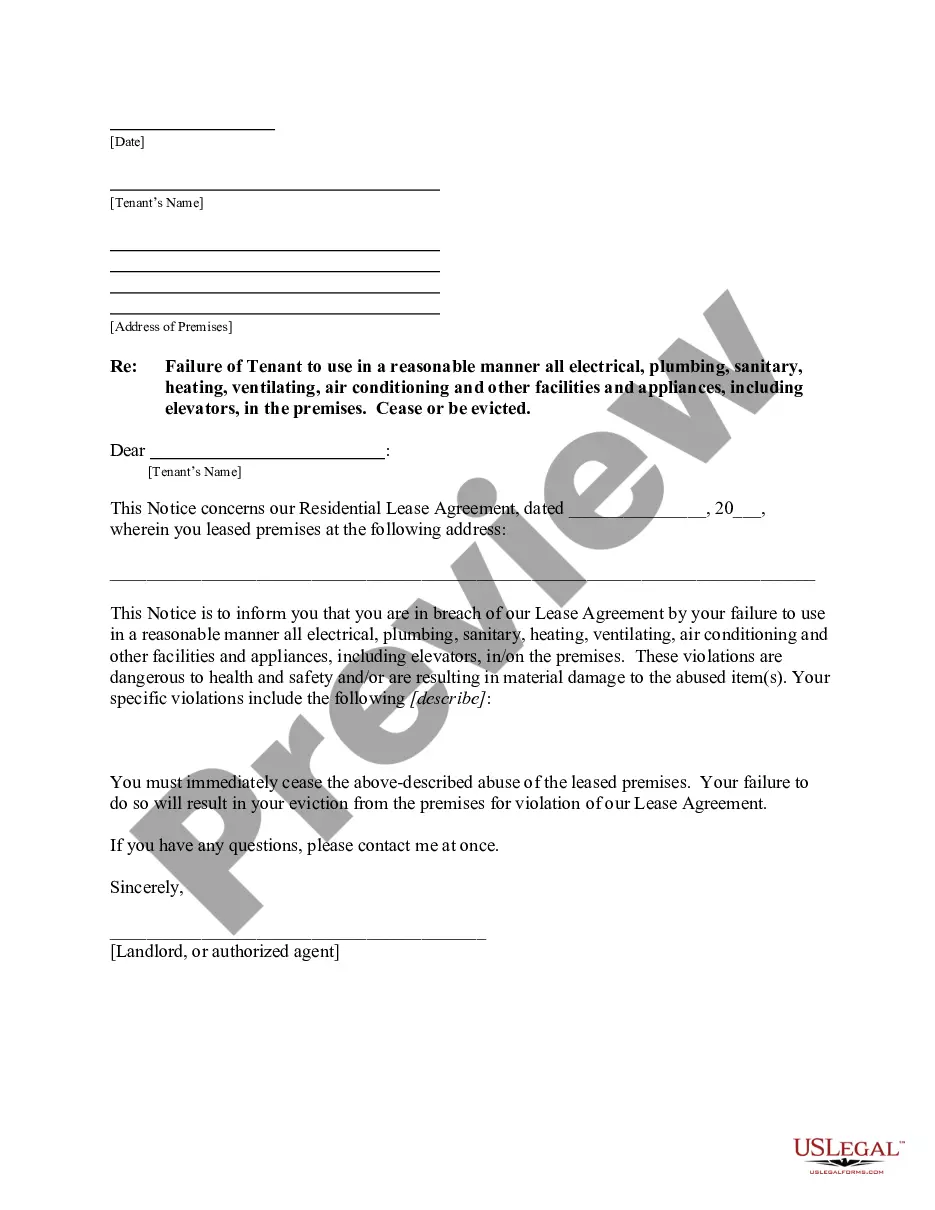

- Step 2. Use the Review feature to examine the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of your legal form template.

- Step 4. Once you have located the form you need, click on the Get now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Mississippi Self-Employed Awning Services Contract.

Form popularity

FAQ

The independent contractor law in Mississippi establishes that individuals providing services can operate as independent contractors rather than employees. This distinction is crucial for those interested in a Mississippi Self-Employed Awning Services Contract, as it affects tax responsibilities and liability. Independent contractors have the freedom to set their own schedules and operate their own businesses. However, it's essential to understand the legal implications to protect your interests.

In Mississippi, you can enter into a legally binding contract for personal property when you reach the age of 18. This is important for those considering a Mississippi Self-Employed Awning Services Contract. If you are younger than 18, a guardian or parent may need to co-sign. Understanding this age requirement helps ensure that your contracts are enforceable.

In Mississippi, several services are taxable, including construction, repair, and installation services. If you're working on projects like those outlined in a Mississippi Self-Employed Awning Services Contract, it's important to be aware of these tax implications. Staying informed will help you avoid unexpected costs and ensure a smooth transaction.

Yes, Mississippi requires most contractors to obtain a license to operate legally. This includes individuals working under a Mississippi Self-Employed Awning Services Contract. Obtaining the appropriate licensing not only ensures compliance but also enhances your credibility with clients.

Yes, handyman work is generally considered taxable in Mississippi, especially if it involves repairs or installations. This includes services provided under a Mississippi Self-Employed Awning Services Contract. It is important to factor in any applicable taxes when planning your projects to ensure compliance and accurate budgeting.

Certain items are exempt from sales tax in Mississippi, including most groceries, prescription drugs, and certain agricultural products. Additionally, specific services, such as those related to healthcare, may also be tax-exempt. Understanding these exemptions can benefit you when structuring your Mississippi Self-Employed Awning Services Contract.

To be eligible for a Mississippi Personal Contract (MPC), individuals must demonstrate that they operate as a legitimate business. This includes having the necessary licenses and fulfilling tax obligations. If you are working under a Mississippi Self-Employed Awning Services Contract, ensuring you meet these eligibility criteria will help you navigate the regulatory landscape effectively.

In Mississippi, various goods and services are subject to sales tax, including tangible personal property and certain services. Specifically, services related to construction, such as those provided under a Mississippi Self-Employed Awning Services Contract, may be taxable. It's crucial to be aware of these taxes when estimating your project costs.

The new contractor law in Mississippi focuses on ensuring that contractors comply with state regulations and licensing requirements. This law aims to protect consumers by requiring proof of liability insurance and adherence to safety standards. If you are entering into a Mississippi Self-Employed Awning Services Contract, understanding this law can safeguard your interests and ensure your contractor is qualified.