Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor

Description

How to fill out Translator And Interpreter Agreement - Self-Employed Independent Contractor?

Locating the appropriate legal template can be a challenge. Of course, there are numerous templates available online, but how do you identify the legal document you need? Utilize the US Legal Forms website. This service provides thousands of templates, including the Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor, that can be utilized for business and personal purposes. All the forms are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor. Use your account to browse through the legal forms you have previously obtained. Navigate to the My documents section of your account and download another copy of the document you need.

If you are a new customer of US Legal Forms, here are simple steps you should follow: First, ensure you have selected the correct form for your city/state. You can review the form using the Review button and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the right form. Once you are sure the form is correct, click the Purchase now button to obtain the form. Choose the payment plan you prefer and enter the required details. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document to your device. Finally, complete, edit, print, and sign the received Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor.

Make sure to take full advantage of the resources available on the US Legal Forms platform for all your legal document needs.

- US Legal Forms is the largest repository of legal forms where you can access various document templates.

- Utilize the service to obtain professionally crafted paperwork that meets state requirements.

- Ensure compliance with local and federal laws.

- Access thousands of legal templates for various needs.

- Navigate easily through your account to manage your documents.

- Streamline your document creation process efficiently.

Form popularity

FAQ

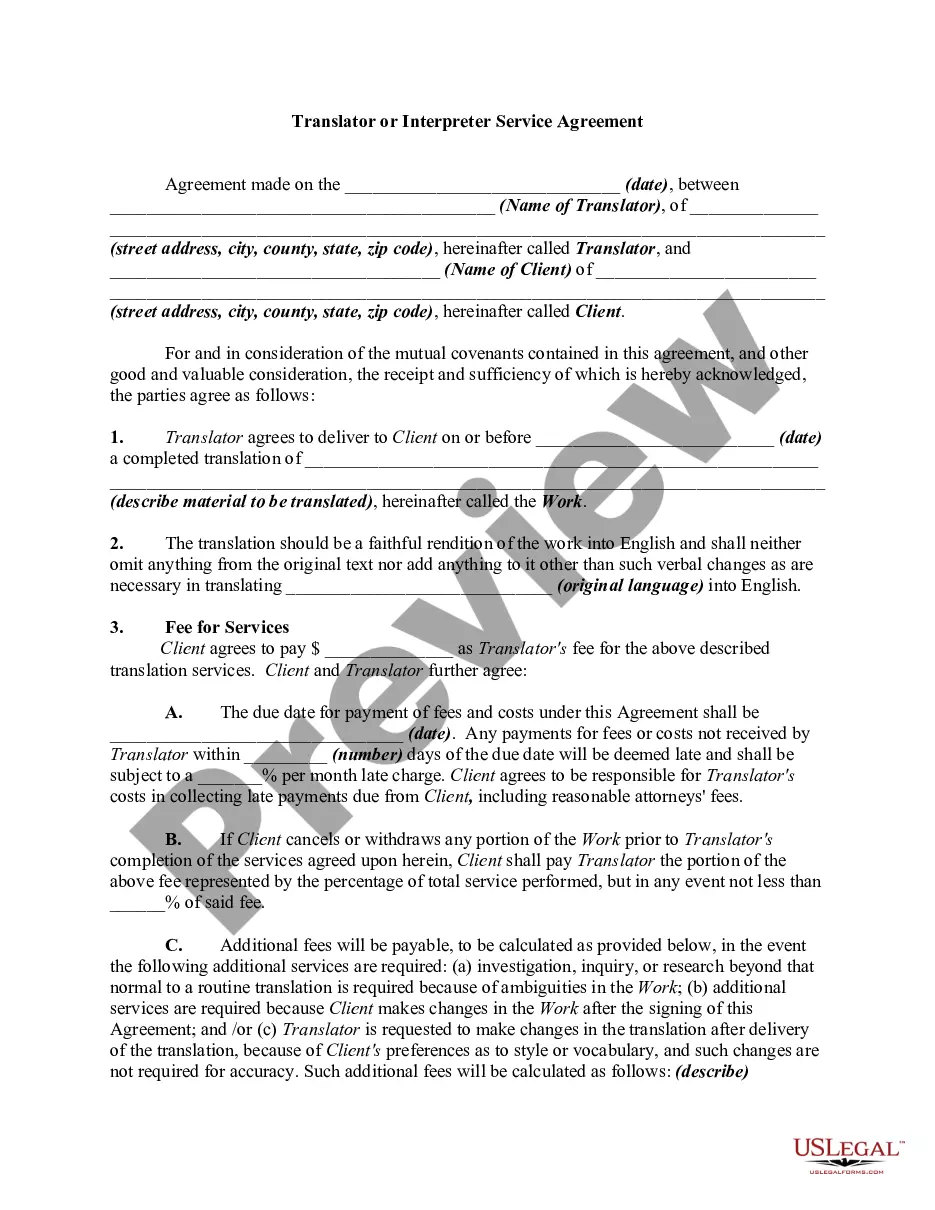

To write a Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor, start by outlining the essential elements such as the scope of work, payment terms, and duration of the contract. Include clauses that address confidentiality, termination, and dispute resolution to protect both parties. Furthermore, using templates from uslegalforms can simplify the process and ensure that you include all necessary legal stipulations. This approach not only saves time but also helps you create a clear and professional agreement.

Creating an independent contractor agreement is a straightforward process. Start by outlining key details such as the scope of work, payment terms, and duration of the agreement. Utilizing a Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor template from UsLegalForms can simplify this task significantly. By using a well-structured template, you ensure that all critical aspects are covered, providing clarity and legal protection for both parties.

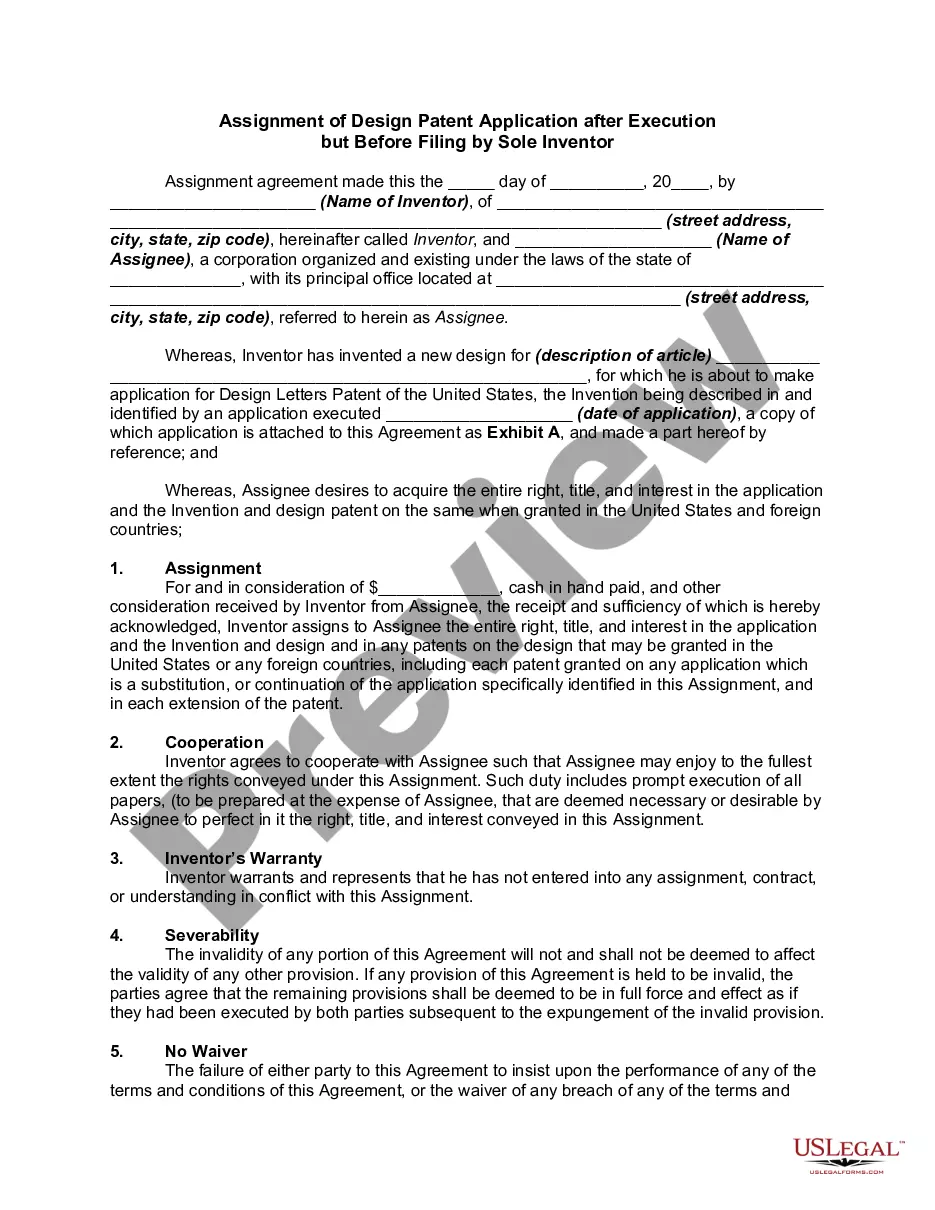

The independent contractor law in Mississippi generally defines the relationship between a contractor and a client. It establishes that independent contractors, like those providing translation or interpretation services, are responsible for their taxes and benefits. Through a Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor, individuals can clarify their status and responsibilities, which helps maintain compliance with state laws. It's essential to understand these regulations to operate successfully.

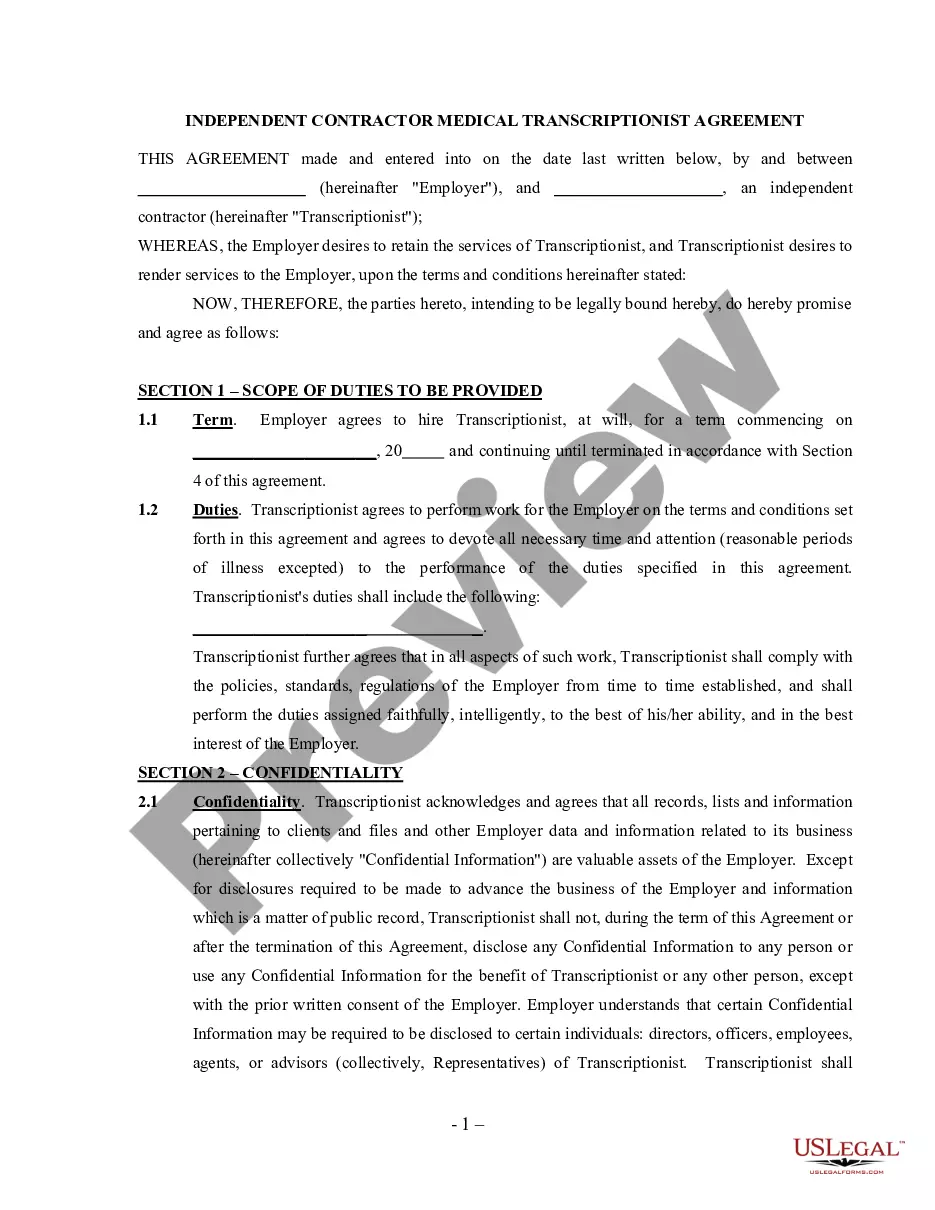

Yes, an interpreter can operate as an independent contractor. This means that they work for themselves and are not considered employees of any organization. With a Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor, interpreters can outline their terms of service, payment structures, and other essential conditions easily. This agreement helps safeguard both the interpreter's rights and the client's expectations.

To write an independent contractor agreement, include key elements such as the scope of work, payment terms, and confidentiality clauses. Clearly define the relationship between parties to avoid misunderstandings related to your role as an independent contractor. The Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor provides a solid framework you can adapt to meet your specific needs. This agreement also helps protect your interests and ensures clarity in your professional engagements.

Billing insurance for interpreter services requires clear communication and documentation. Start by confirming the patient's insurance coverage for interpreter services, and record the relevant details. Then, submit an invoice that follows proper guidelines, ensuring it reflects your status as a self-employed independent contractor. Utilizing the Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor can help you structure the billing process accurately.

Yes, having a contract as an independent contractor is essential for protecting your rights and clarifying obligations. A Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor clearly defines your role, payment terms, and project scope. This contract not only helps establish professionalism but also aids in avoiding potential disputes. Using a platform like US Legal Forms can streamline this process, providing you with easy access to customizable contract templates.

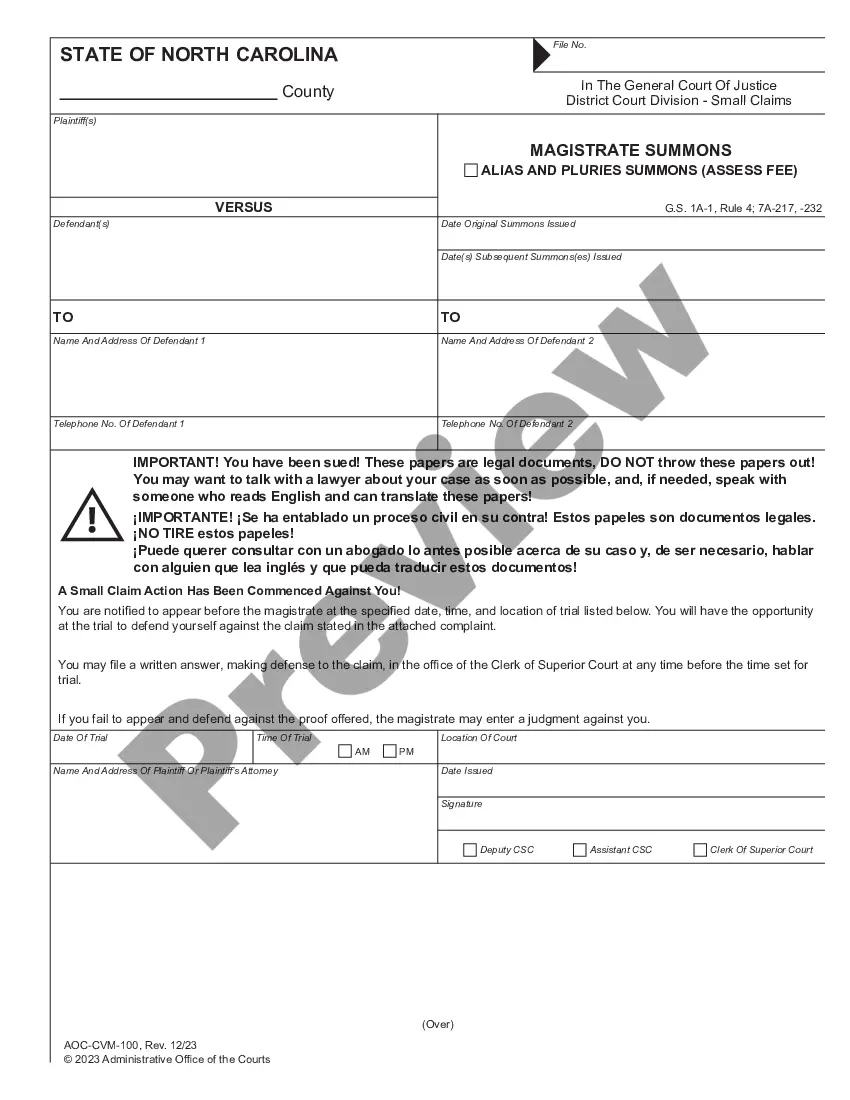

In Mississippi, verbal agreements can be legally binding, but they may pose challenges in enforcement. It's often difficult to prove the terms of an agreement without written documentation. To ensure clarity and protect your interests, it's advisable to use a Mississippi Translator And Interpreter Agreement - Self-Employed Independent Contractor. This formal contract provides a clear outline of responsibilities and expectations, which can help prevent misunderstandings.