Mississippi Breeder Agreement - Self-Employed Independent Contractor

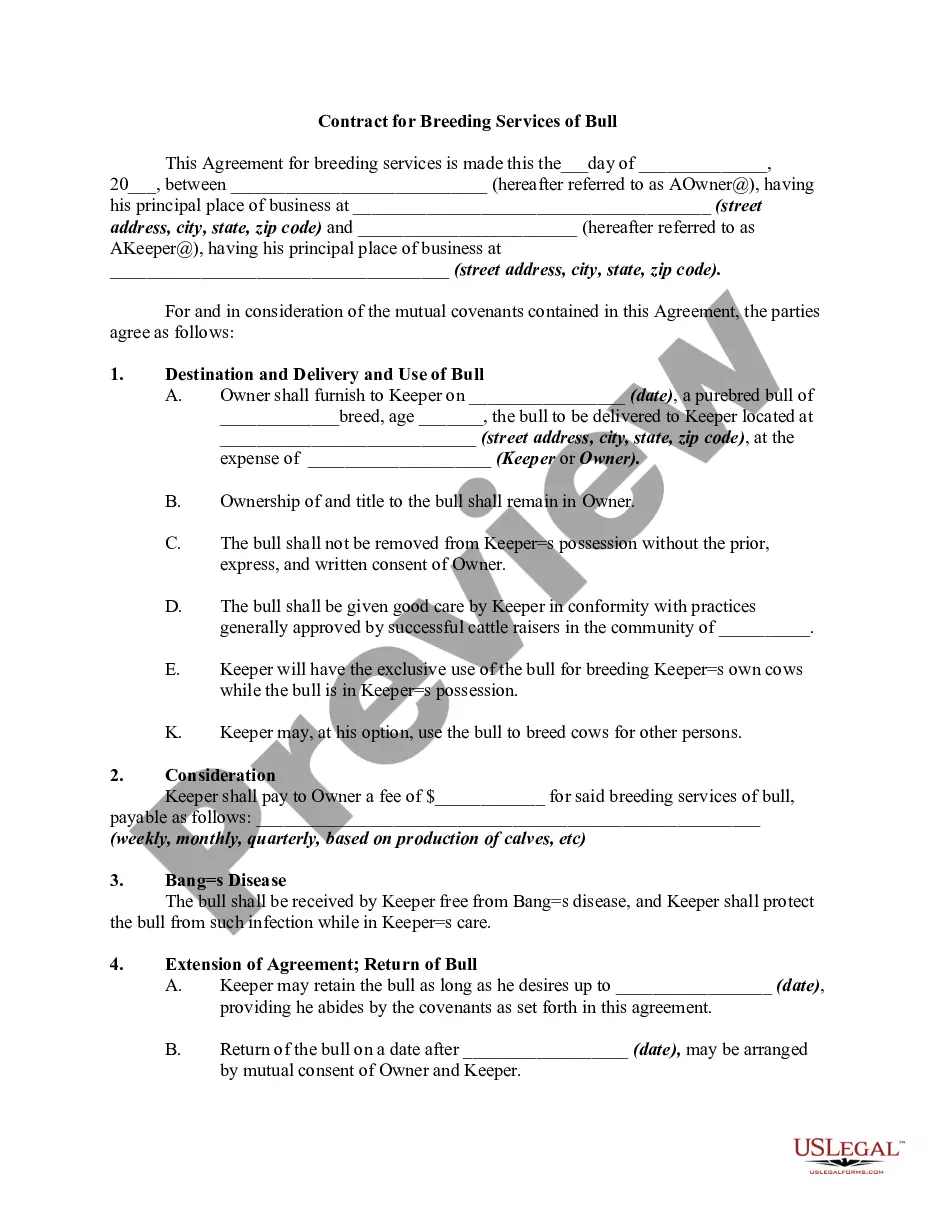

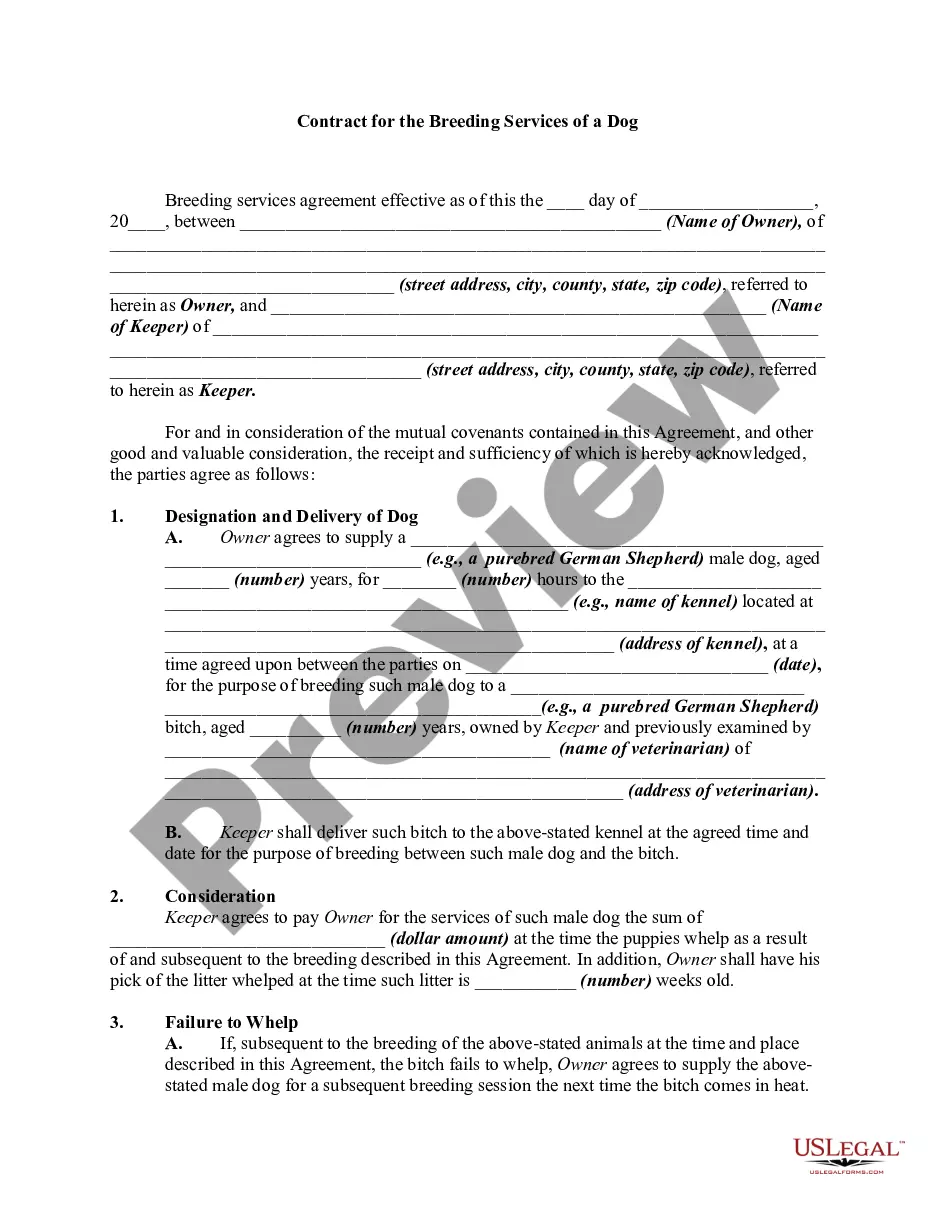

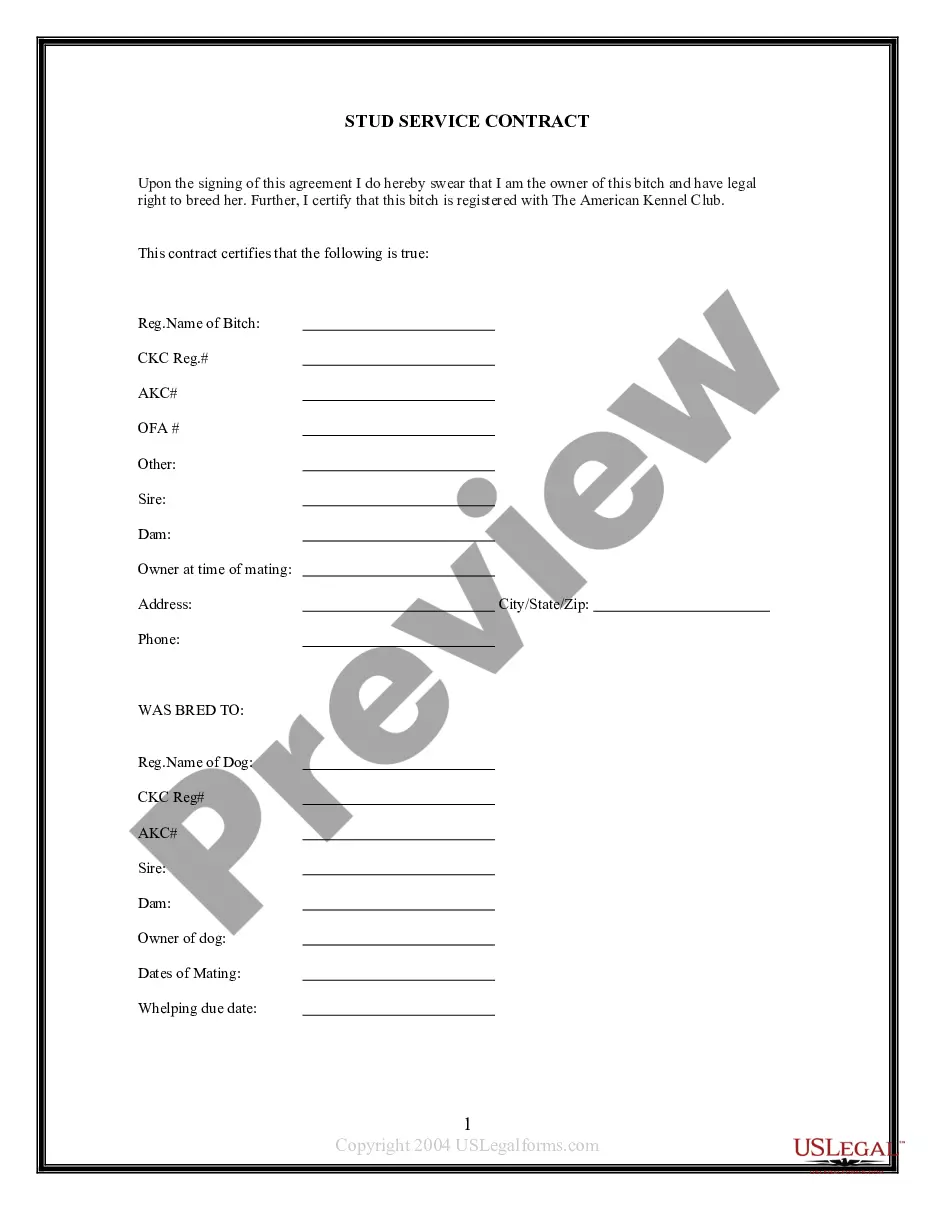

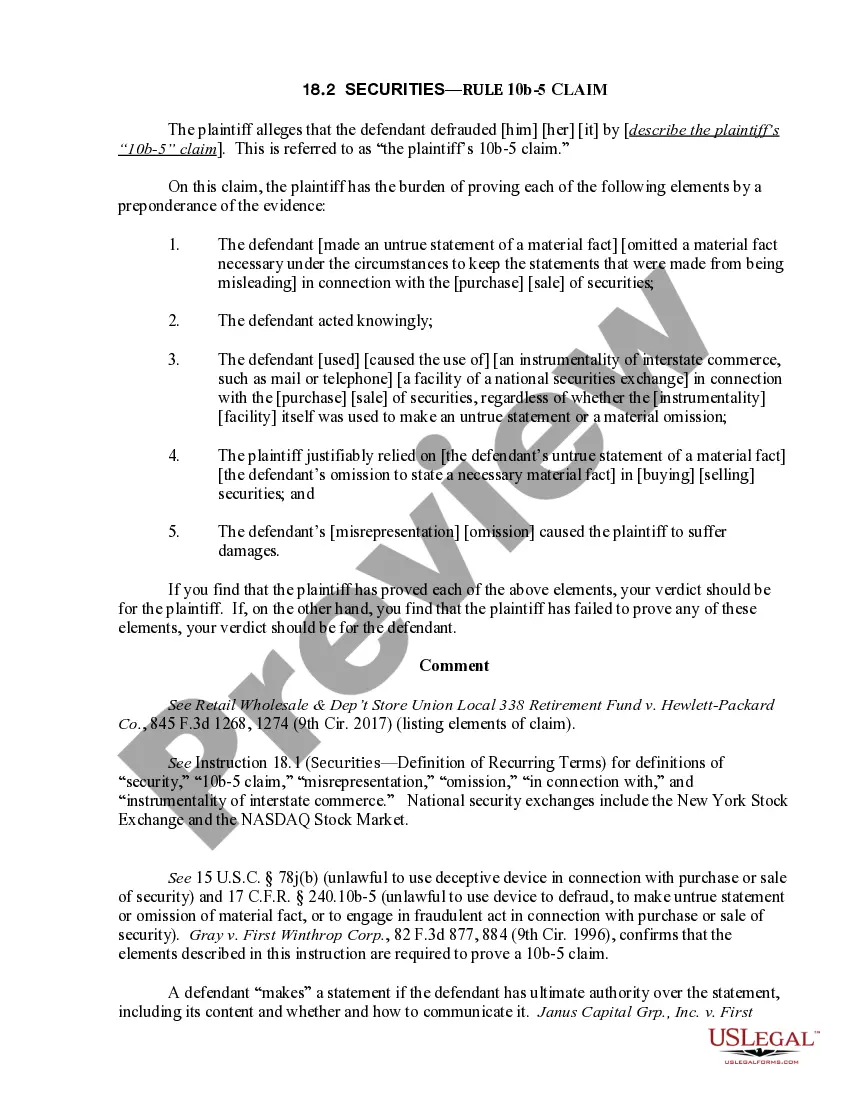

Description

How to fill out Breeder Agreement - Self-Employed Independent Contractor?

If you need to finish, download, or print valid document templates, utilize US Legal Forms, the leading collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Use US Legal Forms to locate the Mississippi Breeder Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Mississippi Breeder Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

To legally work as a self-employed independent contractor in Mississippi, specific requirements must be met. First, you must obtain the necessary licenses or permits relevant to your business. It's essential to sign a Mississippi Breeder Agreement - Self-Employed Independent Contractor to clarify roles and expectations. Moreover, maintaining accurate records for tax purposes ensures compliance with federal and state laws.

In Mississippi, there are no specific state laws regulating the number of hours you can work without a break as an independent contractor. However, it's wise to manage your time effectively to maintain productivity and prevent burnout. Referencing your Mississippi Breeder Agreement - Self-Employed Independent Contractor can help you establish a healthy work-life balance that suits your needs.

While it may not be legally required, having a contract as an independent contractor is highly advisable. A contract protects your interests by clearly outlining expectations, payment terms, and deliverables. It also serves as a reference point in case of disputes, making a Mississippi Breeder Agreement - Self-Employed Independent Contractor an essential tool for your business.

The new contractor law in Mississippi aims to clarify the status and rights of independent contractors. It sets forth guidelines for defining contractor relationships and establishes certain protections. Understanding these laws is crucial, especially if you are entering into a Mississippi Breeder Agreement - Self-Employed Independent Contractor, as this will help you navigate your rights effectively.

To create an independent contractor agreement, begin by clearly defining the scope of work, terms of payment, and timeline. Include clauses that outline responsibilities, confidentiality, and termination procedures. For a well-drafted Mississippi Breeder Agreement - Self-Employed Independent Contractor, consider utilizing platforms like uslegalforms, which offer templates and guidance tailored to your specific needs.

Starting July 1, 2025, Mississippi will implement new regulations affecting independent contractors. These laws include updated definitions and protections for workers operating under agreements like the Mississippi Breeder Agreement - Self-Employed Independent Contractor. It's essential to stay informed, as these changes can impact your rights, benefits, and obligations.

As an independent contractor, you have rights that include the ability to set your own hours and choose your own workload. You also have the right to negotiate your contractual terms, including project fees. Importantly, the Mississippi Breeder Agreement - Self-Employed Independent Contractor empowers you to maintain control over your business operations and provides protections under state laws.

To write an independent contractor agreement, start by defining the scope of work, payment terms, and deadlines. Ensure you include clauses that clarify the independent contractor's status, in line with guidelines such as the Mississippi Breeder Agreement - Self-Employed Independent Contractor. Utilizing the US Legal Forms platform can streamline this process, providing you with templates that are easy to customize and legally sound.

Yes, an independent contractor is generally considered self-employed. This means they operate their own business and are responsible for paying their own taxes. With a Mississippi Breeder Agreement - Self-Employed Independent Contractor, you clearly outline the terms of your work relationship. This agreement helps to define your status and responsibilities.

To fill out an independent contractor agreement, begin by identifying both parties involved and the specific services provided. Clearly outline payment details, deadlines, and any other critical terms. Using a reliable resource like US Legal Forms can help you access templates that guide you through creating a comprehensive Mississippi Breeder Agreement - Self-Employed Independent Contractor.