Mississippi Dancer Agreement - Self-Employed Independent Contractor

Description

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

If you want to collect, retrieve, or produce legal document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Take advantage of the website's user-friendly and straightforward search feature to find the documents you require.

Various templates for business and personal purposes are categorized by type and region, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to obtain the Mississippi Dancer Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to get the Mississippi Dancer Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously saved from the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

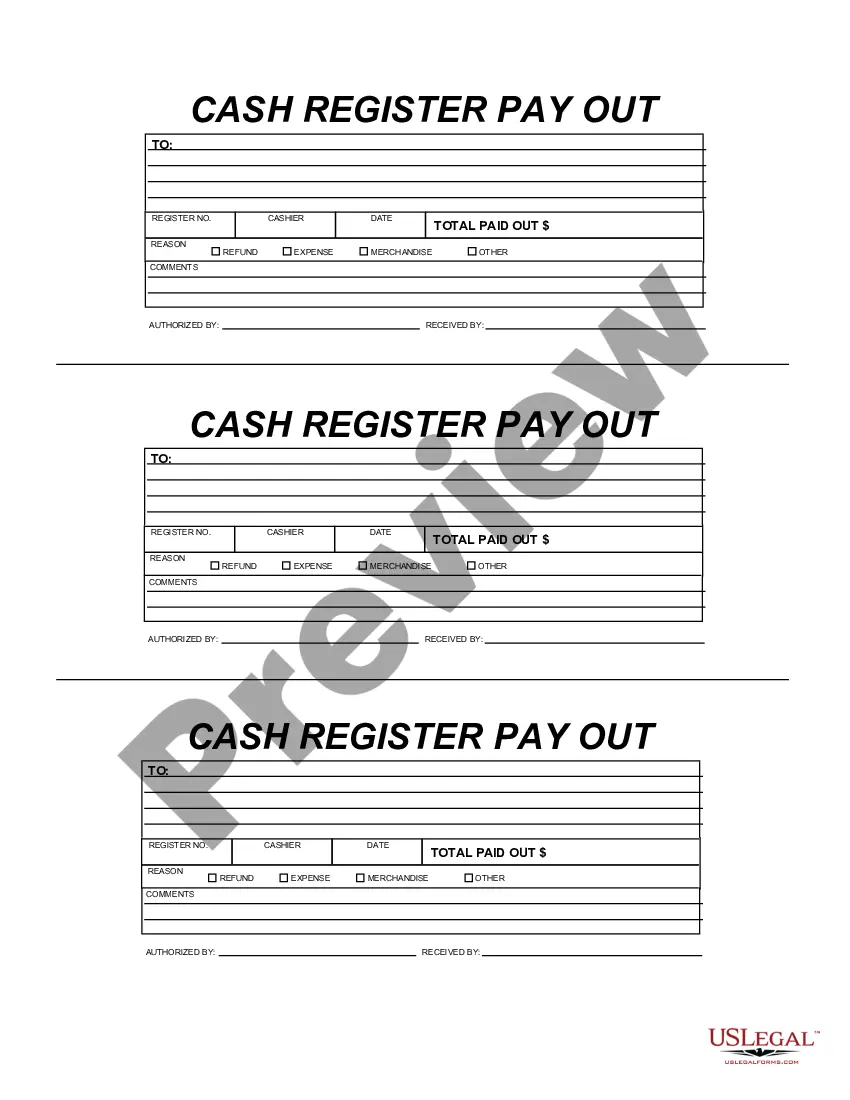

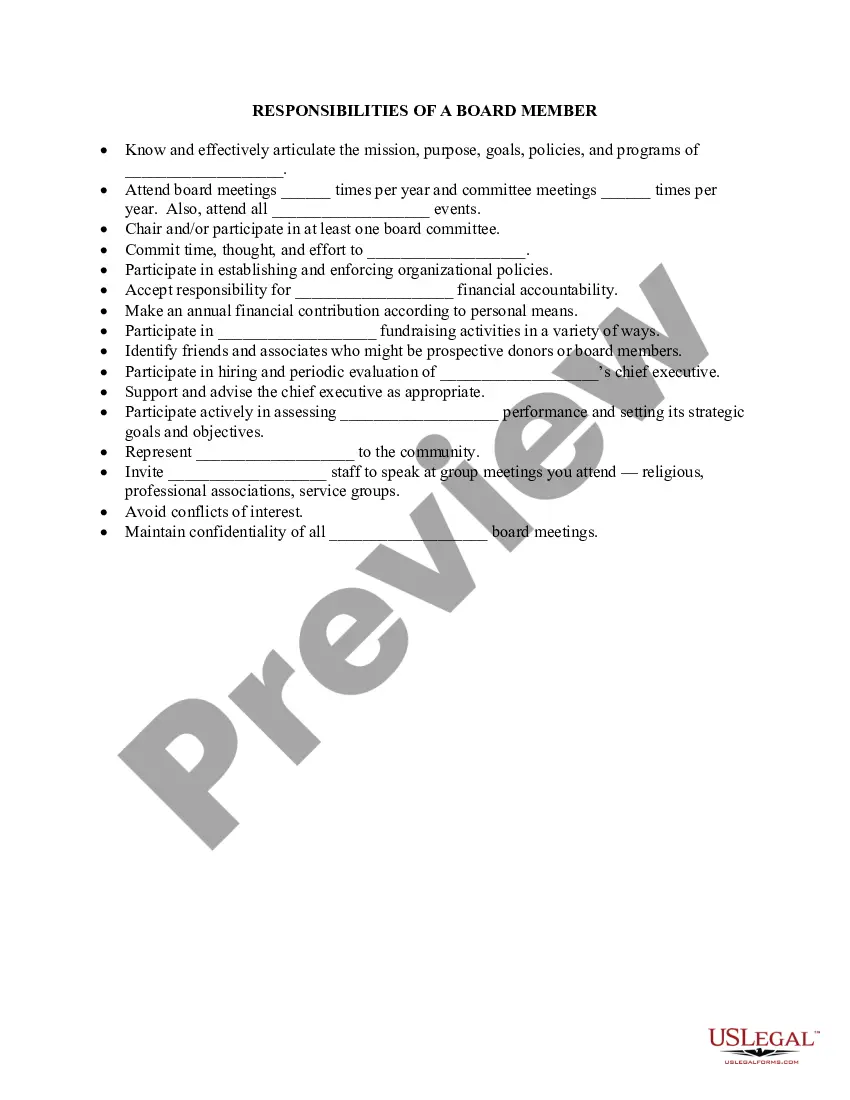

- Step 2. Use the Preview feature to review the form's content. Don't forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To fill out an independent contractor agreement, begin by entering the names and details of both parties. Next, specify the services to be provided, payment terms, and any deadlines. A Mississippi Dancer Agreement - Self-Employed Independent Contractor can serve as a valuable resource, guiding you through the essential sections to include for clarity and legal compliance.

When filling out an independent contractor form, include your personal information, the nature of the work, and payment details. Ensure that all information is accurate and aligns with the terms outlined in your Mississippi Dancer Agreement - Self-Employed Independent Contractor. This consistency will help in maintaining clear records and facilitating smooth transactions.

Filling out a declaration of independent contractor status form involves providing details about your business structure and services offered. Be sure to accurately describe your working relationship with clients to reflect your independent contractor status. Consider utilizing a Mississippi Dancer Agreement - Self-Employed Independent Contractor for clear and authoritative guidance through this process.

To write an independent contractor agreement, start by clearly stating the parties involved, the scope of work, and payment terms. Include clauses related to confidentiality and termination to ensure both parties understand their obligations. Using a Mississippi Dancer Agreement - Self-Employed Independent Contractor template can simplify this process and ensure you cover all necessary points.

As a self-employed independent contractor in Mississippi, you need to fill out a Form 1099-MISC to report your income. Additionally, a Mississippi Dancer Agreement - Self-Employed Independent Contractor can help clarify your terms of service with clients. It's important to have a proper agreement to protect your rights and outline your responsibilities.

In Mississippi, independent contractor laws govern the relationship between businesses and self-employed individuals. These laws outline rights, responsibilities, and eligibility criteria for independent contractors. Understanding these laws is vital, especially when drafting a Mississippi Dancer Agreement - Self-Employed Independent Contractor. For detailed insights and legal guidance, consider leveraging resources from UsLegalForms.

Creating an independent contractor agreement involves a few key steps. First, identify the specifics of the arrangement, including responsibilities, payment terms, and duration. Next, use a solid template for the Mississippi Dancer Agreement - Self-Employed Independent Contractor, which can simplify the process. Platforms like UsLegalForms can help you tailor the agreement to reflect the unique requirements of your business and ensure legal adherence.

Typically, the hiring party or the business that needs services writes the independent contractor agreement. However, both parties can collaborate to ensure the Mississippi Dancer Agreement - Self-Employed Independent Contractor accurately reflects their needs. Using a well-defined template can streamline this process, and services like UsLegalForms can provide essential guidance and ensure compliance with local laws.