Mississippi Material Liability Agreement

Description

How to fill out Material Liability Agreement?

Choosing the best authorized file web template might be a struggle. Of course, there are a lot of web templates available on the Internet, but how can you find the authorized kind you will need? Utilize the US Legal Forms internet site. The support offers thousands of web templates, such as the Mississippi Material Liability Agreement, which you can use for organization and personal requires. Each of the varieties are checked out by professionals and meet federal and state requirements.

If you are previously authorized, log in to your accounts and click the Down load button to obtain the Mississippi Material Liability Agreement. Make use of accounts to appear with the authorized varieties you may have purchased formerly. Check out the My Forms tab of the accounts and get yet another copy of the file you will need.

If you are a fresh user of US Legal Forms, here are simple instructions that you can follow:

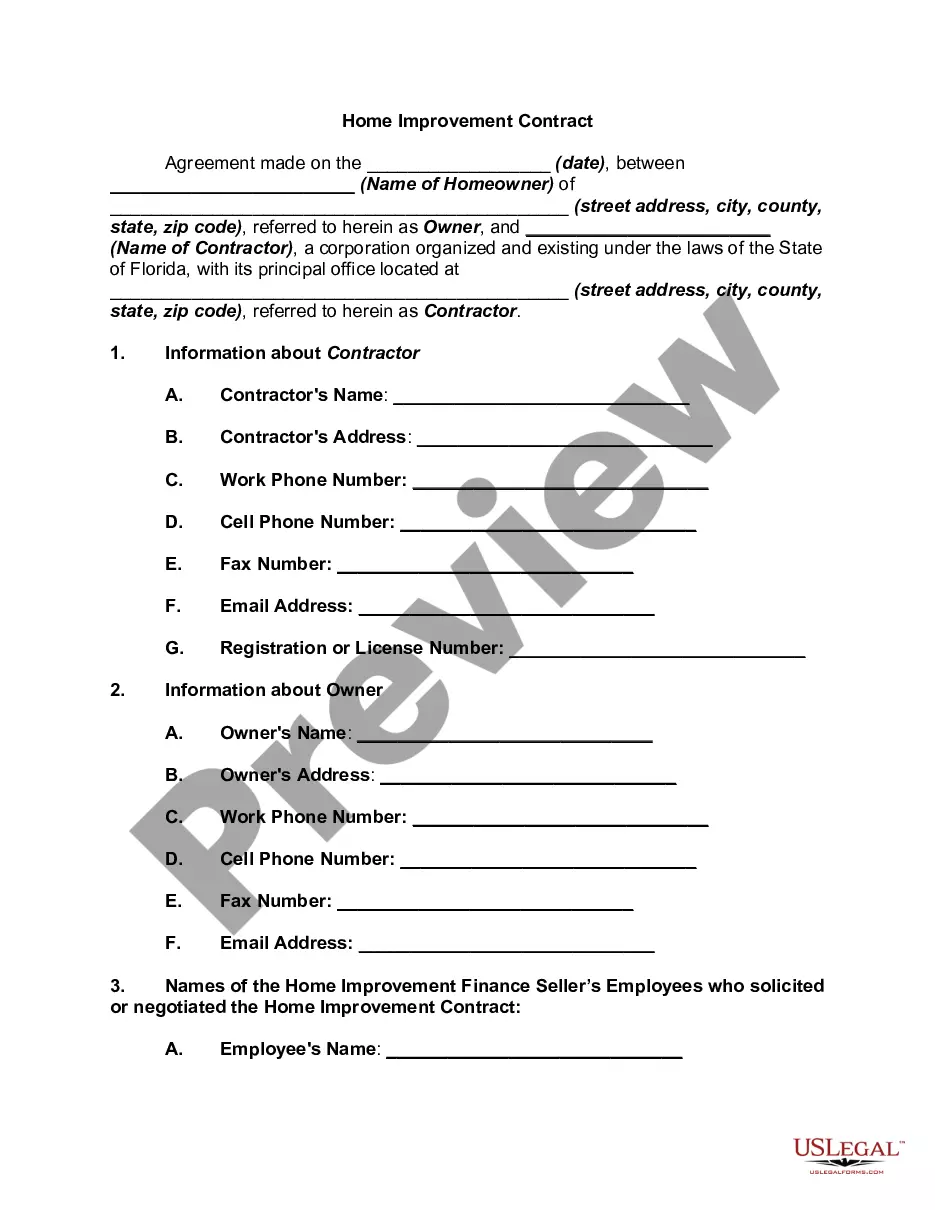

- Initially, ensure you have selected the proper kind for your personal metropolis/region. It is possible to look over the form while using Review button and look at the form description to guarantee it is the right one for you.

- When the kind does not meet your needs, utilize the Seach industry to get the proper kind.

- When you are certain the form is proper, go through the Acquire now button to obtain the kind.

- Pick the pricing plan you desire and enter the needed information. Create your accounts and buy the order using your PayPal accounts or bank card.

- Choose the file file format and obtain the authorized file web template to your gadget.

- Comprehensive, revise and print and signal the acquired Mississippi Material Liability Agreement.

US Legal Forms is the biggest local library of authorized varieties that you can find various file web templates. Utilize the service to obtain appropriately-produced files that follow condition requirements.

Form popularity

FAQ

Sales Tax Exemption: Farm equipment and machinery purchased for the exclusive and direct use in farming may be exempt for a reduced Sales Tax Rate of 1.5% in the State of Mississippi and is good for 7 years from June 26, 2018.

Some customers are exempt from paying sales tax under Mississippi law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

How Much Does It Cost? A General Contractor Application fee is $200, plus $50 for each classification. Commercial Licensing fee: $400, and includes one classification. Residential Licensing fee: $50, and includes one classification.

Material Purchase Certificate (MPC) Prior to beginning work, the prime contractor(s) is required to apply for a MPC for the contract . You may apply for a MPC on TAP.

A residential contractor license is required for anyone working on residential construction totaling $50,000 or more, or residential remodeling or roofing over $10,000. Residential electrical, plumbing or HVAC work is regulated by the city or county where the work is done.

Some goods are exempt from sales tax under Mississippi law. Examples include most non-prepared food items purchased with food stamps, prescription drugs, and some medical supplies.

Mississippi sales tax law imposes a 3.5% contractor's tax on all non-residential construction activities when the total contract price or compensation exceeds $10,000. The tax is levied on the entire contract price even though most construction contracts will consist of both goods and services.