Mississippi Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp.

Description

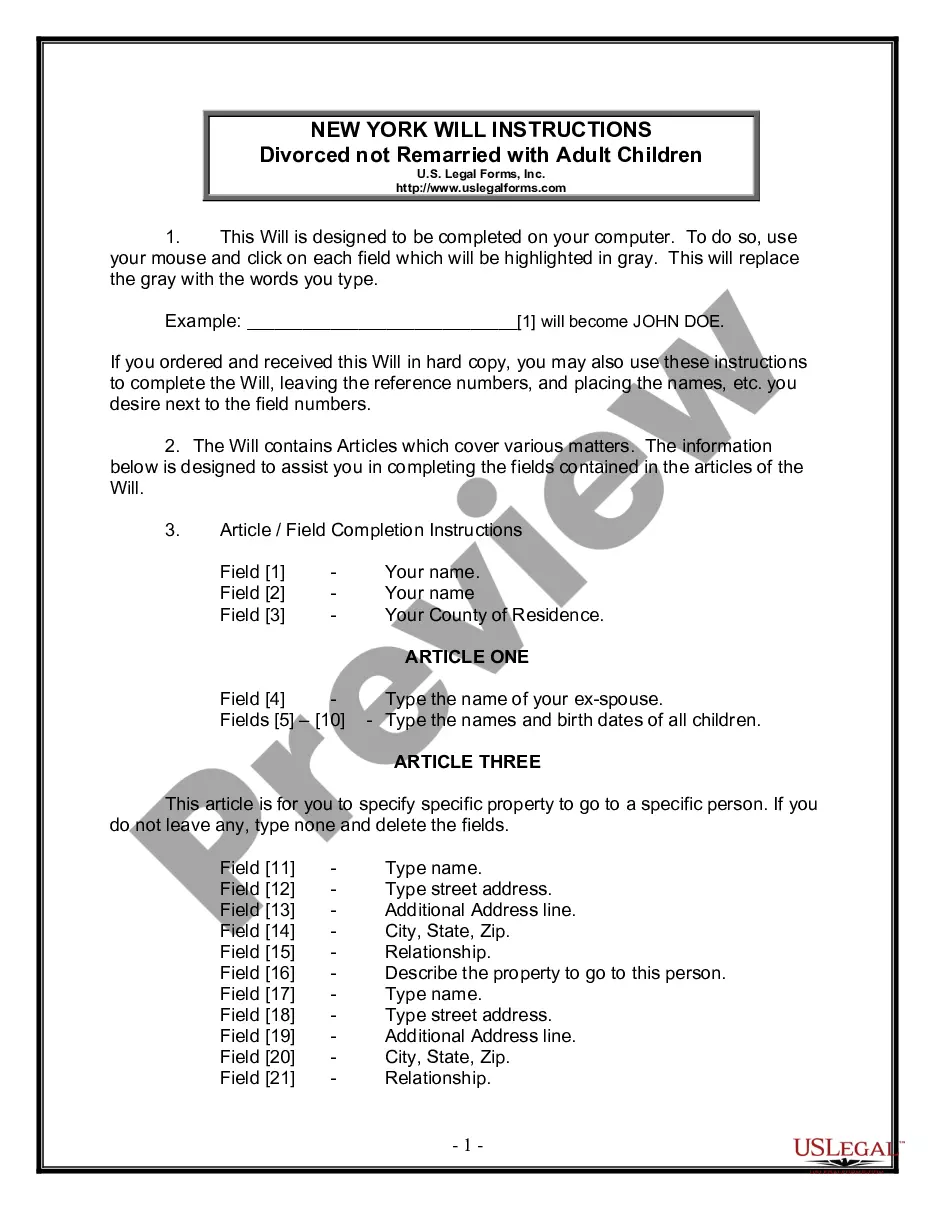

How to fill out Sample Stock Purchase Agreement Regarding Acquisition By Finova Capital Corp. Of All Outstanding Shares Of Fremont Financial Corp.?

Are you within a position the place you will need documents for sometimes organization or specific purposes just about every day? There are a lot of lawful document themes available on the Internet, but finding types you can rely on isn`t straightforward. US Legal Forms delivers a large number of type themes, just like the Mississippi Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp., that are published to satisfy state and federal specifications.

When you are currently knowledgeable about US Legal Forms site and also have your account, merely log in. After that, you are able to acquire the Mississippi Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. web template.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is to the right town/state.

- Take advantage of the Review option to review the shape.

- See the description to actually have chosen the right type.

- In the event the type isn`t what you are searching for, use the Search field to get the type that fits your needs and specifications.

- Once you obtain the right type, click Acquire now.

- Choose the pricing plan you want, complete the specified information and facts to make your bank account, and pay money for an order utilizing your PayPal or charge card.

- Choose a handy paper format and acquire your copy.

Find every one of the document themes you might have bought in the My Forms food selection. You can aquire a additional copy of Mississippi Sample Stock Purchase Agreement regarding acquisition by Finova Capital Corp. of all outstanding shares of Fremont Financial Corp. anytime, if needed. Just select the essential type to acquire or print out the document web template.

Use US Legal Forms, the most comprehensive selection of lawful types, to save lots of time as well as avoid blunders. The support delivers professionally created lawful document themes which you can use for a variety of purposes. Create your account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

Scope of a share purchase agreement The parties to the agreement. Information on the company selling shares. Purchase price of the shares. Title. Timetable for completion. Warranties. Restrictions following completion. Confidentiality requirements.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

Some of the essential items that you can find in all sales contracts are as follows: Seller and buyer information. Details on the property sold. Sales price and how the buyer is financing the purchase. Appliances and fixtures that the sale includes and excludes. Closing date and possession date. Deposit amount.

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

Some of the key items that are listed in a stock purchase agreement are: Name of the company whose shares are being bought and sold; Name of the buyer and seller of shares; The number of shares being sold and the par value of those shares; The date and place of the transaction;

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.

A stock purchase agreement typically includes the following information: Your business name. The name and mailing address of the entity buying shares in your company's stocks. The par value (essentially the sale price) of the stocks being sold. The number of stocks the buyer is purchasing.