Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist

Description

How to fill out Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist?

Have you ever been in a situation where you require documentation for either business or personal purposes almost on a daily basis? There is an abundance of legal form templates available online, yet locating reliable ones can be challenging.

US Legal Forms provides thousands of form templates, including the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist, crafted to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Afterwards, you can download the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist template.

Find all of the form templates you have purchased in the My documents section. You can download another copy of the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist anytime, if necessary. Simply click on the desired form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legal documents, to save time and avoid errors. The service offers well-crafted legal form templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life simpler.

- Acquire the form you need and ensure it is for the correct locality/region.

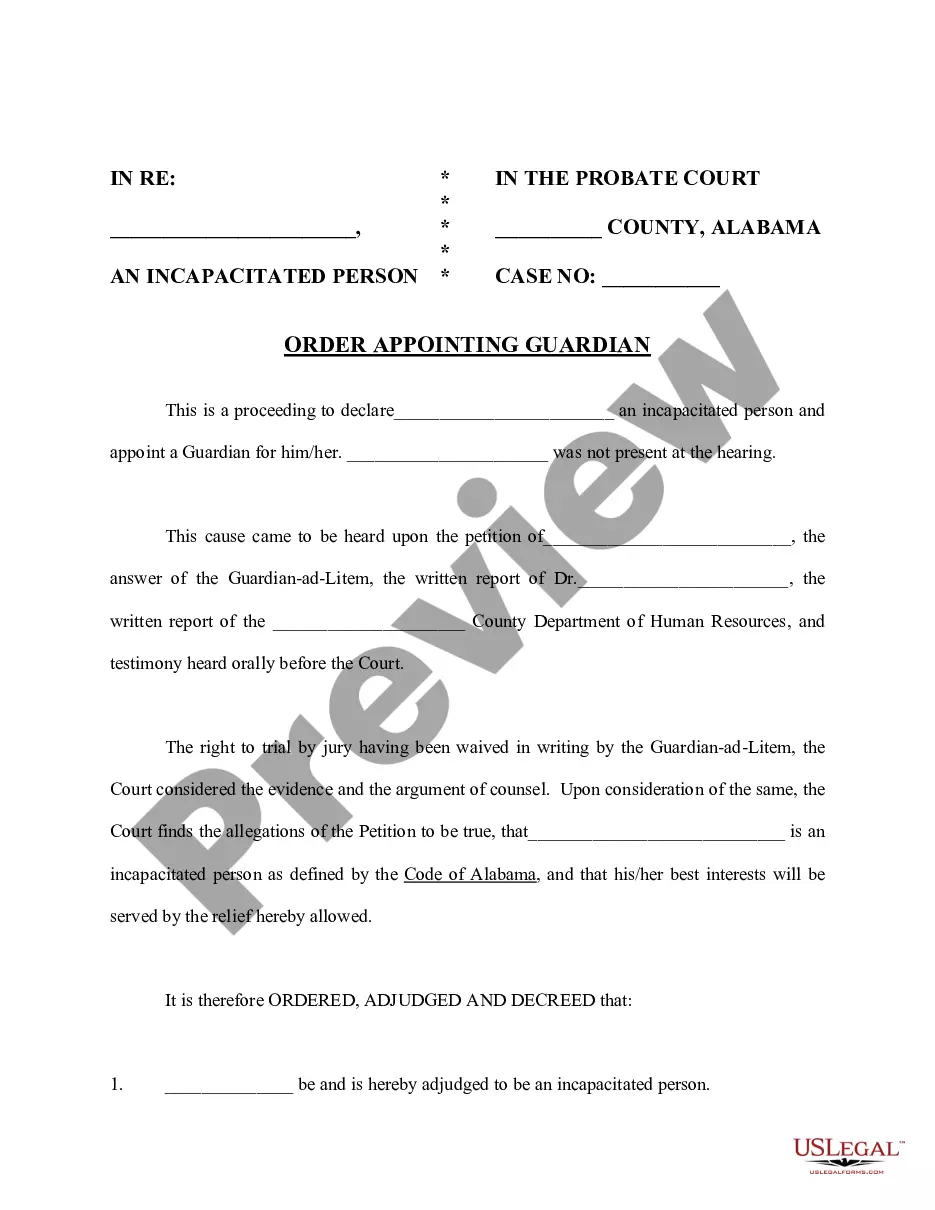

- Utilize the Preview button to view the document.

- Review the description to confirm you have selected the correct form.

- If the form is not what you seek, use the Search area to find a form that suits your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Choose the payment plan you desire, fill in the required information to create your account, and complete your purchase using PayPal or a credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

Yes, many REITs work with investment advisors to guide their investment strategies and manage portfolios. An investment advisor can provide insights into the real estate market, helping REITs optimize their investment decisions. Engaging with an experienced advisor while utilizing the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist can lead to better investment outcomes.

You can find information about a REIT's investment portfolio on its official website, in its financial reports, and through various investment research platforms. Many REITs disclose their portfolio details in annual reports or investor presentations, making it easier for investors to assess their assets. Reviewing this information alongside the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist can enhance your investment strategy.

A REIT portfolio is a collection of investments in real estate properties or mortgages that a real estate investment trust owns. It can include various types of real estate, such as residential, commercial, and industrial properties. Knowing the composition of a REIT portfolio can help you make informed decisions, especially when reviewing the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist.

A due diligence checklist in real estate serves as a roadmap for assessing properties and identifying risks. It typically covers areas such as title verification, zoning regulations, and tenant contracts. Utilizing the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist ensures you have a detailed framework that helps minimize surprises during the investment process.

The 4 P's of due diligence include People, Property, Purpose, and Potential. These elements help investors evaluate not only the financial viability of a property but also the team behind it and its future growth. By thoroughly considering the 4 P's, particularly with tools like the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist, you can make informed decisions.

A due diligence checklist is a comprehensive list of items that investors should review when assessing a property. This checklist guides you through key areas, including financial records, property condition, and legal compliance. Using the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist can streamline your review process and enhance your investment decisions.

A due diligence check in real estate involves a thorough investigation of a property before making an investment decision. Investors review financial, legal, and physical aspects of the property to identify any potential risks. This process ensures you understand what you're committing to, particularly when considering the Mississippi Landlord Tenant Investment Trust REIT Due Diligence Supplemental Checklist.