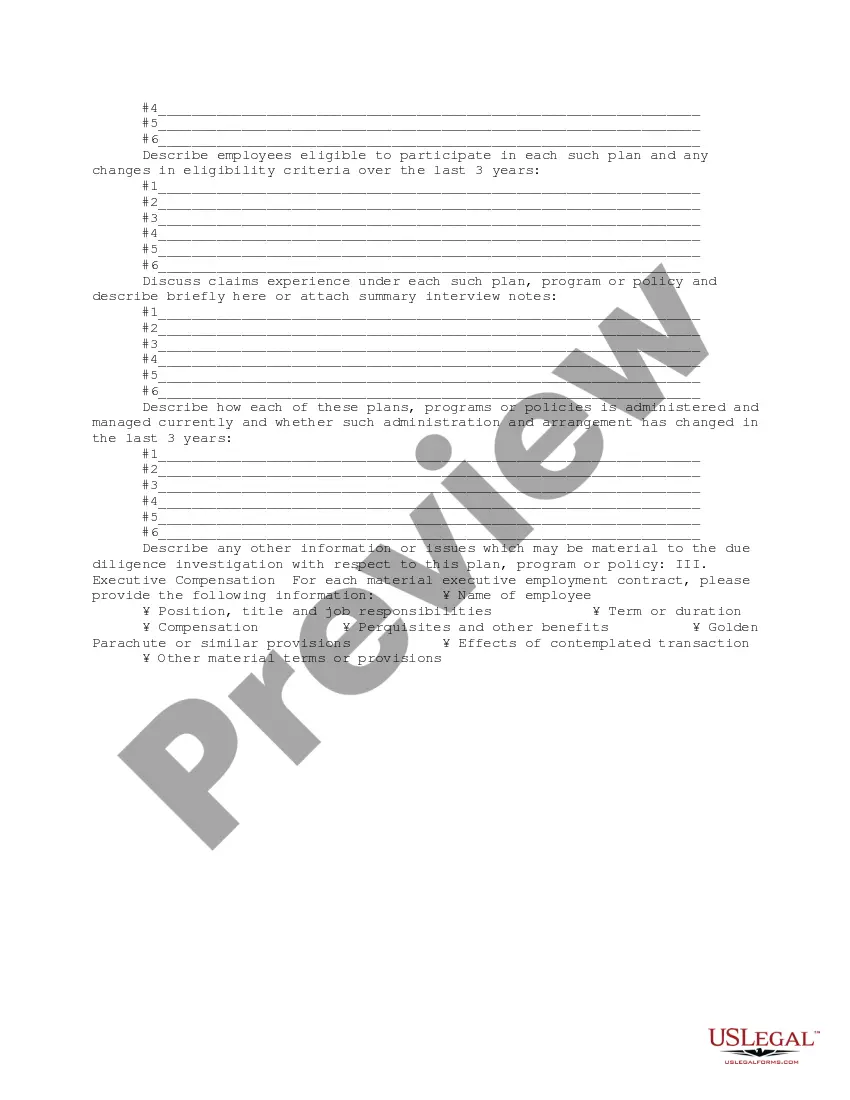

Mississippi Employee Benefit Plan Workform

Description

How to fill out Employee Benefit Plan Workform?

Finding the appropriate legal document template can be challenging. Naturally, there are numerous formats available online, but how can you locate the precise form you need.

Utilize the US Legal Forms platform. The service offers a multitude of templates, such as the Mississippi Employee Benefit Plan Workform, which can be used for both business and personal purposes. All the forms are verified by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to access the Mississippi Employee Benefit Plan Workform. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you require.

Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Mississippi Employee Benefit Plan Workform. US Legal Forms is the largest repository of legal templates where you can find a variety of document formats. Utilize the service to download professionally created documents that comply with state regulations.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your jurisdiction/state. You can explore the document using the Review button and read the form details to confirm it is suitable for you.

- If the form does not fulfill your needs, use the Search box to find the right template.

- Once you are certain that the form is appropriate, click the Get now button to acquire the document.

- Select the pricing plan you wish to use and input the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

Form popularity

FAQ

The CalPERS 457 Plan is a retirement savings plan. Generally, you cannot withdraw money from your plan account while you are still employed by your employer. You may, however, make Emergency withdrawals for specific financial hardships prior to separation from employment.

You cannot receive loans, partial refunds, or hardship withdrawals of your contributions. However, upon termination from employment, you may apply for a full refund of your contributions.

The Public Employees' Retirement System of Mississippi (PERS or the System) is a governmental defined benefit plan qualified under Section 401(a) of the Internal Revenue Code.

You may request a balance of your account by contacting PERS Customer Service. You may call in your request at 800-444-7377 or 6601-359-3589, or you may fax your request to 601-359-6707 with the following information: Name. Retirement Plan (PERS, SLRP, MHSPRS, or MRS)

With a graded vesting schedule, your company's contributions must vest at least 20% after two years, 40% after three years, 60% after four years, 80% after five years and 100% after six years. If enrollment is automatic and employer contributions are required, they must vest within two years.

The minimum retirement age for service retirement for most members is 50 years with five years of service credit. The more service credit you have, the higher your retirement benefits will be.

Service retirement is a lifetime benefit. Employees can retire as early as age 50 with five years of CalPERS pensionable service credit unless all service was earned on or after January 1, 2013, then employees must be at least age 52 to retire.

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.

The California Public Employees Retirement System (CalPERS) offers a defined benefit retirement plan. It provides benefits based on members years of service, age, and final compensation. In addition, benefits are provided for disability death, and payments to survivors or beneficiaries of eligible members.

Once CalPERS membership is terminated, you no longer are entitled to any CalPERS benefits, including retirement. You are eligible for a refund only if you are not entering employment with another CalPERS-covered employer. Applicable state and federal taxes will be withheld from your refund.