Mississippi Industrial Revenue Development Bond Workform

Description

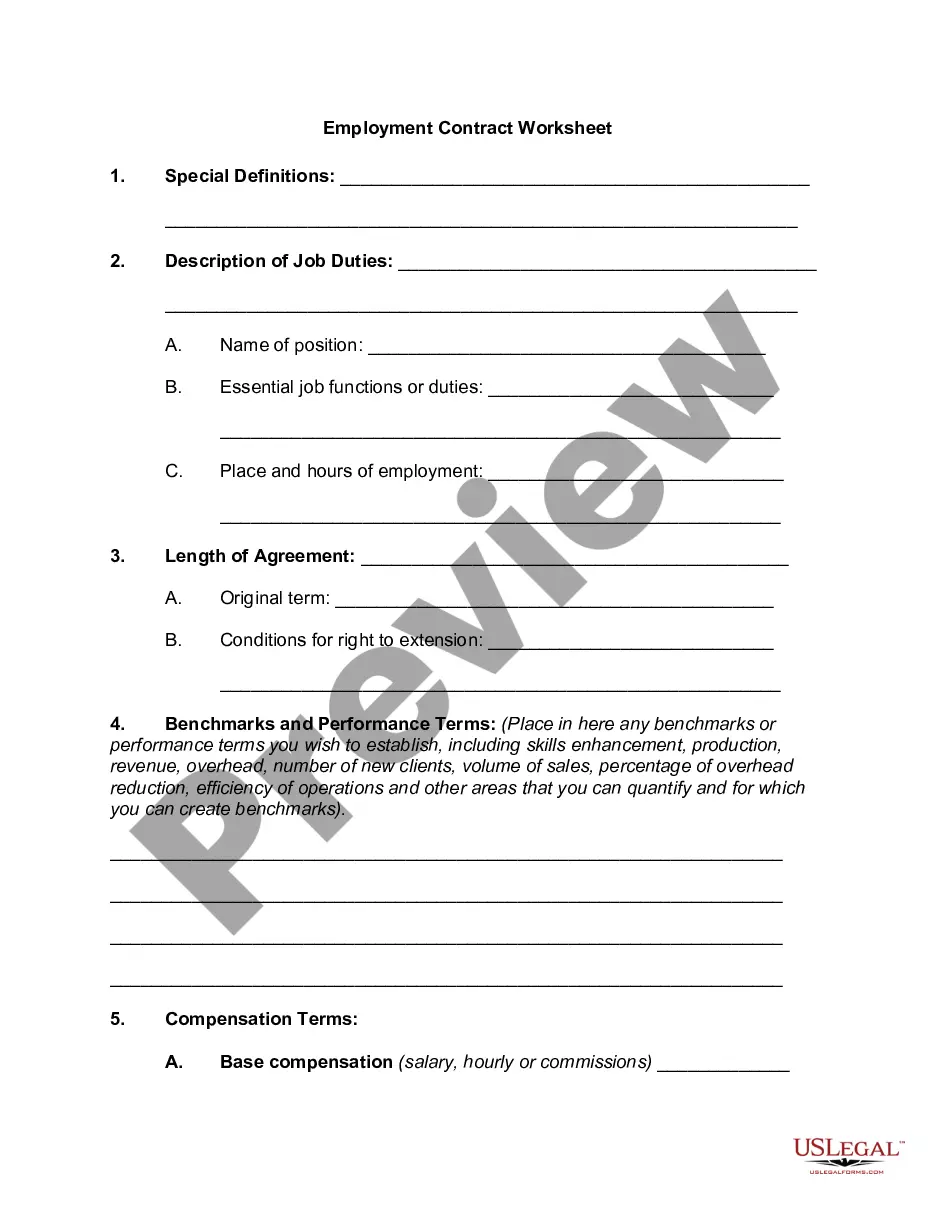

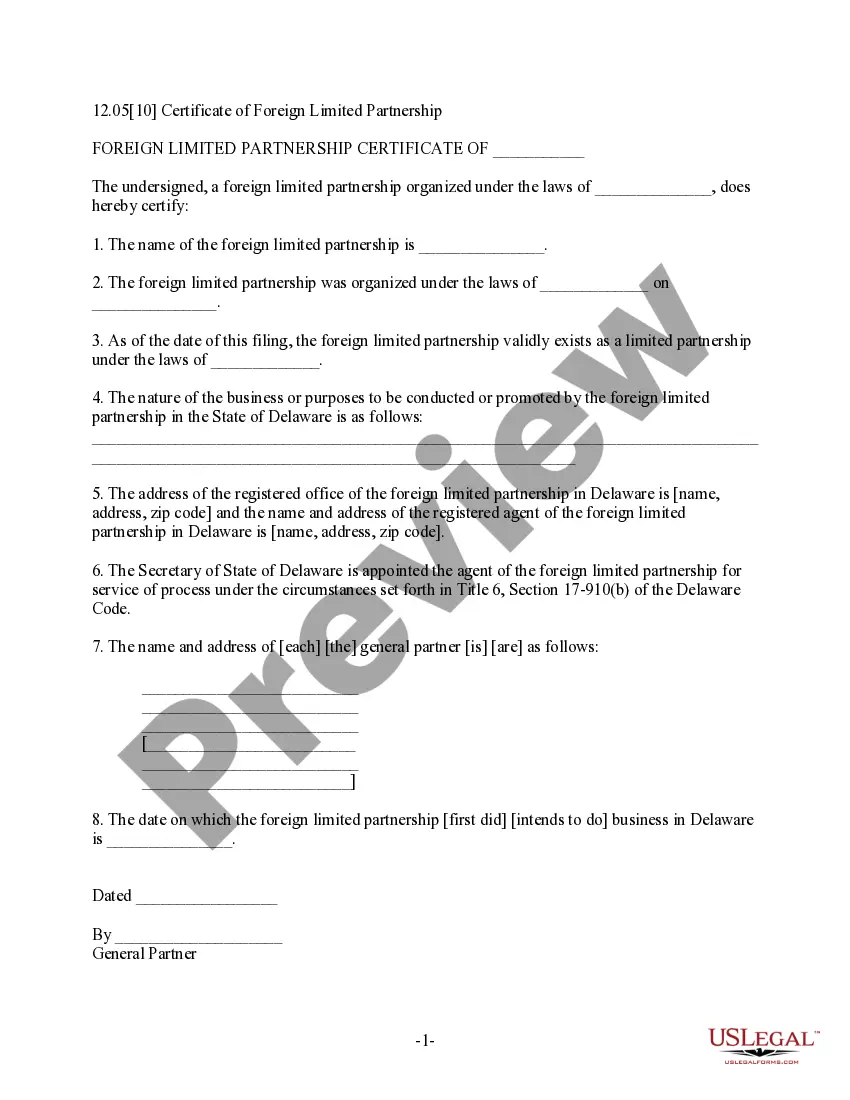

How to fill out Industrial Revenue Development Bond Workform?

If you need to full, acquire, or print out legitimate document templates, use US Legal Forms, the most important assortment of legitimate types, which can be found on the Internet. Make use of the site`s simple and practical research to find the files you require. Numerous templates for business and personal uses are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to find the Mississippi Industrial Revenue Development Bond Workform within a couple of click throughs.

In case you are presently a US Legal Forms customer, log in to the profile and click the Download button to get the Mississippi Industrial Revenue Development Bond Workform. You can even access types you previously saved from the My Forms tab of your own profile.

If you use US Legal Forms the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for the right town/region.

- Step 2. Take advantage of the Review choice to examine the form`s information. Do not forget to read the outline.

- Step 3. In case you are unsatisfied with all the form, use the Search industry towards the top of the display to find other variations in the legitimate form design.

- Step 4. Once you have identified the form you require, select the Acquire now button. Select the costs prepare you favor and add your credentials to register for an profile.

- Step 5. Process the purchase. You should use your Мisa or Ьastercard or PayPal profile to perform the purchase.

- Step 6. Pick the structure in the legitimate form and acquire it in your system.

- Step 7. Full, modify and print out or indicator the Mississippi Industrial Revenue Development Bond Workform.

Every legitimate document design you purchase is yours for a long time. You possess acces to every single form you saved in your acccount. Select the My Forms area and select a form to print out or acquire once more.

Compete and acquire, and print out the Mississippi Industrial Revenue Development Bond Workform with US Legal Forms. There are thousands of specialist and condition-certain types you can utilize for your business or personal demands.

Form popularity

FAQ

Hear this out loud PauseKey Takeaways. Revenue bonds are a class of municipal bonds issued to fund public projects which then repay investors from the income created by that project. For instance, a toll road or utility can be financed with municipal bonds with creditors' interest and principal repaid from the tolls or fees collected.

Hear this out loud PauseAn IRB is a variety of revenue bond, specifically a private activity bond. IRBs raise capital to fund the development of a manufacturing facility or equipment that will benefit the community at large; bondholders are repaid by the revenue the project generates.

Hear this out loud PauseMississippi Works Fund Grant: The Mississippi Works Fund is a flexible workforce training incentive that allows Mississippi to proactively meet the training needs of both new and existing employers in the state.

General obligation bonds, which are also referred to as GOs, are municipal bonds which provide a way for state and local governments to raise money for projects that may not generate a revenue stream directly.

Hear this out loud PauseGovernment agencies issue bonds to finance a variety of economic or public development projects for private and public entities. When investors purchase bonds, they essentially lend money to the borrower through the issuer.

BOND ISSUERS Specific requirements vary under state law. State Law. Private Activity Bonds must be issued by governmental authorities. Virtually all states authorize Bond financing, and the types of Issuers and the Projects that they may finance vary.

Development Impact Bonds (DIBs), like Social Impact Bonds (SIBs), are results-based contracts in which private investors provide pre-financing for social programmes and public sector agencies pay back investors their principal plus a return if, and only if, these programmes succeed in delivering social outcomes.

Under the Basel II guidelines, banks are allowed to use their own estimated risk parameters for the purpose of calculating regulatory capital. This is known as the internal ratings-based (IRB) approach to capital requirements for credit risk.