Mississippi Debt Conversion Agreement with exhibit A only

Description

How to fill out Debt Conversion Agreement With Exhibit A Only?

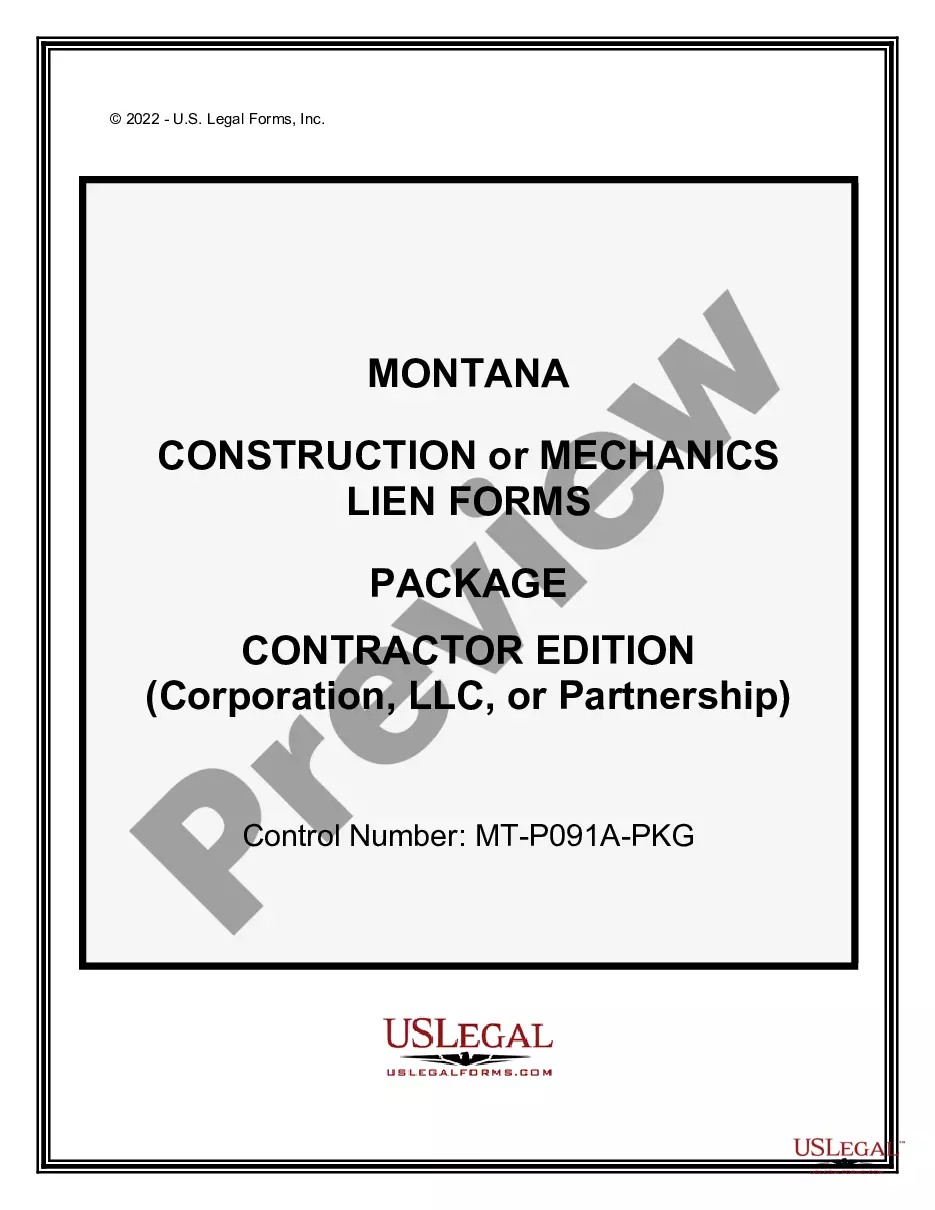

Finding the right legitimate document design can be quite a have a problem. Of course, there are a variety of themes available on the Internet, but how will you get the legitimate kind you need? Make use of the US Legal Forms web site. The service gives 1000s of themes, like the Mississippi Debt Conversion Agreement with exhibit A only, which can be used for organization and personal needs. Every one of the kinds are checked by experts and meet state and federal specifications.

In case you are presently listed, log in for your profile and click on the Acquire switch to get the Mississippi Debt Conversion Agreement with exhibit A only. Utilize your profile to look with the legitimate kinds you possess ordered earlier. Check out the My Forms tab of the profile and acquire yet another backup of the document you need.

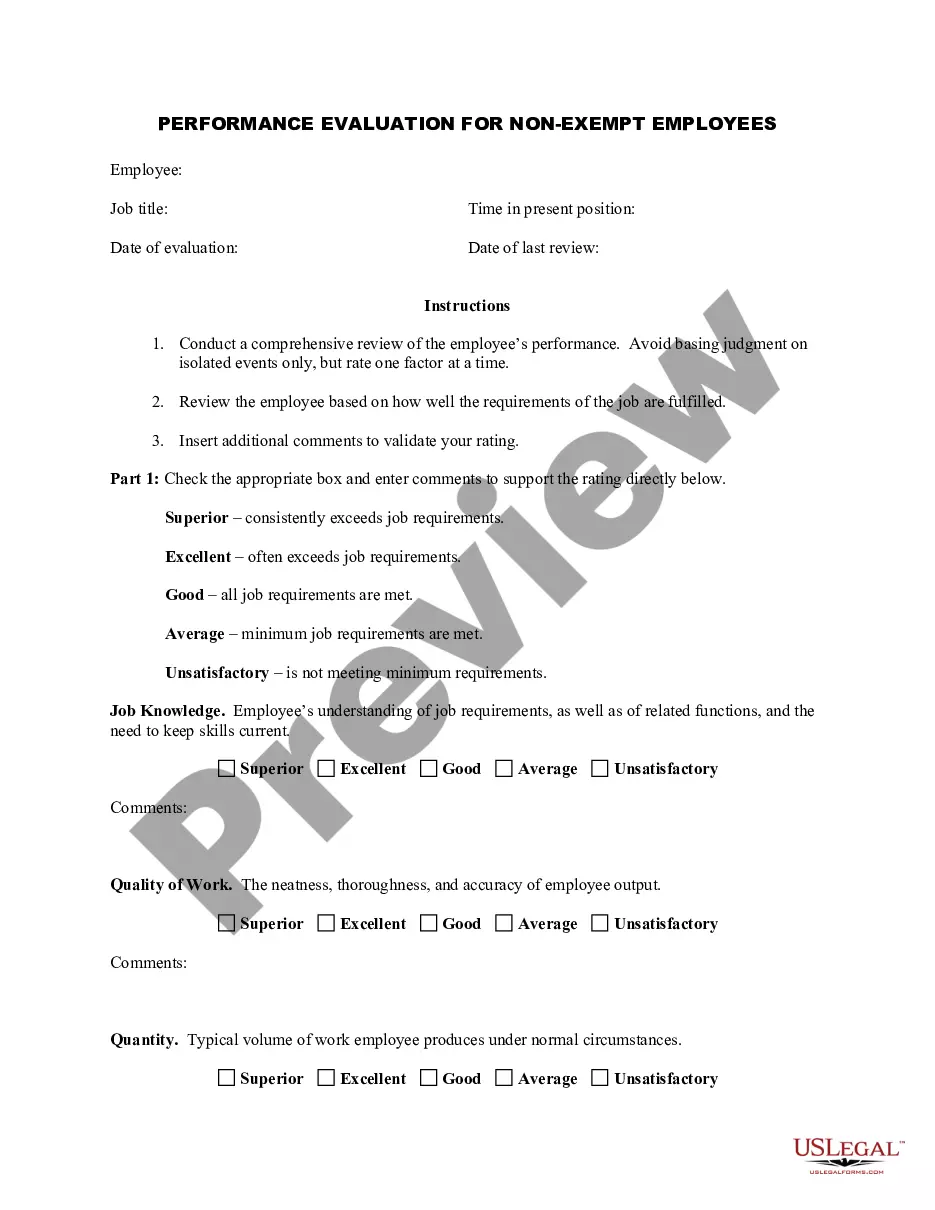

In case you are a new consumer of US Legal Forms, listed below are easy instructions so that you can follow:

- Initially, make certain you have selected the right kind for the area/region. You can examine the form while using Review switch and look at the form explanation to guarantee it will be the right one for you.

- In the event the kind is not going to meet your needs, make use of the Seach area to get the appropriate kind.

- Once you are certain that the form is proper, select the Buy now switch to get the kind.

- Opt for the prices prepare you need and type in the needed information and facts. Design your profile and buy your order making use of your PayPal profile or credit card.

- Choose the submit format and obtain the legitimate document design for your system.

- Full, change and print and sign the received Mississippi Debt Conversion Agreement with exhibit A only.

US Legal Forms is definitely the greatest catalogue of legitimate kinds where you can find different document themes. Make use of the service to obtain skillfully-created files that follow state specifications.

Form popularity

FAQ

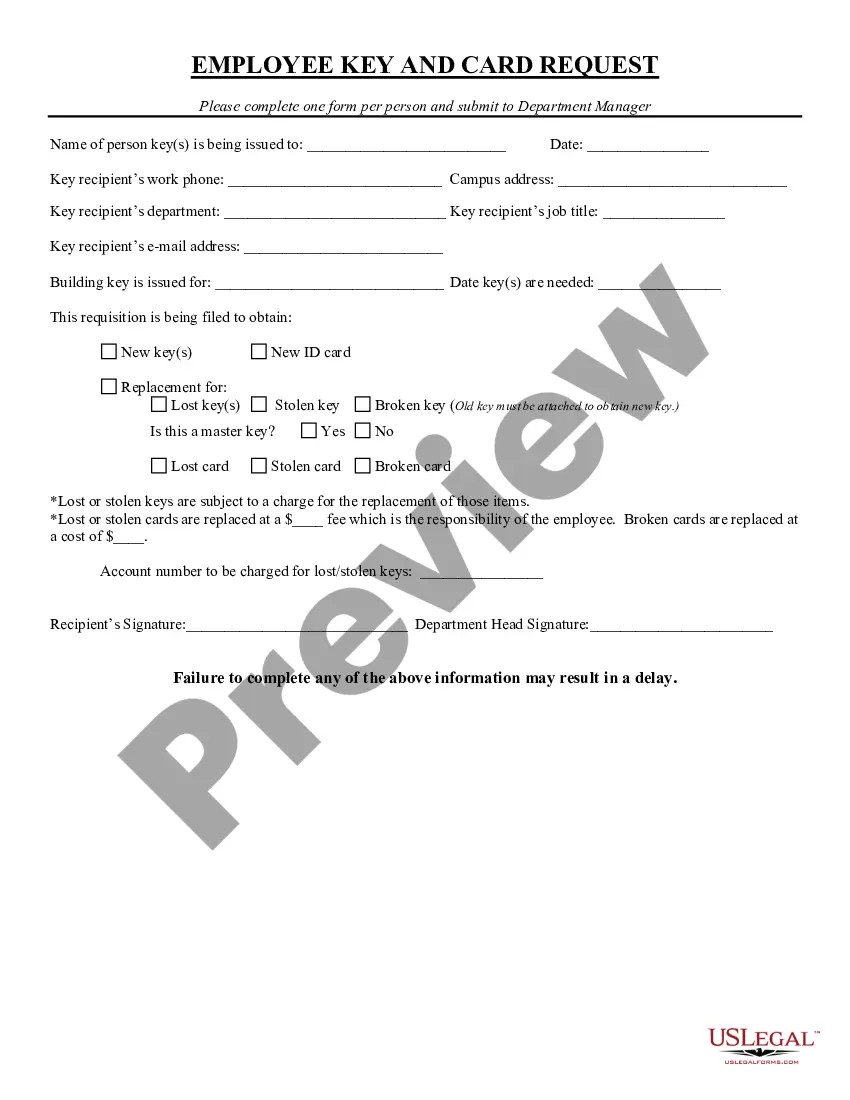

A debt/equity swap is a refinancing deal in which a debt holder gets an equity position in exchange for the cancellation of the debt. The swap is generally done to help a struggling company continue to operate. The logic behind this is an insolvent company cannot pay its debts or improve its equity standing.

In the case of an equity-for-debt swap, all specified shareholders are given the right to exchange their stock for a predetermined amount of debt in the same company. Bonds are usually the type of debt that is offered.

The primary advantages are the following: Financial survival ? A debt/equity swap may offer the company the best chance of weathering financial difficulties. Preservation of credit rating ? By not defaulting on loan payments, the company can maintain its credit rating.

Creditors involved in a debt-to-equity swap are generally able to convert their debt into equity in a tax neutral transaction, where the tax book value of the shares received equals the tax book value of the converted debt. The position may be different if the creditor is a related party of the debtor.

The ratio at which debt is exchanged for equity can vary, with more favorable ratios making the swap more enticing. Advantages include cost-effective financing and reputation preservation, while disadvantages include loss of control and potential financial instability.

There are a number of risks and rewards associated with debt conversion. One of the biggest risks is that the company may not be able to make the required interest payments on the new equity. If this happens, the company may be forced to issue more equity or take on additional debt in order to make the payments.

With convertible debt, a business borrows money from a lender or investor where both parties enter the agreement with the intent (from the outset) to repay all (or part) of the loan by converting it into a certain number of its preferred or common shares at some point in the future.

Section 62(3) of the Companies Act allows for the conversion of loans into equity. This section states that a company may, with the approval of a special resolution passed by its shareholders, convert any of its loans into shares of the company.