Mississippi Incentive and Nonqualified Share Option Plan

Description

How to fill out Incentive And Nonqualified Share Option Plan?

Are you within a position where you require documents for sometimes enterprise or individual functions virtually every day time? There are a lot of legal file web templates available on the Internet, but getting kinds you can rely on isn`t straightforward. US Legal Forms delivers thousands of type web templates, like the Mississippi Incentive and Nonqualified Share Option Plan, that are composed in order to meet state and federal demands.

Should you be currently informed about US Legal Forms site and get an account, basically log in. After that, you may down load the Mississippi Incentive and Nonqualified Share Option Plan web template.

Should you not have an account and would like to start using US Legal Forms, abide by these steps:

- Find the type you will need and ensure it is for the right town/region.

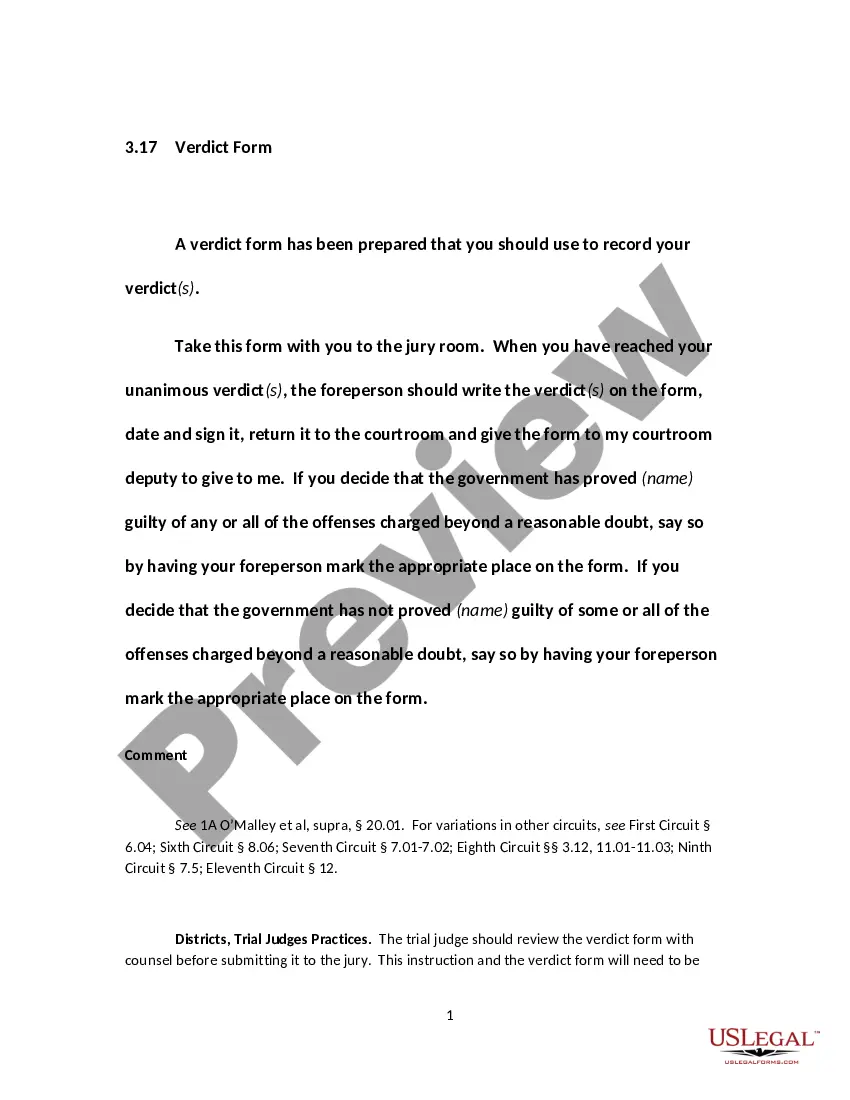

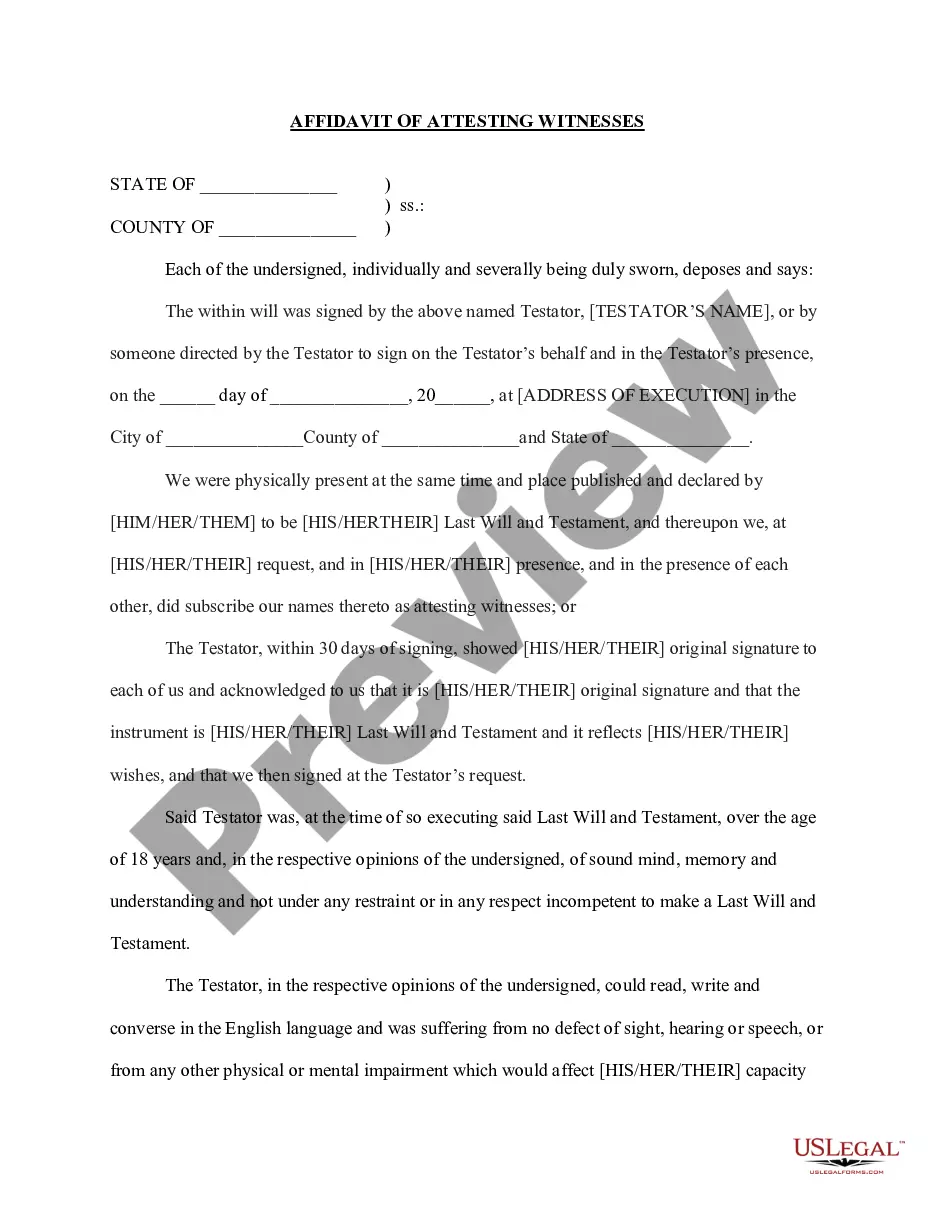

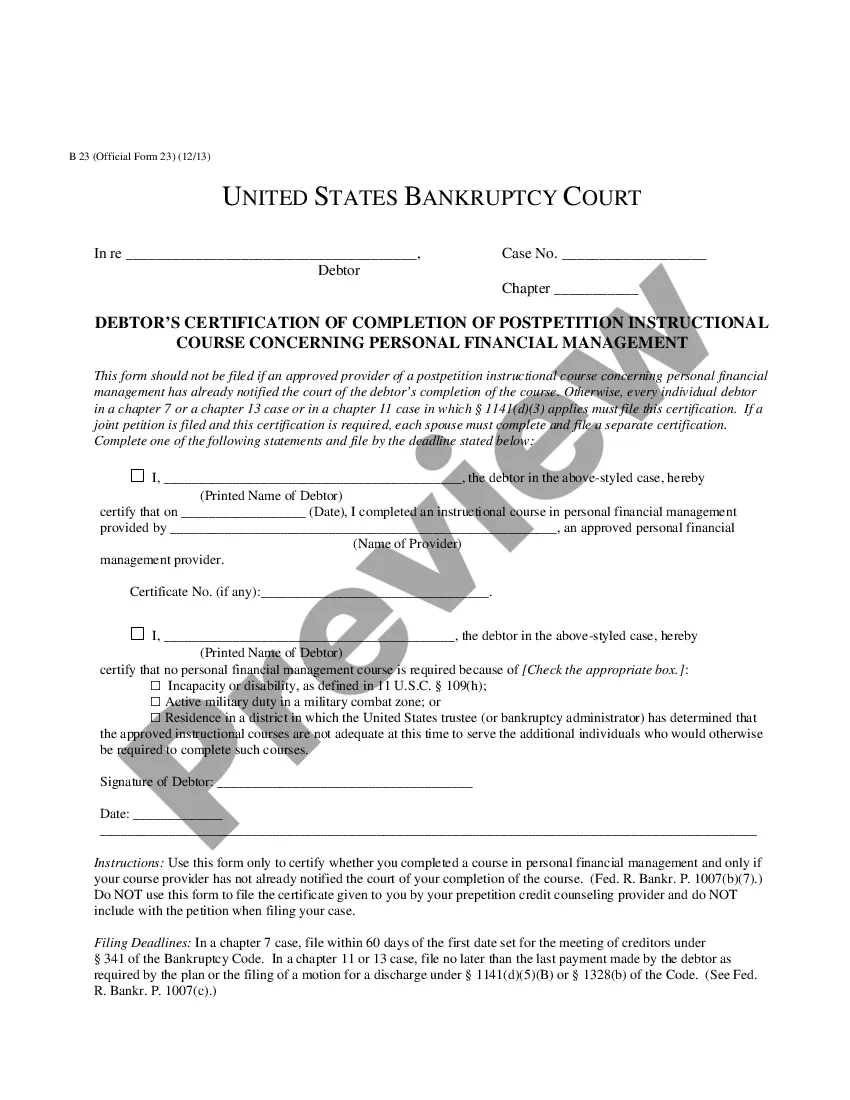

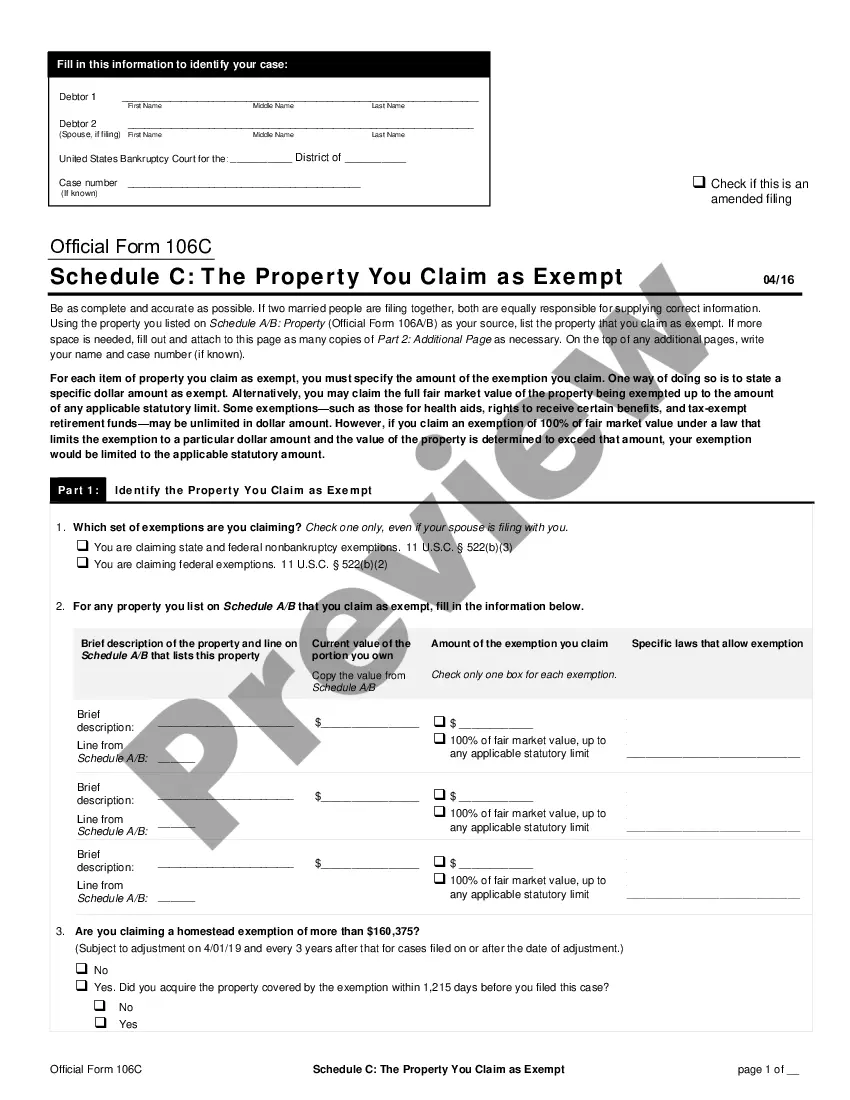

- Utilize the Review option to analyze the form.

- See the outline to actually have chosen the right type.

- In case the type isn`t what you are seeking, take advantage of the Look for industry to discover the type that meets your requirements and demands.

- Whenever you get the right type, simply click Get now.

- Opt for the costs strategy you would like, fill out the desired information to generate your account, and pay money for an order utilizing your PayPal or bank card.

- Pick a practical paper file format and down load your backup.

Get all the file web templates you have bought in the My Forms menu. You can obtain a additional backup of Mississippi Incentive and Nonqualified Share Option Plan any time, if necessary. Just click on the needed type to down load or produce the file web template.

Use US Legal Forms, one of the most considerable assortment of legal varieties, to save time and prevent mistakes. The services delivers appropriately produced legal file web templates which can be used for a variety of functions. Create an account on US Legal Forms and start generating your way of life a little easier.

Form popularity

FAQ

When you exercise nonqualified stock options, your employer will most likely withhold a flat 22% for federal income taxes. However, you might be under-withheld if you're in the 32%, 35%, or 37% tax bracket. Stock options can be advantageous but can also create unexpected tax consequences.

Tax Treatment for Incentive Stock Options (ISOs) ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

You report the taxable income only when you sell the stock. And, depending on how long you own the stock, that income could be taxed at capital gain rates ranging from 0% to 23.8% (for sales in 2023)?typically a lot lower than your regular income tax rate.

Qualified Stock Option (NSO) is much like an ISO. However, unlike ISOs, NSOs are eligible for any service providers, e.g. employees, consultants, and directors, and may or may not include a vesting schedule. Their expiration is more flexible without a fixed period. They don't qualify for special tax treatment.

Tax Treatment for Incentive Stock Options (ISOs) ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

An incentive stock option (ISO) is a qualified stock option that provides added tax benefits to employees. Unlike common stock, a stock option provides its holder with the right to buy shares of the company's stock at a set price (the ?exercise price? or ?strike price? ) at a future date.

Taxation. The main difference between ISOs and NQOs is the way that they are taxed. NSOs are generally taxed as a part of regular compensation under the ordinary federal income tax rate. Qualifying dispositions of ISOs are taxed as capital gains at a generally lower rate.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.