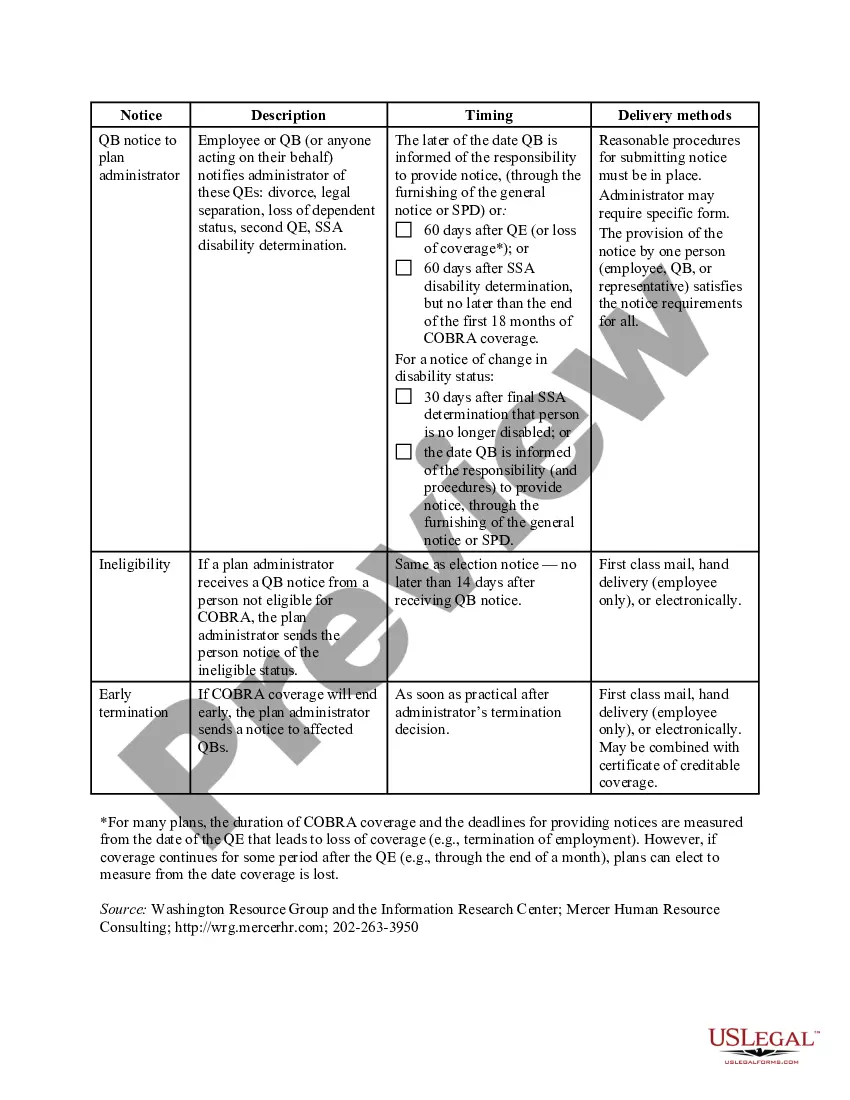

Mississippi COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

Finding the correct legal template can be a challenge.

Certainly, there are numerous templates available online, but how can you locate the legal document you require.

Utilize the US Legal Forms website. This service offers a wide array of templates, including the Mississippi COBRA Notice Timing Delivery Chart, which can be utilized for professional and personal purposes.

First, make sure you have chosen the correct document for your city/state. You can review the form using the Preview option and read the form summary to ensure it meets your needs.

- All templates are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Mississippi COBRA Notice Timing Delivery Chart.

- Use your account to navigate through the legal templates you have previously purchased.

- Visit the My documents section of your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions that you should follow.

Form popularity

FAQ

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

COBRA continuation coverage may be terminated if we don't receive timely payment of the premium. What is the grace period for monthly COBRA premiums? After election and initial payment, qualified beneficiaries have a 30-day grace period to make monthly payments (that is, 30 days from the due date).

When does COBRA continuation coverage startCOBRA is always effective the day after your active coverage ends. For most, active coverage terminates at the end of a month and COBRA is effective on the first day of the next month.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

Employers who fail to comply with the COBRA requirements can be required to pay a steep price. Failure to provide the COBRA election notice within this time period can subject employers to a penalty of up to $110 per day, as well as the cost of medical expenses incurred by the qualified beneficiary.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.

COBRA allows a 30-day grace period. If your premium payment is not received within the 30-day grace period, your coverage will automatically be terminated without advance warning. You will receive a termination letter at that time to notify you of a lapse in your coverage due to non-payment of premiums.

COBRA coverage follows a "qualifying event". An example of a qualifying event would be if your hours were reduced or you lost your job (as long as there was no gross misconduct). Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event.