Full text and statutory guidelines for the Insurers Rehabilitation and Liquidation Model Act.

Mississippi Insurers Rehabilitation and Liquidation Model Act

Description

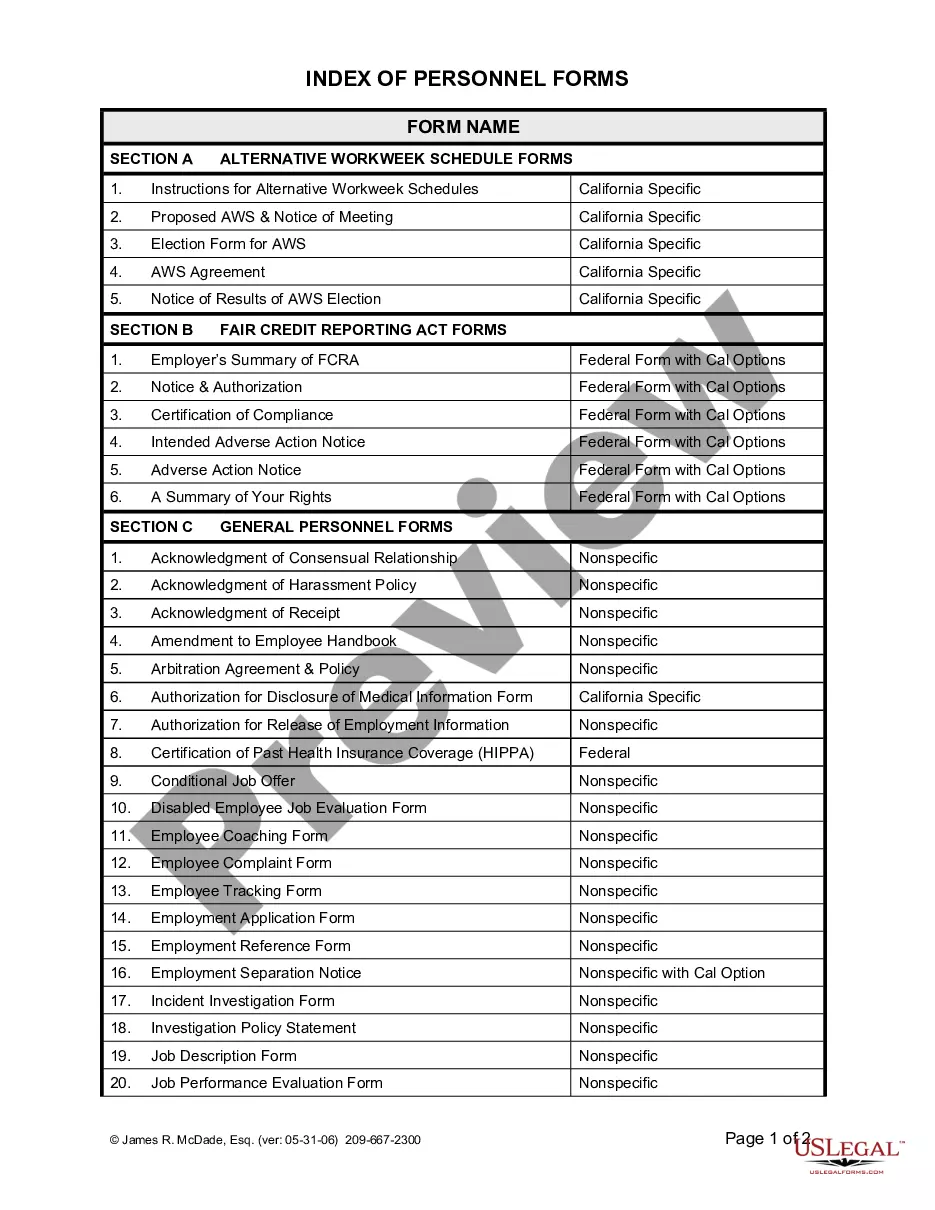

How to fill out Insurers Rehabilitation And Liquidation Model Act?

US Legal Forms - one of many most significant libraries of legal types in the States - offers a variety of legal document themes it is possible to acquire or print out. Using the site, you may get thousands of types for enterprise and person uses, categorized by groups, claims, or search phrases.You will find the newest types of types much like the Mississippi Insurers Rehabilitation and Liquidation Model Act within minutes.

If you currently have a membership, log in and acquire Mississippi Insurers Rehabilitation and Liquidation Model Act from your US Legal Forms collection. The Obtain option will appear on each kind you look at. You have access to all formerly delivered electronically types in the My Forms tab of your respective profile.

If you would like use US Legal Forms the first time, allow me to share basic recommendations to obtain started:

- Be sure to have chosen the right kind for your city/state. Go through the Review option to analyze the form`s content. Read the kind outline to actually have chosen the appropriate kind.

- When the kind does not satisfy your demands, utilize the Look for area near the top of the screen to obtain the one that does.

- In case you are satisfied with the shape, verify your choice by simply clicking the Buy now option. Then, choose the costs prepare you prefer and offer your qualifications to sign up to have an profile.

- Method the financial transaction. Use your bank card or PayPal profile to perform the financial transaction.

- Pick the formatting and acquire the shape on your device.

- Make alterations. Load, revise and print out and signal the delivered electronically Mississippi Insurers Rehabilitation and Liquidation Model Act.

Every web template you added to your money lacks an expiration day and it is your own eternally. So, if you want to acquire or print out one more backup, just check out the My Forms segment and click on about the kind you want.

Get access to the Mississippi Insurers Rehabilitation and Liquidation Model Act with US Legal Forms, one of the most considerable collection of legal document themes. Use thousands of specialist and status-particular themes that meet up with your company or person demands and demands.

Form popularity

FAQ

Once the liquidation is ordered, the guaranty association provides coverage to the company's policyholders who are state residents (up to the levels specified by state laws?see below; any benefit amounts above the guaranty asociation benefit levels become claims against the company's remaining assets).

When an insurer is given an order of liquidation, who will protect the insureds' unpaid claims? The Insurance Security Fund was created to provide insureds with protection against an insurer's liquidation.

In order to transact insurance within a given state, an insurer must obtain an insurer's license. This license is granted by the state insurance regulatory authority and authorizes the insurer to conduct insurance business within that particular state.

Renewable Term. Renewable term plans give you the right to renew for another period when a term ends, regardless of the state of your health. With each new term the premium is increased. The right to renew the policy without evidence of insurability is an important advantage to you.

The spendthrift clause in a life insurance policy is designed to protect beneficiaries from their creditors by providing that the death benefits payable are not subject to creditor claims. This clause applies only while the insurer holds the money, and only to installment payments.

An insurance guaranty association is a state-sanctioned organization that protects policyholders and claimants in the event of an insurance company's impairment or insolvency.