Mississippi Resolution of Meeting of LLC Members to Dissolve the Company

Description

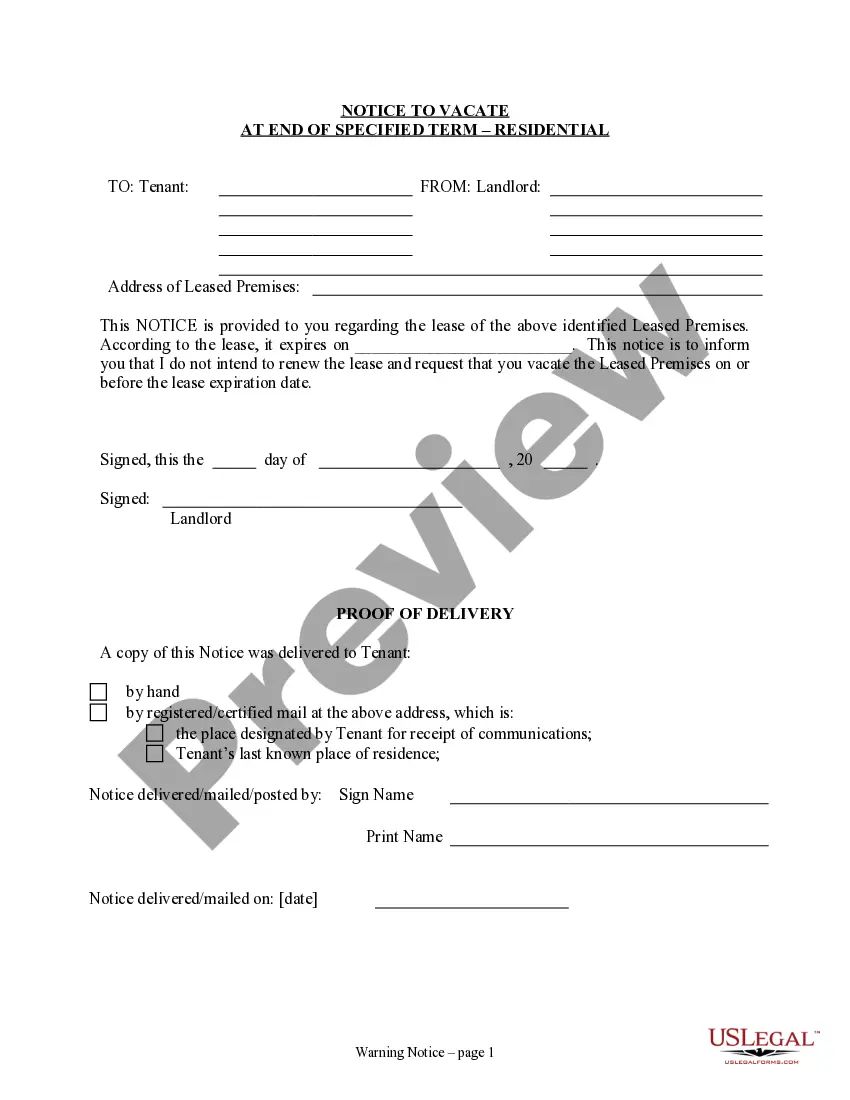

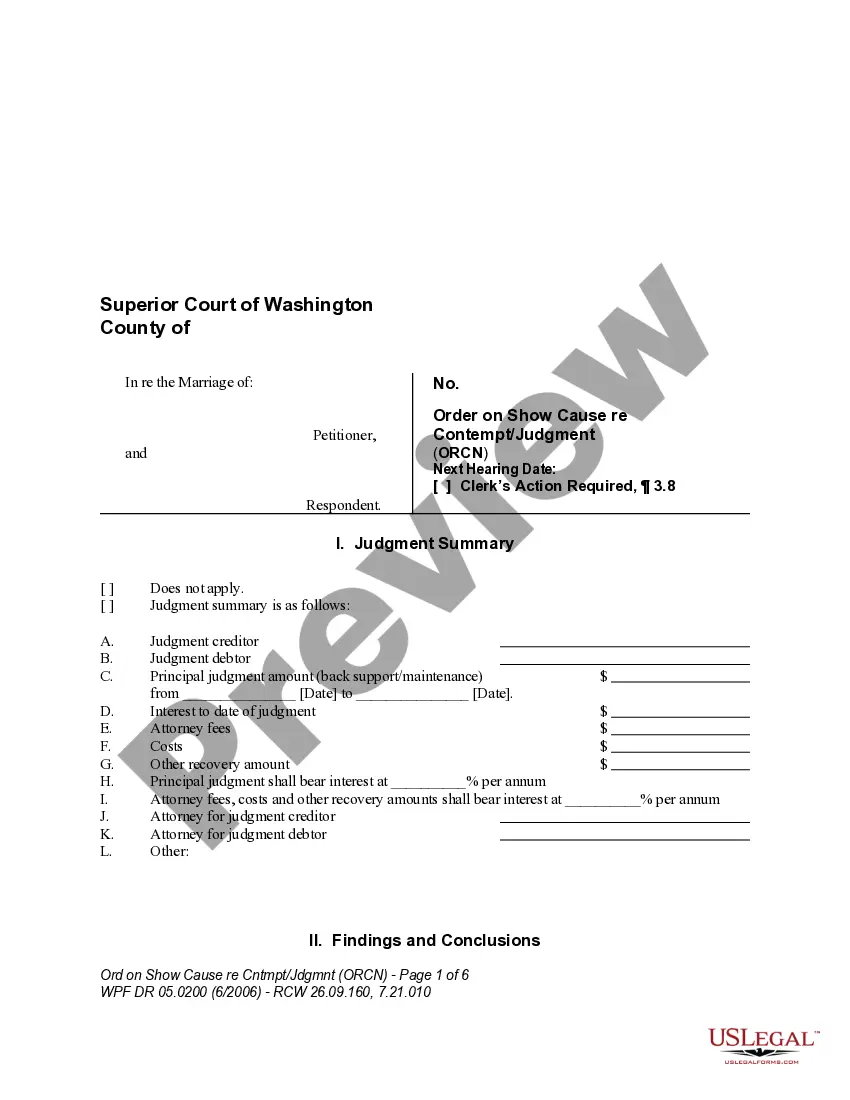

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

If you need to compile, download, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need. Numerous templates for business and personal applications are organized by type and state, or keywords.

Use US Legal Forms to find the Mississippi Resolution of Meeting of LLC Members to Dissolve the Company in just a few clicks.

Every legal document template you obtain is yours forever. You have access to every form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Complete, download, and print the Mississippi Resolution of Meeting of LLC Members to Dissolve the Company with US Legal Forms. There are many professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms customer, Log Into your account and click the Download button to retrieve the Mississippi Resolution of Meeting of LLC Members to Dissolve the Company.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Use the Review feature to examine the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Mississippi Resolution of Meeting of LLC Members to Dissolve the Company.

Form popularity

FAQ

How to Dissolve an LLCConfirm the Company Is in Good Standing.Hold a Vote to Dissolve the Business.File LLC Articles of Dissolution.Notify the Company's Stakeholders.Cancel Business Licenses and Permits.File the LLC's Final Payroll Taxes.Pay Final Sales Tax.File Final Income Tax Returns.More items...?19-Oct-2021

Some states require a document to be filed when the winding up is done. This document may be called articles of termination, articles of cancellation, or a similar name. In it, the LLC has to state that all debts and liabilities have been paid or provided for and any remaining assets distributed.

Dissolution generally occurs when the business purpose of the LLC is completed or ceases to be economically viable. The members may also agree to dissolve the LLC if they are at an impasse regarding fundamental decisions concerning the LLC's business operations.

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

Mississippi requires business owners to submit their Articles of Dissolution by mail or online. Online users must log into the website, then select "File Articles of Dissolution or Certificate of Withdrawal". You can also have a professional service provider file your Articles of Dissolution for you.

Closing an LLC is not as simple as locking the door and walking away. There are several steps you must take to protect yourself from liability and withdraw remaining assets from the company. by Brette Sember, J.D. Making the decision to close a business can be stressful.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

All Mississippi LLC filings can now be completed online. You simply create a corporate filing account with the Secretary of State and complete the dissolution online. You will have the option to do the whole dissolution process and pay your fees online or to print the forms and mail them to the Secretary of State.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.