Mississippi Agreement to Sell Partnership Interest to Third Party

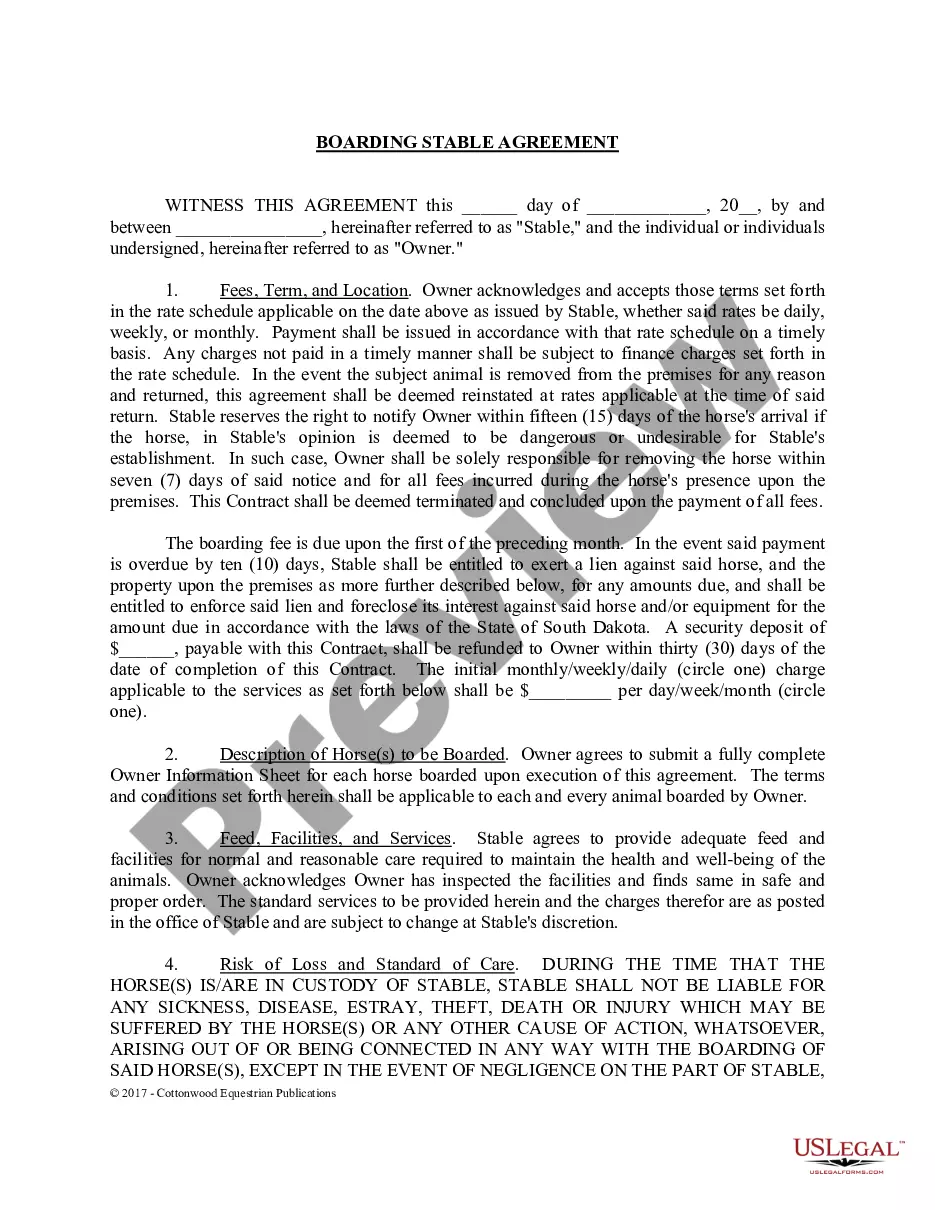

Description

How to fill out Agreement To Sell Partnership Interest To Third Party?

Selecting the most suitable legal document template can be a challenge. Naturally, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website.

This service offers thousands of templates, including the Mississippi Agreement to Sell Partnership Interest to Third Party, which can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log Into your account and click the Download button to access the Mississippi Agreement to Sell Partnership Interest to Third Party. Use your account to browse the legal forms you have purchased previously. Navigate to the My documents section of your account and fetch another version of the document you need.

Complete, edit, print, and sign the acquired Mississippi Agreement to Sell Partnership Interest to Third Party. US Legal Forms is the largest repository of legal documents where you can find a variety of document templates. Use the service to download professionally-created paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/state. You can examine the form using the Preview button and review the form description to confirm it is suitable for you.

- If the form does not meet your needs, utilize the Search field to find the correct form.

- Once you are confident that the form is appropriate, click the Buy now button to obtain the form.

- Select the payment plan you prefer and enter the necessary information. Create your account and complete the transaction using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

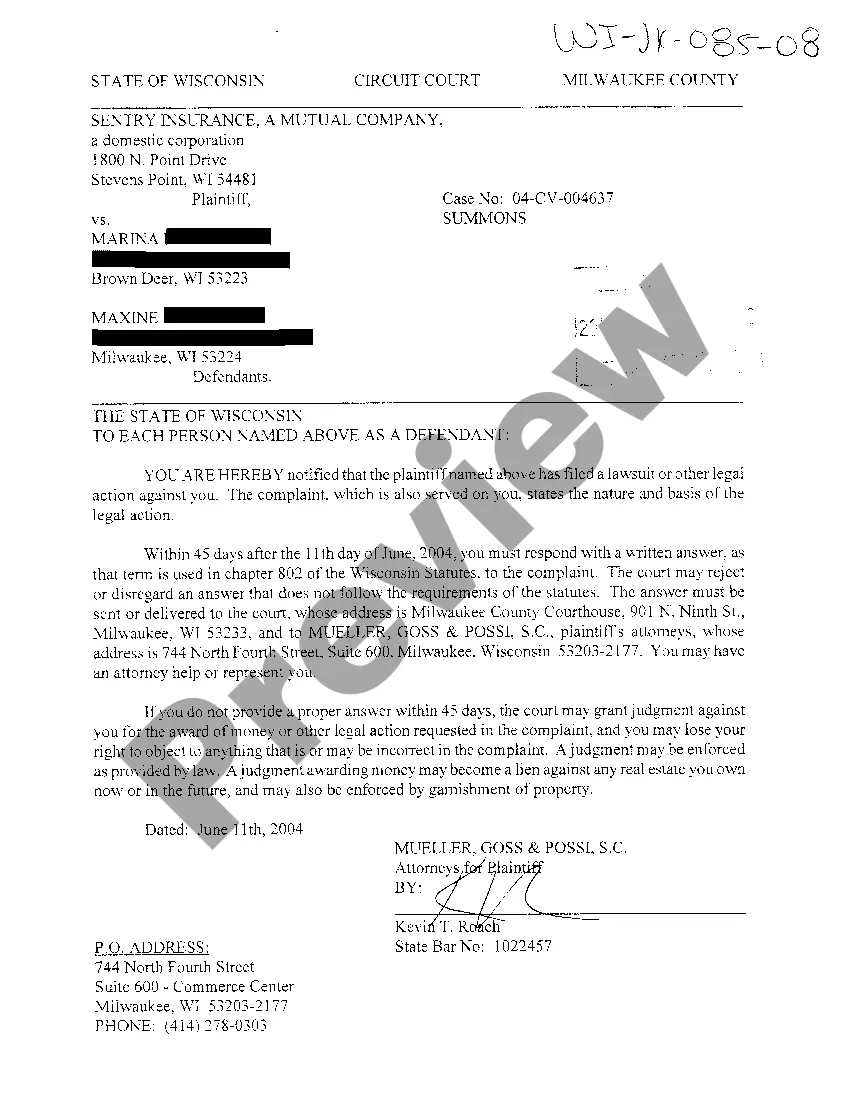

When a partnership interest is sold, gain or loss is determined by the amount of the sale minus the partner's interest, often called the partner's outside basis.

2012 Review Schedule D, Form 8949 and Form 4797 to determine the amount of gain or loss the partner reported on the sale of the partnership interest. After determining a partner sold its interest in the partnership, establish other relevant facts that can impact the tax treatment of this transaction.

Because tax law views a partnership both as an entity and as an aggregate of partners, the sale of a partnership interest may result either in a capital gain or loss or all or a portion of the gain may be taxed as ordinary income.

Here's an overview of what those steps entail:Review your Operating Agreement and Articles of Organization.Establish What Your Buyer Wants to Buy.Draw Up a Buy-Sell Agreement with the New Buyer.Record the Sale with the State Business Registration Agency.

The gain or loss from the sale of a partnership interest is the difference between the sales proceeds received and the partner's tax basis in the interest at the time of the sale.

Partnerships file Form 8308 to report the sale or exchange by a partner of all or part of a partnership interest where any money or other property received in exchange for the interest is attributable to unrealized receivables or inventory items (that is, where there has been a section 751(a) exchange).

How to Report a Sale of a Share of a Partnership on a 1065Complete Part I and Part II, Items E through I, on each partner's K-1. This is used to provide personal information.Complete Part III of each partner's K-1.Complete the selling partner's K-1.Complete the remaining partners' K-1s.

SALE OR EXCHANGE OF PARTNERSHIP INTEREST. A. General Rule. Since the interest of a partner in the partnership is treated as a capital asset, the sale or exchange of a partner's interest will result in capital gain or loss to the transferor partner.

This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.