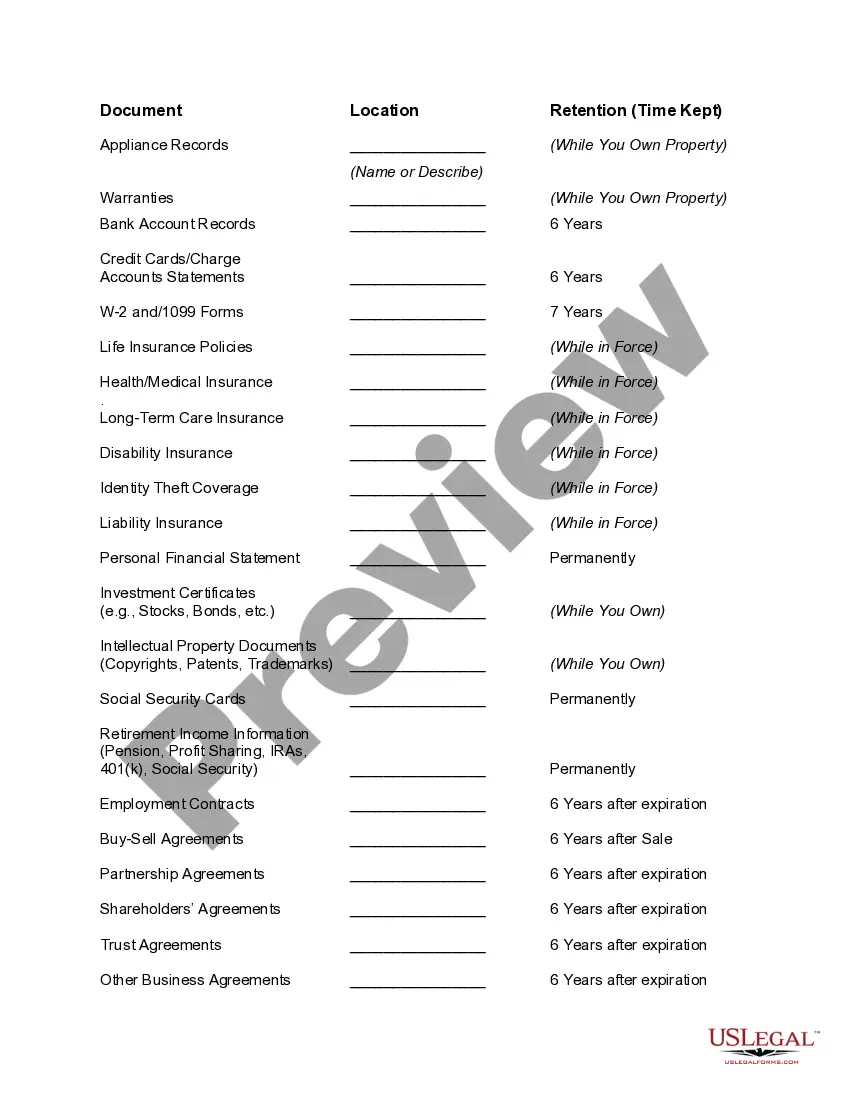

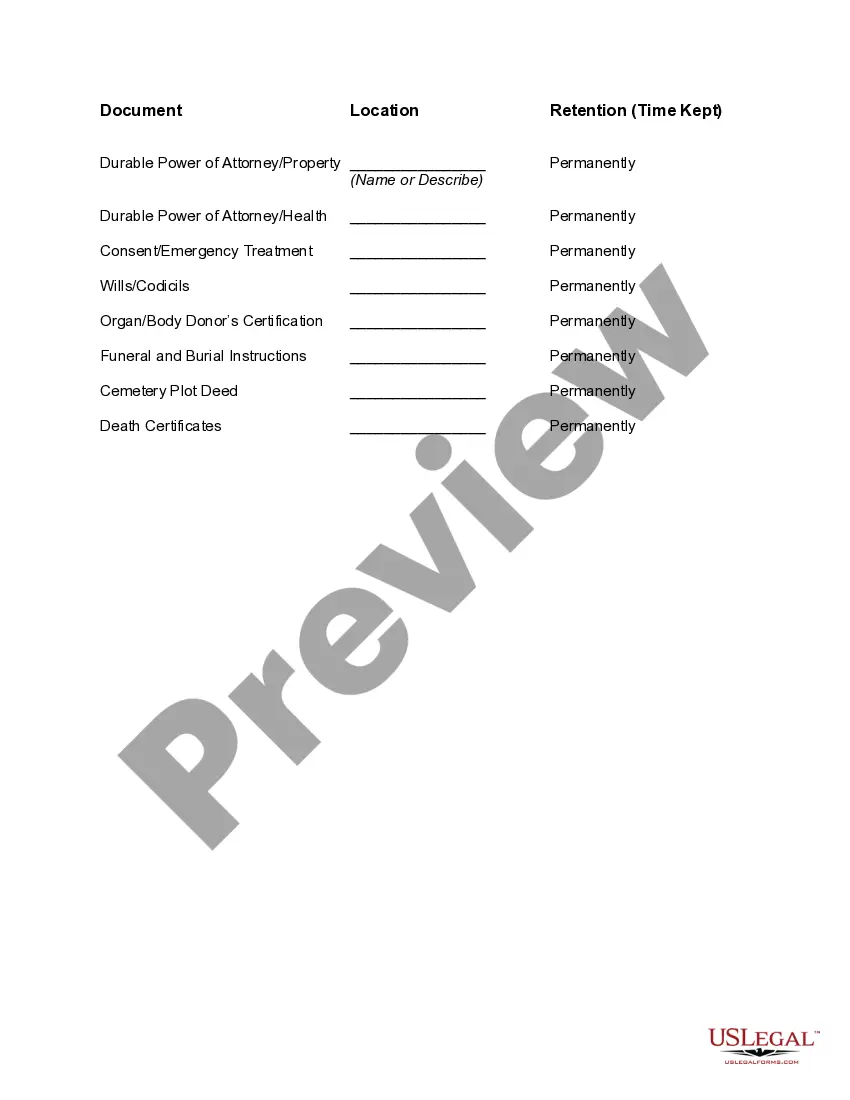

Mississippi Document Organizer and Retention

Description

How to fill out Document Organizer And Retention?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a wide array of legal form templates you can download or print.

By using the platform, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms like the Mississippi Document Organizer and Retention within moments.

Read the form description to ensure you have selected the right form.

If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you possess a membership, sign in and download the Mississippi Document Organizer and Retention from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Make sure you have chosen the correct form for your area/region.

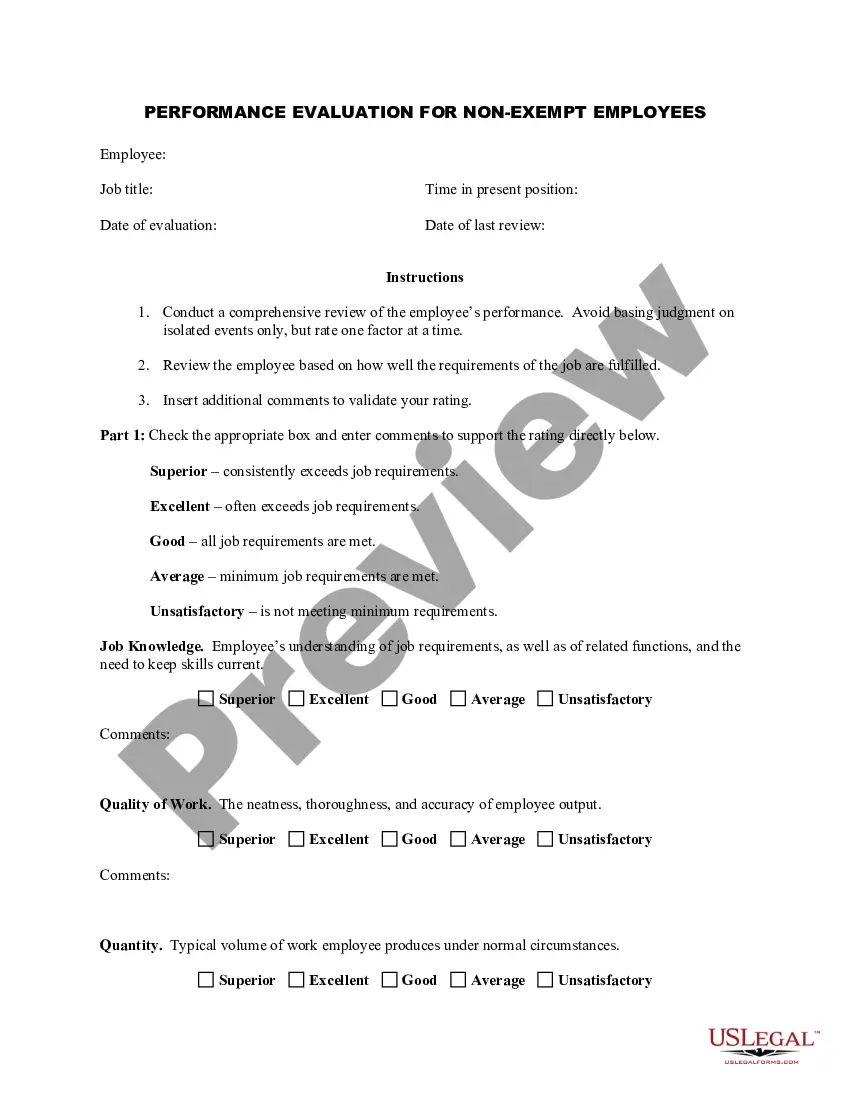

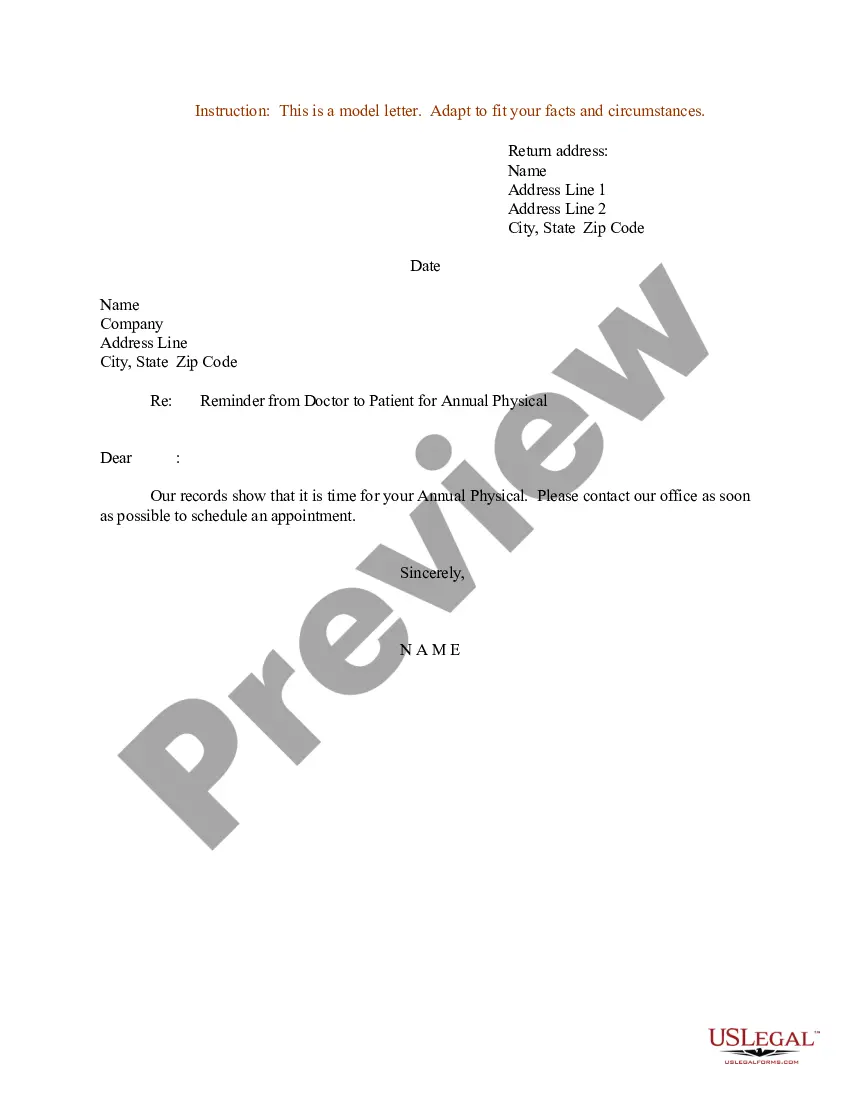

- Click the Review button to check the form's content.

Form popularity

FAQ

A document retention policy is a company policy, which establishes the customary practice and guidelines regarding the retention and maintenance of company records, and sets forth a schedule for the destruction of certain documents received or created during the course of business.

Document retention is a system that allows you and your employees to automatically create policies and determine what should be done with particular documents or records at a certain point of time.

As a general rule of thumb, tax returns, financial statements and accounting records should be retained for a minimum of six years.

Retention policies help to manage many risks including lost or stolen information, excessive backlog of paper files, loss of time and space while internally managing records and lack of organization system for records, making them hard to find, just to name a few.

For example, if financial records have a retention period of five years, and the records were created during the 1995-1996 fiscal year (July 1, 1995 - June 30, 1996), the five-year retention period begins on July 1, 1996 and ends five years later on July 1, 2001.

A document retention policy identifies confidential information and categorizes it by how and where documents are stored (electronically or in paper) and the required retention period based on federal, state, and other regulatory requirements.

How much should be the retention of internal audit and MRM records? The logical answer is a minimum of 3 years as that is the time frame of ISO certificate.

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

The longest retention period wins.If content is subject to multiple retention settings that retain content for different periods of time, the content will be retained until the end of the longest retention period for the item.

A comprehensive document retention policy would have directed the company to its relevant documents. Any policy should also state the names of the custodian(s) of the information and should list the types of servers and backup tapes that are used.