Mississippi Notice Accompanying Check Tendered in Settlement of Disputed Claim

Description

How to fill out Notice Accompanying Check Tendered In Settlement Of Disputed Claim?

Selecting the appropriate legal document format can be a challenge. Naturally, there are numerous templates accessible online, but how do you locate the legal form you require.

Make use of the US Legal Forms site. The service provides thousands of templates, including the Mississippi Notice Accompanying Check Tendered in Settlement of Disputed Claim, which can be utilized for business and personal purposes.

All of the forms are verified by experts and meet state and federal standards.

If the form does not meet your requirements, use the Search field to find the proper form. Once you are confident the form is appropriate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the purchase using your PayPal account or credit card. Select the document format and download the legal document format to your device. Finally, edit, print, and sign the acquired Mississippi Notice Accompanying Check Tendered in Settlement of Disputed Claim. US Legal Forms is the largest library of legal documents where you can find a variety of document templates. Utilize the service to obtain professionally crafted papers that comply with state regulations.

- If you are already registered, sign in to your account and click the Acquire button to obtain the Mississippi Notice Accompanying Check Tendered in Settlement of Disputed Claim.

- Use your account to search for the legal documents you have purchased before.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you can follow.

- First, ensure you have selected the correct form for your city/county.

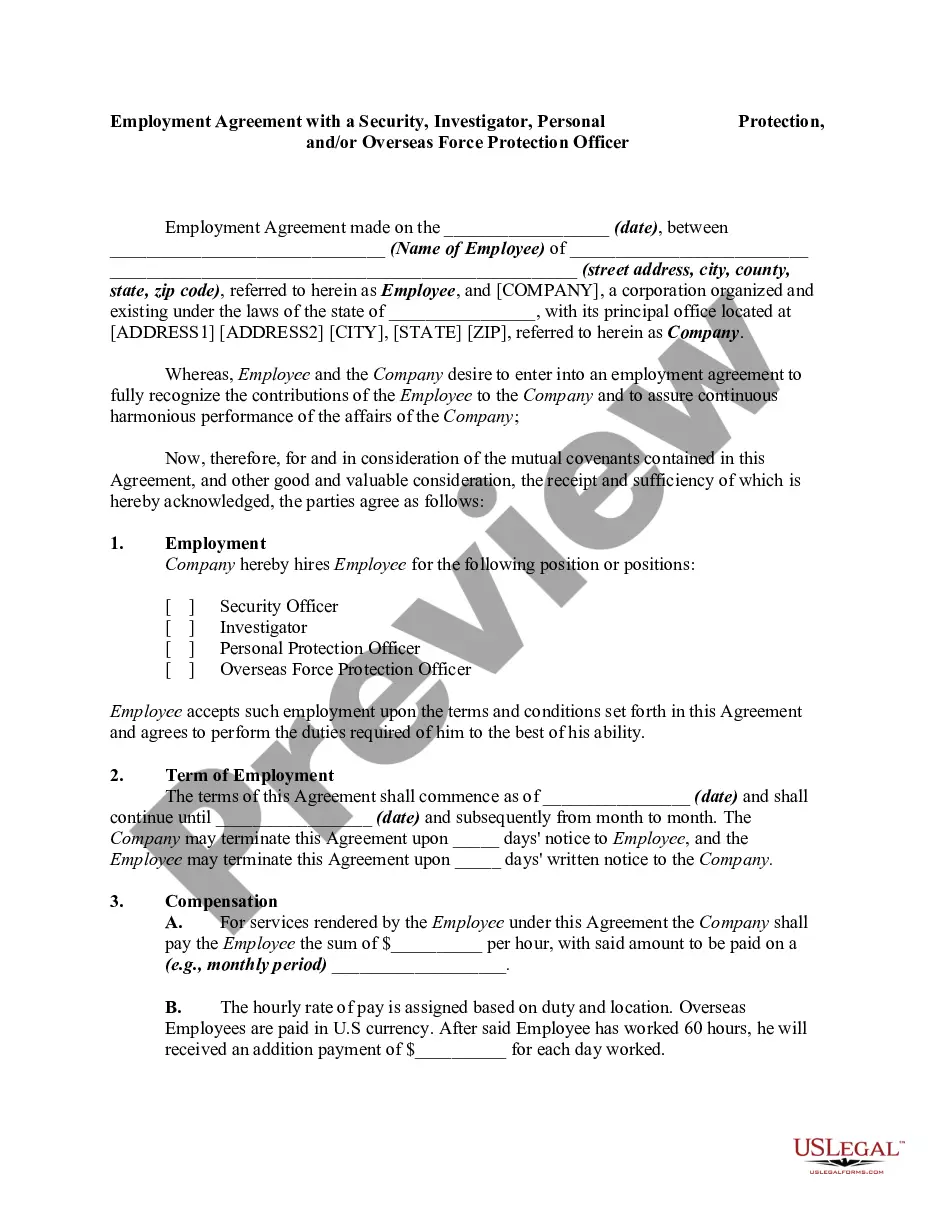

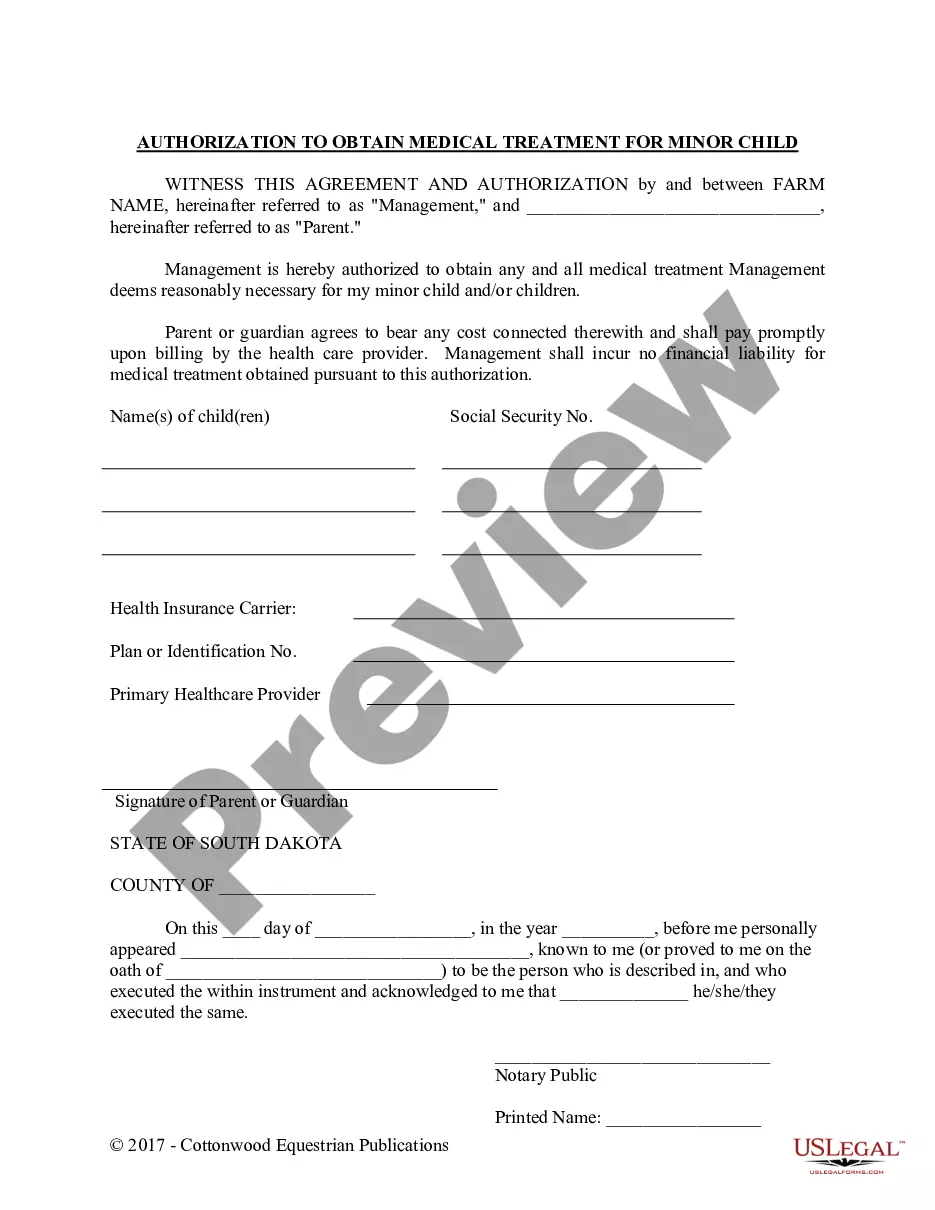

- You can preview the form using the Review button and read the form description to confirm it is suitable for you.

Form popularity

FAQ

Endorsing a CheckBe careful not to write below the line that says, "DO NOT WRITE, STAMP, OR SIGN BELOW THIS LINE." This area is reserved for bank processing stamps. Once a check is endorsed, it can be cashed by anyone, so wait until you are at the bank to endorse a check made payable to you.

Accord and satisfaction is a contract law concept about the purchase of the release from a debt obligation. It is one of the methods by which parties to a contract may terminate their agreement.

Cashing the check is considered to be acceptance of the offer and extinguishes the debt. In order to be effective, however, the words must be clear and conspicuous on the check. There must be no doubt that the debtor intends the check to settle the debt entirely.

Let us answer your questions with a quick how-to.Step 1: Date the check. Write the date on the line at the top right-hand corner.Step 2: Who is this check for?Step 3: Write the payment amount in numbers.Step 4: Write the payment amount in words.Step 5: Write a memo.Step 6: Sign the check.

Short Beware checks with Payment in Full, Full and Final Settlement or similar language written in the memo line or endorsement area. When these Payment in Full checks are cashed, they are very often binding, and can eliminate your rights to recover under contract or the mechanics lien laws.

Take a look at the following seven precautions for accepting checks to get started.Make sure all the parts of a check are there.Keep an eye out for key security features.Ask the customer for ID.Get the customer's contact information.Be a stickler about signatures and dates.Try to limit checks to local banks.More items...?19-Nov-2019

The satisfaction is the execution or acceptance of this agreement, and once satisfaction occurs, the previous contract is extinguished. Accord and satisfaction is an affirmative defense to a breach of contract claim, requiring the asserting party to plead and prove the defense.

You don't necessarily need to get everything on the memo line. You can write additional information just about anywhere on the front of a check, as long as it doesn't cover up any important information. However, you should not use the back of the check for writing any memo information.

In short, pursuant to California Commercial Code §3311, if a check is marked "paid in full," "final settlement," or words of similar effect and you cash it, you may be precluded from seeking the balance of what you believe is owed even if you strike out the paid in full language.

No, it is not legally binding. One party may not unilaterally change the amount owed or terms of payment by doing this. There is a common myth that the memo line on a check has legal force - it doesn't. It's just for informational purposes.