Mississippi Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

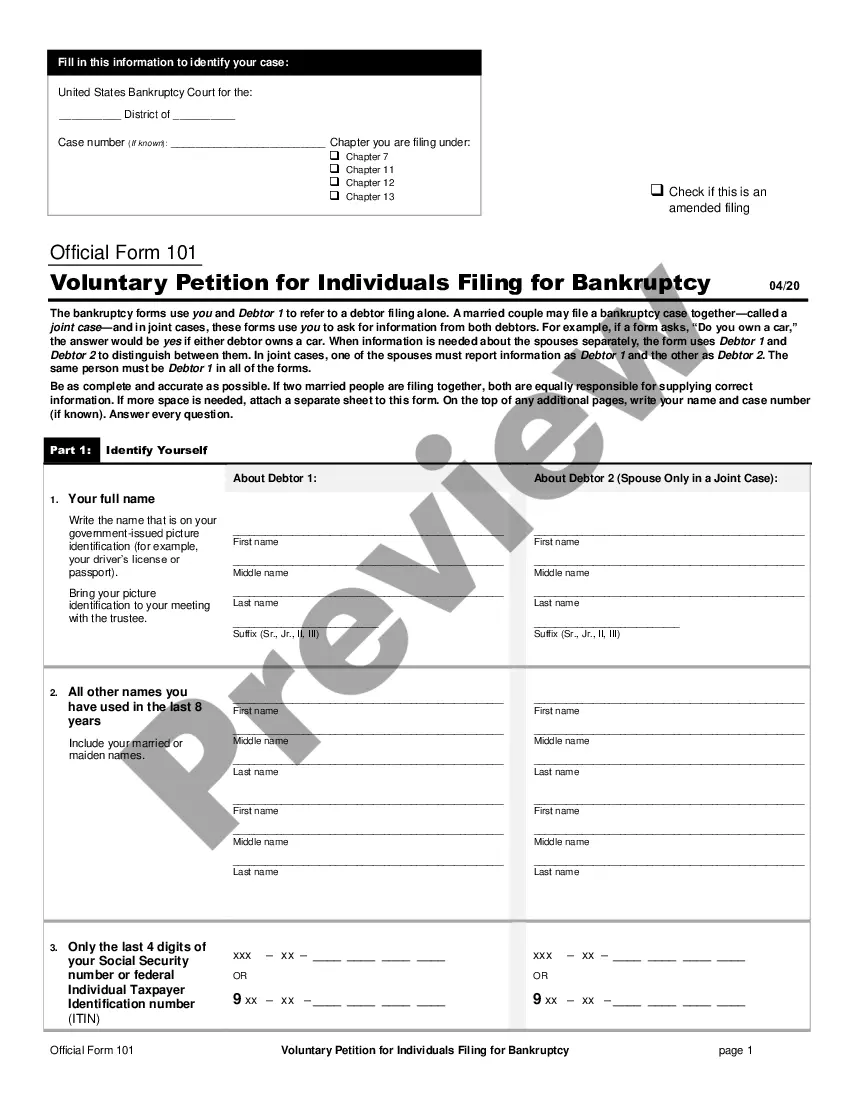

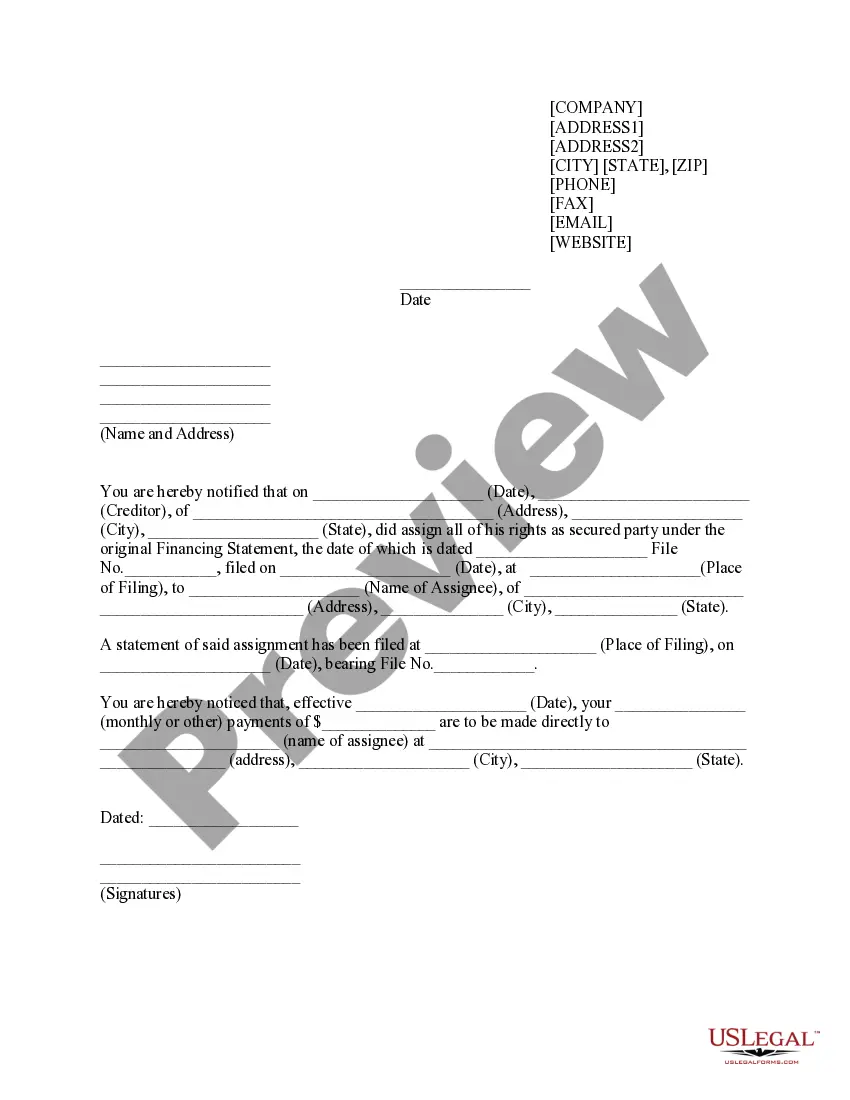

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

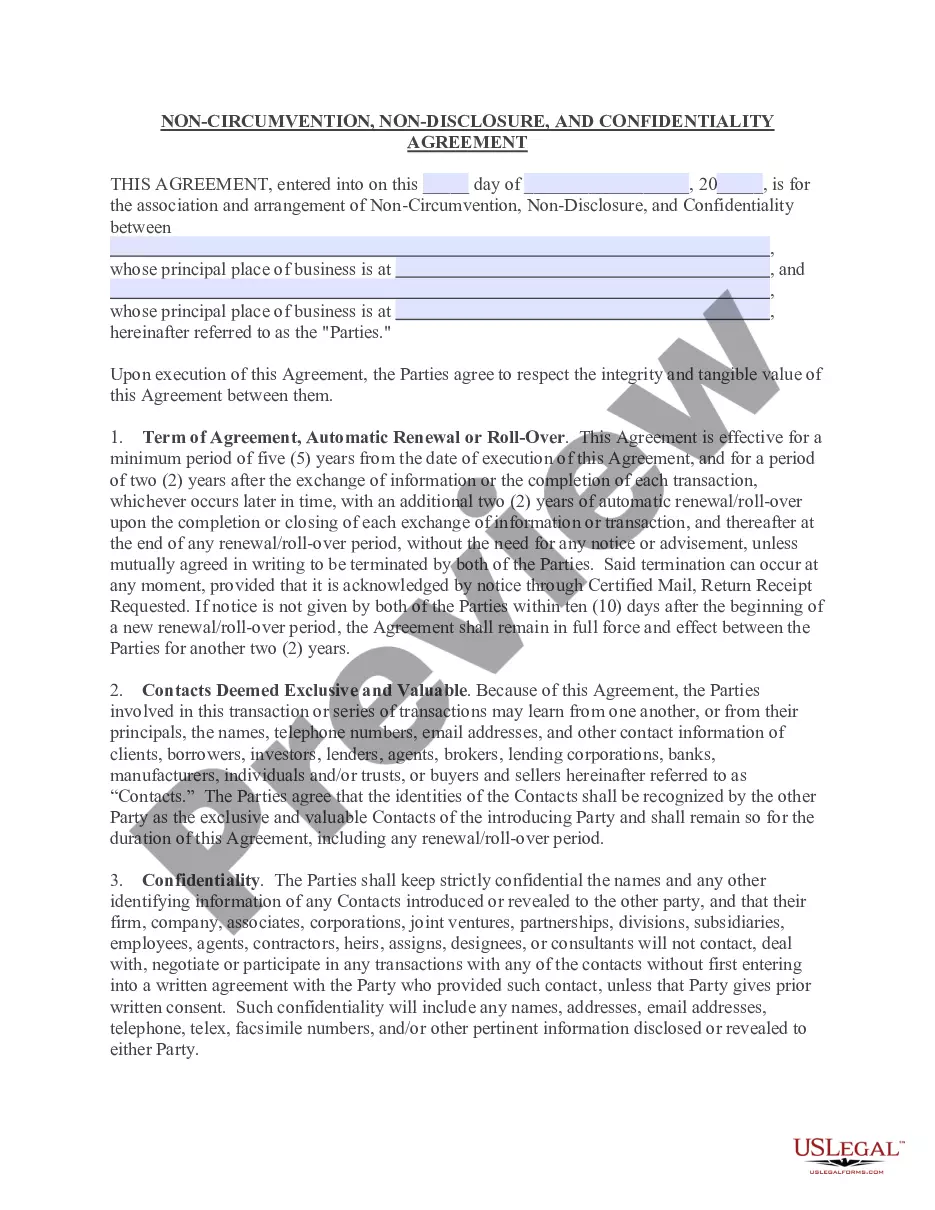

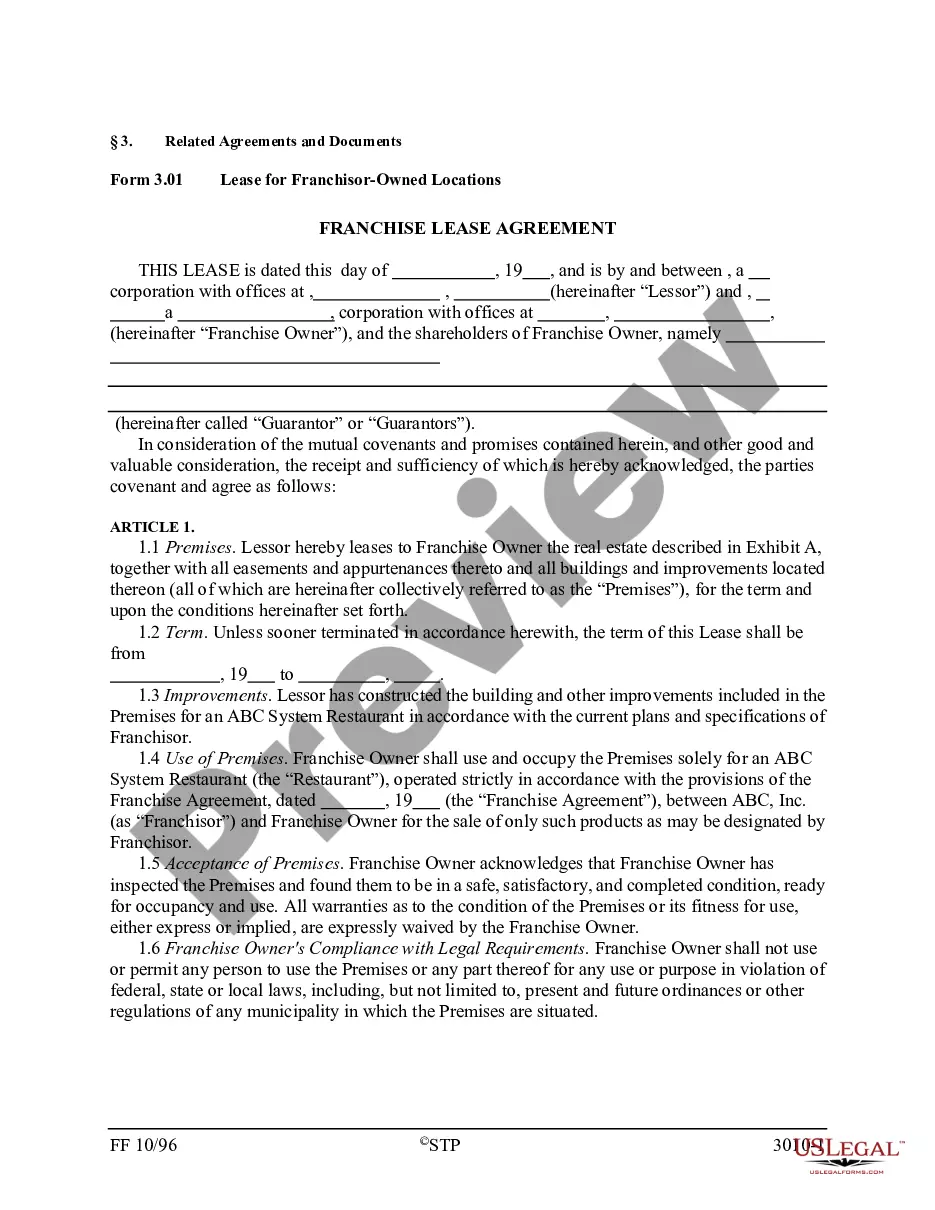

Choosing the best authorized record web template can be a struggle. Naturally, there are a lot of templates accessible on the Internet, but how do you get the authorized form you need? Make use of the US Legal Forms internet site. The service provides 1000s of templates, such as the Mississippi Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name, that can be used for company and private requirements. All of the kinds are examined by pros and fulfill federal and state needs.

In case you are currently registered, log in in your accounts and then click the Obtain option to have the Mississippi Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Utilize your accounts to look from the authorized kinds you might have ordered earlier. Check out the My Forms tab of the accounts and have yet another version of your record you need.

In case you are a new customer of US Legal Forms, allow me to share simple guidelines that you should follow:

- Initially, ensure you have chosen the appropriate form for your personal metropolis/area. You are able to look over the shape while using Review option and read the shape explanation to ensure this is the right one for you.

- In case the form does not fulfill your needs, utilize the Seach industry to discover the appropriate form.

- When you are sure that the shape is proper, go through the Acquire now option to have the form.

- Select the rates prepare you need and enter in the required info. Make your accounts and buy an order with your PayPal accounts or charge card.

- Select the data file formatting and acquire the authorized record web template in your device.

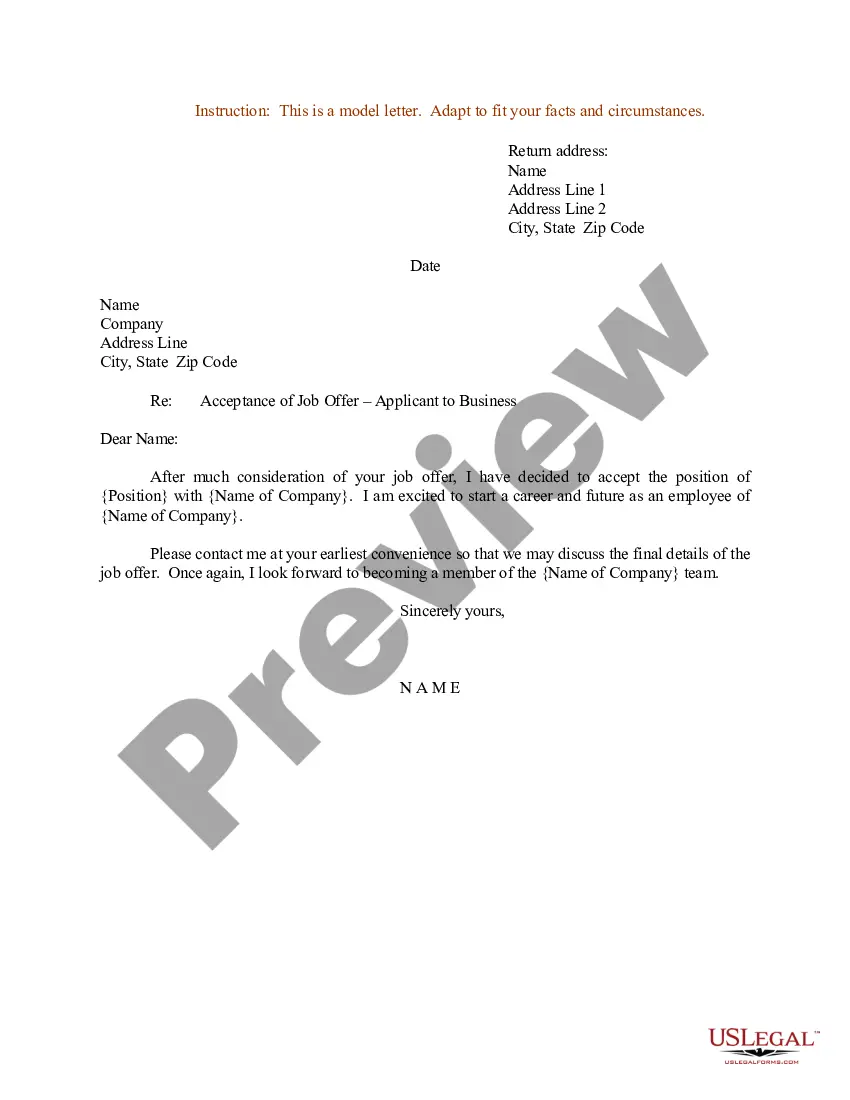

- Comprehensive, edit and printing and sign the acquired Mississippi Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

US Legal Forms will be the greatest catalogue of authorized kinds that you can discover numerous record templates. Make use of the service to acquire skillfully-created files that follow express needs.

Form popularity

FAQ

Subrogation is a term describing a right held by most insurance carriers to legally pursue a third party that caused an insurance loss to the insured. This is done in order to recover the amount of the claim paid by the insurance carrier to the insured for the loss.

3 Benefits of Subrogation in Car Insurance Speeds up the claims process for policyholders. Refunds insurers for claims if their customer wasn't at-fault. Keeps premiums low for policyholders who aren't responsible for damage.

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

?Subrogation? refers to the act of one person or party standing in the place of another person or party. It is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss in order to recover the amount the insurance carrier paid the insured to cover the loss.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

Negotiate the claim. If you and your lawyer are unable to stop the subrogation claim altogether, it is possible to negotiate. Most insurance companies are willing to negotiate because they want to settle claims quickly and get their money.