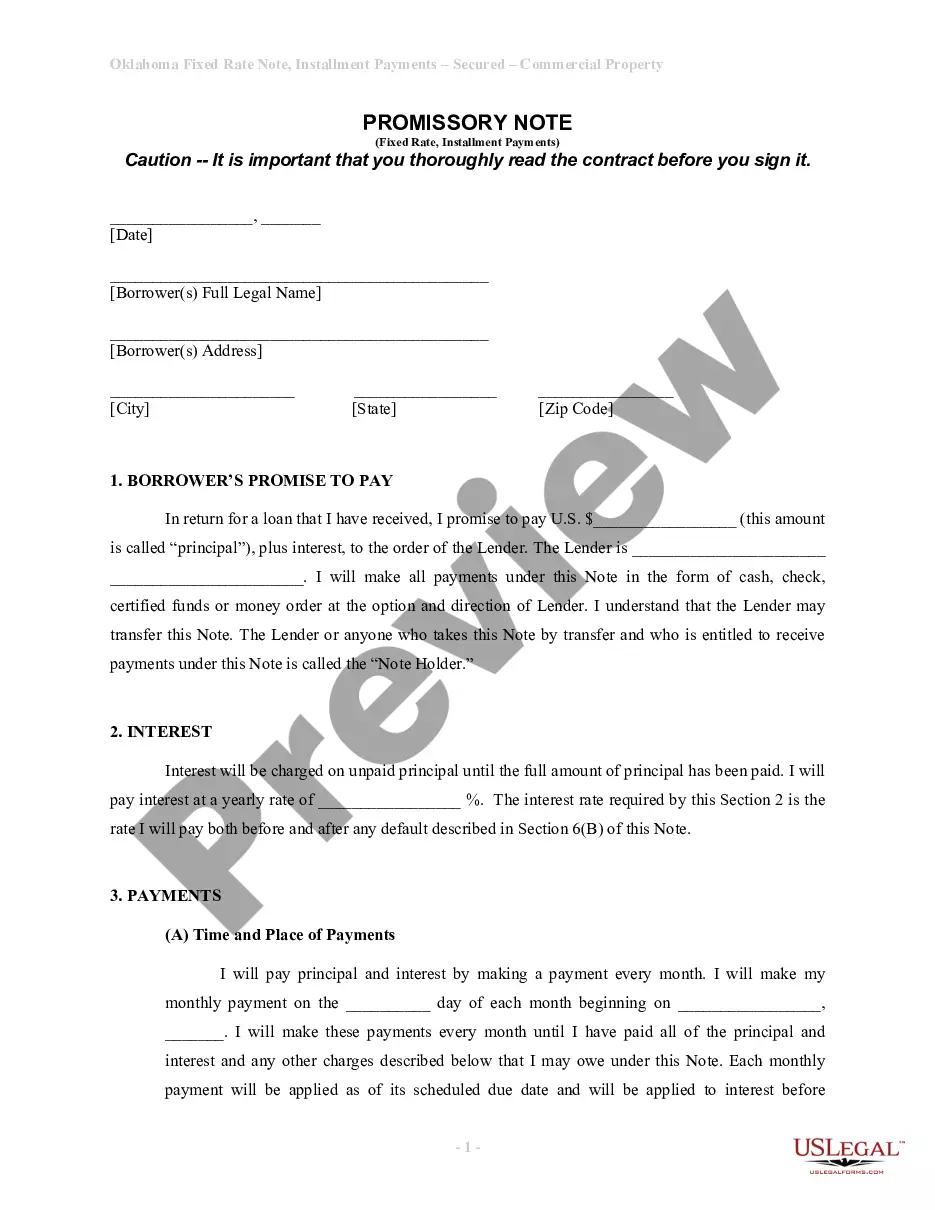

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer.

Mississippi Checklist - Items to Consider for Drafting a Promissory Note

Description

How to fill out Checklist - Items To Consider For Drafting A Promissory Note?

Finding the appropriate legal document template can be challenging.

Indeed, there are numerous templates accessible online, but how can you locate the legal document you require.

Utilize the US Legal Forms site.

You can review the document using the Preview button and read the form description to confirm it meets your requirements.

- The platform provides a vast selection of templates, such as the Mississippi Checklist - Items to Consider for Drafting a Promissory Note, suitable for both business and personal use.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already a member, Log In to your account and click the Download button to obtain the Mississippi Checklist - Items to Consider for Drafting a Promissory Note.

- You can also browse through the legal forms you have previously purchased by going to the My documents section of your account and obtaining another copy of the document you need.

- If you are a new user of US Legal Forms, follow these straightforward steps.

- First, ensure you select the correct form for your city/state.

Form popularity

FAQ

The essentials of a promissory note include a clear statement of the debt, terms of repayment, and any additional conditions that apply. It's important to specify what happens in case of missed payments or defaults. Following the Mississippi Checklist - Items to Consider for Drafting a Promissory Note can help you verify that your document meets legal standards and protects both parties.

A promissory note should clearly outline the amount being borrowed, the interest rate, and the repayment schedule. Additionally, it must include the names and addresses of both the borrower and the lender. To ensure your document is thorough, consult the Mississippi Checklist - Items to Consider for Drafting a Promissory Note, which covers these critical components.

Legal requirements for a promissory note vary by jurisdiction, but generally, they include a written document, signatures, and the presence of consideration. In Mississippi, following the Mississippi Checklist - Items to Consider for Drafting a Promissory Note can guide you through complying with these legal requirements. Always ensure that your notes meet local regulations to avoid complications.

A promissory note must always contain essential components to ensure its legal enforceability. These components include the principal amount, interest rate, repayment terms, and signatures from both parties. When drafting, refer to the Mississippi Checklist - Items to Consider for Drafting a Promissory Note to verify that you include these critical elements for clarity and protection.

Promissory notes must adhere to specific rules to remain enforceable. These include specifying the repayment terms, detailing the interest rate, and clarifying any provisions for default. Utilizing the Mississippi Checklist - Items to Consider for Drafting a Promissory Note ensures you follow best practices. USLegalForms provides templates and guidance that help keep your documents compliant with state laws.

When creating a promissory note template, it is vital to include all essential elements like clear payment terms, the involved parties' names, and a legitimate signature. Following the legal requirements outlined in the Mississippi Checklist - Items to Consider for Drafting a Promissory Note will ensure your template stands up to scrutiny. Consider using US Legal Forms for reliable templates that can simplify this process.

Essentially, a promissory note should identify the parties involved, include the repayment terms, and specify the interest rate, if any. Additionally, it should be clearly dated and signed for authenticity. Following the Mississippi Checklist - Items to Consider for Drafting a Promissory Note will ensure your document is solid and enforceable.

The essential elements of promissory notes align with the Mississippi Checklist - Items to Consider for Drafting a Promissory Note. These include the amount being borrowed, the interest rate if applicable, the payment schedule, and the maturity date. Clear articulation of these components facilitates understanding and can prevent future disputes.