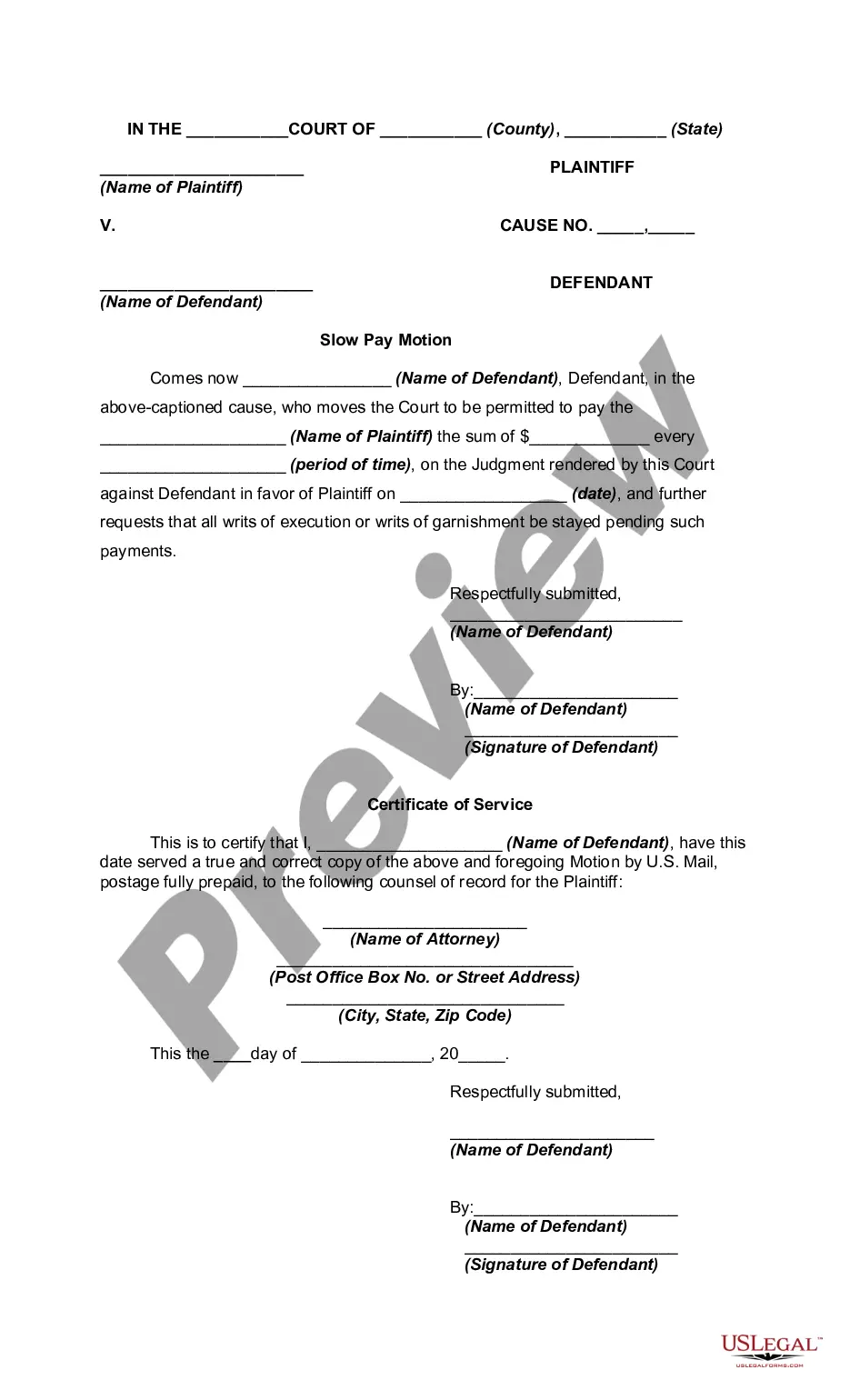

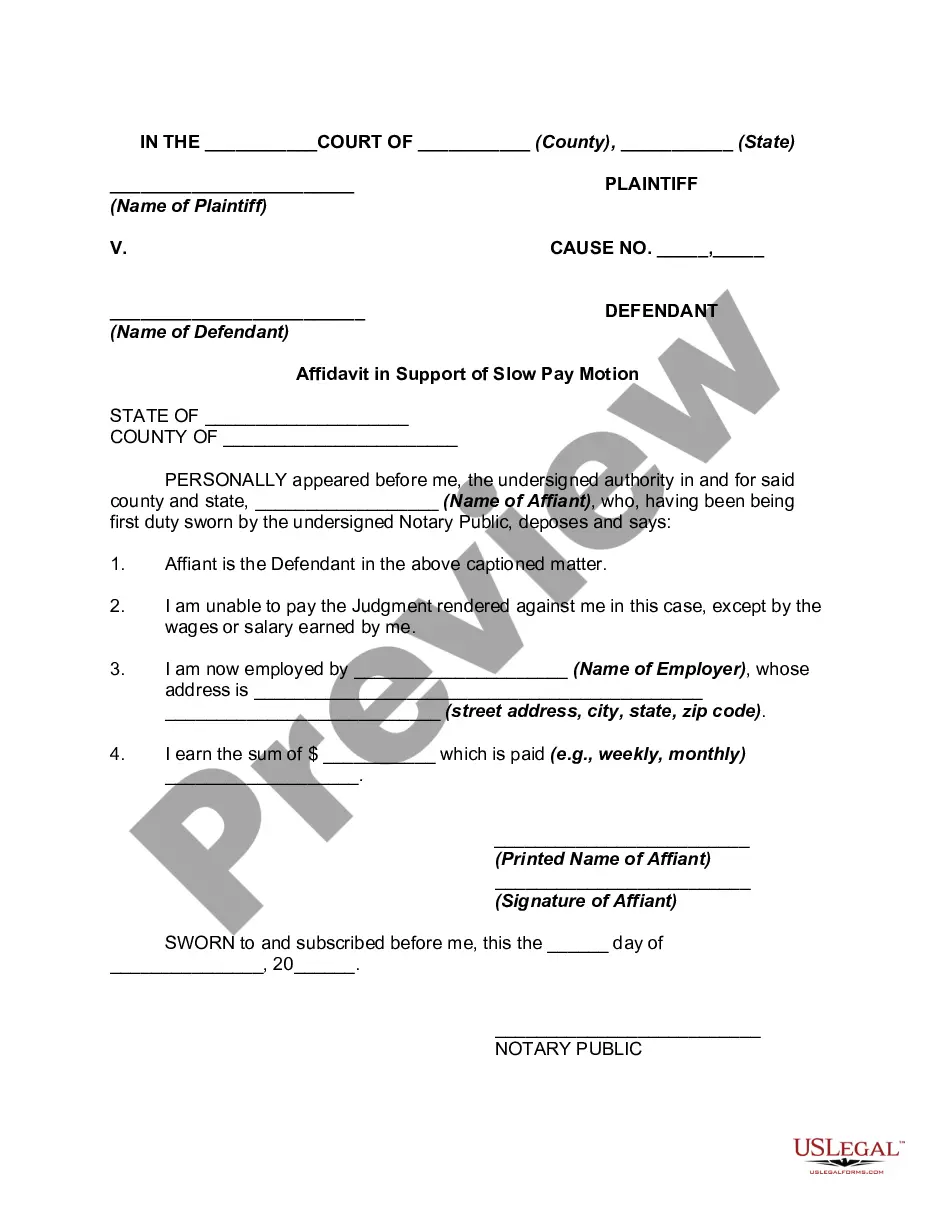

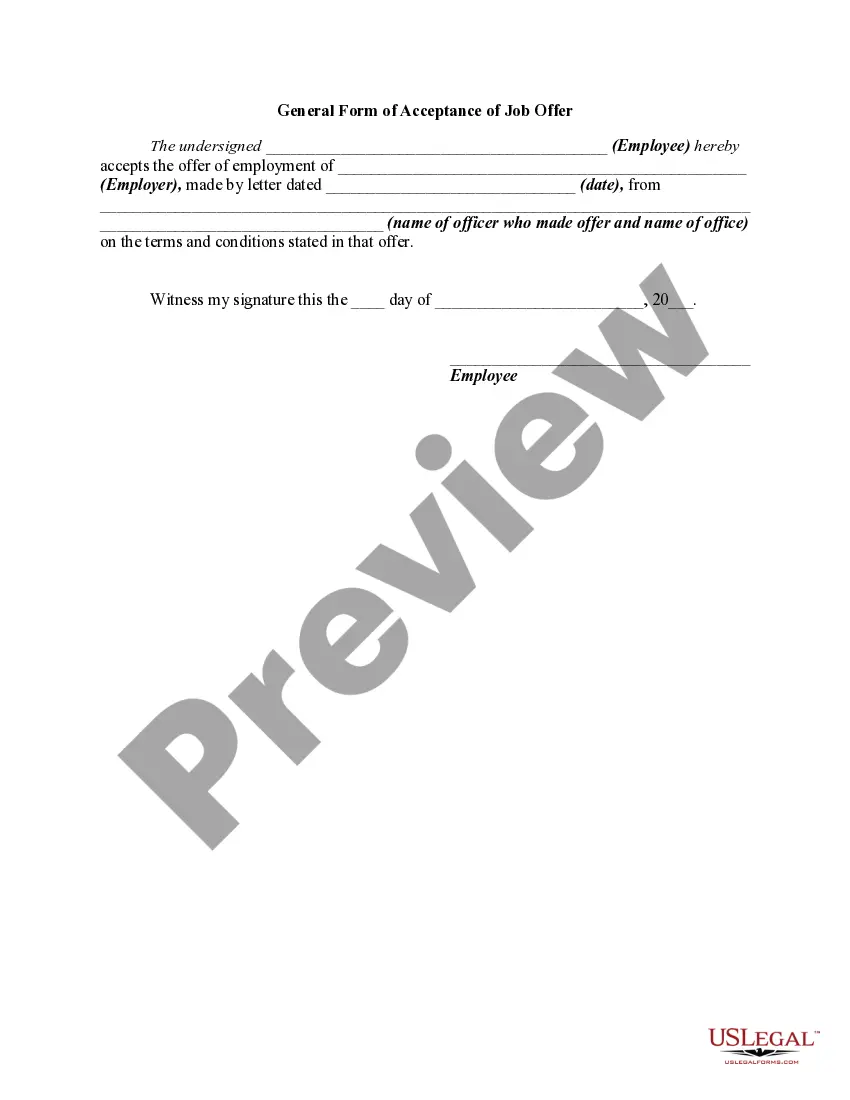

A Slow-Pay Motion is a pleading that asks the Judge to let a defendant in a case make small or manageable payments on a judgment against the defendant. The payments should be fixed to leave defendant enough money to pay other necessary bills.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.