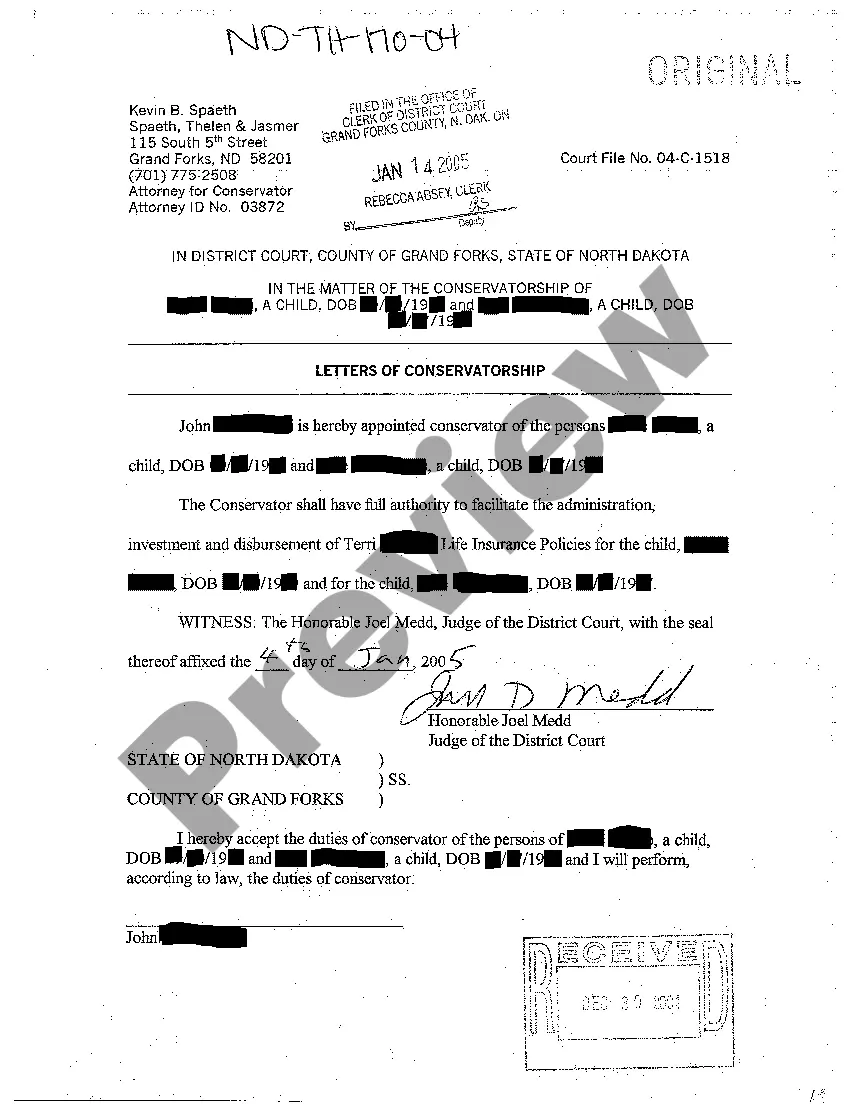

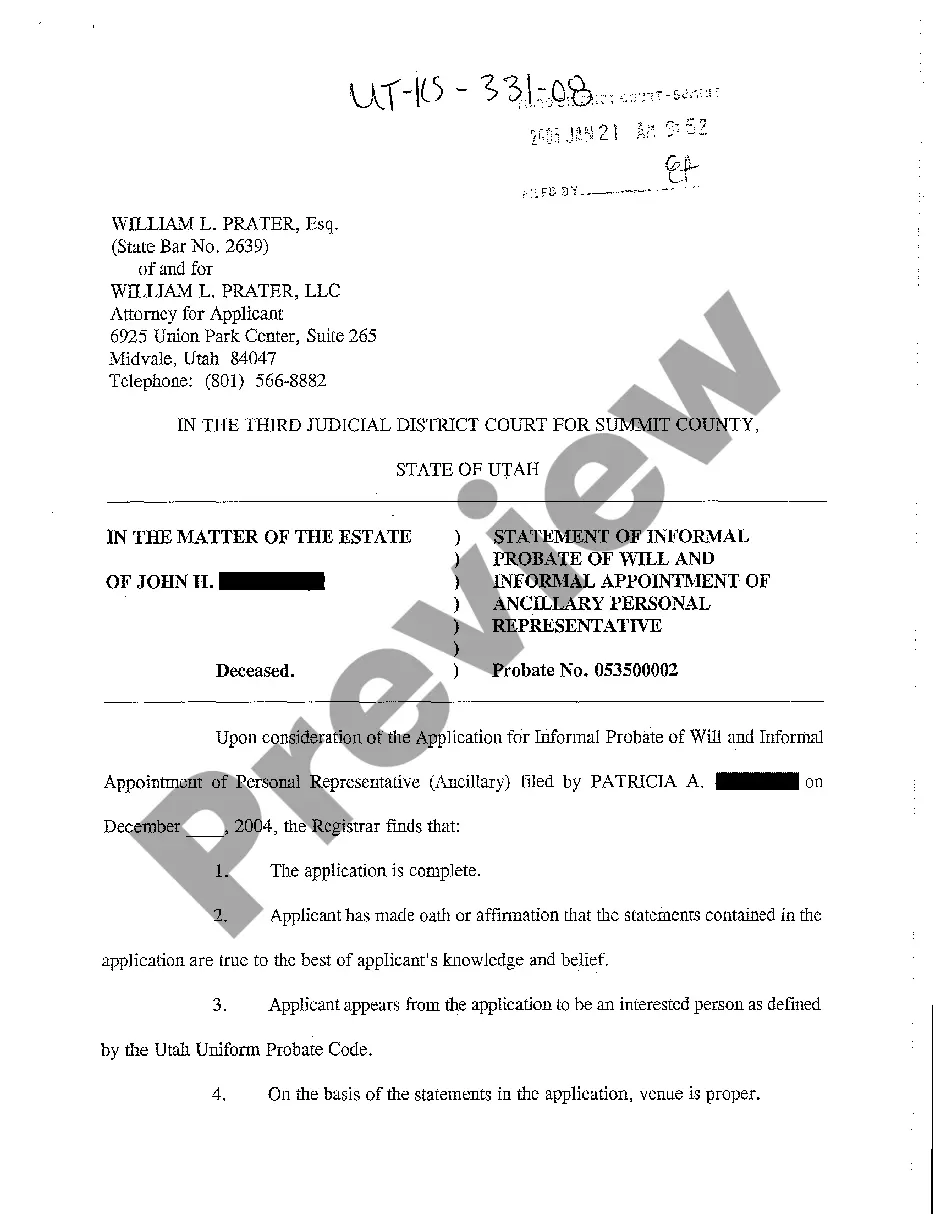

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse

Description

How to fill out Notice Of Non-Responsibility For Debts Or Liabilities Contracted By Spouse?

Locating the appropriate authorized document template can be challenging.

Naturally, there are numerous formats available online, but how can you discover the official version you need.

Utilize the US Legal Forms website. This service provides thousands of templates, such as the Mississippi Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse, which are suitable for both business and personal purposes.

You can preview the form using the Review button and read the form description to confirm it is the appropriate one for you.

- All of the documents are verified by professionals and meet state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Mississippi Notice of Non-Responsibility for Debts or Liabilities Incurred by Spouse.

- Use your account to search through the legal documents you may have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct template for your city/county.

Form popularity

FAQ

Generally, a debt collector cannot pursue you for your spouse's debt if you have filed a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This notice clarifies that you are not responsible for debts your spouse incurs. However, if the debt is joint or you co-signed, the collector may still attempt to collect from you. To protect yourself, consider looking into the resources offered by uslegalforms, which can guide you through the process of establishing your legal protections.

In most cases, creditors cannot pursue you for your spouse's debt as long as you are not jointly liable. Utilizing a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can further safeguard your interests. Remember, if you shared accounts or co-signed loans, your situation could differ. It is beneficial to speak with a legal expert to understand the nuances of your financial obligations.

Generally, a wife cannot be held responsible for her husband's debts unless she co-signed or otherwise agreed to those financial obligations. In Mississippi, employing a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse helps clarify this separation of liability. If you have concerns, documenting your financial independence and rights can be vital. Consulting with a legal professional can provide clarity on your specific circumstances.

Using a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can effectively absolve you from responsibility for your spouse's debts. This formal notice asserts that you do not share liability for their financial obligations. In addition, separating your finances and assets can further protect you. It is wise to seek legal counsel to ensure you fully understand your options.

In Mississippi, you typically are not responsible for your deceased spouse's debt unless you jointly incurred it. If you wish to clarify potential liabilities, filing a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can be beneficial. However, the estate of the deceased spouse may still be liable for those debts. Consulting with a probate lawyer may help you navigate this complex situation.

You can avoid responsibility for your husband's debt by utilizing a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This document serves as an official record indicating your non-liability for any debts he may accrue. Furthermore, you should also consider legal separation or maintaining separate financial obligations. Seeking advice from a legal expert can ensure you understand your rights and responsibilities.

To protect yourself from your husband's debts, consider filing a Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse. This legal notice helps clarify that you are not liable for financial obligations he incurs. Additionally, maintaining separate accounts and assets can further isolate your financial responsibilities. Consulting an attorney familiar with Mississippi law may also provide valuable guidance.

In most cases, you are not personally responsible for debts your husband incurs unless you jointly signed for those debts or live in a community property state. The Mississippi Notice of Non-Responsibility for Debts or Liabilities Contracted by Spouse can help clarify your legal standing. By filing this notice, you can protect your assets from claims related to your spouse's financial obligations. For a thorough understanding of your rights, consider using our platform, USLegalForms, to access the necessary documents and guidance.