This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of Portion For Specific Amount Of Money Of Interest In Estate In Order To Pay Indebtedness?

Choosing the right legitimate file template can be quite a struggle. Naturally, there are plenty of web templates available on the Internet, but how do you discover the legitimate develop you want? Make use of the US Legal Forms internet site. The support gives thousands of web templates, such as the Mississippi Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness, which can be used for company and personal requires. All the varieties are checked out by specialists and satisfy state and federal requirements.

Should you be currently registered, log in to your bank account and click on the Acquire switch to obtain the Mississippi Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness. Make use of bank account to check throughout the legitimate varieties you might have acquired previously. Check out the My Forms tab of your bank account and acquire yet another duplicate of your file you want.

Should you be a whole new customer of US Legal Forms, listed below are easy recommendations that you should stick to:

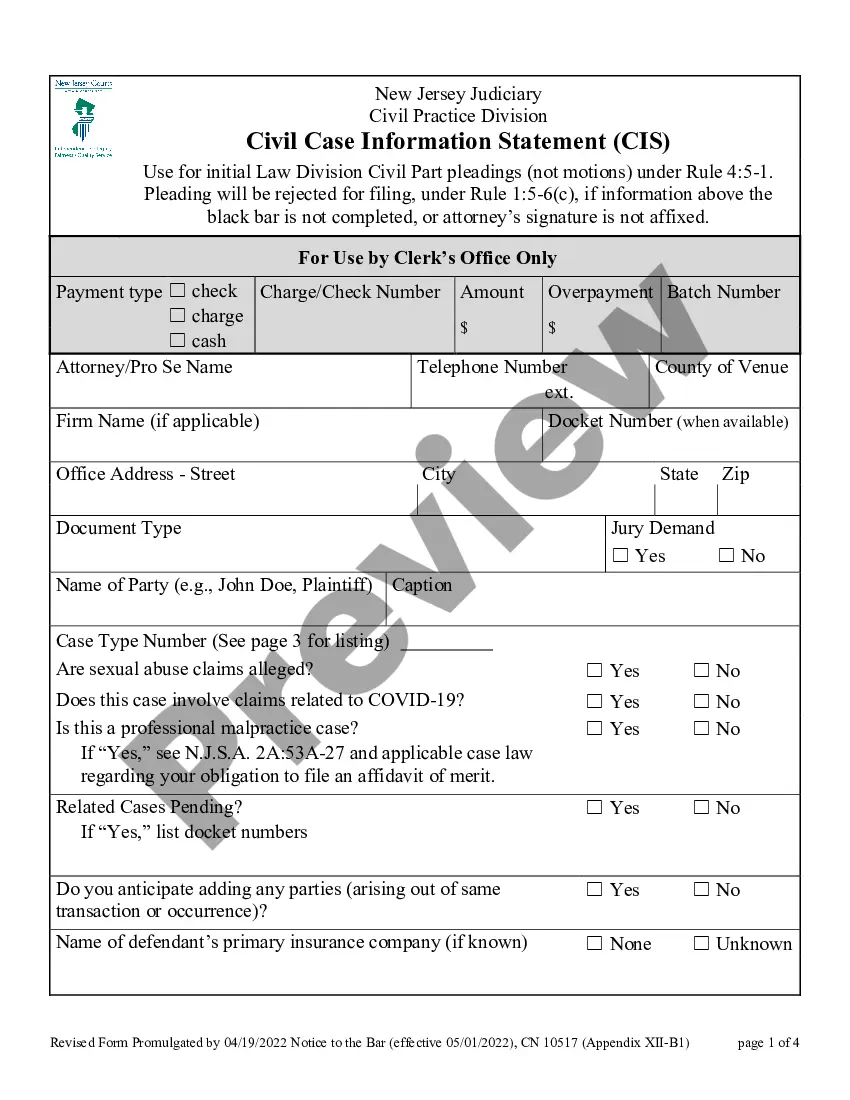

- Initially, make sure you have chosen the right develop to your town/state. You can check out the form using the Review switch and study the form information to make sure this is the right one for you.

- In case the develop does not satisfy your needs, utilize the Seach field to obtain the right develop.

- Once you are positive that the form would work, click the Acquire now switch to obtain the develop.

- Select the prices strategy you need and enter the necessary info. Make your bank account and pay money for the order with your PayPal bank account or credit card.

- Choose the file file format and down load the legitimate file template to your gadget.

- Complete, modify and print out and signal the attained Mississippi Assignment of Portion for Specific Amount of Money of Interest in Estate in Order to Pay Indebtedness.

US Legal Forms may be the most significant collection of legitimate varieties where you can discover different file web templates. Make use of the service to down load expertly-produced documents that stick to status requirements.

Form popularity

FAQ

Mississippi does not have an inheritance tax nor a gift tax. Extension?The executor must complete a 60 Day Notice and Extension Request (form 94-100). Approximate values may be used for the valuation of assets requested on the Notice.

The federal estate tax exemption shields $12.06 million from tax as of 2022 (rising to $12.92 million in 2023).3 There's no income tax on inheritances.

What is the Inheritance Tax in Mississippi? Since Mississippi is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero). As a result, you won't owe Mississippi inheritance taxes.

If one sibling is living in an inherited property and refuses to sell, a partition action can potentially be brought by the other siblings or co-owners of the property in order to force the sale of the property. In general, no one can be forced to own property they don't want, but they can be forced to sell.

Though there is no deadline for filing probate in Mississippi, the court is legally allowed to compel surviving family members to present their loved one's will. In that case, you would be required to file probate within 40 days of their death.

If you die with children but no spouse, your children will inherit everything. If you die with one child, your spouse gets half of the intestate property and your child gets the other half. If you die with two or more children, your surviving spouse and children each get an equal share of your intestate property.

You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government.