No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

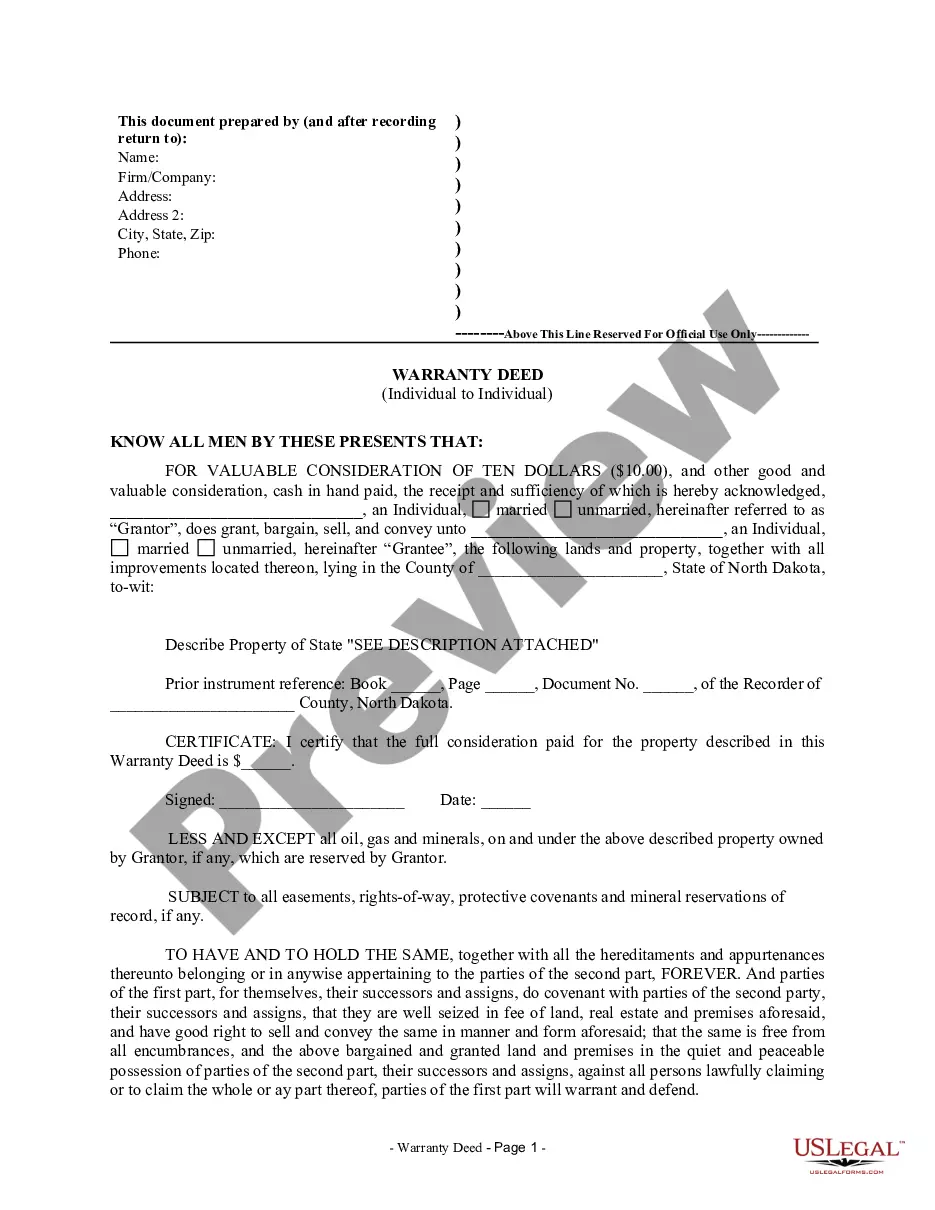

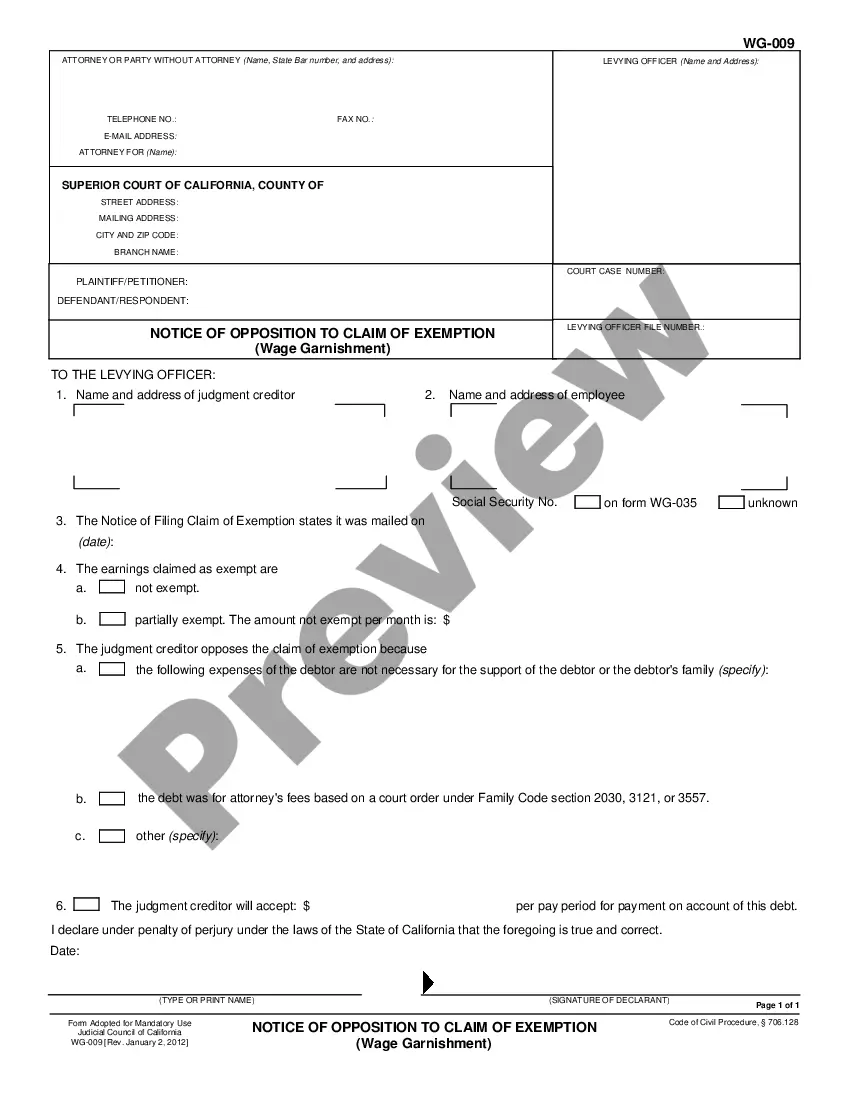

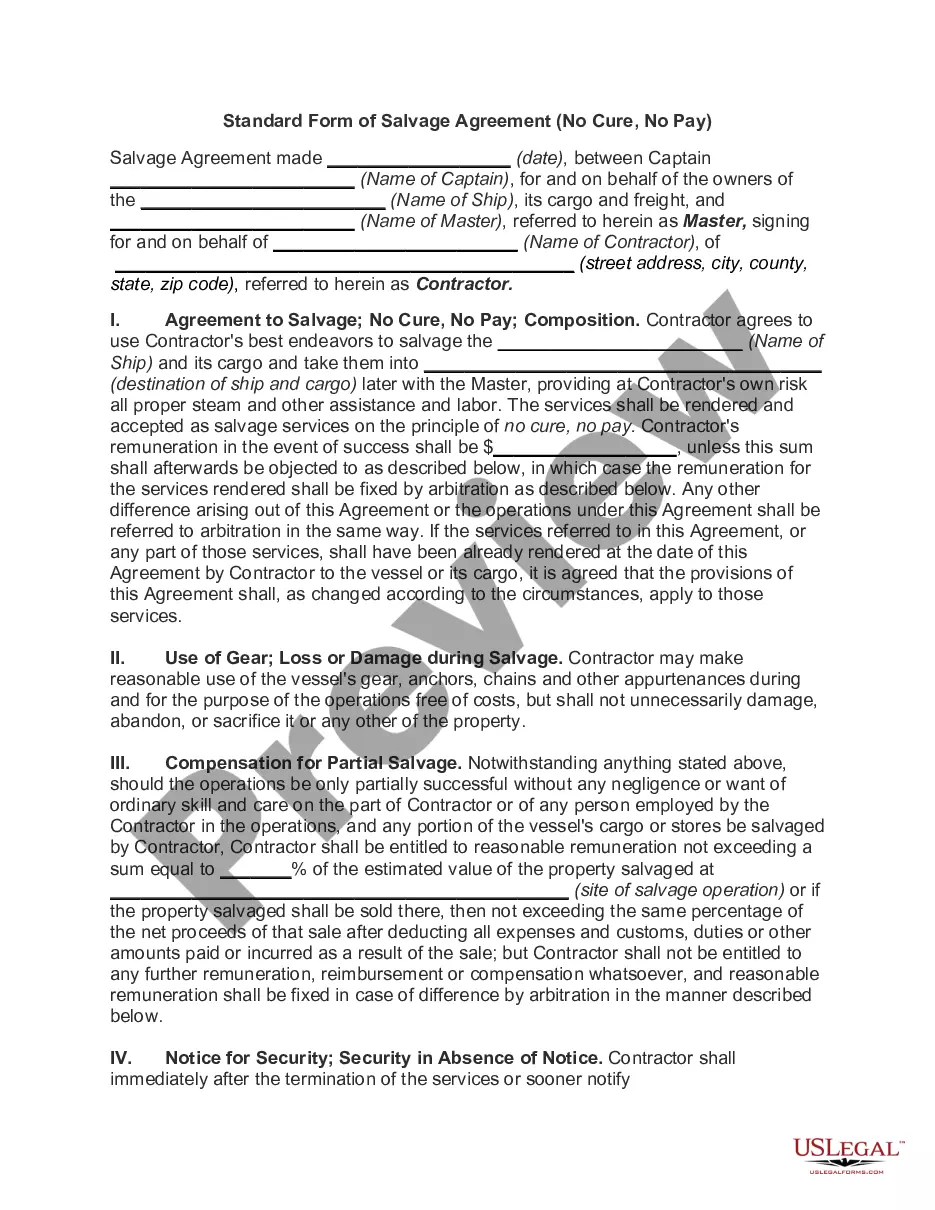

Mississippi Collection Agency's Return of Claim as Uncollectible

Description

How to fill out Collection Agency's Return Of Claim As Uncollectible?

US Legal Forms - one of the largest repositories of legal documents in the USA - provides a vast array of legal document templates that you can acquire or print out.

Utilizing the website, you can access numerous forms for business and personal purposes, categorized by type, location, or keywords. You can retrieve the most recent versions of forms like the Mississippi Collection Agency's Return of Claim as Uncollectible within moments.

If you already have an account, Log In and download Mississippi Collection Agency's Return of Claim as Uncollectible from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms from the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to finalize the payment.

Select the file format and download the form onto your device. Edit. Fill out, revise, print, and sign the downloaded Mississippi Collection Agency's Return of Claim as Uncollectible.

Every template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you need to obtain or print another copy, simply navigate to the My documents section and click on the form you want.

Access the Mississippi Collection Agency's Return of Claim as Uncollectible with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that satisfy your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the appropriate form for your region/state.

- Click the Review button to evaluate the form’s contents.

- Check the form overview to confirm that you’ve selected the correct document.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase Now button.

- Then, choose your preferred payment plan and provide your information to register for an account.

Form popularity

FAQ

There are 3 ways you can remove collections from your credit report without paying. 1) sending a Goodwill letter asking for forgiveness 2) disputing the collections yourself 3) working with a credit repair company like Credit Glory that can dispute it for you.

Like your lawyer told you, negative information such as foreclosures and charge-off accounts remain on your credit reports for seven years from the date of the first missed payment. After this cycle is completed, they will automatically fall off.

6 Ways to Remove Collection Accounts from Your Credit ReportAsk the Collection Agency to Validate the Debt.Dispute the account with the Credit Bureau even if it's accurate.Try to set up a Pay for Delete.Settle the debt and dispute it again.Wait for the account to be sold to another agency and dispute it.More items...

Ask the credit bureau to remove it from your credit report using a dispute letter. If a collector keeps a debt on your credit report longer than seven years, you can challenge the debt and request it be removed. This is especially true if you have proof of the start of the delinquency.

Most negative information generally stays on credit reports for 7 years. Bankruptcy stays on your Equifax credit report for 7 to 10 years, depending on the bankruptcy type. Closed accounts paid as agreed stay on your Equifax credit report for up to 10 years.

The statute of limitations for debt collection under Mississippi law is typically 3 years but there are exceptions. If the statute of limitations has passed, you can no longer be sued for the debt and you can ignore the debt collector.

Generally, write-off is mandatory for debts delinquent more than two years, unless documented and justified to OMB in consultation with Treasury. However, in those cases where material collections can be documented to occur after two years, debt cannot be written off until the estimated collections become immaterial.

Typically, the only way to remove a collection account from your credit reports is by disputing it. But if the collection is legitimate, even if it's paid, it'll likely only be removed once the credit bureaus are required to do so by law.

Unpaid credit card debt will drop off an individual's credit report after 7 years, meaning late payments associated with the unpaid debt will no longer affect the person's credit score. Unpaid credit card debt is not forgiven after 7 years, however.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.