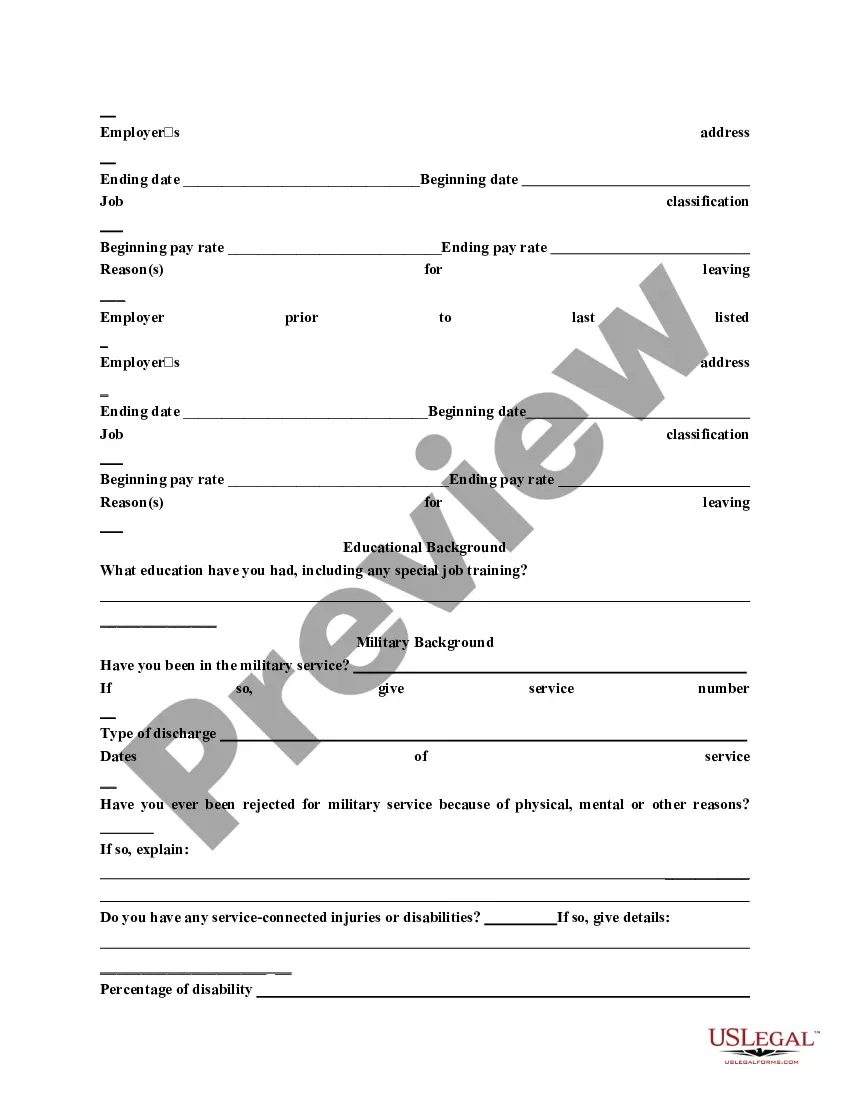

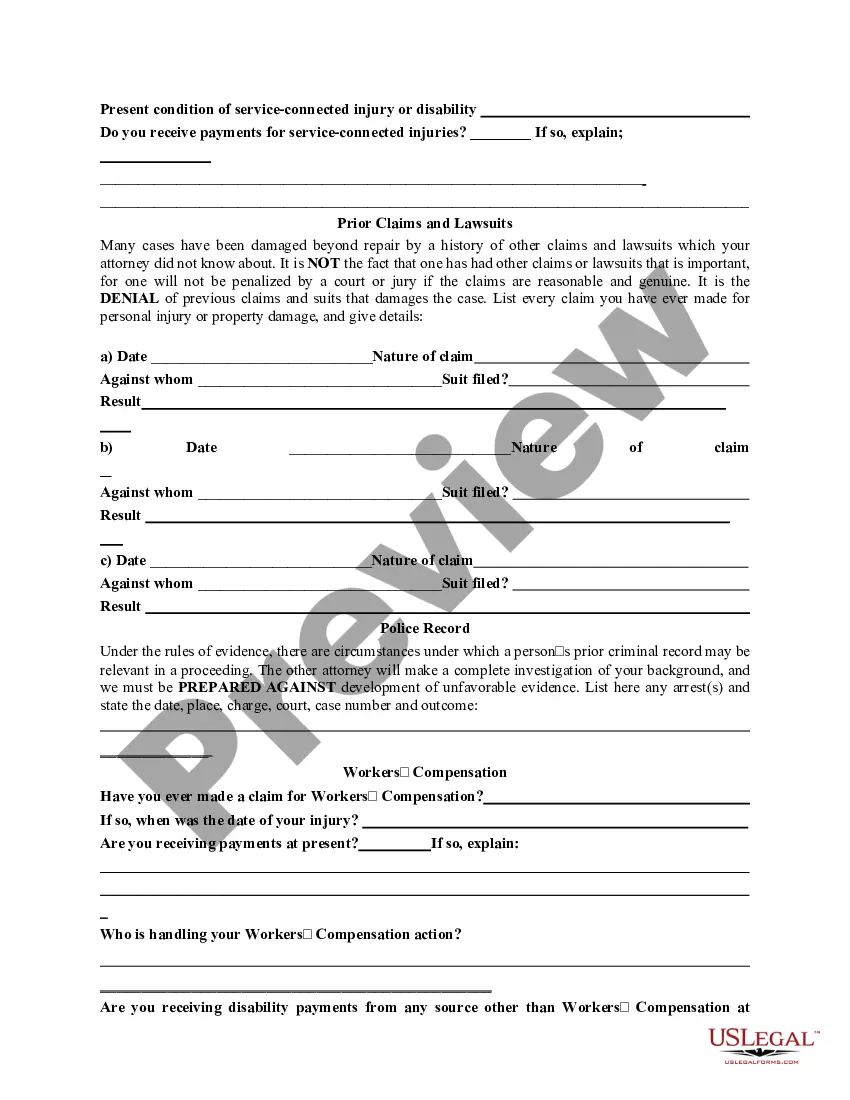

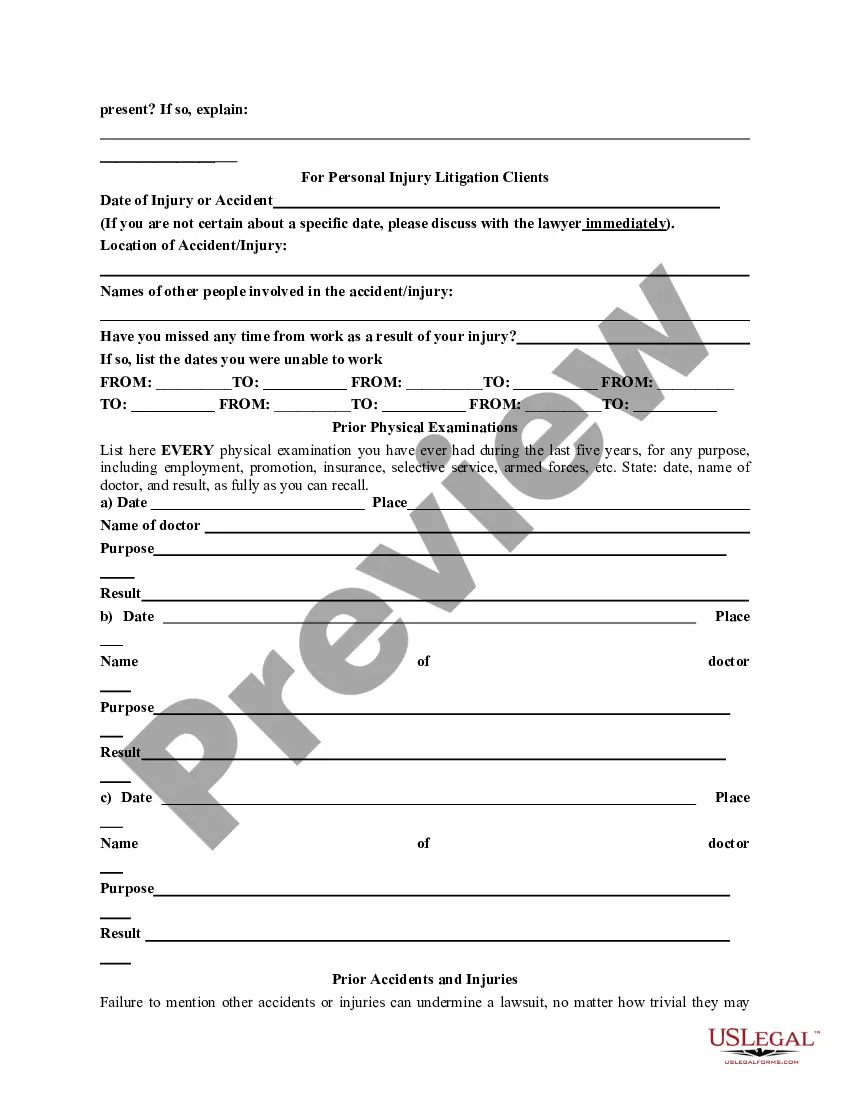

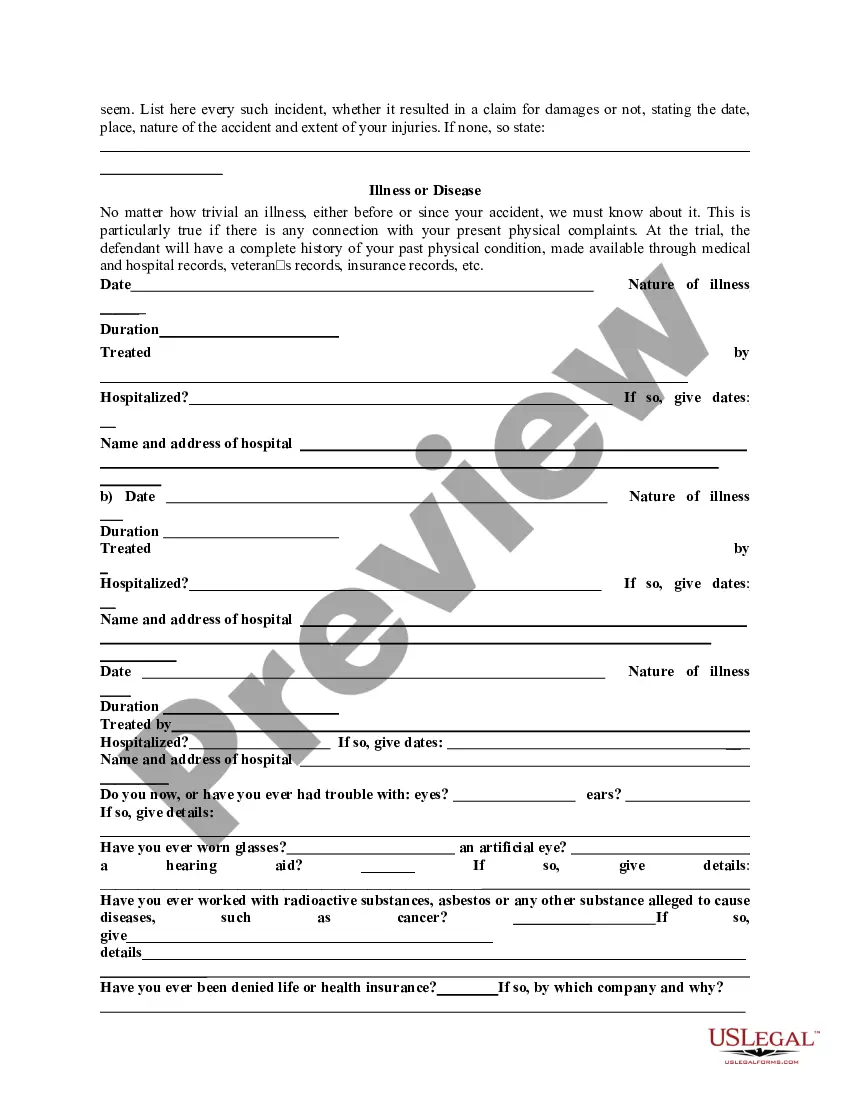

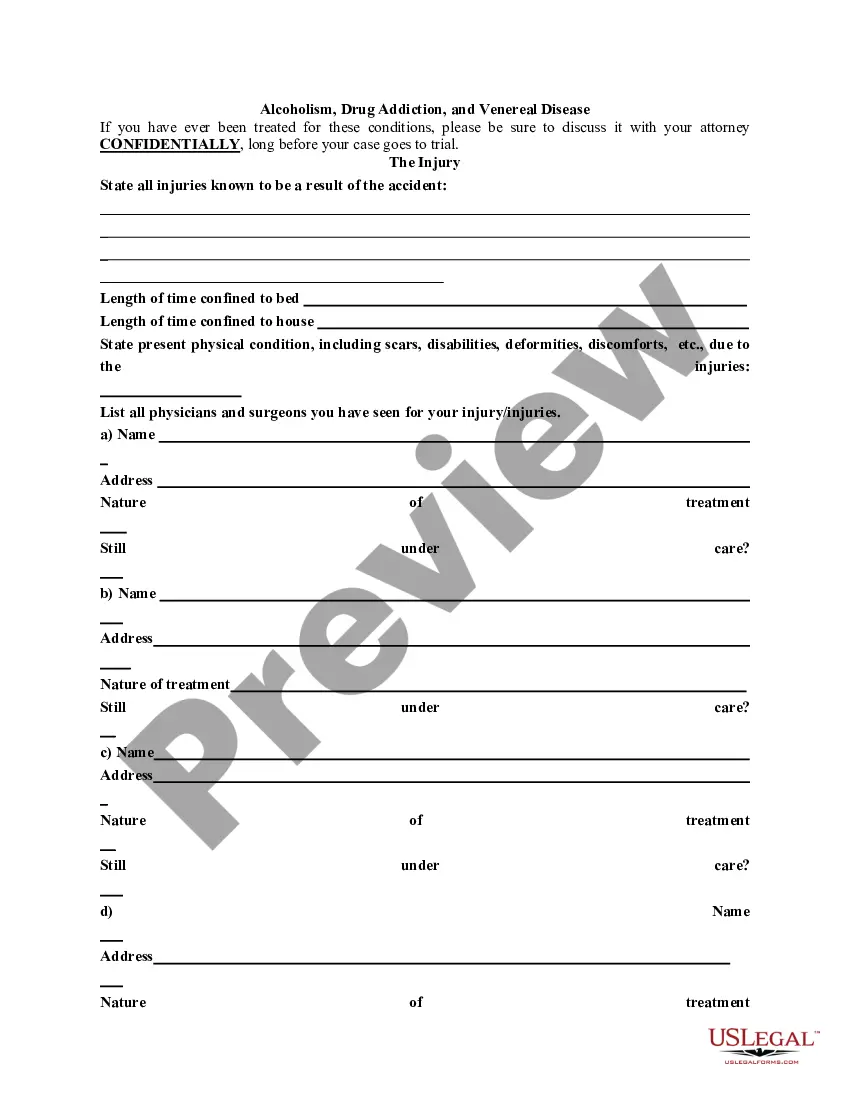

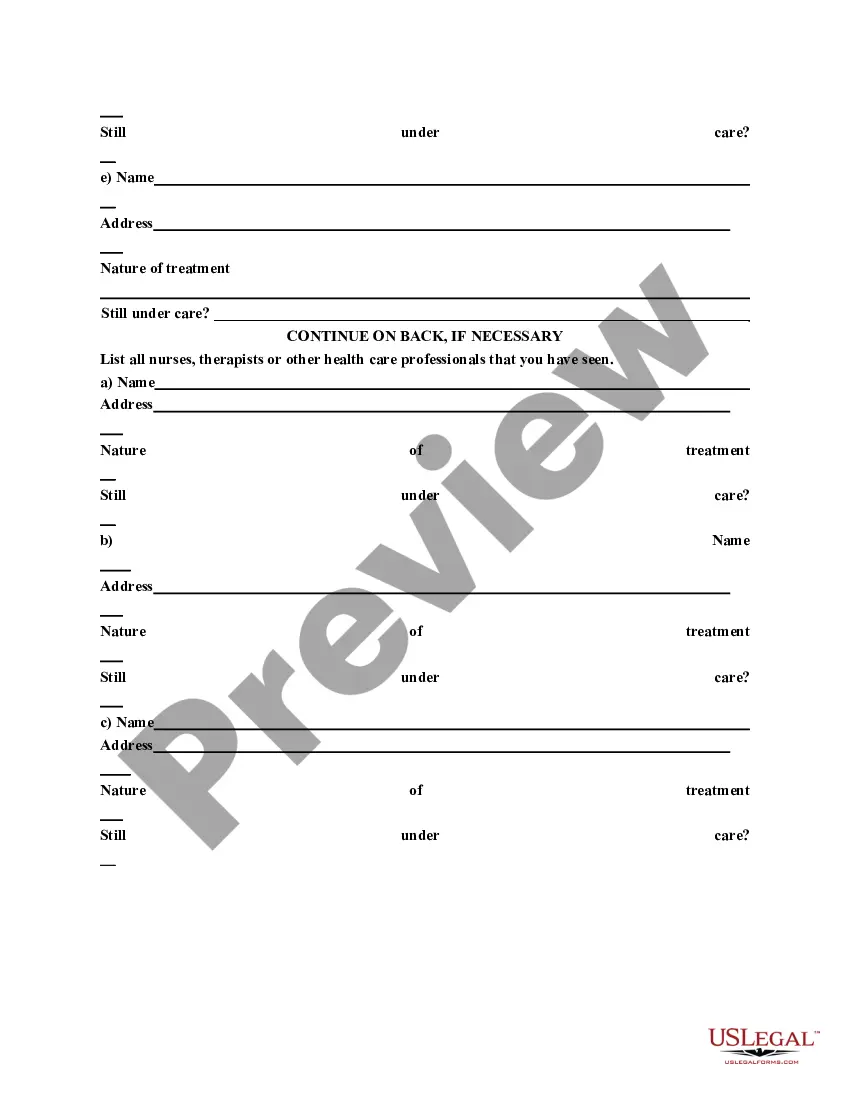

The first part of this questionnaire is designed to be useful in most civil and criminal representations. The last part can be used when screening prospective personal injury litigation clients. The questionnaire can be completed by the attorney during a first meeting with prospective clients or mailed to the client in advance and reviewed at a first meeting.

Mississippi General Information Questionnaire

Description

How to fill out General Information Questionnaire?

Selecting the appropriate authorized document template can be quite a challenge. Indeed, there are numerous templates available online, but how can you obtain the legal form you require? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Mississippi General Information Questionnaire, which can serve both business and personal purposes. All of the forms are verified by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the Mississippi General Information Questionnaire. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents tab of your account and obtain another copy of the document you need.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- First, ensure you have selected the correct form for your region/county.

- You can preview the form using the Review button and examine the form details to confirm it is the right one for you.

- If the form does not meet your needs, use the Search field to locate the appropriate form.

- Once you are confident that the form is suitable, click the Get now button to acquire the form.

- Choose the payment plan you prefer and fill in the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Mississippi General Information Questionnaire.

Form popularity

FAQ

The 3rd Grade MAAP ELA Assessment component will be summative and will determine the minimum level of competency in reading and be administered each spring. Students will have the ability to retest on the 3rd Grade Alternative Assessment as districts deem appropriate.

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

To get a tax clearance letter from the Mississippi Department of Revenue, you'll need to send a written request. In your letter, include your Mississippi LLC's name and the signature of a manager or member. You can send it by mail or fax.

The Mississippi Academic Assessment Program (MAAP) is designed to measure student achievement in English Language Arts (ELA), Mathematics, Science, and US History.

You should file a Mississippi Income Tax Return if any of the following statements apply to you: You have Mississippi income tax withheld from your wages (other than Mississippi gambling income). You are a non-resident or part-year resident with income taxed by Mississippi (other than gambling income).

The 89-350 Mississippi Employee's Withholding Exemption Certificate must be completed by employees so employers know how much state income tax to withhold from wages. This form should be maintained in conjunction with the federal Form W-4.

Form 89-350?? - Withholding Exemption Certificate Completed by employee; retained by employer.

3) Form 89-350 Facilitates Proper Tax Withholding and Reporting. One primary purpose of Form 89-350 is to facilitate tax withholding and reporting. Employers use this form to determine the correct amount of federal income tax to withhold from employees' paychecks.