Mississippi Corporation - Transfer of Stock

Description

How to fill out Corporation - Transfer Of Stock?

It is feasible to dedicate time on the web attempting to locate the sanctioned document format that meets the state and federal regulations you seek.

US Legal Forms provides an extensive array of legal documents that are evaluated by specialists.

It is straightforward to obtain or print the Mississippi Corporation - Transfer of Stock from my assistance.

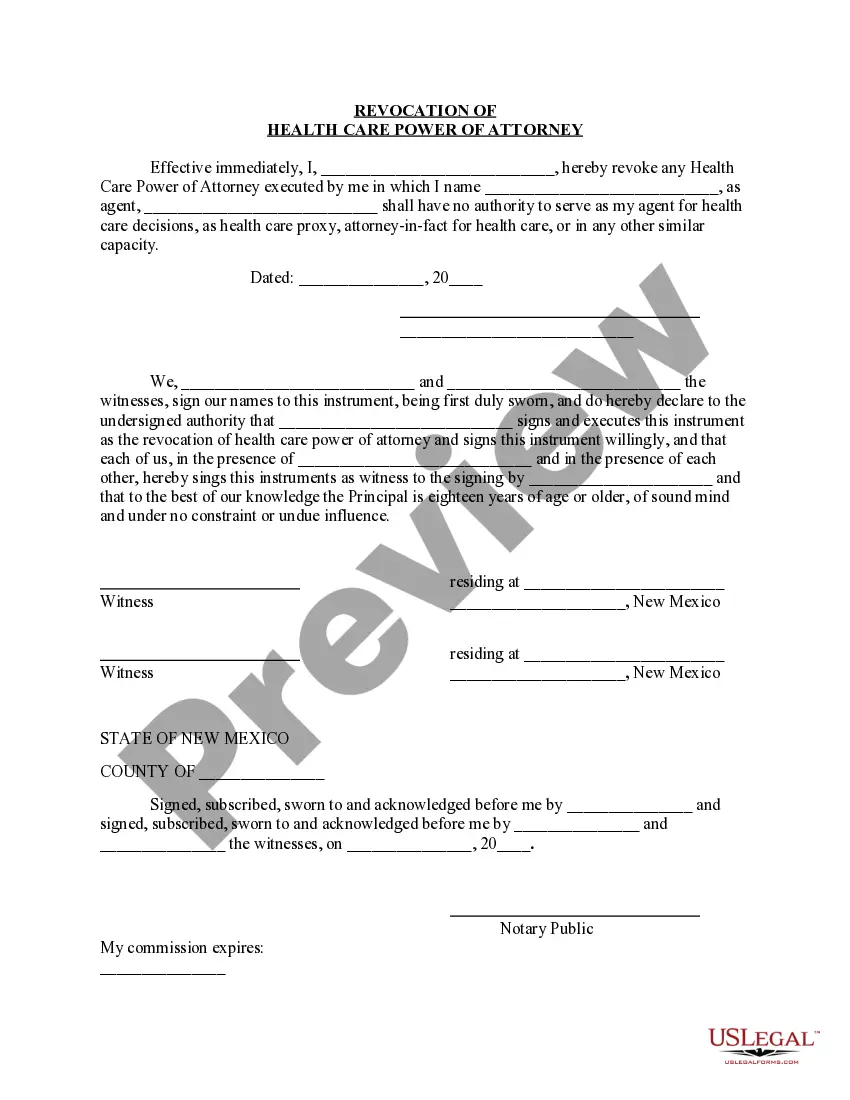

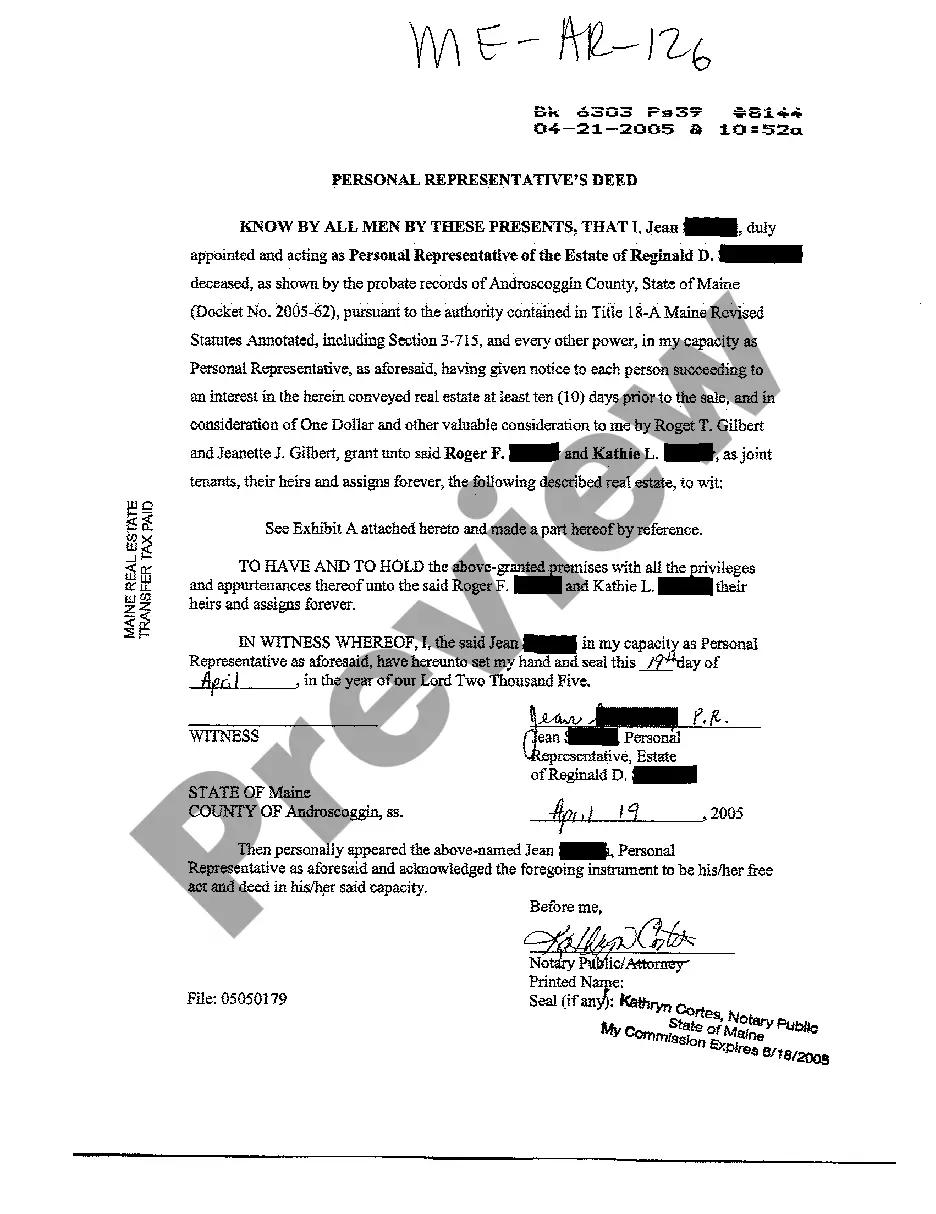

If available, utilize the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterward, you can complete, modify, print, or sign the Mississippi Corporation - Transfer of Stock.

- Each legal document format you buy belongs to you permanently.

- To obtain another copy of the purchased document, visit the My documents tab and click on the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, make sure you have selected the correct document format for the state/town of your choice.

- Review the document outline to confirm you have chosen the suitable form.

Form popularity

FAQ

To withdraw a foreign corporation from Mississippi, you must file the appropriate paperwork with the Secretary of State's office. This process typically involves submitting a Certificate of Withdrawal and ensuring all fees and taxes are settled. Utilizing resources like US Legal Forms can streamline this process, making it easier to manage your affairs regarding the withdrawal of your Mississippi Corporation.

A certificate of existence in Mississippi confirms that your corporation is valid under state law and is authorized to conduct business. This document is essential when performing transactions, such as transferring stock, as it assures partners that your Mississippi Corporation is compliant with legal requirements. It reflects your commitment to maintaining a reputable business.

Yes, transferring ownership through stock in a corporation is generally simpler and more structured than other forms of ownership transfer. This is particularly true in a Mississippi Corporation, where shares can be easily bought, sold, or gifted. The process is regulated, providing clarity and protection for all parties involved during the transfer of stock.

A certificate of fact is an official statement issued by the state that attests to specific details regarding a corporation's legitimacy, operations, and structure. This document can be particularly important for ensuring transparency during the transfer of stock in your Mississippi Corporation. By obtaining a certificate of fact, you reinforce trust among shareholders and enhance your corporation’s professional standing.

In Mississippi, a certificate of fact is an official document that states the status and existence of a corporation. This certificate proves that the Mississippi Corporation is in good standing, which is crucial for any stock transfer. Employers and investors frequently request this certificate to verify the corporation's credibility before making decisions.

A certificate of fact in Mississippi provides specific details about your corporation, such as its formation date, status, and registered agent. This document helps validate your Mississippi Corporation during the transfer of stock process. By having this certificate, you can assure prospective investors and partners of your corporation's legitimacy and operational history.

A certificate of existence serves as official proof that your Mississippi Corporation is legally registered and compliant with state regulations. This document confirms that your corporation has fulfilled its requirements, such as filing necessary reports and paying taxes. It is often required when transferring stock or opening bank accounts, ensuring a smooth process for stakeholders.

To close a business in Mississippi, you need to follow specific steps to ensure compliance with state laws. First, notify all stakeholders about your decision to close and settle any outstanding debts. Next, file the necessary paperwork to dissolve your Mississippi Corporation. Utilizing a platform like uslegalforms can simplify the Mississippi Corporation - Transfer of Stock process, making your transition smoother and compliant with legal requirements.

Yes, corporations, especially Mississippi Corporations, facilitate easier ownership transfers through stock. Shareholders can sell their shares without complex legal procedures, making it a straightforward process. This feature makes corporations an appealing choice for those looking to invest or divest in a business.

In general, shares in a corporation are easier to transfer than ownership in other business structures like sole proprietorships or partnerships. This ease comes from the ability to sell shares without needing to dissolve the business or significantly alter its operations. Choosing a Mississippi Corporation structure can provide the flexibility you need.