Mississippi Jury Instruction - Loss of Wage Earning Capacity - Definition of Term

Description

How to fill out Mississippi Jury Instruction - Loss Of Wage Earning Capacity - Definition Of Term?

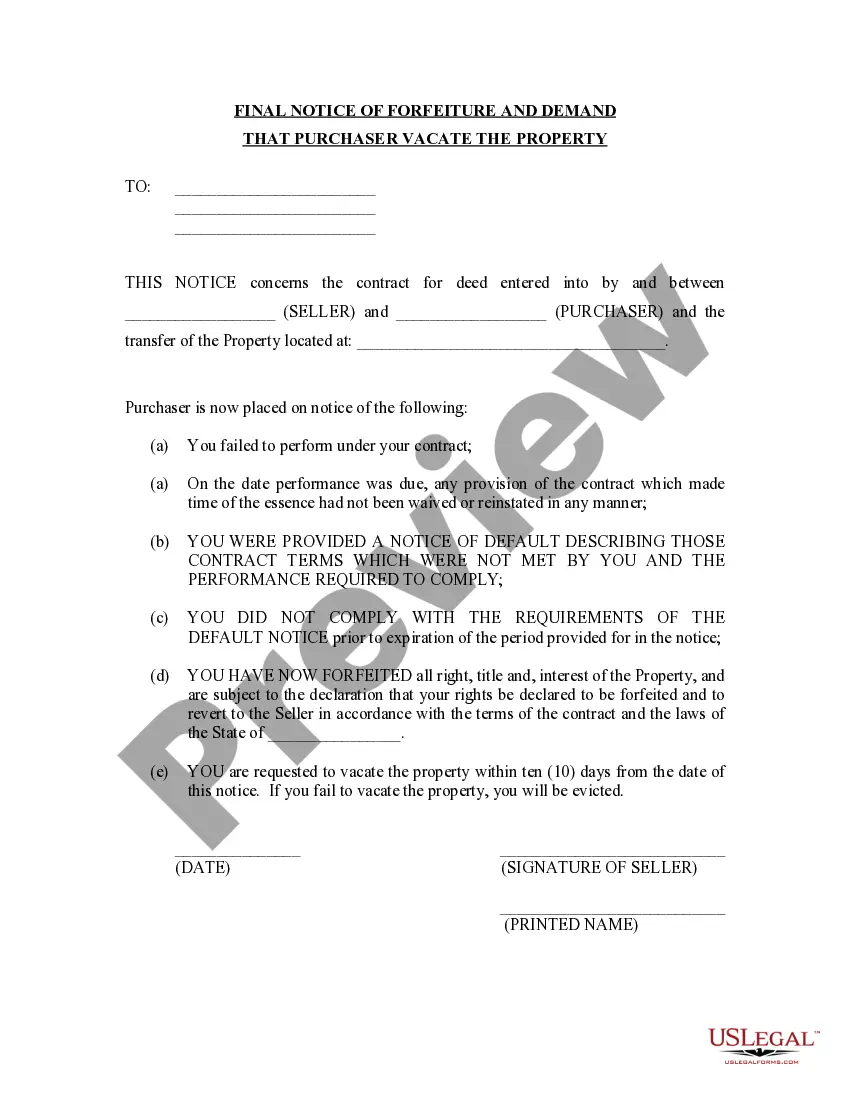

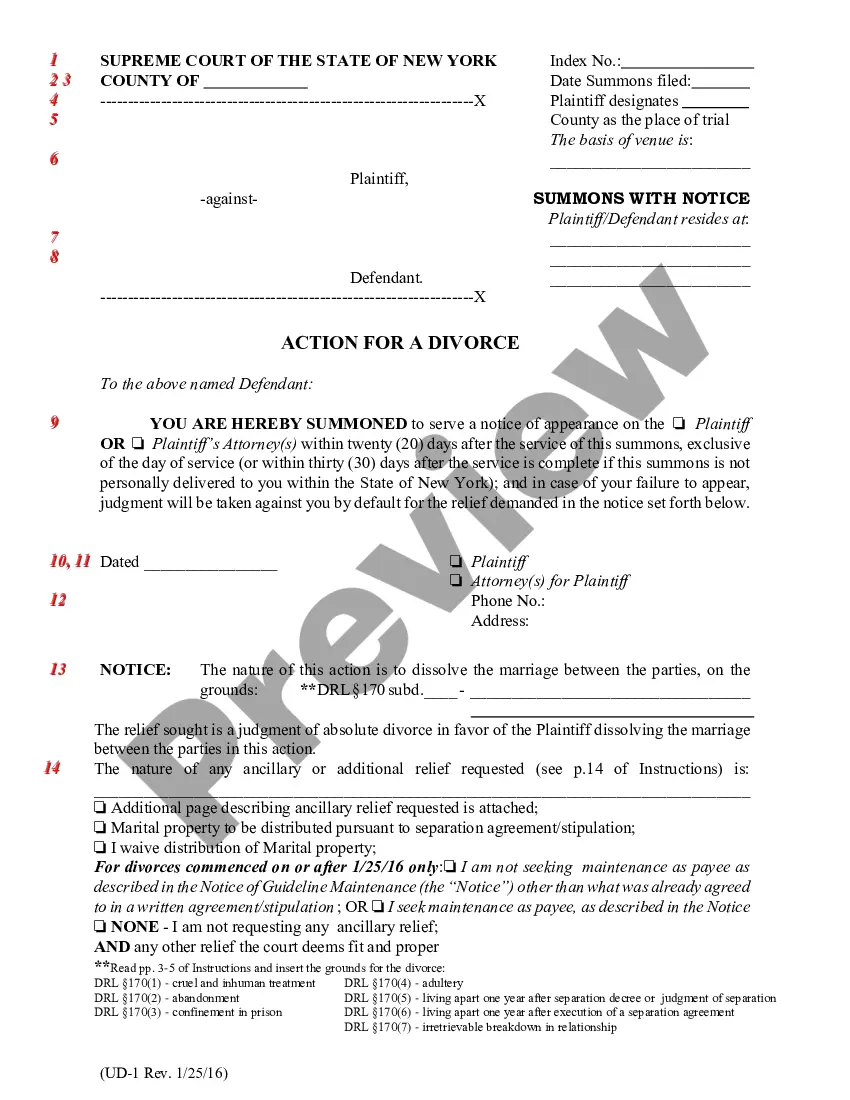

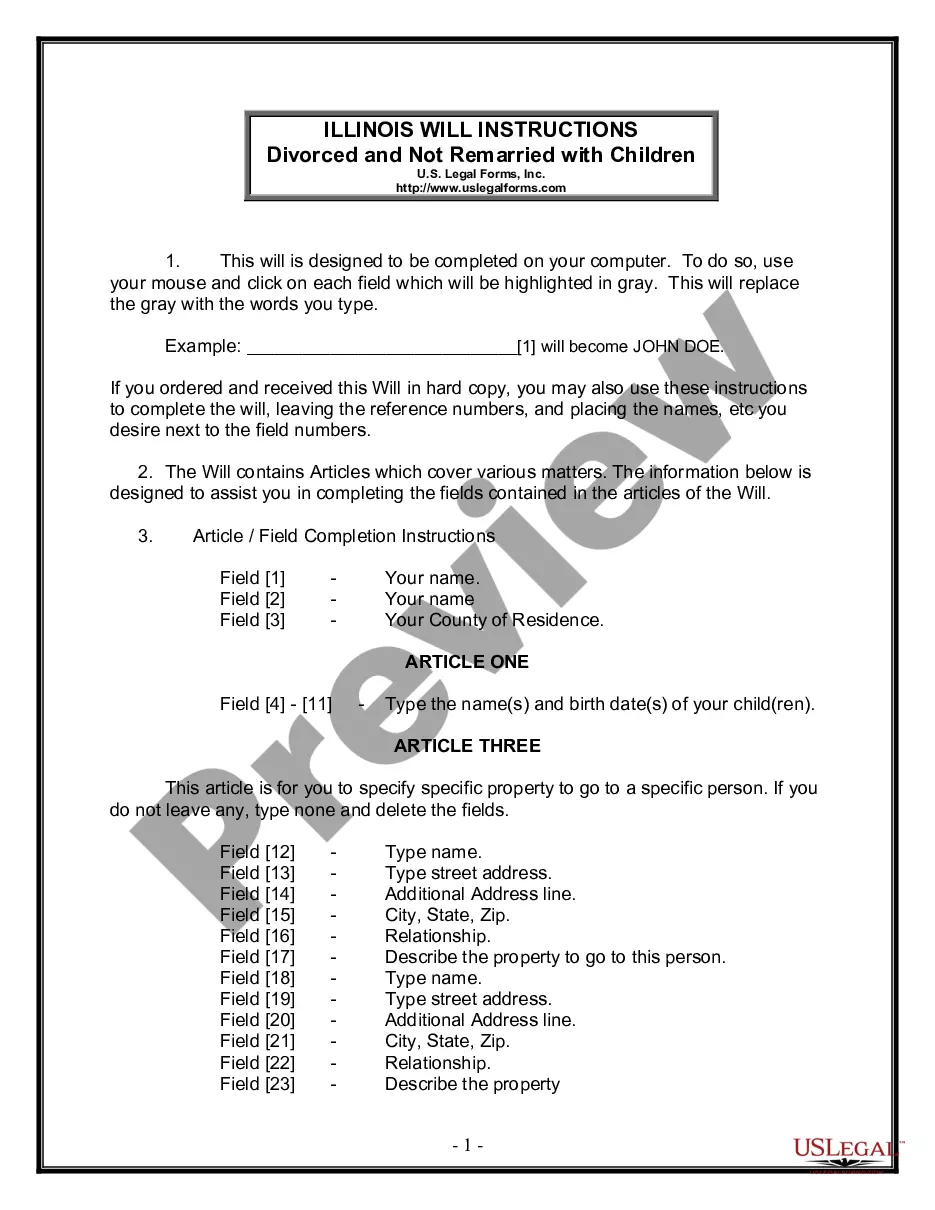

Obtain a printable Mississippi Jury Instruction - Loss of Wage Earning Capacity - Definition of Term within just several mouse clicks from the most complete catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of reasonably priced legal and tax forms for US citizens and residents online since 1997.

Customers who have already a subscription, must log in straight into their US Legal Forms account, download the Mississippi Jury Instruction - Loss of Wage Earning Capacity - Definition of Term see it saved in the My Forms tab. Customers who never have a subscription must follow the tips below:

- Ensure your form meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, preview the shape to see more content.

- Once you are sure the form suits you, click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay out via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you have downloaded your Mississippi Jury Instruction - Loss of Wage Earning Capacity - Definition of Term, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Succinctly, the step-by-step guide to compute an award for loss of earning capacity dictates: (1) Subtract the age of the deceased from 80. (2) Multiply the answer in (1) by 2, and divide it by 3 (these operations are interchangeable). (3) Multiply 50 (percent) to the annual gross income of the deceased.

Earning capacity means a person's capability or power to acquire money by contributing a person's talent, skills, training, and experience. It is also called as earning power. Earning capacity is considered in the following situations: when measuring the damages recoverable in a personal- injury law suit; and.

Loss of earning capacity is usually proven through the testimony of expert witnesses who review the victim's work history and employment records to make reasonable estimates about the person's likely future earnings before and after the accident.

Lost earning capacity, sometimes called future loss of earning or impairment of earning power, refers to the fact that an injured employee may not be able to earn the income he might have if not for the injury.

Return on Equity Shareholders funds(ROE) is the extra earning capacity of a firm.

How to prove lost earning capacity in California. Future lost earnings must be reasonably certain in order to be recoverable in a California personal injury case. Although not necessary, proof of past income can be helpful. Useful documents include past years' tax returns, pay stubs and employer's letters.

Are you able to claim for future loss of earnings? If you have suffered an injury through clinical negligence resulting in the inability to work and having to give up your current position of employment, there is a possibility that you can claim for future loss of earnings.

Earning capacity is a term often used by the courts to describe what is compensable to a person with a disability.The intent of the law is that if the tort feasor is liable for the injury, he or she must pay damages to a person with a disability that will compensate for potential future losses.