Mississippi Conservators' Bond

Understanding this form

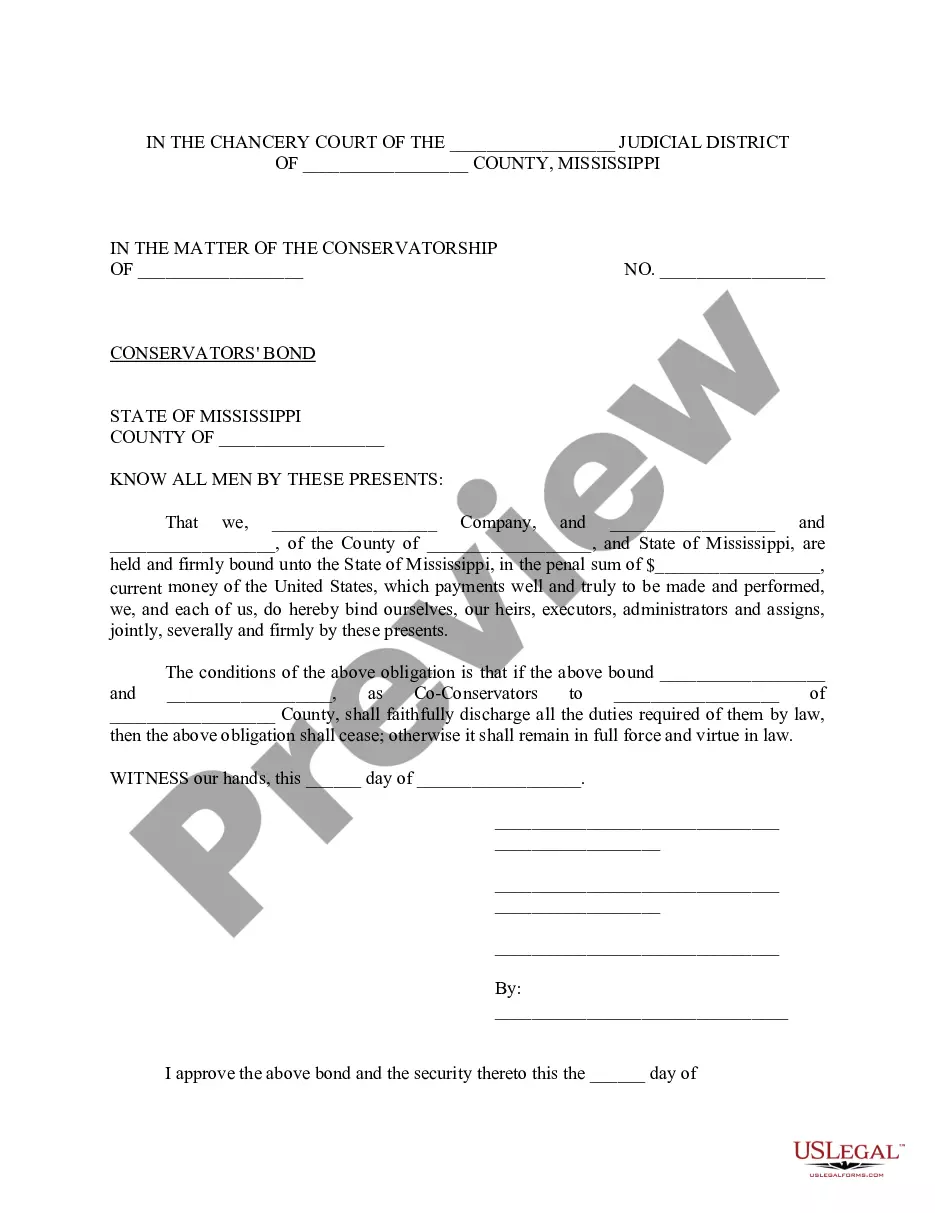

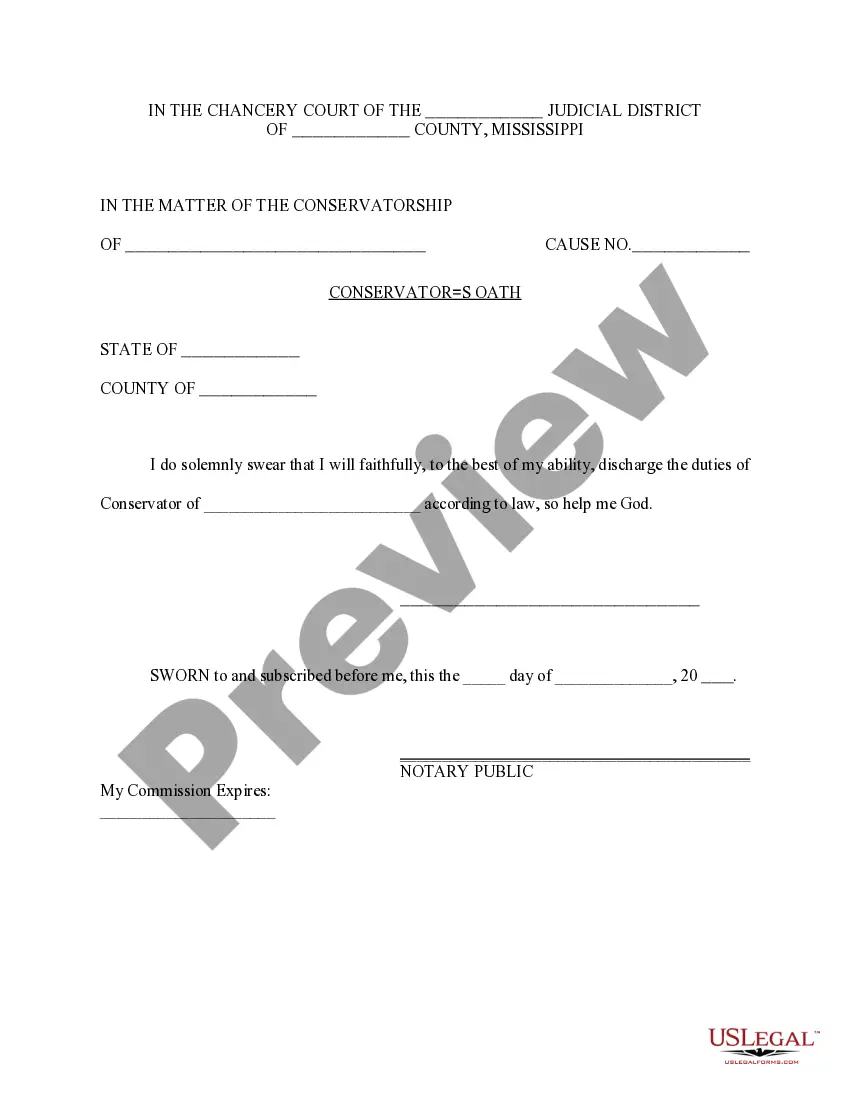

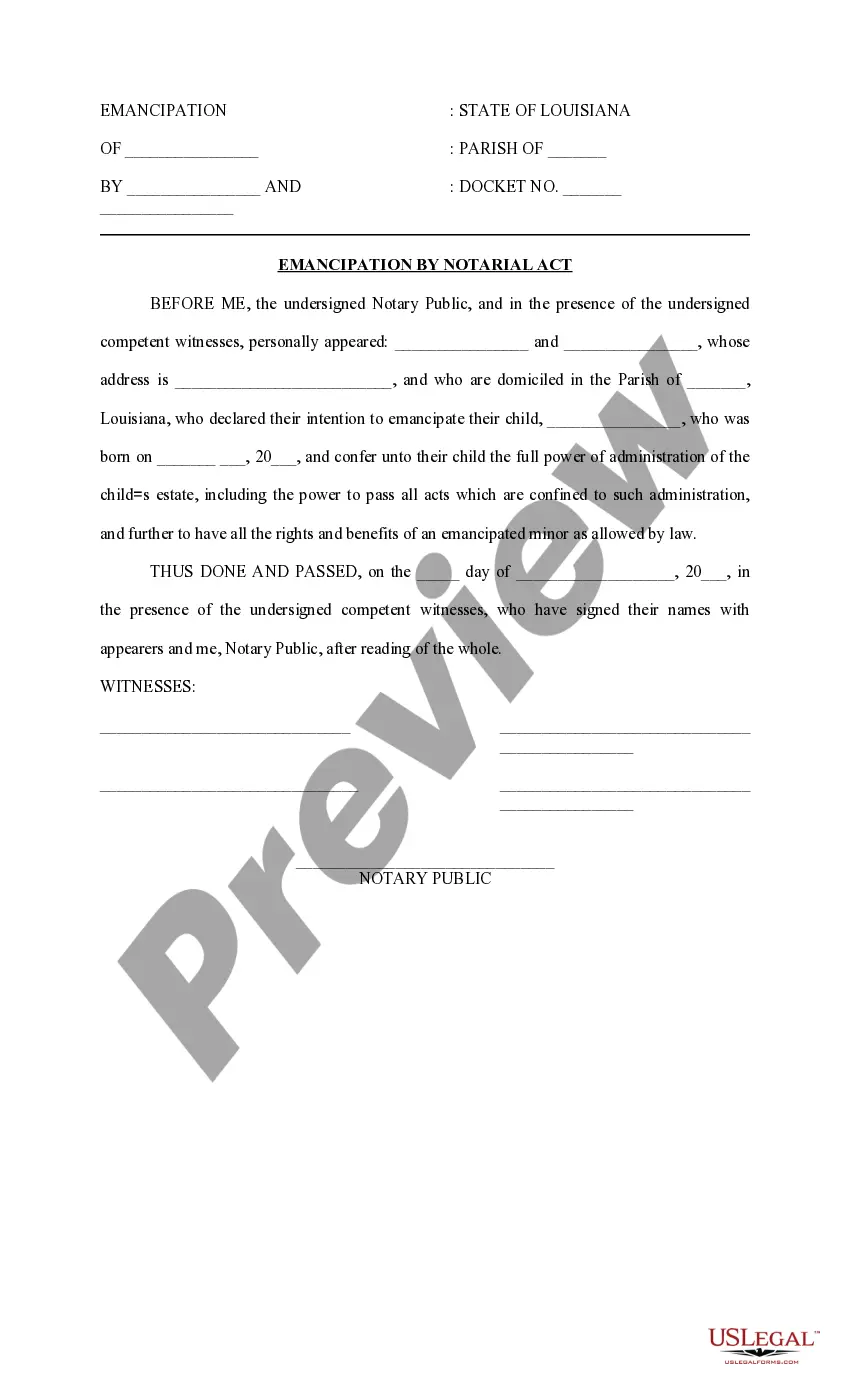

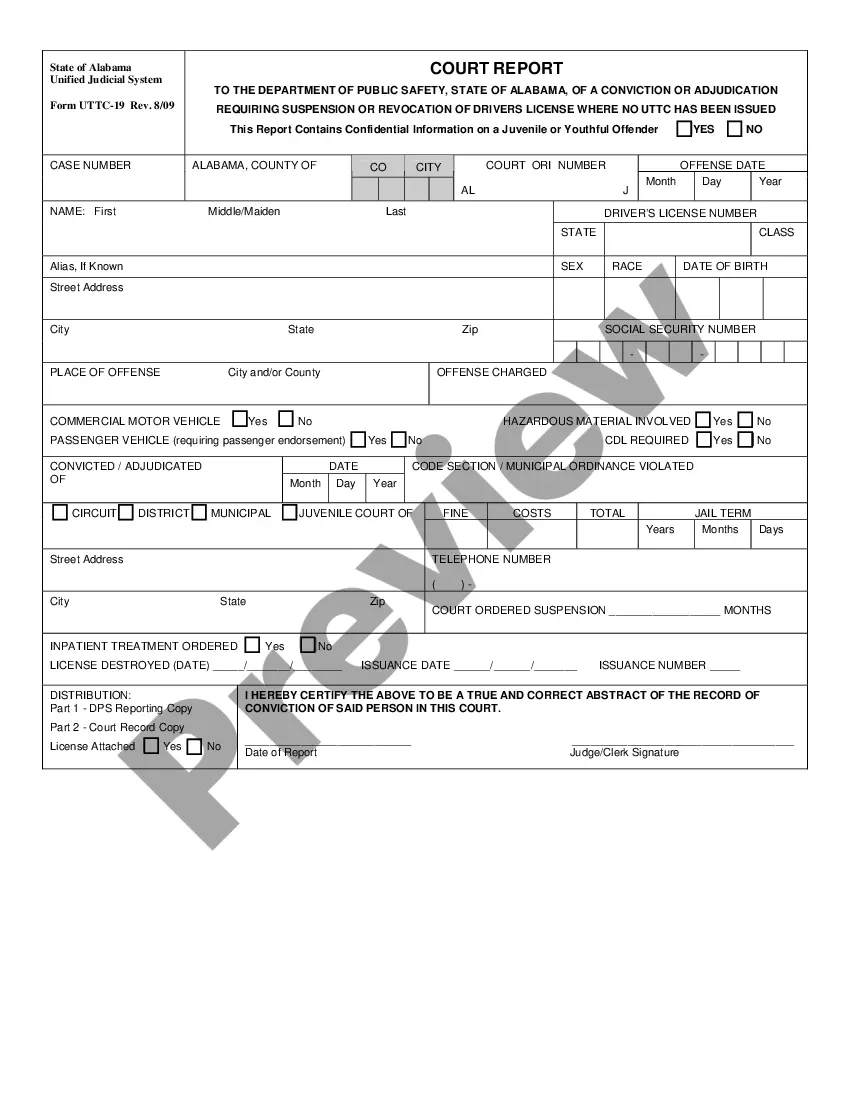

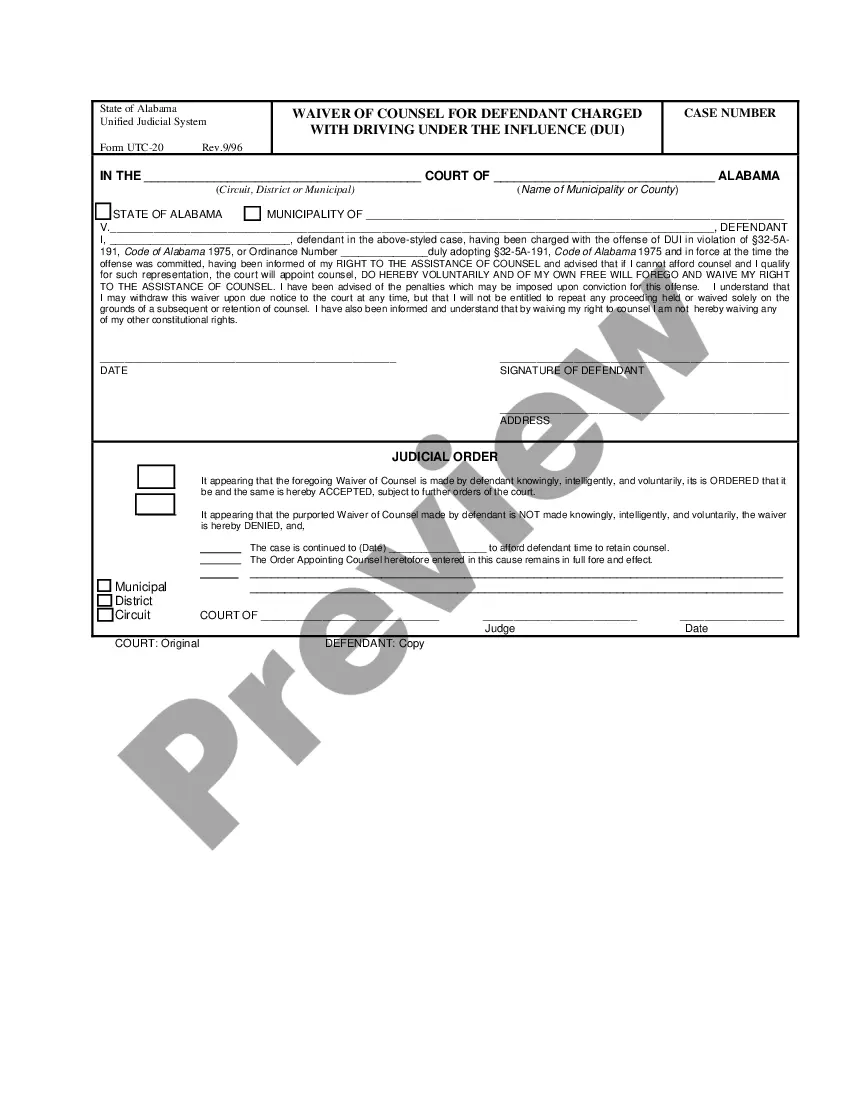

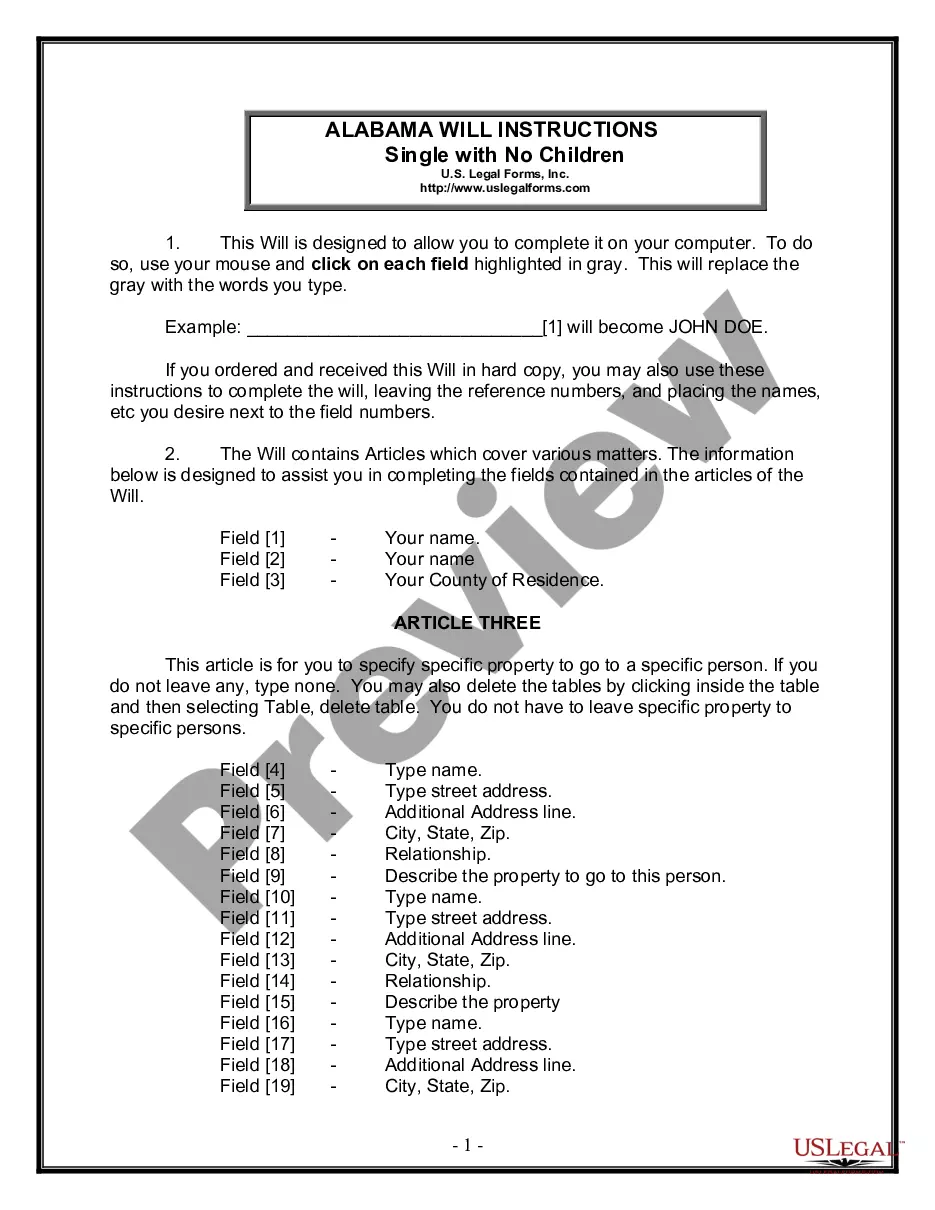

The Conservators' Bond is a legal document used in Mississippi that requires a conservator to pay a specified sum of money as a penalty if they fail to fulfill their obligations. This bond ensures that the conservator acts in the best interests of the individual they are appointed to protect, providing an additional layer of accountability. Unlike other financial documents, a conservators' bond is specifically tied to the responsibilities of the conservator, ensuring compliance with state laws governing conservatorships.

Main sections of this form

- Identification of the conservators and the estate or person under their care.

- The stated amount of the bond, which acts as a financial guarantee.

- Conditions under which the bond remains valid or becomes void.

- Signatures of the conservators and the Chancery Clerk validating the bond.

- Inclusion of the court's jurisdiction and case number relevant to the conservatorship.

When to use this form

This form should be used when a conservator has been appointed by the court to manage the affairs of an individual who is unable to do so. The bond is typically required at the onset of the conservatorship process to ensure that the conservator will act ethically and manage financial matters appropriately. It is necessary to submit this bond as part of the court's requirements in order to officially take on the responsibilities of conservatorship.

Who this form is for

- Individuals appointed as conservators in Mississippi.

- Legal guardians responsible for managing the affairs of another person.

- Family members or relatives acting on behalf of a loved one in need of conservatorship.

- Legal professionals seeking to formalize the conservatorship with the court.

Steps to complete this form

- Identify the parties involved, including the conservators and the individual requiring conservatorship.

- Enter the amount of the bond, which acts as a financial guarantee.

- Specify the court jurisdiction and case number associated with the conservatorship.

- Ensure that all conservators sign the bond in the designated areas.

- Obtain the Chancery Clerkâs approval and signature to validate the bond.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all required signatures, particularly from the Chancery Clerk.

- Entering an incorrect bond amount that does not meet court requirements.

- Omitting the case number or court jurisdiction, which can delay processing.

- Not understanding the specific duties and obligations under the bond agreement.

Benefits of completing this form online

- Convenient access to legal forms without the need for physical visits.

- Ability to edit and customize the form according to your specific needs.

- Ensured compliance with Mississippi laws due to professionally drafted templates.

- Quick download and printing options, streamlining the filing process.

Looking for another form?

Form popularity

FAQ

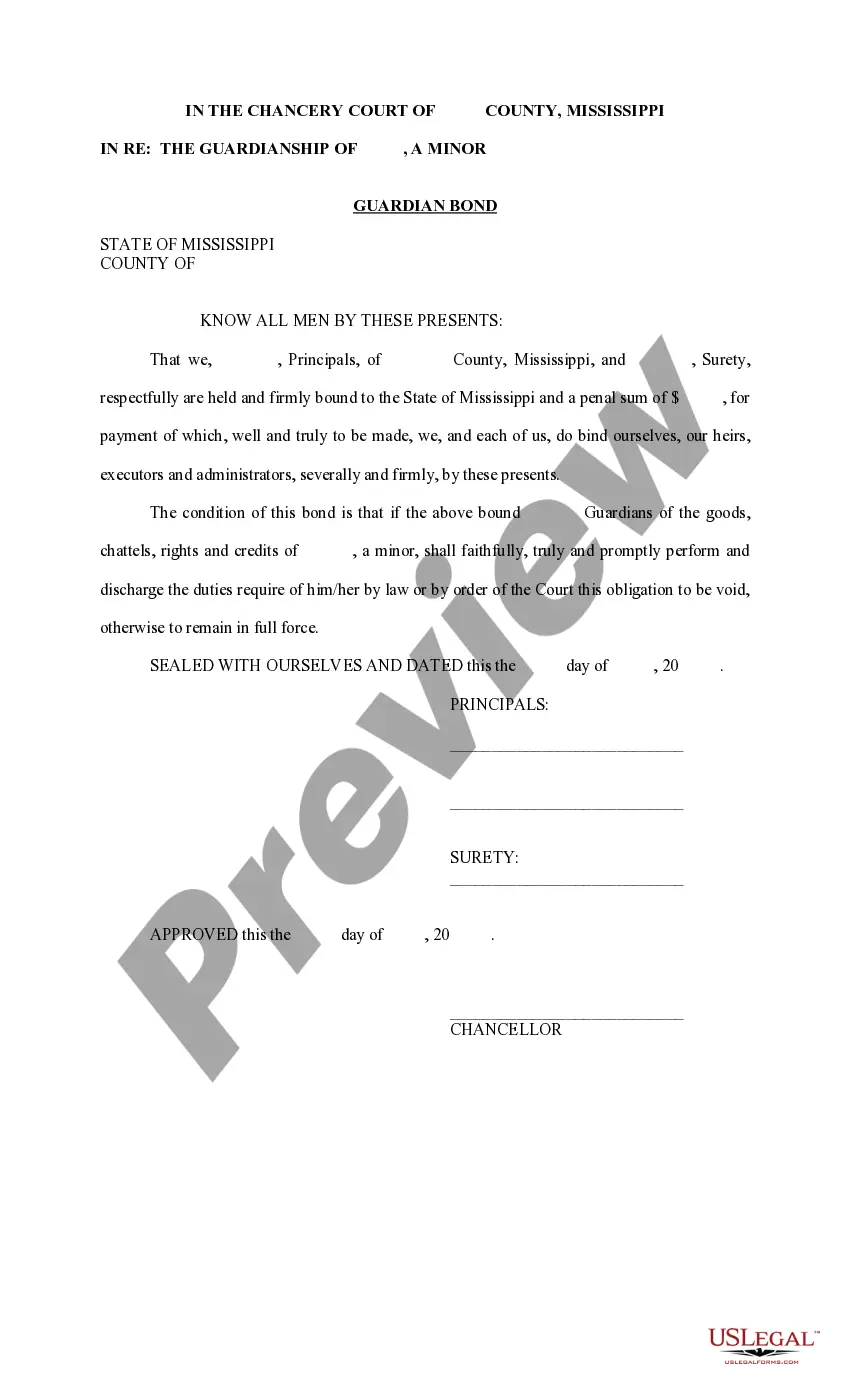

The duties of a guardian, generally speaking, are to oversee the welfare and safety of the person under guardianship, and to attend to the financial needs of the individual, using his or her assets wisely. A guardian has a legal duty, called a "fiduciary duty", to act in the best interests of the individual.

At its simplest, a surety bond requires the surety to pay a set amount of money to the obligee if a principal fails to perform a contractual obligation.The surety bond requires the principal to sign an indemnity agreement that pledges company and personal assets to reimburse the surety if a claim occurs.

Submit an application and executed indemnity agreement supplied by the surety broker/agent; Provide a copy of the court paperwork pertinent to the case; and. Pay the premium for the bond once approved.

A guardianship bond is required by an assigned person who handles the property and monies of a minor or persons with limited intellectual functioning. Subject to its specific terms, this bond guarantees an honest accounting and faithful performance of duties.

A conservator over the estate is responsible for marshalling, protecting, and managing the conservatee's assets that remain in their estate. A conservator reports to the court that appointed them, and is monitored by the supervising judicial court in the county in which the conservatee permanently resides.

A fiduciary bond is a legal instrument that essentially serves as insurance to protect beneficiaries, heirs and creditors when a fiduciary fails to perform honestly or competently. A court may require a fiduciary bond for any person or party that has fiduciary duty or responsibility to another.

A guardian is someone who by appointment or by relationship has the care of a person or that person's property, or both.Guardianship by nature is the natural guardianship arising out of the relation of parent and child. A guardian by judicial appointment is one named by a court with jurisdiction over such relations.

A Conservatorship Bond is a type of court bond that ensures a court-appointed individual will perform and fulfill their obligations. A note on Guardians and Conservators:In our experience, Conservators handle monetary matters for an individual, while Guardians handle the day-to-day care of an individual.

There are two types of guardianships, a full guardianship and a limited guardianship.