Missouri Partnership Formation Questionnaire

Description

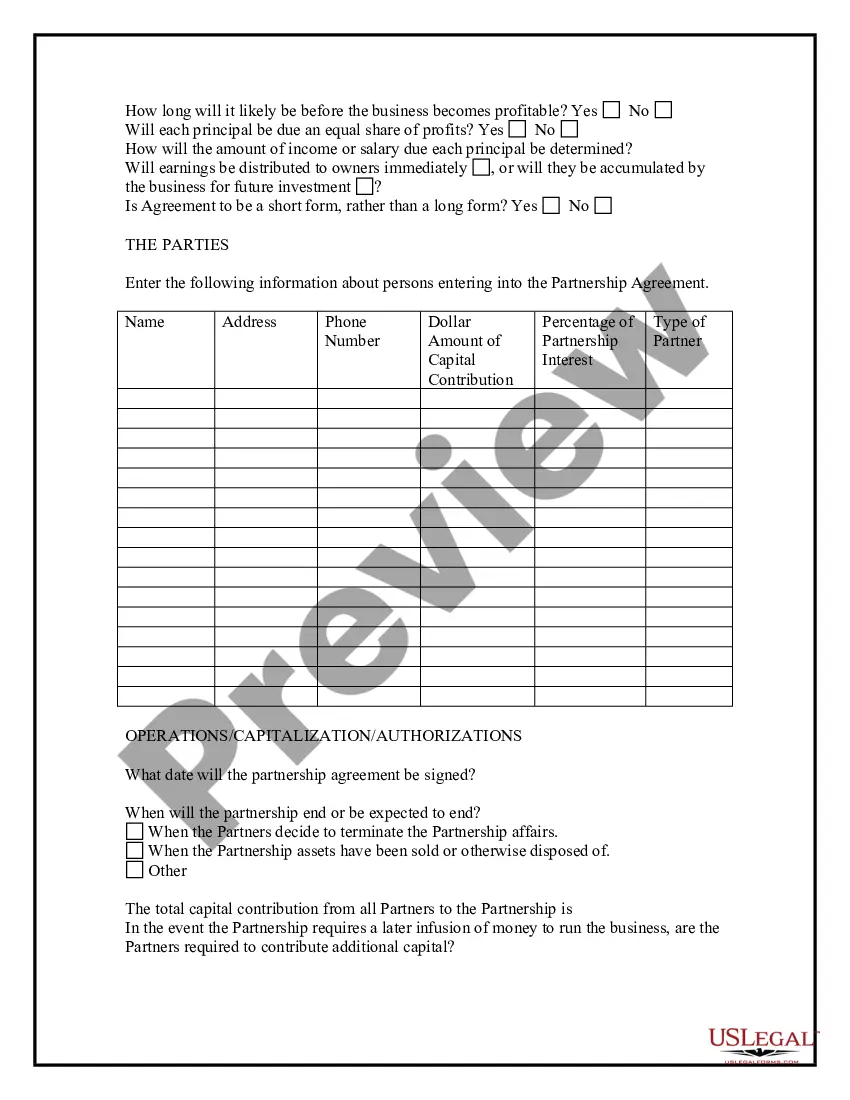

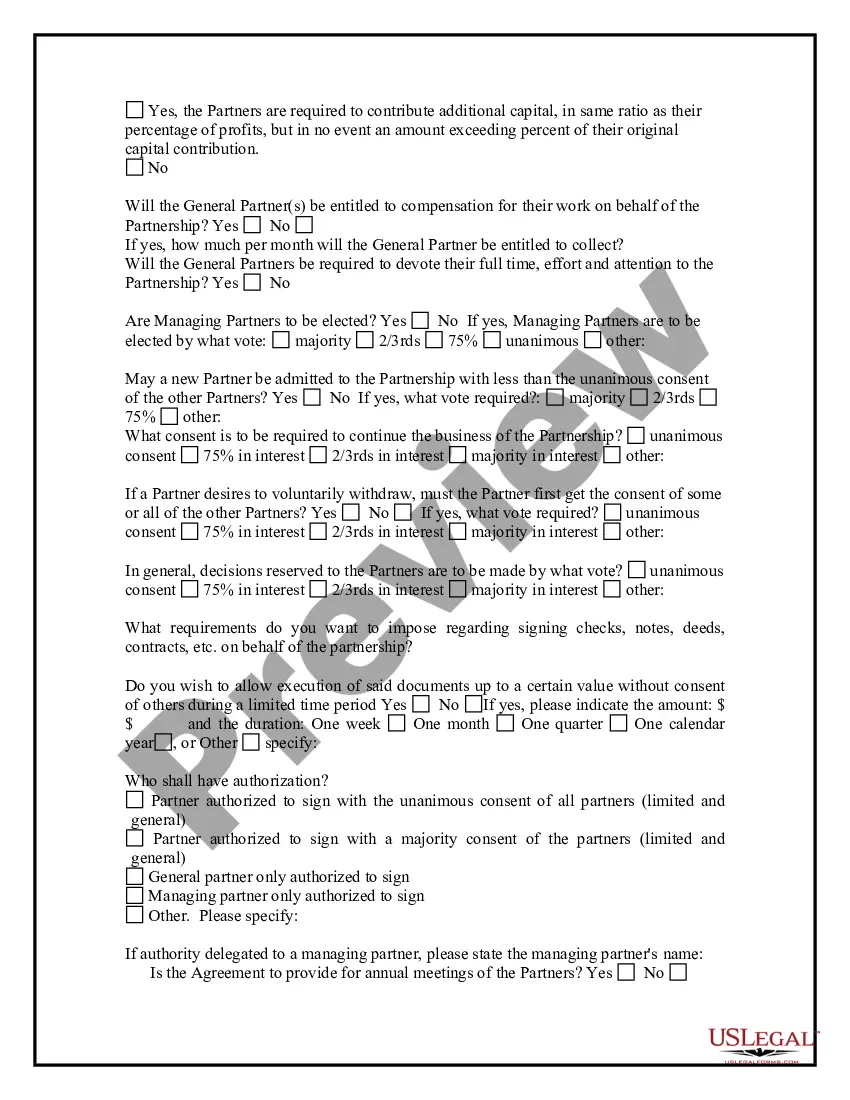

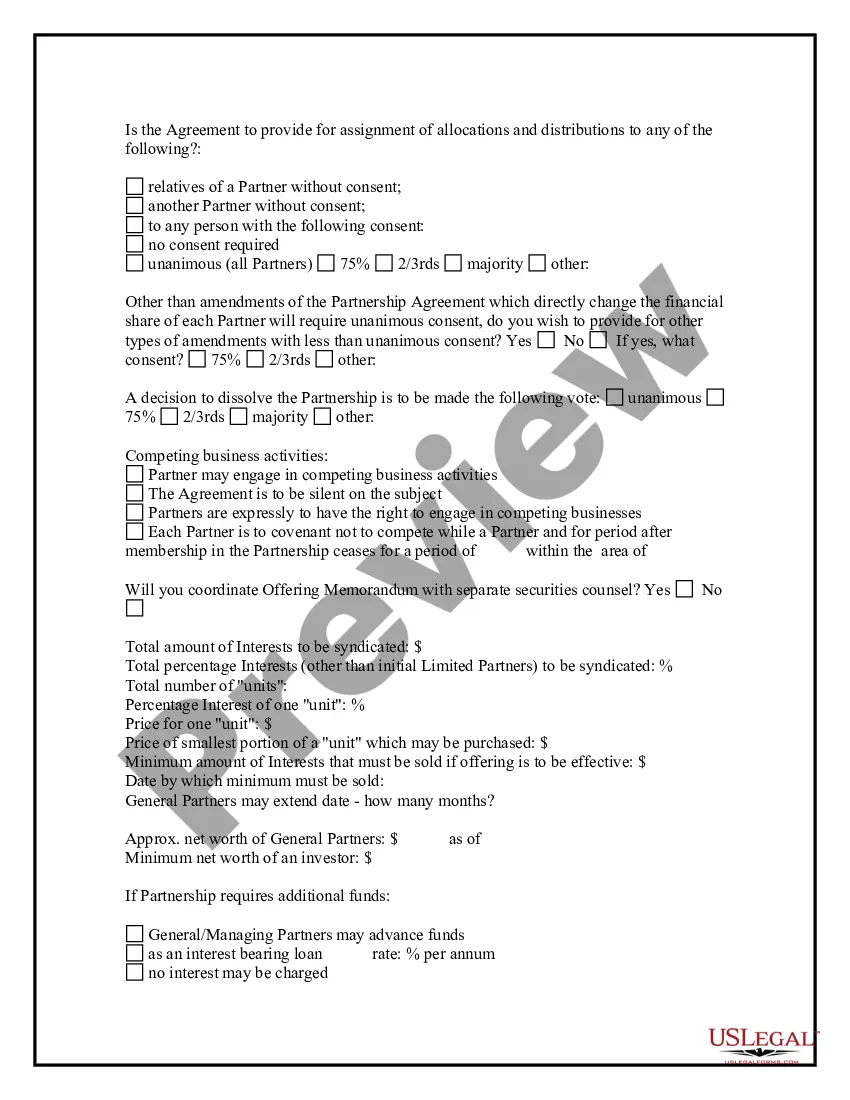

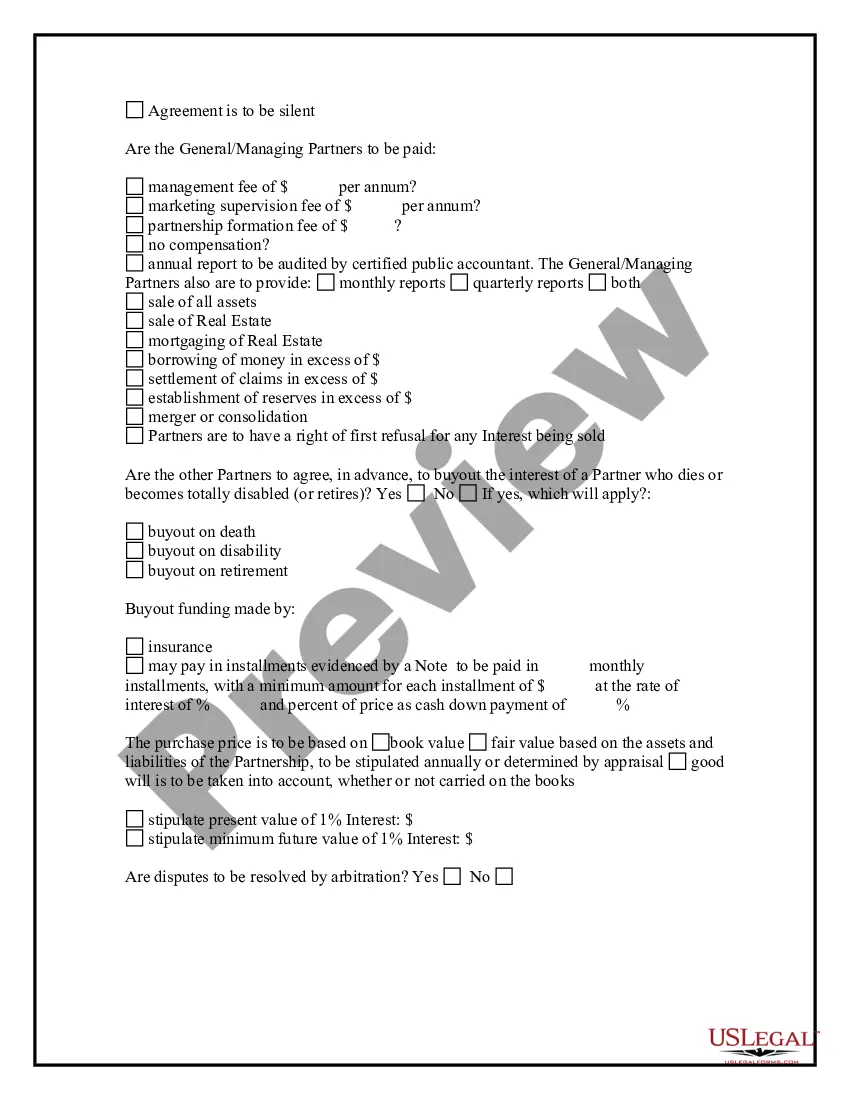

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

Selecting the optimal authorized document template can be a challenge. Naturally, numerous templates exist online, but how can you acquire the legal form you require? Utilize the US Legal Forms platform. This service offers thousands of templates, including the Missouri Partnership Formation Questionnaire, which you can use for business and personal purposes. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Missouri Partnership Formation Questionnaire. Use your account to search through the legal forms you have purchased previously. Navigate to the My documents section of your account and retrieve another copy of the documents you need.

If you are a first-time user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your region/county. You can review the form using the Preview button and read the form description to confirm it is suitable for you. If the form does not meet your requirements, utilize the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the downloaded Missouri Partnership Formation Questionnaire.

By using US Legal Forms, you can easily access and manage the legal documents necessary for your needs.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Leverage the service to obtain professionally crafted documents that adhere to state requirements.

- Make sure to review the forms carefully before purchasing.

- Utilize the search functionality for easier navigation through available forms.

- Keep your account information secure to manage your documents effectively.

- Contact customer support for any assistance regarding your document needs.

Form popularity

FAQ

You can obtain MO tax forms from the Missouri Department of Revenue's official website or at local tax offices. Additionally, US Legal Forms offers a variety of Missouri tax forms, making it easy to find what you need. For those seeking to form a partnership, the Missouri Partnership Formation Questionnaire is also available to help streamline your experience.

To fill out a 53/1 form in Missouri, you need to provide detailed information about your partnership, including its name, address, and the names of partners. You will also need to report income and expenses accurately. Utilizing the Missouri Partnership Formation Questionnaire can guide you through this process, ensuring you complete the form correctly.

Form MO-2NR is the Nonresident Income Tax Return form for individuals who earn income in Missouri but reside in another state. This form allows nonresidents to report their Missouri-sourced income correctly. Understanding how to fill out this form is crucial for nonresidents, and using the Missouri Partnership Formation Questionnaire can clarify your partnership's tax responsibilities.

The Missouri partnership tax form is used by partnerships to report income, deductions, and credits for state tax purposes. This form is essential for ensuring compliance with Missouri tax laws. If you are starting a partnership, completing the Missouri Partnership Formation Questionnaire can help you navigate the specifics of tax obligations.

Those factors include the following:The state or states in which your business operates (the most important consideration for most companies)Initial LLC filing fees.Annual filing fees and annual reporting requirements.State-specific advantages such as privacy rights.01-Mar-2008

LLP Registration ProcessStep 1: Obtain Digital Signature Certificate (DSC)Step 2: Apply for Director Identification Number (DIN)Step 3: Name Approval.Step 4: Incorporation of LLP.Step 5: File Limited Liability Partnership (LLP) Agreement.

General partnerships are relatively simple and inexpensive to formthere are no formal legal requirements. All the company needs is a registered trade name, a registered tax number for applicable taxes and a bank account.

In general, an LLC offers better liability protection and more tax flexibility than a partnership. But the type of business you're in, the management structure, and your state's laws may tip the scales toward partnership.

Here are your steps to starting an LLC in Missouri:File articles of organization with the Secretary of State.Create an operating agreement.Obtain an Employer Identification Number (EIN)You may be required to register with the Missouri Department of Revenue and/or the Missouri Department of Labor.More items...?

In Missouri, partnerships typically need to be on file with the state, pay a filing fee, and file the required paperwork. Missouri has some additional and/or different paperwork for out of state businesses. General Partnerships (GP) GPs file with the state if doing business under an assumed name.