This office lease clause describes the allocation of risks. The parties desire to allocate certain risks of personal injury, bodily injury or property damage, and risks of loss of real or personal property by reason of fire, explosion or other casualty, and to provide for the responsibility for insuring those risks as permitted by law.

Missouri No Fault Clause

Description

How to fill out No Fault Clause?

Discovering the right authorized file format could be a battle. Of course, there are a lot of templates available online, but how will you find the authorized type you want? Take advantage of the US Legal Forms website. The services delivers a large number of templates, for example the Missouri No Fault Clause, which you can use for organization and personal requirements. Each of the forms are checked by pros and meet up with federal and state requirements.

When you are currently signed up, log in to your account and click on the Down load option to find the Missouri No Fault Clause. Make use of your account to look through the authorized forms you might have acquired in the past. Check out the My Forms tab of your account and get an additional version of the file you want.

When you are a fresh customer of US Legal Forms, allow me to share basic instructions that you should follow:

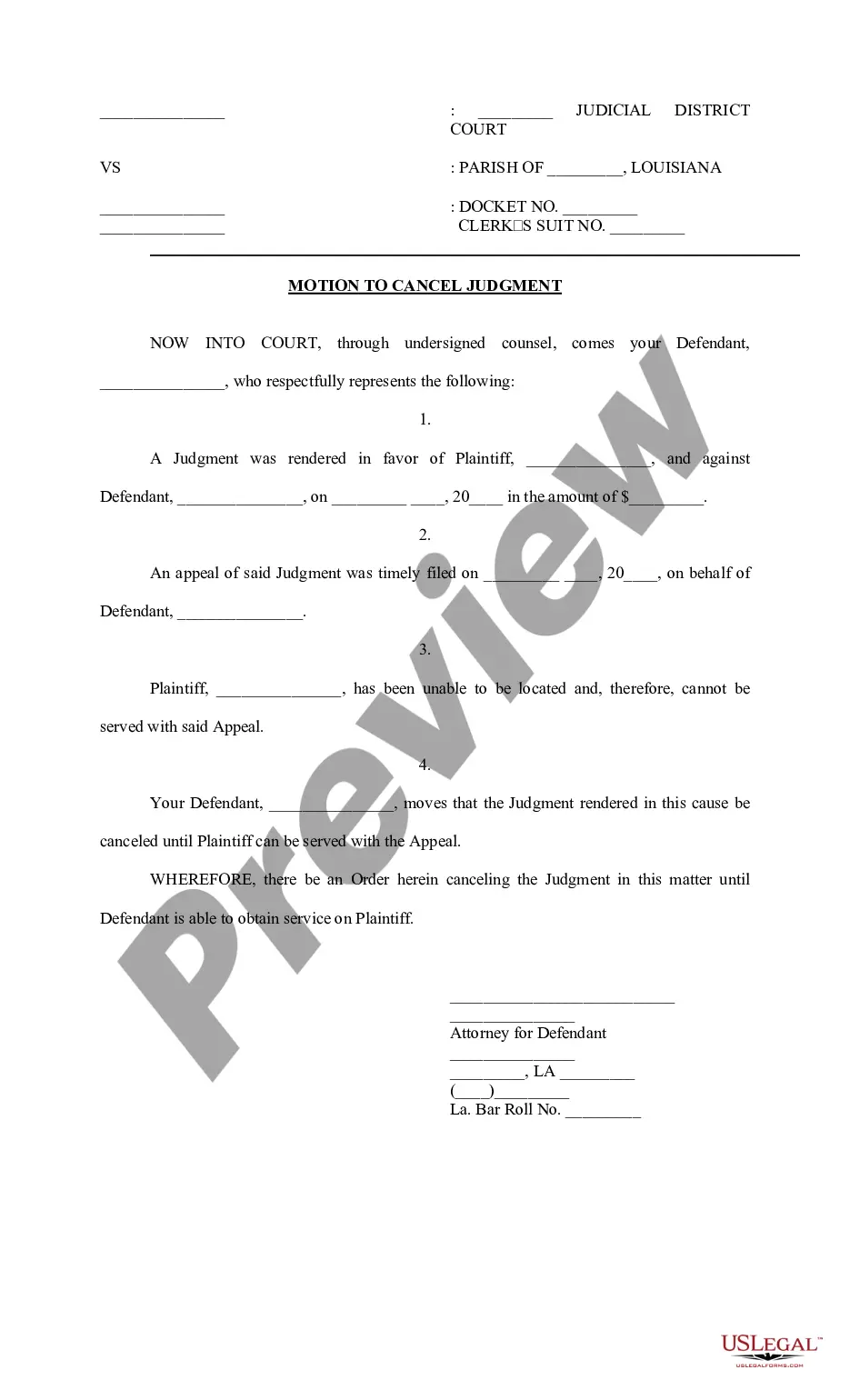

- Initially, ensure you have chosen the proper type to your metropolis/area. It is possible to look over the shape utilizing the Preview option and study the shape information to make certain it is the best for you.

- In the event the type is not going to meet up with your requirements, make use of the Seach discipline to discover the correct type.

- When you are sure that the shape would work, click on the Buy now option to find the type.

- Pick the pricing plan you want and type in the required info. Design your account and pay money for the transaction utilizing your PayPal account or credit card.

- Choose the document formatting and download the authorized file format to your gadget.

- Full, modify and printing and sign the obtained Missouri No Fault Clause.

US Legal Forms will be the most significant local library of authorized forms for which you can see various file templates. Take advantage of the service to download professionally-produced documents that follow state requirements.

Form popularity

FAQ

In this situation, you would use your own policy's uninsured motorist (UM) protection, which Missouri law requires. Your medical expenses, past and future lost wages, pain and suffering, and other emotional harms will all be covered by this coverage. You can get back as much as your policy's UM allowance.

In a no-fault claim, the parties are not required to prove any party's blameworthiness to resolve the claim. In contrast, parties to a fault-based claim must prove a party was at fault to prevail on the claim.

In no-fault states, everyone must use their own car insurance to pay for their damages and injuries, regardless of who caused the wreck. If a person's injuries exceed their no-fault coverage, they may be able to make a claim against the other driver's policy, but many states limit the amount that can be recovered.

Determining who's at fault requires that you prove the at-fault party breached their duty of care as a driver. This duty of care requires that a driver take reasonable care to ?ensure any action taken or failed to take does not cause injury to another person on the road or cause damage to property.?

There are two types of 'fault' rules used to determine who is liable in a car accident: No-Fault and At-Fault. No-Fault is the simpler of the two, and is used in several states. Under No-Fault rules, insurance companies compensate victims for their injuries regardless of who caused the accident.

Missouri's ?No Pay, No Play? law prevents uninsured motorists from pursuing non-economic damages after an auto accident (RSMo section § 303.390). This includes uninsured drivers who own the vehicle, uninsured permissive drivers of the vehicle, and uninsured nonpermissive drivers.