Missouri Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease

Description

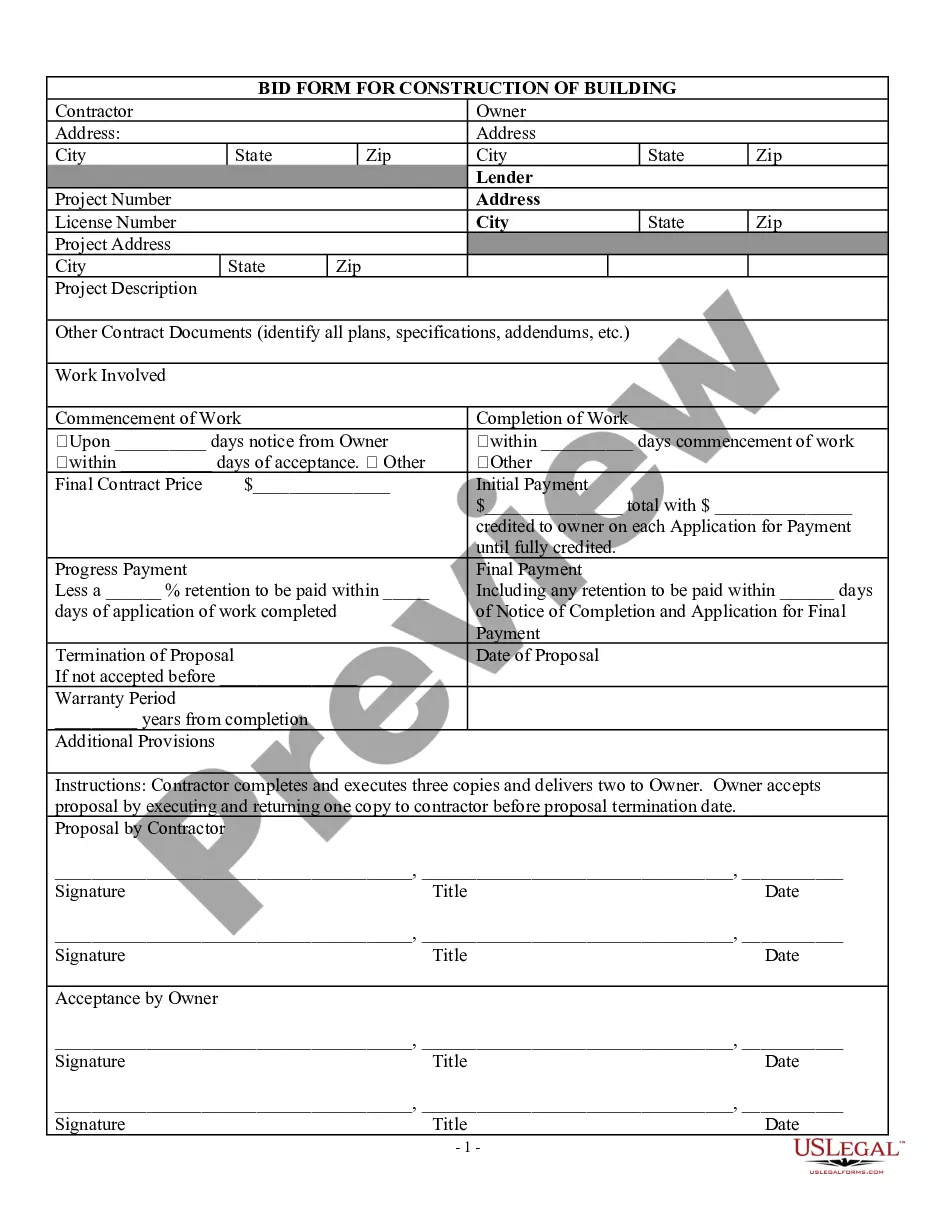

How to fill out Stipulation Governing Payment Of Nonparticipating Royalty Under Segregated Tracts Covered By One Oil And Gas Lease?

You can invest hrs on the web searching for the legitimate record format that suits the federal and state requirements you require. US Legal Forms offers a huge number of legitimate varieties which are reviewed by pros. It is simple to down load or printing the Missouri Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease from my service.

If you currently have a US Legal Forms account, you may log in and then click the Down load option. Following that, you may total, edit, printing, or sign the Missouri Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease. Each legitimate record format you get is your own for a long time. To obtain one more duplicate for any purchased kind, check out the My Forms tab and then click the corresponding option.

If you use the US Legal Forms website for the first time, keep to the simple instructions listed below:

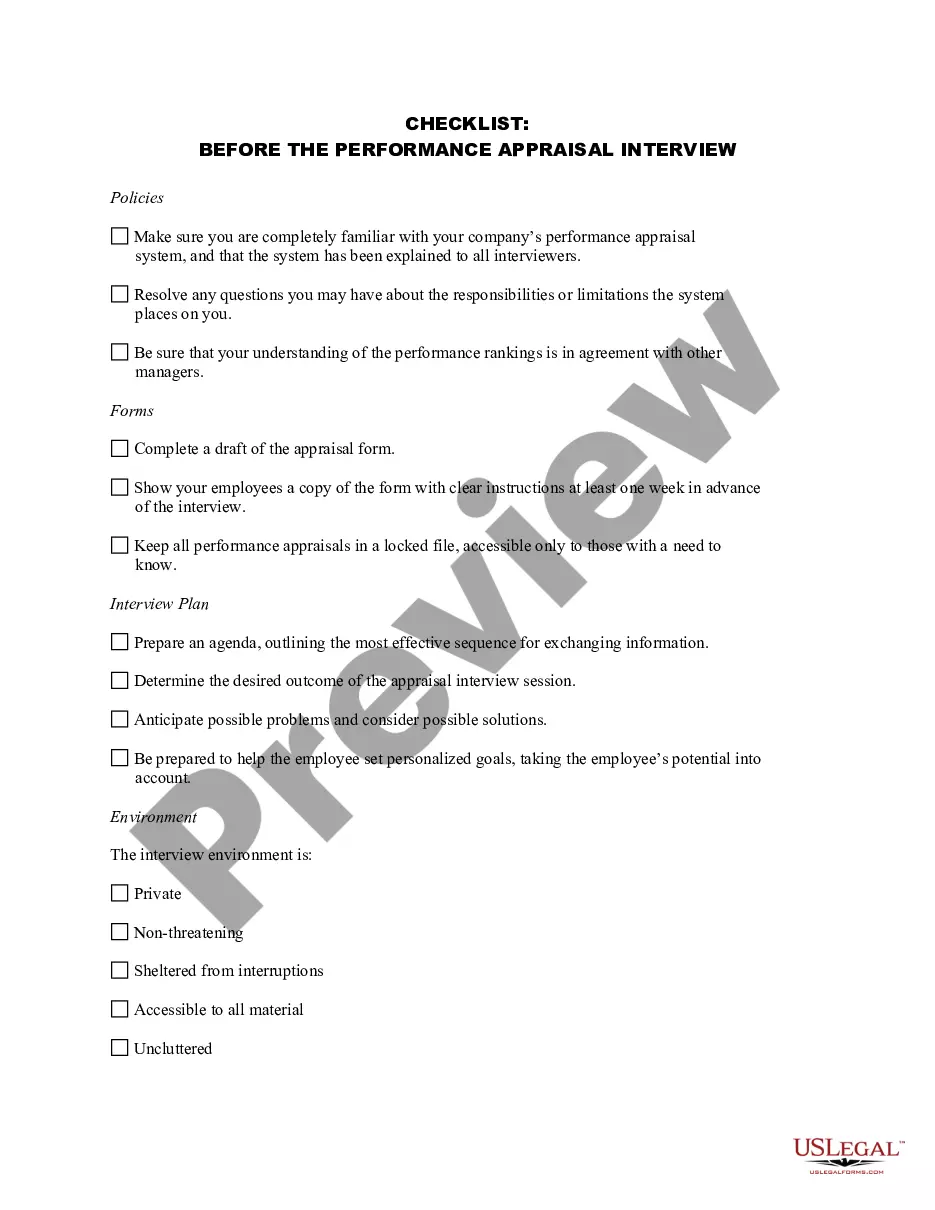

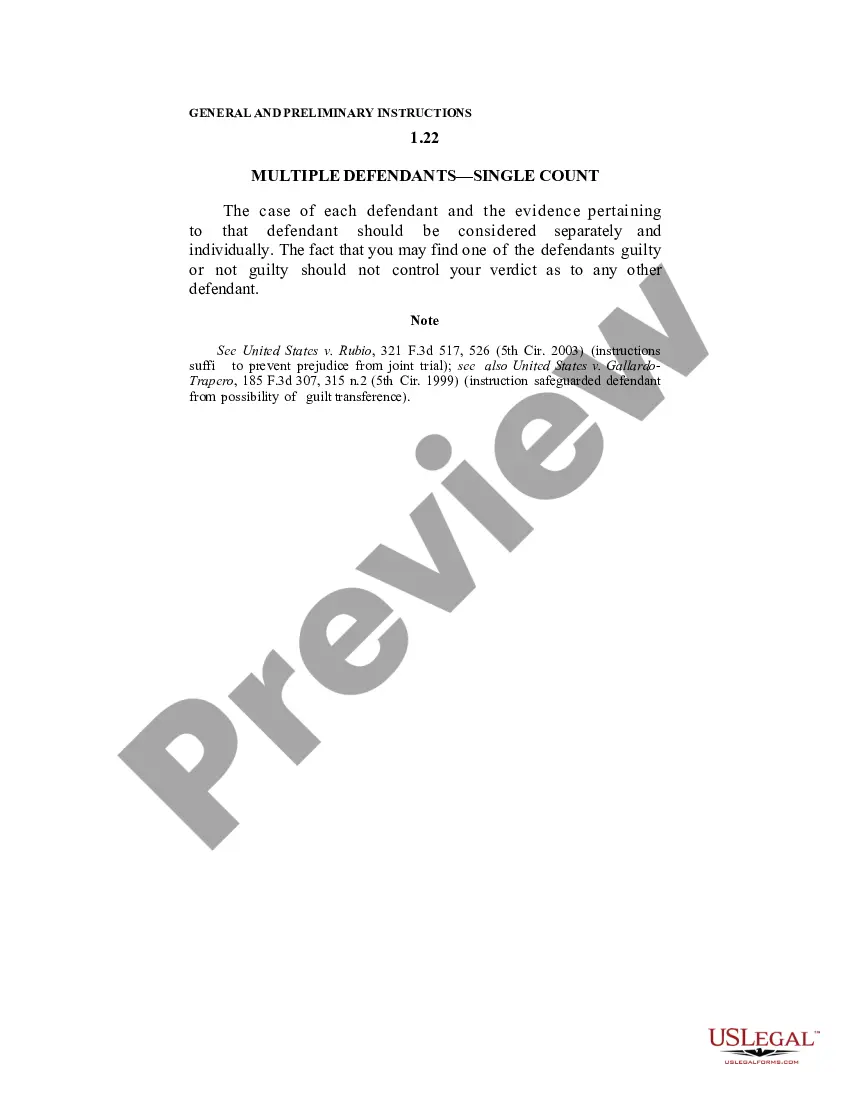

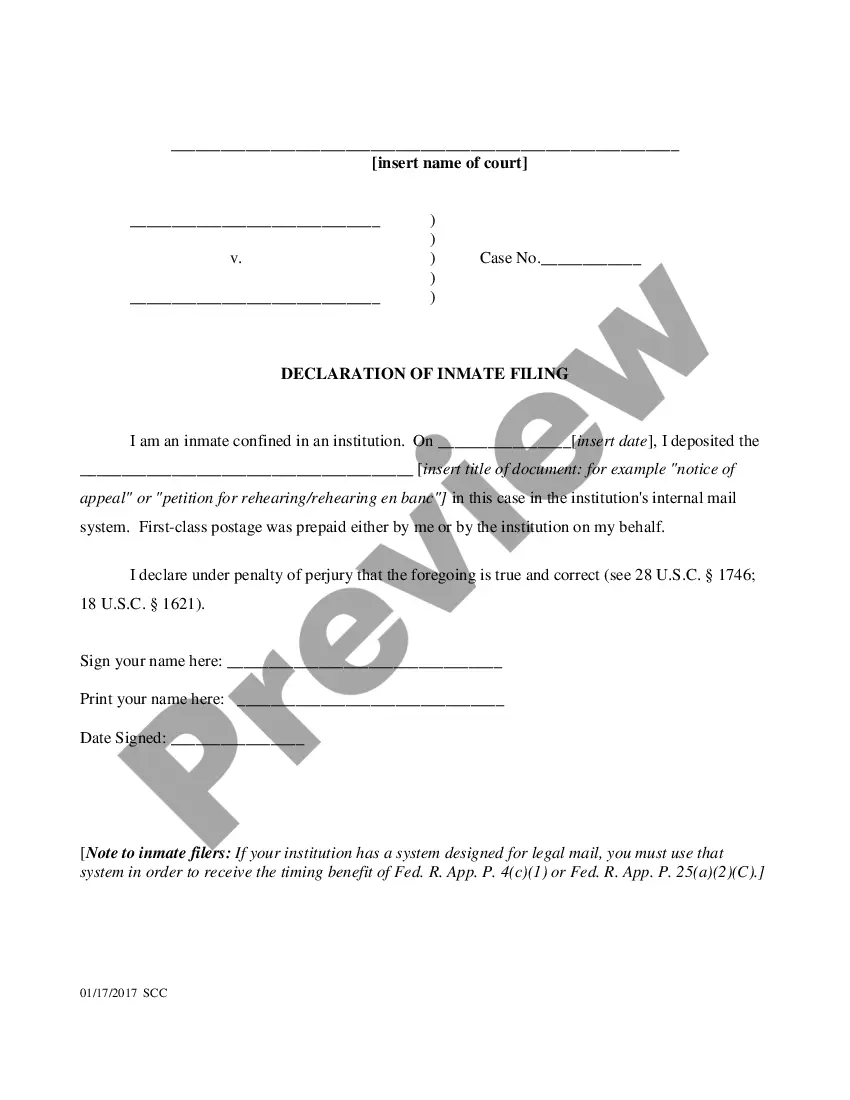

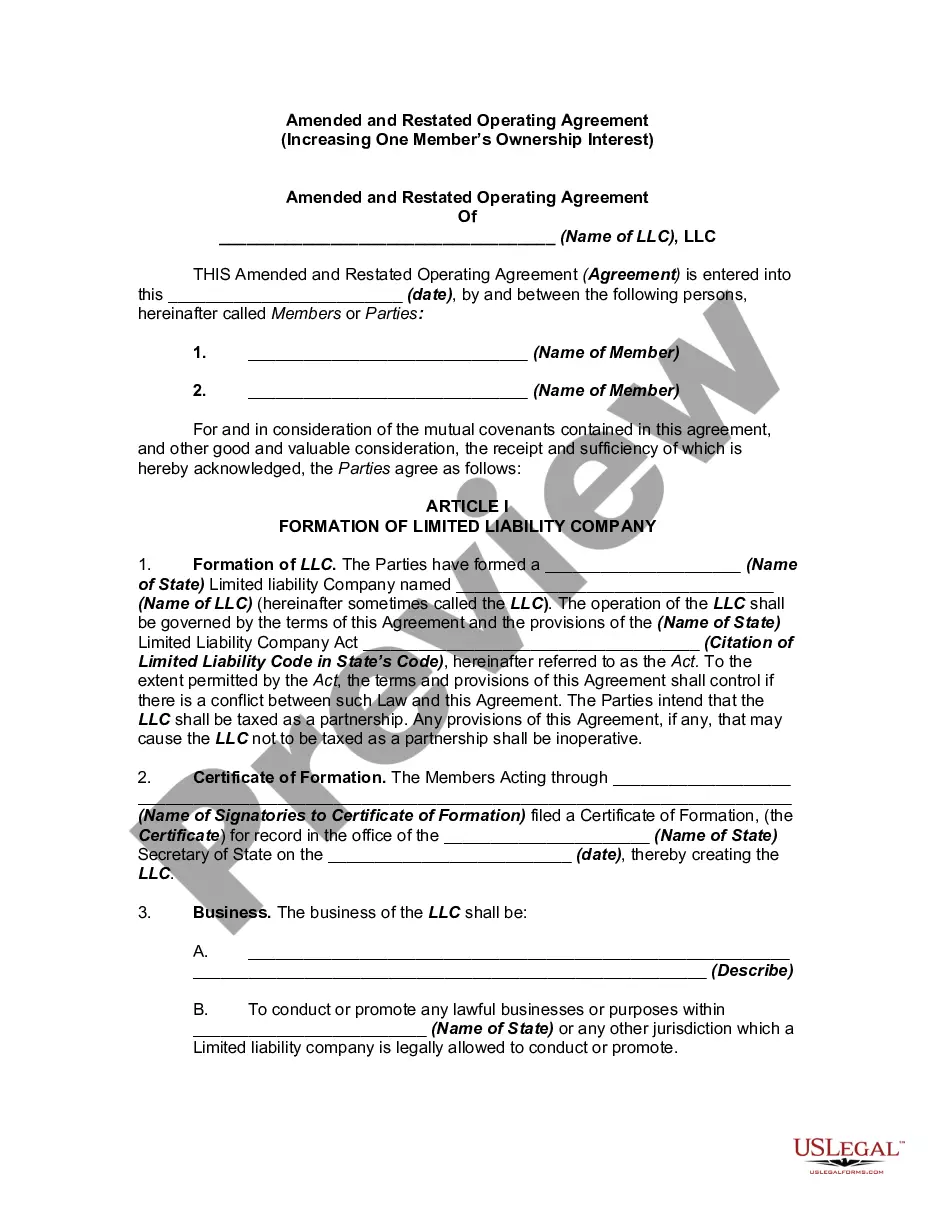

- Very first, make certain you have chosen the proper record format to the area/area of your choosing. Read the kind description to ensure you have picked out the right kind. If readily available, take advantage of the Review option to search throughout the record format at the same time.

- If you wish to find one more variation from the kind, take advantage of the Lookup area to obtain the format that meets your needs and requirements.

- When you have located the format you want, click on Purchase now to continue.

- Choose the rates prepare you want, type your credentials, and register for your account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Choose the formatting from the record and down load it for your system.

- Make modifications for your record if necessary. You can total, edit and sign and printing Missouri Stipulation Governing Payment of Nonparticipating Royalty Under Segregated Tracts Covered by one Oil and Gas Lease.

Down load and printing a huge number of record templates using the US Legal Forms website, which offers the largest collection of legitimate varieties. Use skilled and condition-distinct templates to tackle your organization or personal requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Royalty Payment Clauses A royalty is agreed upon as a percentage of the lease, minus what was reasonably used in the lessee's production costs. This is stipulated in a Royalty Clause. The royalty is paid by the lessee to the owner of the mineral rights, the lessor in the lease.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

They generally range from 12?25 percent. Before negotiating royalty payments on private land, careful due diligence should be conducted to confirm ownership. Mineral ownership records are often outdated.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.