Missouri Affidavit of Heirship - Descent

Description

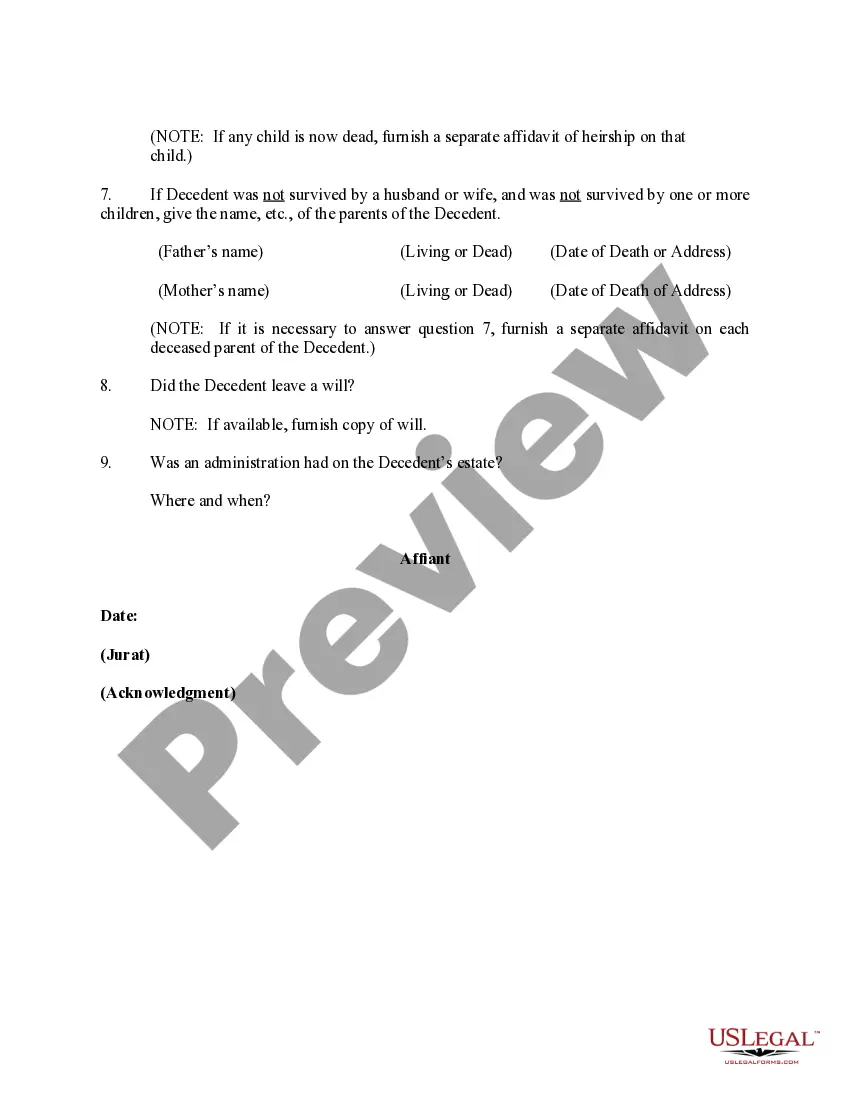

How to fill out Affidavit Of Heirship - Descent?

US Legal Forms - one of the biggest libraries of lawful varieties in the States - delivers an array of lawful record themes it is possible to down load or print out. Utilizing the internet site, you may get a large number of varieties for organization and individual uses, categorized by types, states, or search phrases.You can find the most up-to-date types of varieties just like the Missouri Affidavit of Heirship - Descent within minutes.

If you have a monthly subscription, log in and down load Missouri Affidavit of Heirship - Descent in the US Legal Forms catalogue. The Down load button can look on each and every develop you see. You have access to all earlier delivered electronically varieties inside the My Forms tab of your own profile.

If you wish to use US Legal Forms the first time, here are simple guidelines to help you get began:

- Ensure you have chosen the correct develop for your personal metropolis/state. Click on the Preview button to examine the form`s articles. Read the develop explanation to ensure that you have chosen the right develop.

- If the develop does not fit your requirements, make use of the Search discipline near the top of the monitor to discover the one who does.

- Should you be happy with the form, confirm your decision by clicking on the Get now button. Then, pick the rates strategy you want and supply your references to register to have an profile.

- Approach the deal. Utilize your credit card or PayPal profile to perform the deal.

- Find the format and down load the form on your own gadget.

- Make changes. Load, modify and print out and indicator the delivered electronically Missouri Affidavit of Heirship - Descent.

Each format you included in your money lacks an expiration time and is also the one you have permanently. So, if you wish to down load or print out yet another copy, just check out the My Forms portion and then click around the develop you need.

Get access to the Missouri Affidavit of Heirship - Descent with US Legal Forms, by far the most substantial catalogue of lawful record themes. Use a large number of skilled and condition-certain themes that meet up with your business or individual requires and requirements.

Form popularity

FAQ

If all inheritors do not agree then the property cannot be sold. Chill! If the majority of the inheritors are willing to sell the property they need to go through a probate court. The inheritors can file a 'partition action' lawsuit in the probate court.

Specific information is needed to determine the identity of the Heirs at Law of the Heir Property. A properly prepared Texas Affidavit of Heirship must provide the following information: The deceased owner's full name, last address, date of birth and date and place of death.

A: By law, most probate matters require you to be represented by an attorney ? Sections 473.153 (7) and 475.020 RSMo. However, Applications for a Refusal of Letters for a Spouse, for a Creditor or for an Unmarried Minor Child can be filed without an attorney.

It will need to be signed by all parties and their spouses (if married), and the papers will need to be filed in the county recorder's office where the property is located. Once this is completed, the real estate will have been officially transferred to the heirs, probate-free.

Value is. All estates with a total value of $40,000.00 or more, must be handled by an attorney. Property that is jointly held, TOD, transferred on death, POD, payable on death, has living beneficiaries or is listed under a trust, may not have to go through Probate.

If a person has died leaving property or any interest in property in Missouri and no administration has been commenced on the estate of the decedent, any person claiming an interest in such property as heir or through an heir may file a petition in the probate division of the circuit court for the administration of the ...

Importantly, all creditor claims must be made within one year after a decedent's death. Under Missouri law, an affidavit of heirship can be used when a probate proceeding is not required to transfer title to the relevant heirs.

NOTE: Filing of an Affidavit To Establish Title of Distributee To Property In Estate of Less than $40,000 ? Small Estate ? Intestate (Without Will) cannot be done pro se (without an attorney).

Once the small estate affidavit is drafted and signed in front of a notary, it must be filed with the Probate Court in the county of the residence of the deceased person.