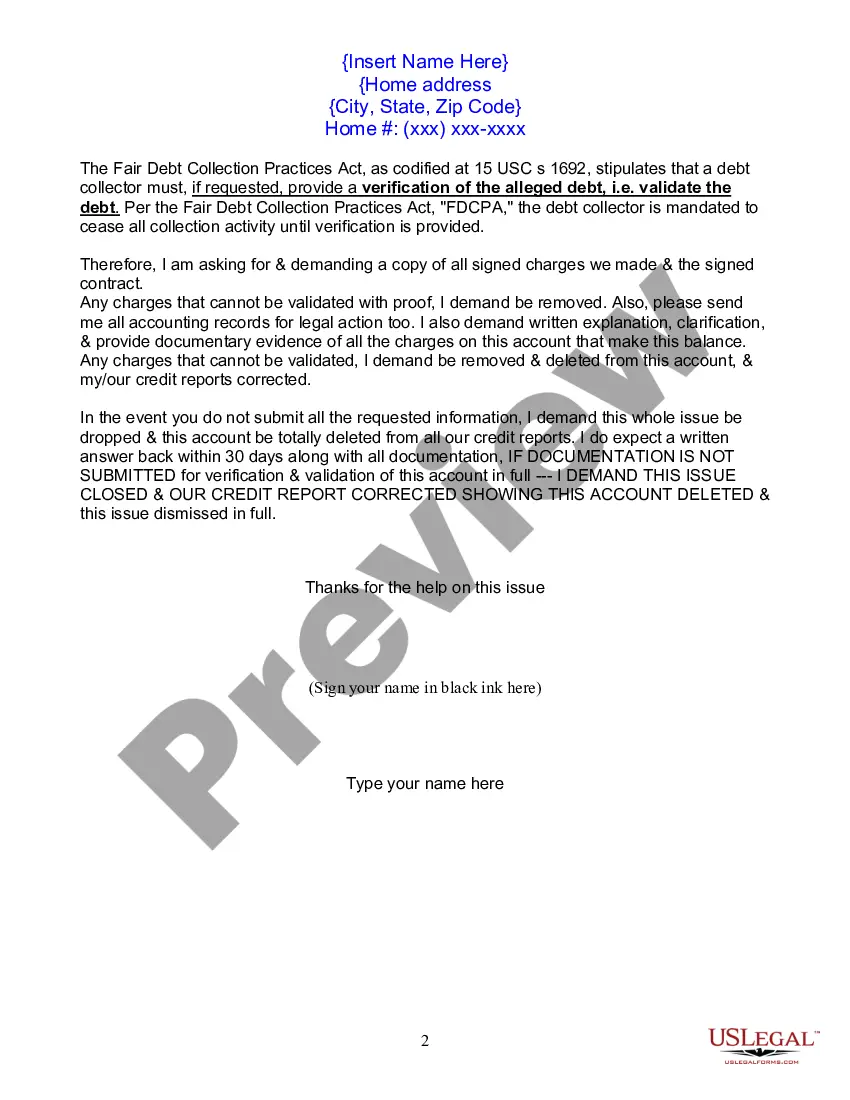

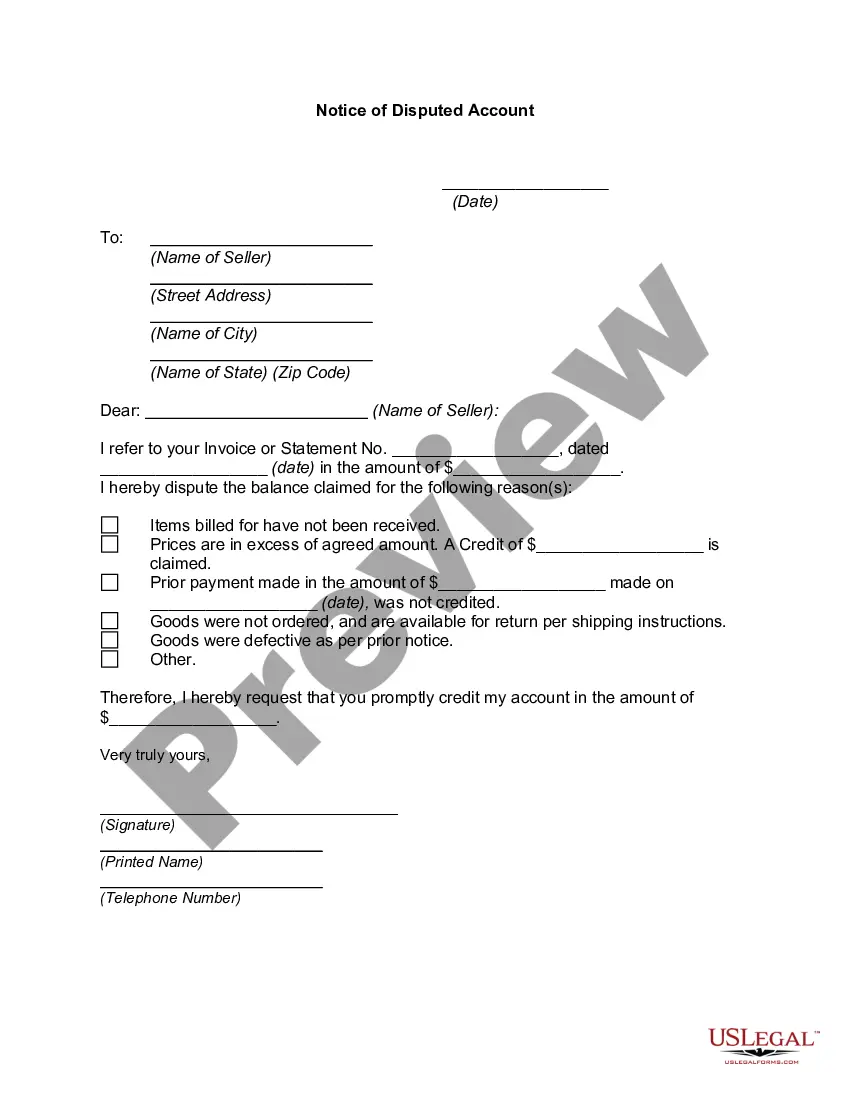

This form is to be used when a collection company is demanding full payment from you and you disagree with the balance. Use this form as your first letter of dispute.

Missouri Letter of Dispute - Complete Balance

Description

How to fill out Letter Of Dispute - Complete Balance?

You can spend hours online trying to find the valid document format that meets the federal and state requirements you need.

US Legal Forms offers thousands of valid templates that are evaluated by professionals.

It's easy to download or print the Missouri Letter of Dispute - Complete Balance from my service.

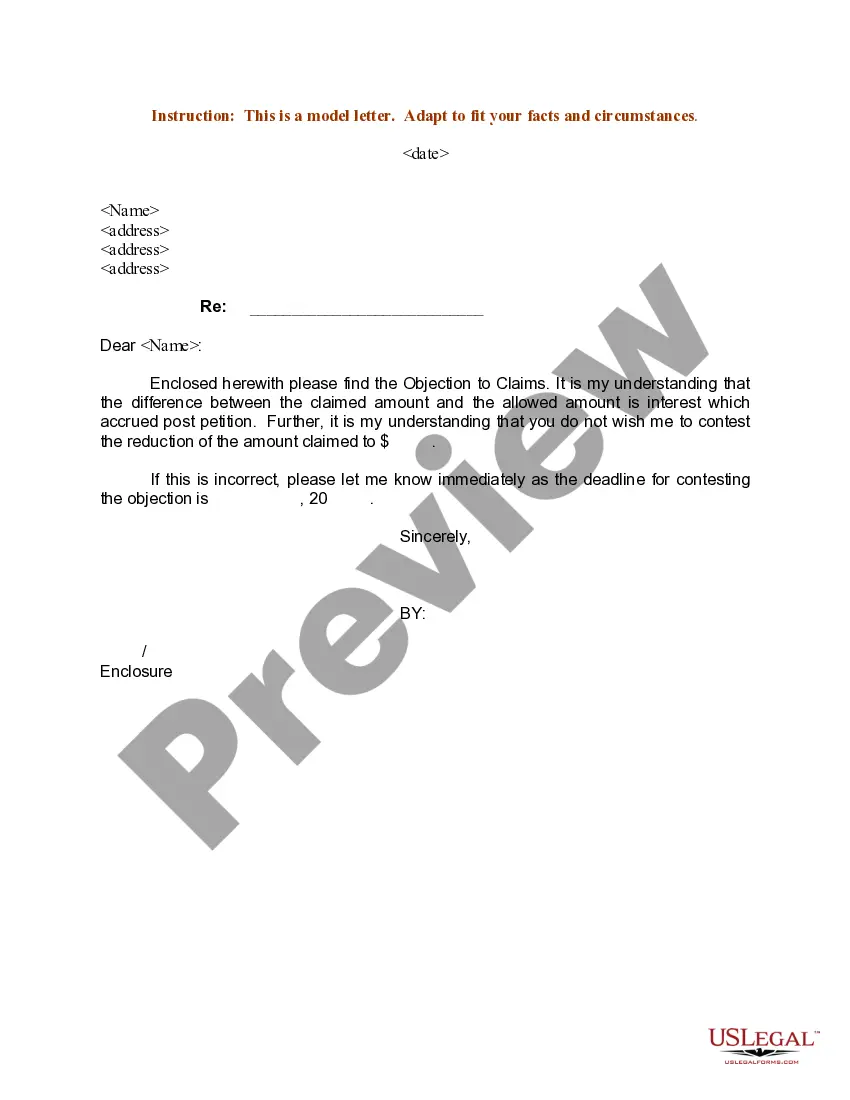

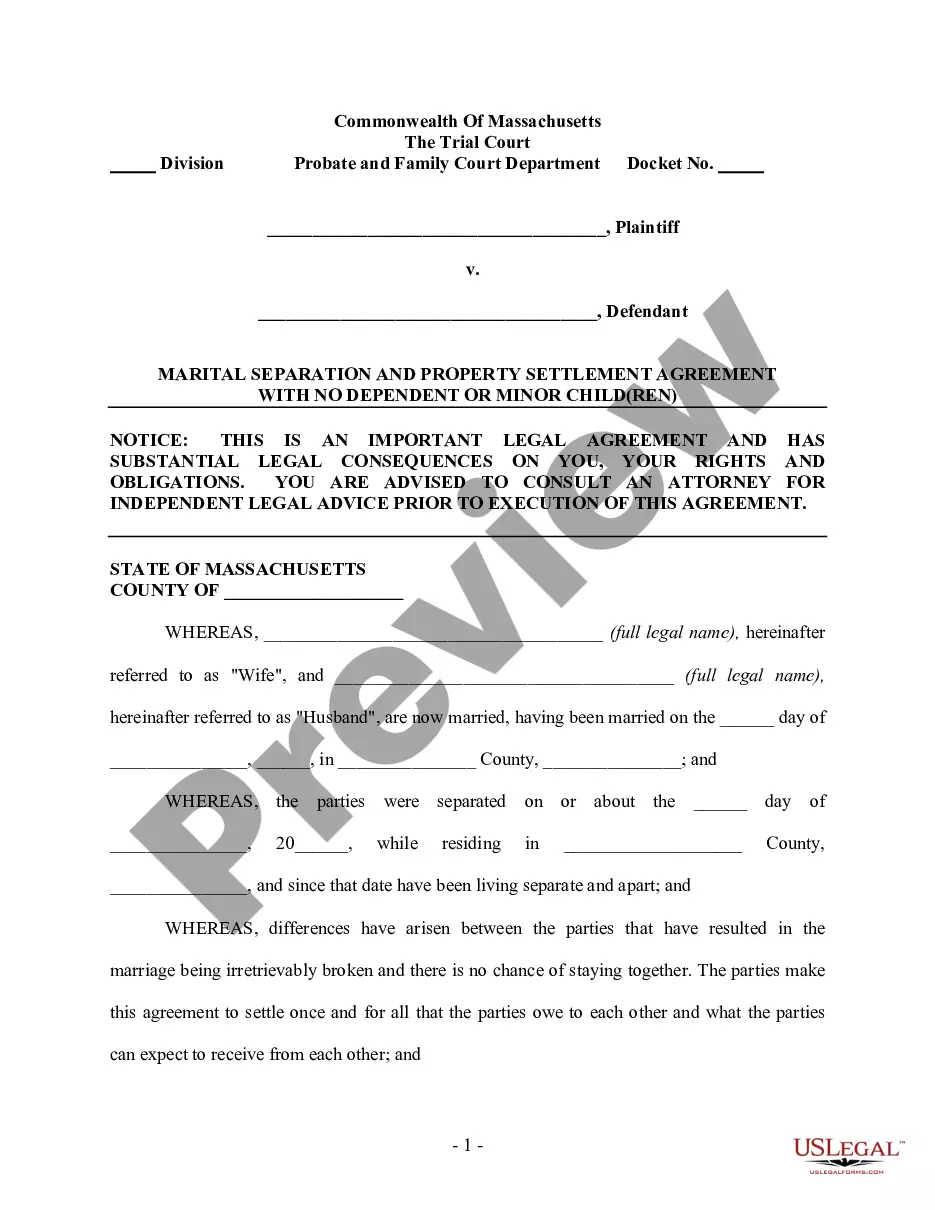

If available, use the Review button to look through the document format at the same time. If you wish to find another version of the form, use the Search area to locate the format that meets your needs and specifications. Once you have found the format you want, click Buy now to proceed. Choose the pricing plan you prefer, enter your credentials, and register for an account on US Legal Forms. Complete the payment. You can use your credit card or PayPal account to pay for the legal form. Select the format of the document and download it to your device. Make modifications to your document if needed. You can complete, edit, sign, and print the Missouri Letter of Dispute - Complete Balance. Obtain and print thousands of document templates using the US Legal Forms website, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and then click the Acquire button.

- After that, you can complete, edit, print, or sign the Missouri Letter of Dispute - Complete Balance.

- Each valid document template you purchase is yours to keep for a long time.

- To obtain another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form outline to confirm you have chosen the right form.

Form popularity

FAQ

Debt collectors in Missouri can pursue old debts for up to five years, depending on the type of debt. This time limit begins from the date of the last payment or the last activity on the account. After this period, collectors may not take legal action to recover the debt. If you receive communication about an old debt, consider using a Missouri Letter of Dispute - Complete Balance to formally challenge the claim.

In Missouri, the statute of limitations for most debts is typically five years. After this period, creditors can no longer legally pursue collections through the courts. However, it’s essential to understand that even if a debt becomes uncollectible, it may still appear on your credit report. Using a Missouri Letter of Dispute - Complete Balance can help address inaccuracies and clarify your financial standing.

The Missouri Department of Revenue may send you a letter for several reasons, such as informing you about a tax refund, notifying you of a balance due, or addressing discrepancies in your tax returns. If the letter pertains to a Missouri Letter of Dispute - Complete Balance, it likely requires your attention. It is advisable to respond promptly and accurately to avoid potential penalties. For assistance, consider using US Legal Forms to help manage your dispute effectively.

The Missouri Department of Revenue issues various documents, including tax returns, payment notices, and letters regarding disputes or balances due. If you find a letter in your mailbox, it could relate to your tax filings or outstanding amounts owed. Understanding the contents of these communications is vital, especially if you are dealing with a Missouri Letter of Dispute - Complete Balance. You can contact them for clarification on any document you receive.

No, the Department of Revenue and the IRS are not the same entity. The Department of Revenue operates at the state level, handling state taxes, while the IRS manages federal tax matters. If you have questions about your state tax situation, especially regarding a Missouri Letter of Dispute - Complete Balance, it is crucial to direct your inquiries to the Department of Revenue.

The Department of Revenue may send you a letter for various reasons, including issues with your tax return or outstanding balances. Often, these letters serve to inform you about necessary actions or provide clarification regarding your tax status. If you received a letter related to a Missouri Letter of Dispute - Complete Balance, it is essential to review the details carefully. You may need to respond or take specific actions to resolve any discrepancies.

Receiving a letter from the Missouri Department of Revenue may indicate a variety of issues, such as an outstanding balance or a request for additional information. If the letter pertains to a balance dispute, the Missouri Letter of Dispute - Complete Balance can help you respond appropriately. It's essential to read the letter carefully and act promptly to resolve any issues. If you need assistance, consider using platforms like uslegalforms to guide you through the process.

If you need to mail your Missouri Personal Tax Exemption (PTE) forms, the address will depend on the type of form you are submitting. Generally, you should send your documents to the Missouri Department of Revenue at their designated mailing address listed on their website. If you are disputing a balance, consider using the Missouri Letter of Dispute - Complete Balance to ensure your request is processed correctly.

To file a complaint with the Missouri Department of Revenue, you can start by completing the Missouri Letter of Dispute - Complete Balance form. This form allows you to clearly state your issue and provide necessary details. Once completed, you can submit the form online or mail it to the appropriate department. Ensure that you keep a copy for your records.

The Missouri Department of Revenue (MO DOR) provides various forms, including the Missouri Letter of Dispute - Complete Balance. These forms help you address discrepancies in your tax information or balance. You can find these forms on the MO DOR website or request them directly from their office. It's crucial to select the correct forms to ensure your dispute is processed efficiently.