Missouri Software Specifications Agreement

Description

How to fill out Software Specifications Agreement?

Are you presently in a position where you need documents for both business or personal purposes almost every day.

There are numerous legal document templates available online, but finding trustworthy ones isn’t easy.

US Legal Forms offers a multitude of form templates, such as the Missouri Software Specifications Agreement, designed to meet state and federal requirements.

Access all the document templates you have purchased in the My documents section.

You can download another copy of the Missouri Software Specifications Agreement anytime, if needed. Just click the necessary form to download or print the document template.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Software Specifications Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for your specific city/region.

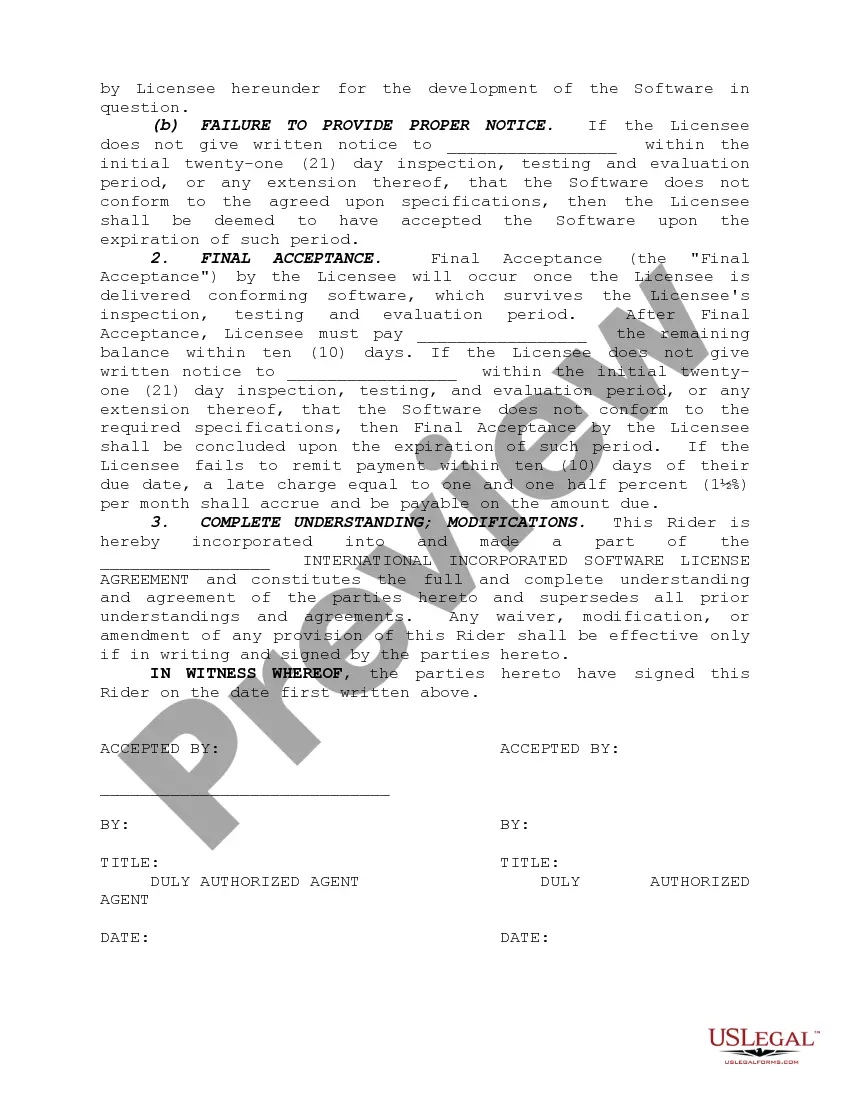

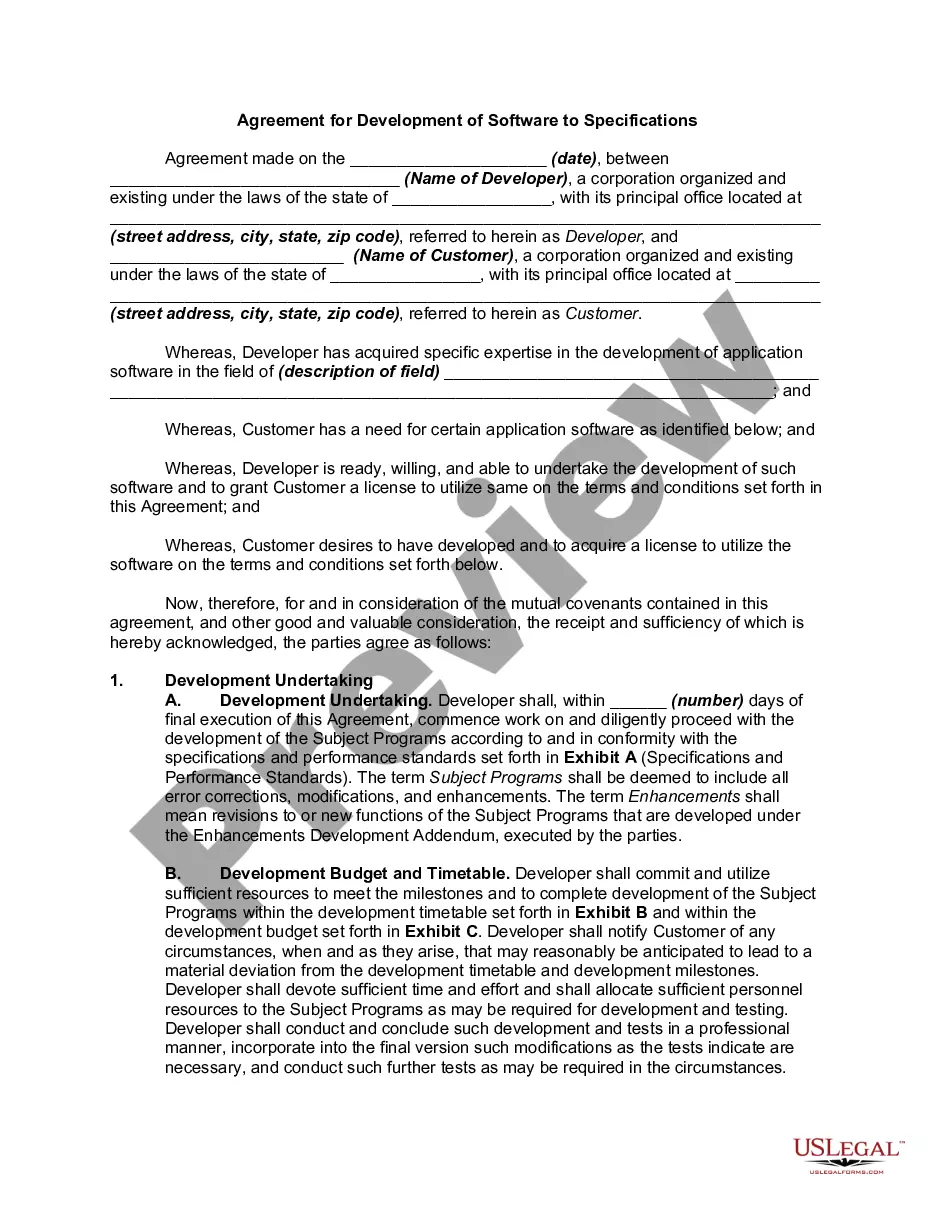

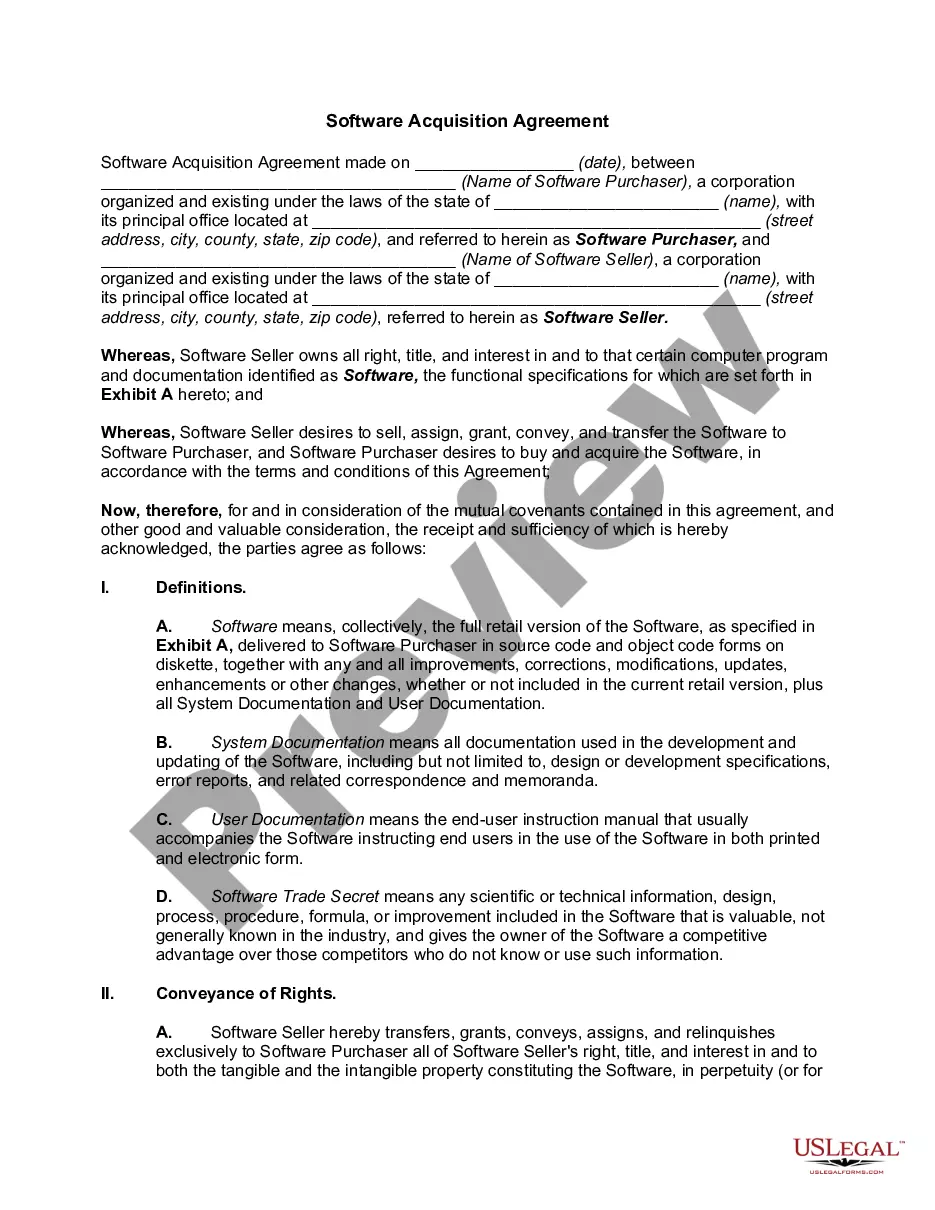

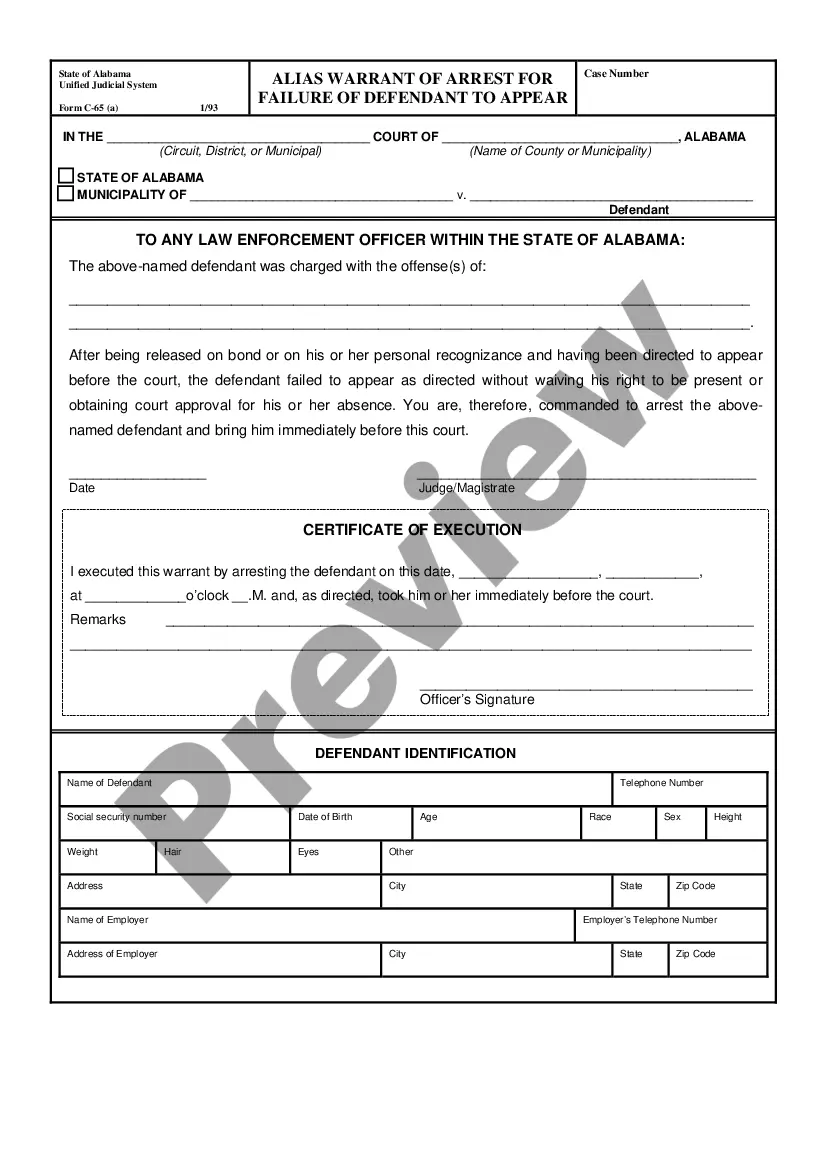

- Utilize the Review button to inspect the form.

- Check the details to confirm you have selected the correct form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the correct form, click Acquire now.

- Choose the pricing plan you need, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- Select a convenient file format and download your copy.

Form popularity

FAQ

To correctly fill out your W-4, start by gathering your personal information, including dependents and additional income. Careful consideration of your tax situation will help you determine the proper number of allowances to claim. Utilizing the Missouri Software Specifications Agreement can also provide guidance on tax compliance. Finally, double-check all entries to ensure accuracy before submission to your employer.

Yes, software subscriptions are generally taxable in Missouri, as they fall under taxable services. Purchases of software as a service, or SaaS, typically incur sales tax, which is essential to account for in your budgeting. For clarity on this matter and to navigate compliance effectively, reference the Missouri Software Specifications Agreement and consider utilizing uslegalforms for templates and resources tailored to your needs.

In Missouri, the withholding rate for state taxes can vary based on your income level. Typically, employers use a graduated scale for state income tax, with rates ranging from 1.5% to 5.4%. To ensure you withhold the correct amount, consult the current Missouri tax tables and consider the implications of the Missouri Software Specifications Agreement for your financial planning.

To file your Missouri state taxes, you typically need Form MO-1040, along with any necessary schedules that apply to your specific situation. Depending on your financial circumstances, additional forms may be required, such as those for businesses or certain deductions. If you're unsure which forms are relevant, especially if you are involved in complex matters like a Missouri Software Specifications Agreement, using US Legal Forms can provide clarity and ensure you have all necessary documentation.

In Missouri, the transfer tax form is the Missouri Real Estate Transfer Form, usually required during property transfers. This form facilitates the payment of transfer taxes when selling real estate and ensures compliance with state regulations. If you’re drafting contracts or agreements, such as a Missouri Software Specifications Agreement, it's crucial to be aware of tax obligations that may arise from property transactions. US Legal Forms can help you access the right forms to make this process easier.

When filing your Missouri state return, you do not need to include a copy of your federal return. However, it is wise to keep a copy for your records as it may help streamline the process. Understanding the details around your tax documents is essential, especially if you are entering into agreements like a Missouri Software Specifications Agreement that may impact your tax situation. For specific forms and guidance, consider using US Legal Forms.

In Missouri, software maintenance services may be subject to sales tax, depending on how the service is provided. If the maintenance involves tangible personal property, then it may incur tax. When engaging in a Missouri Software Specifications Agreement, be clear about maintenance services and their tax implications. Consulting a tax professional can help ensure compliance and avoid surprises.

Software used directly in manufacturing operations in Missouri is often tax-exempt, as it enhances production efficiency. This exemption applies under certain conditions, particularly when specified in a Missouri Software Specifications Agreement. Be sure to document how the software supports your manufacturing processes to qualify for this exemption. It's wise to confirm eligibility with your tax advisor.

Whether to add tax to your invoice for services in Missouri depends on the nature of those services. If your services fall under taxable categories, like software solutions, you will need to include tax. Referencing your Missouri Software Specifications Agreement in your invoicing helps clarify what’s taxable and ensures compliance. Always check with a tax advisor for the latest guidelines.

In Missouri, certain items are exempt from taxes, including tangible personal property and specific services. While software can be taxed, here are exceptions. When drafting a Missouri Software Specifications Agreement, consider which elements might qualify for tax exemptions. It's essential to ensure that you understand these provisions fully.