Missouri Specialty Services Contact - Self-Employed

Description

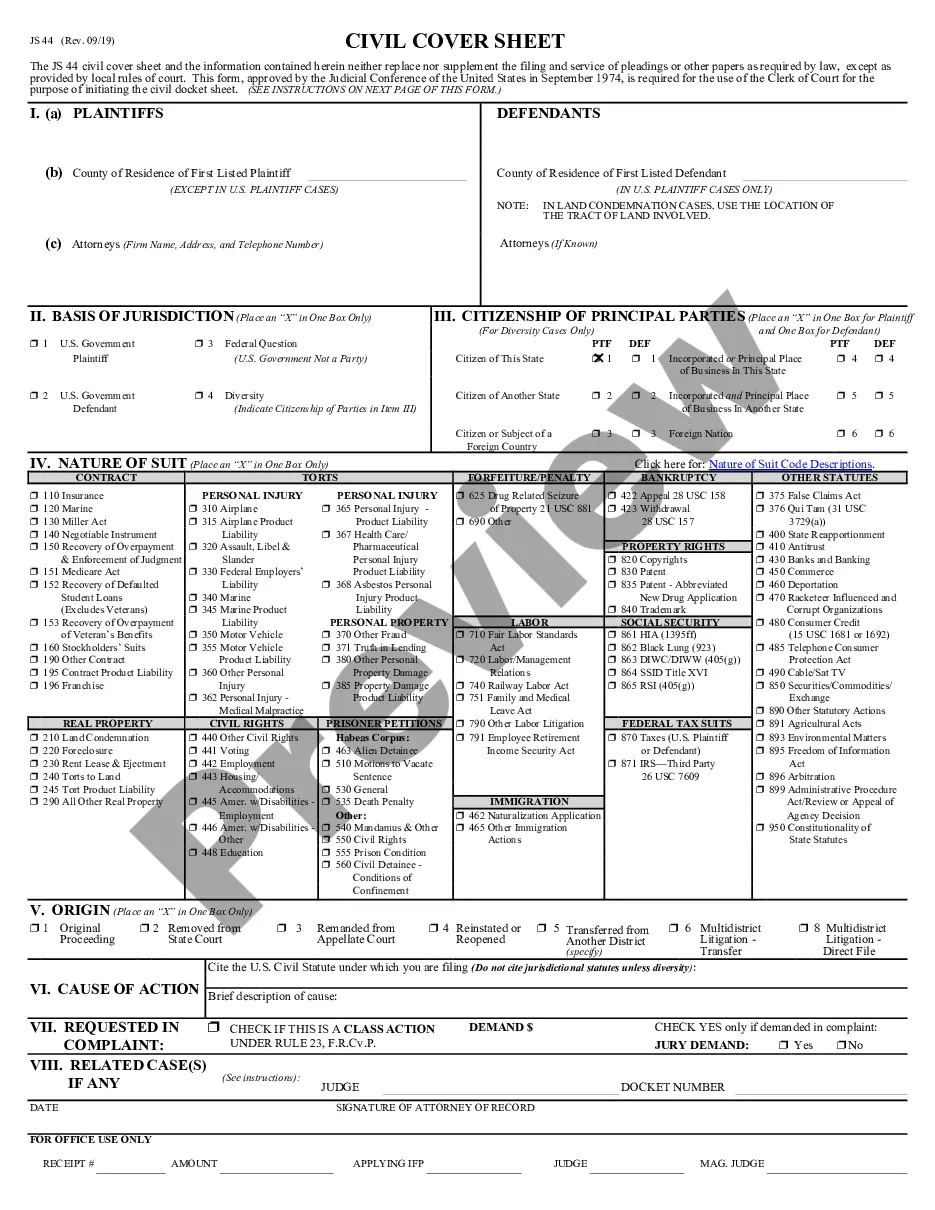

How to fill out Specialty Services Contact - Self-Employed?

Are you presently in a situation where you require documents for either professional or personal tasks almost every business day.

There are numerous authentic document templates available online, but finding reliable ones isn’t easy.

US Legal Forms offers thousands of document templates, such as the Missouri Specialty Services Contact - Self-Employed, that are designed to comply with state and federal regulations.

Once you find the correct document, simply click Buy now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete your purchase using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have acquired in the My documents menu. You can obtain an additional copy of Missouri Specialty Services Contact - Self-Employed anytime if needed. Just access the required form to download or print the document template. Use US Legal Forms, the largest collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Missouri Specialty Services Contact - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you need and ensure it is for the correct city/region.

- Utilize the Review button to evaluate the form.

- Read the description to confirm you have selected the correct document.

- If the document isn’t what you are looking for, use the Lookup section to find the document that meets your needs and requirements.

Form popularity

FAQ

Yes, Missouri does impose self-employment tax on individuals earning income as self-employed. This tax contributes to Social Security and Medicare programs. If you receive income from your LLC or as an independent contractor, understanding this tax is crucial. If you're unsure about compliance details, our Missouri Specialty Services Contact - Self-Employed is here to guide you.

Missouri LLCs face several tax obligations, including state income tax and potentially business taxes. Sales tax may apply if your LLC sells goods or services. It's vital to determine which taxes are applicable based on your business activities. For ease and clarity, our Missouri Specialty Services Contact - Self-Employed can help you navigate these tax requirements.

In Missouri, whether an LLC needs to file its own tax return depends on its classification. For instance, single-member LLCs typically report earnings on their owner's tax return, while multi-member LLCs might file a partnership return. Understanding these requirements is essential for compliance. For tailored assistance, explore options with our Missouri Specialty Services Contact - Self-Employed.

LLCs in Missouri must follow specific guidelines for tax filing, including income tax returns. Depending on your structure, you might need to file as a partnership, corporation, or sole proprietor. Gathering all related financial documents is crucial to ensure accurate filing. You can benefit from help through our Missouri Specialty Services Contact - Self-Employed for a better filing experience.

In Missouri, the main difference lies in the control and independence of the individual. Independent contractors operate their own businesses, have freedom over their work, and face unique tax responsibilities. Employees, on the other hand, follow employer guidelines and receive benefits. For those navigating these distinctions, our Missouri Specialty Services Contact - Self-Employed can provide clarity and guidance.

Yes, LLCs in Missouri must file annual reports to keep their status active. The state requires this update to maintain a transparent record of your business. Filing is straightforward, and you can manage it easily online. For more assistance, consider reaching out through our Missouri Specialty Services Contact - Self-Employed.

In Missouri, the self-employment tax consists of Social Security and Medicare taxes, and it is 15.3% of your net earnings. This tax applies to individuals who earn income through self-employment. It's crucial to factor this tax into your financial planning to ensure you're saving enough. To get tailored advice, consider contacting Missouri Specialty Services Contact - Self-Employed.

Even if you made less than $5000 as a self-employed individual, you may still need to file a tax return, especially if you had net earnings from self-employment. The IRS generally requires you to file if your net earnings are $400 or more. It's important to report all income accurately to avoid future issues. For help understanding your tax obligations, reach out to Missouri Specialty Services Contact - Self-Employed.

No, a self-employed person does not typically use the W-4 form, as it is designed for employees to report their tax withholding preferences. Instead, self-employed individuals usually report their income and calculate their taxes on Form 1040 and Schedule C. This process requires careful tracking of earnings and expenses. For more information, speak with Missouri Specialty Services Contact - Self-Employed.

Yes, you can act as your own registered agent in Missouri if you are self-employed. As a registered agent, you are responsible for receiving legal documents for your business. This adds personal accountability and can simplify the process. If you need further clarification, connect with Missouri Specialty Services Contact - Self-Employed for expert advice.