Missouri Dancer Agreement - Self-Employed Independent Contractor

Description

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

You can spend time online looking for the legal document template that satisfies the federal and state requirements you need. US Legal Forms offers thousands of legal forms that are reviewed by experts.

You can either download or print the Missouri Dancer Agreement - Self-Employed Independent Contractor from this service. If you already have a US Legal Forms account, you can sign in and click the Download button. After that, you can complete, modify, print, or sign the Missouri Dancer Agreement - Self-Employed Independent Contractor. Every legal document template you obtain is yours indefinitely.

To obtain another copy of a purchased form, visit the My documents section and click the corresponding button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure you have selected the correct document template for your county/area of choice. Review the form description to confirm you have chosen the right form. If available, use the Review button to examine the document template as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- If you wish to find another version of the form, use the Search field to locate the template that meets your requirements and needs.

- Once you have found the template you need, click on Get now to proceed.

- Select the pricing plan you need, enter your credentials, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the legal document.

- Choose the format of the document and download it to your device.

- Make modifications to your document if necessary. You can complete, edit, sign, and print the Missouri Dancer Agreement - Self-Employed Independent Contractor.

- Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

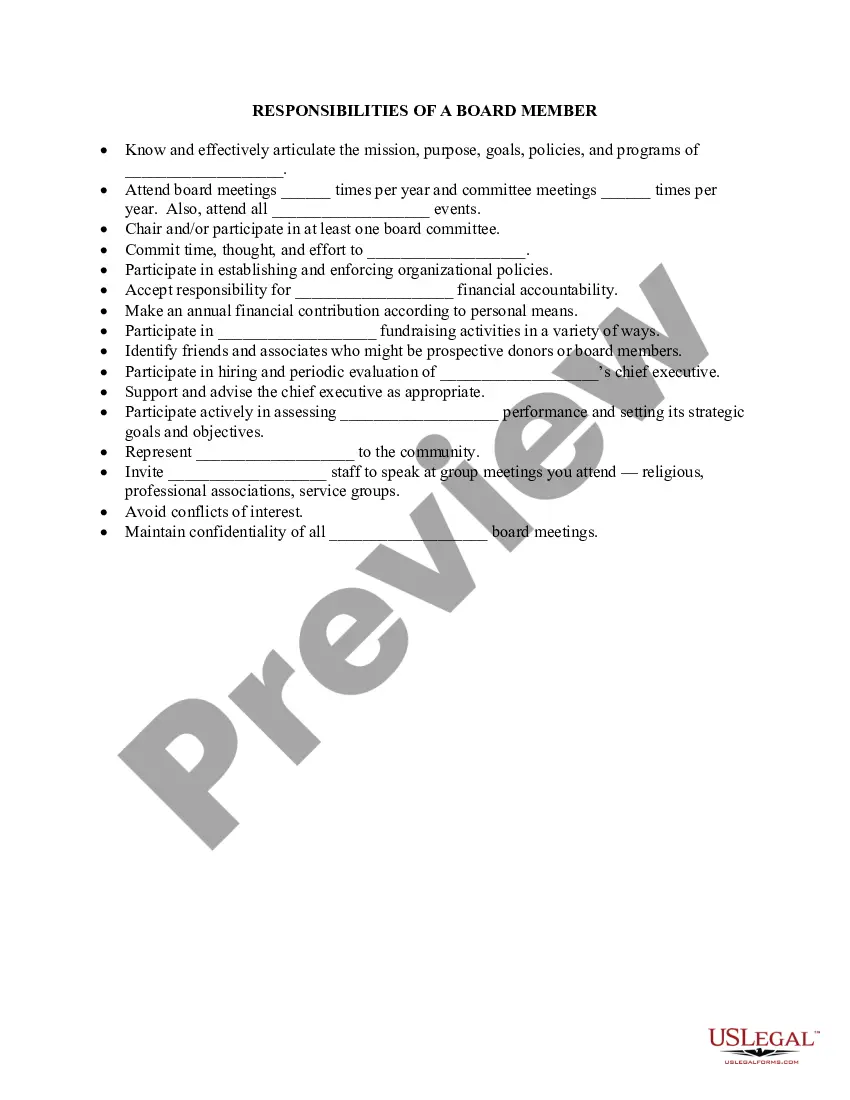

Filling out a Missouri Dancer Agreement - Self-Employed Independent Contractor involves several steps. Start by entering your personal details, including your name and contact information. Then, provide the specifics about the services you will offer and your payment terms. Finally, ensure that both you and the hiring party sign the agreement to create a legally binding document.

Yes, non-compete agreements can be enforceable for independent contractors if they meet certain legal criteria. To be valid, such agreements must be reasonable in duration and geographic scope. Utilizing the Missouri Dancer Agreement - Self-Employed Independent Contractor can help you create an enforceable non-compete that protects your business interests while remaining fair to all parties involved.

Non-compete agreements can be enforced with independent contractors, but their enforceability may depend on specific circumstances. Courts often consider whether the agreement serves a legitimate business interest and is reasonable in scope. It’s wise to consult a legal expert to ensure that your non-compete clause in the Missouri Dancer Agreement - Self-Employed Independent Contractor is positioned effectively.

Yes, an independent contractor is classified as self-employed. This status gives dancers greater flexibility in their work arrangements and income. By using the Missouri Dancer Agreement - Self-Employed Independent Contractor, you can formalize your self-employment status while protecting your rights and defining your business terms.

Yes, many dancers operate as independent contractors. This arrangement allows them to manage their schedules, choose performances, and negotiate contracts directly. The Missouri Dancer Agreement - Self-Employed Independent Contractor clearly outlines the terms of engagement, including payment and responsibilities, ensuring both parties understand their rights and obligations.

Writing a self-employed contract involves detailing the work to be performed, along with payment terms and service timelines. Be explicit about the rights and obligations of both parties to avoid misunderstandings. Make sure to include any relevant legal disclaimers. Utilizing a Missouri Dancer Agreement - Self-Employed Independent Contractor template can simplify your drafting process, ensuring all crucial points are covered.

To write an independent contractor agreement, begin with an introduction that identifies the parties involved and the effective date. Clearly define the services to be rendered, payment details, and any timelines. Include clauses that address confidentiality and termination. You can streamline this process by referring to a Missouri Dancer Agreement - Self-Employed Independent Contractor template, ensuring your contract is complete and legally sound.

Yes, you can write your own legally binding contract as an independent contractor in Missouri. Ensure it includes essential elements like offer, acceptance, consideration, and mutual consent. However, consider professional templates like the Missouri Dancer Agreement - Self-Employed Independent Contractor to help you cover all necessary legal aspects accurately. This approach promotes clarity and minimizes potential disputes.

A basic independent contractor agreement outlines the terms between a freelancer and their client. Key elements include job specifics, payment terms, and duration of the project. This agreement sets clear expectations and responsibilities, benefiting both parties. Utilize a Missouri Dancer Agreement - Self-Employed Independent Contractor template for a well-structured starting point.

The primary difference between an independent contractor and an employee in Missouri lies in the nature of the work relationship. Independent contractors operate with their own discretion, manage their schedules, and carry business liabilities, while employees work under the direction of their employers and receive benefits. Additionally, independent contractors typically must file their taxes differently. Understanding this distinction can guide you when creating a Missouri Dancer Agreement - Self-Employed Independent Contractor.