Missouri Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

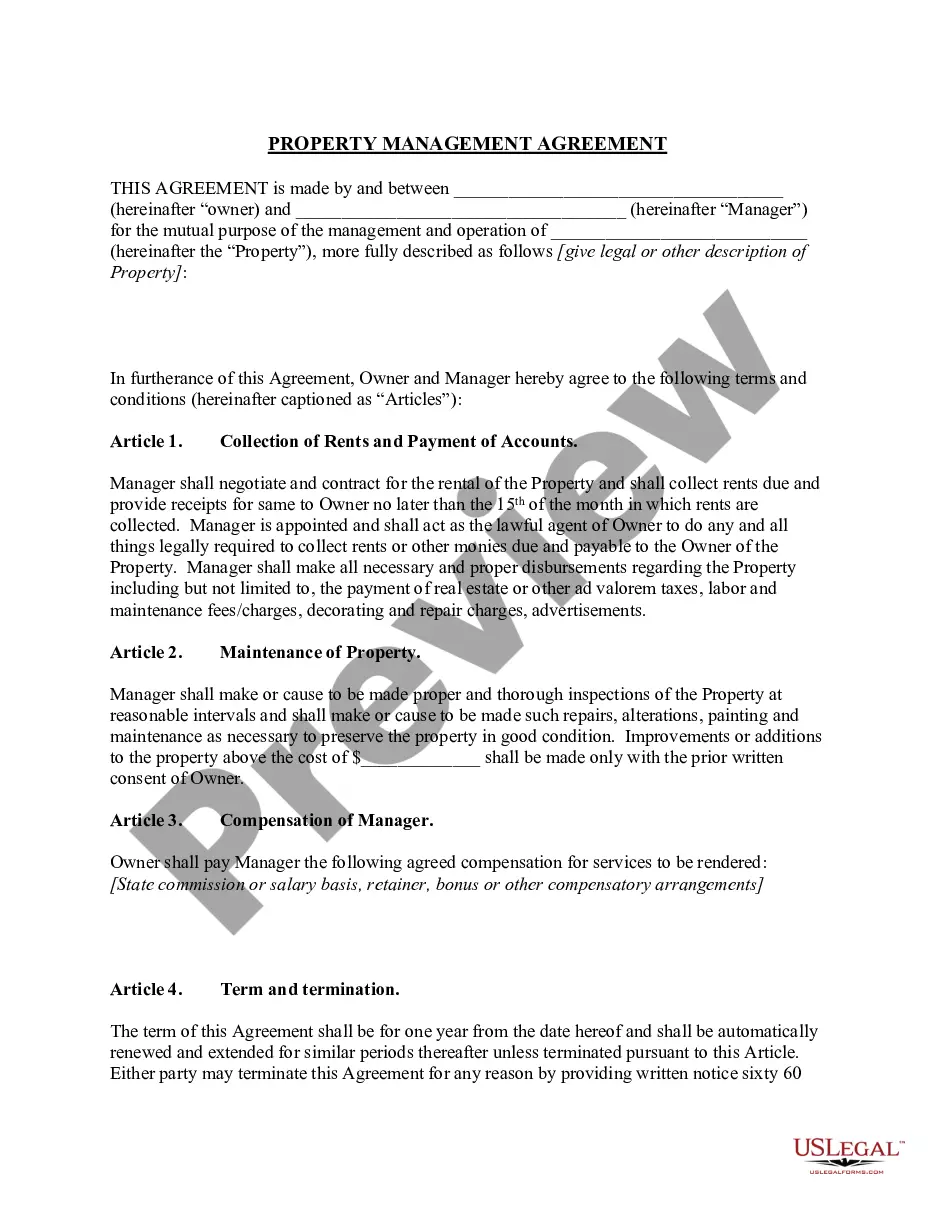

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal document templates that you can download or print.

Through the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest forms such as the Missouri Lab Worker Employment Agreement - Self-Employed in just a few seconds.

If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

If you are satisfied with the form, validate your choice by clicking the Buy now button. After that, select the payment plan you prefer and provide your details to register for an account. Process the transaction. Use a credit card or PayPal account to finalize the transaction. Select the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded Missouri Lab Worker Employment Agreement - Self-Employed. Every template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Missouri Lab Worker Employment Agreement - Self-Employed with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- If you have a subscription, Log In and download the Missouri Lab Worker Employment Agreement - Self-Employed from the US Legal Forms library.

- The Download button will be visible on every form you examine.

- You can access all previously downloaded forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are straightforward steps to get started.

- Ensure you have selected the appropriate form for your city/state.

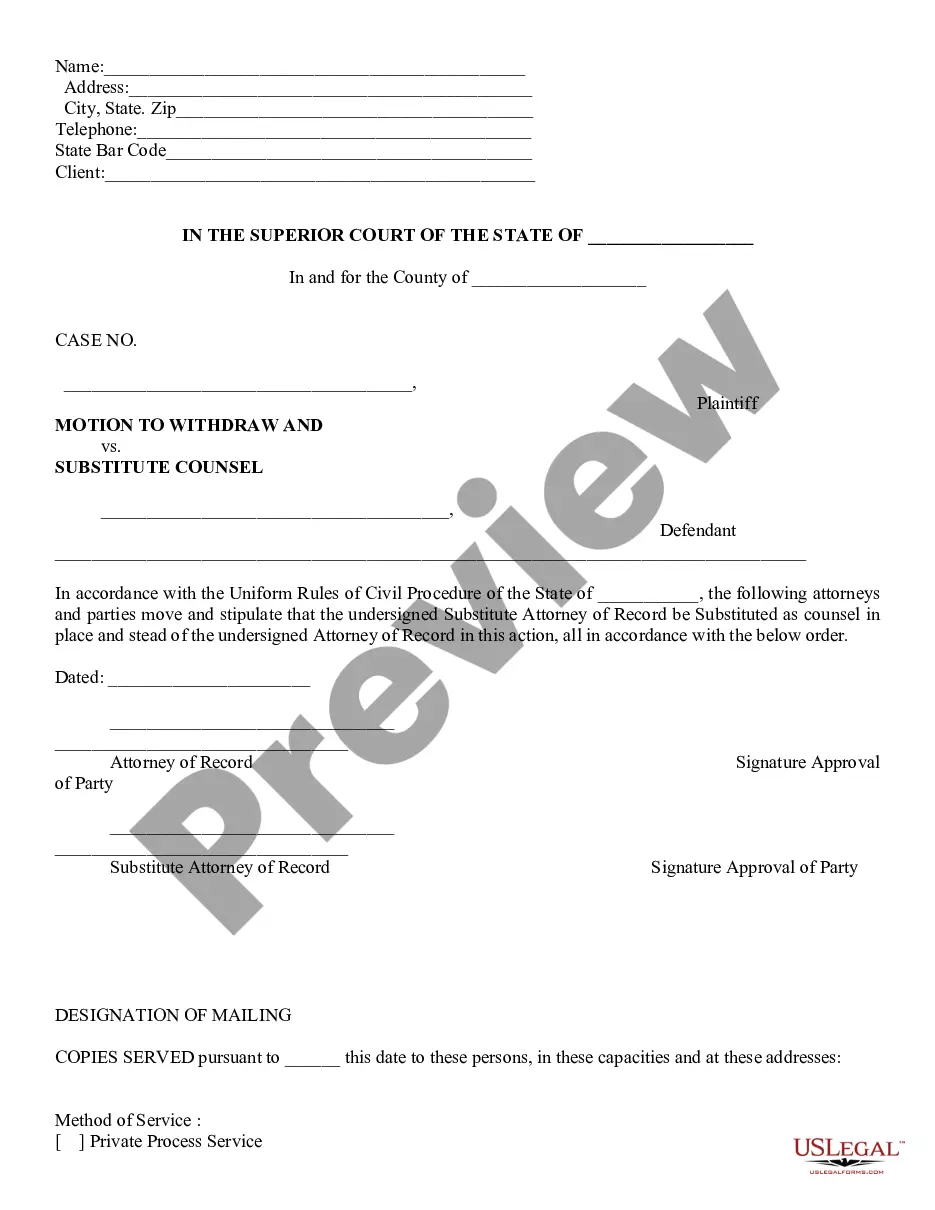

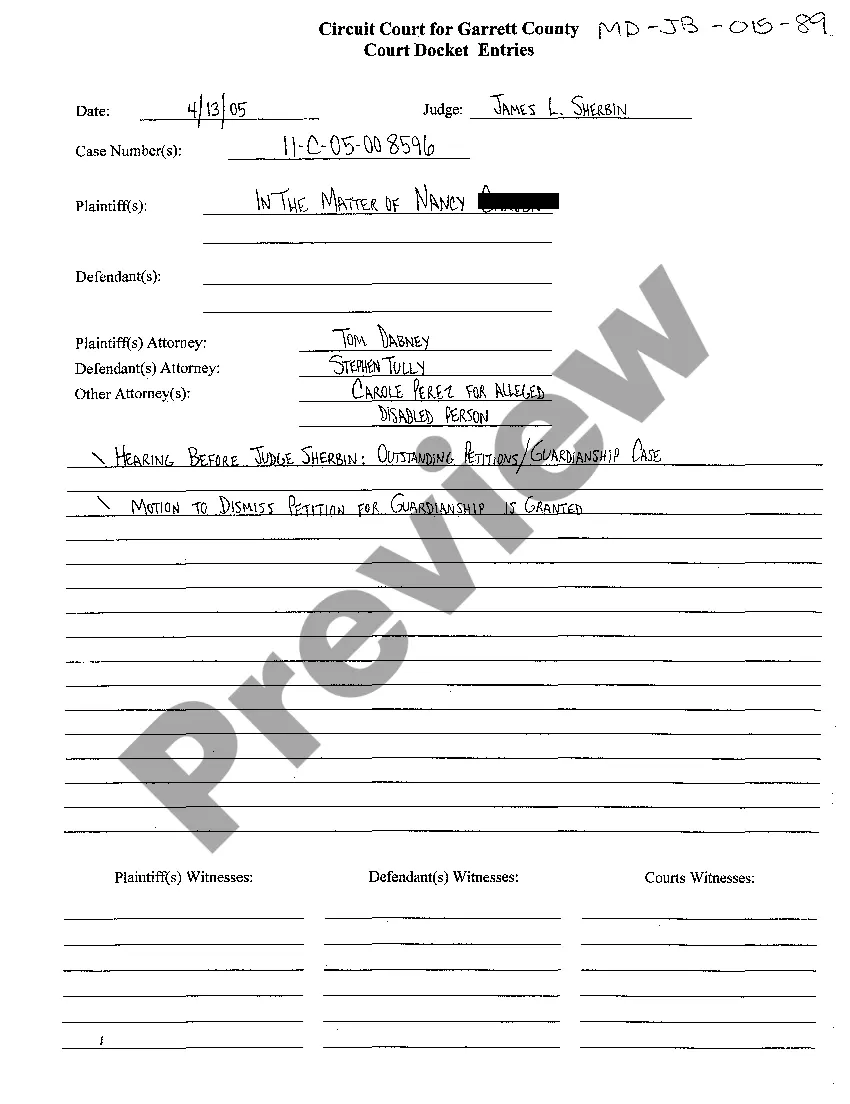

- Click the Review button to inspect the form's details. Check the form information to confirm you have chosen the correct form.

Form popularity

FAQ

When working as an independent contractor in Missouri, you need to understand several legal requirements that relate to your Missouri Lab Worker Employment Contract - Self-Employed. First, it's crucial to have a written contract that outlines your responsibilities, payment structure, and terms of engagement. Additionally, ensure you comply with state tax regulations and report your earnings accordingly. Using the US Legal Forms platform can help you access customizable templates to create a compliant employment contract tailored to your specific needs.

Not all contract employees are considered self-employed, as the classification depends on the nature of the agreement. If your Missouri Lab Worker Employment Contract - Self-Employed grants you independence in how you complete your tasks, then yes, you are likely self-employed. However, if the contract dictates strict adherence to guidelines and oversight, you may not be classified as self-employed. Always review your contract to clarify your employment status.

A contract is an agreement outlining the terms of your work, while being self-employed refers to your overall employment status. With a Missouri Lab Worker Employment Contract - Self-Employed, you establish yourself as an independent worker bound by specific conditions. While both concepts overlap, a contract formalizes your work conditions, income, and client relationships. Hence, understanding these roles is beneficial for your career.

Contract work shares many similarities with being self-employed, yet they are not identical. A Missouri Lab Worker Employment Contract - Self-Employed defines your relationship with clients as independent. This means you control your workload and working hours, similar to self-employment, but you may also have specific obligations outlined in your contracts. It is important to understand your rights and responsibilities in both scenarios.

Yes, contract work does count as employment, but it is classified differently from traditional employment. When you engage in a Missouri Lab Worker Employment Contract - Self-Employed, you operate as an independent contractor. This arrangement provides you with flexibility and autonomy, though it often lacks some benefits associated with full-time employment. Understanding this distinction is crucial for managing your career effectively.

The rules for self-employed individuals continue to evolve, particularly regarding taxation and benefits. Stay informed on legislative changes that affect your status, such as health care obligations or tax deductions. A Missouri Lab Worker Employment Contract - Self-Employed will help you navigate these changes and ensure you stay compliant while maximizing your benefits.

Creating a private contract with yourself is an unconventional practice, but it can serve to clarify your business intentions. While it might not always be necessary, having documented terms can help keep your projects organized. When using a Missouri Lab Worker Employment Contract - Self-Employed, you'll be in a better position to define your personal objectives.

Choosing between self-employed and independent contractor often depends on context. Both terms are commonly accepted, but 'self-employed' might convey broader autonomy. However, when discussing your status related to a Missouri Lab Worker Employment Contract - Self-Employed, either term can effectively communicate your work situation.

Yes, having a contract as a self-employed individual is not only possible but highly advisable. A contract helps define your working relationship and sets clear expectations. When using a Missouri Lab Worker Employment Contract - Self-Employed, you can formalize your agreements and safeguard your rights.

You can obtain your contract of employment from various sources, including legal websites and platforms like USLegalForms. They offer templates and guidance tailored to create a Missouri Lab Worker Employment Contract - Self-Employed. This ensures you have a solid, legally sound document to use throughout your work.