Missouri Shared Earnings Agreement between Fund & Company

Description

used as a substitute for equity-like structures like a SAFE, convertible note, or equity. It is not debt, doesn't have a fixed repayment schedule, doesn't require a personal guarantee."

How to fill out Shared Earnings Agreement Between Fund & Company?

Have you been in a position the place you need to have files for either business or person purposes virtually every day? There are a variety of lawful document layouts accessible on the Internet, but finding kinds you can depend on is not simple. US Legal Forms delivers a large number of form layouts, just like the Missouri Shared Earnings Agreement between Fund & Company, that happen to be composed in order to meet state and federal requirements.

If you are already knowledgeable about US Legal Forms internet site and have an account, merely log in. Next, you may download the Missouri Shared Earnings Agreement between Fund & Company design.

Unless you come with an account and want to begin using US Legal Forms, abide by these steps:

- Discover the form you want and ensure it is to the right area/county.

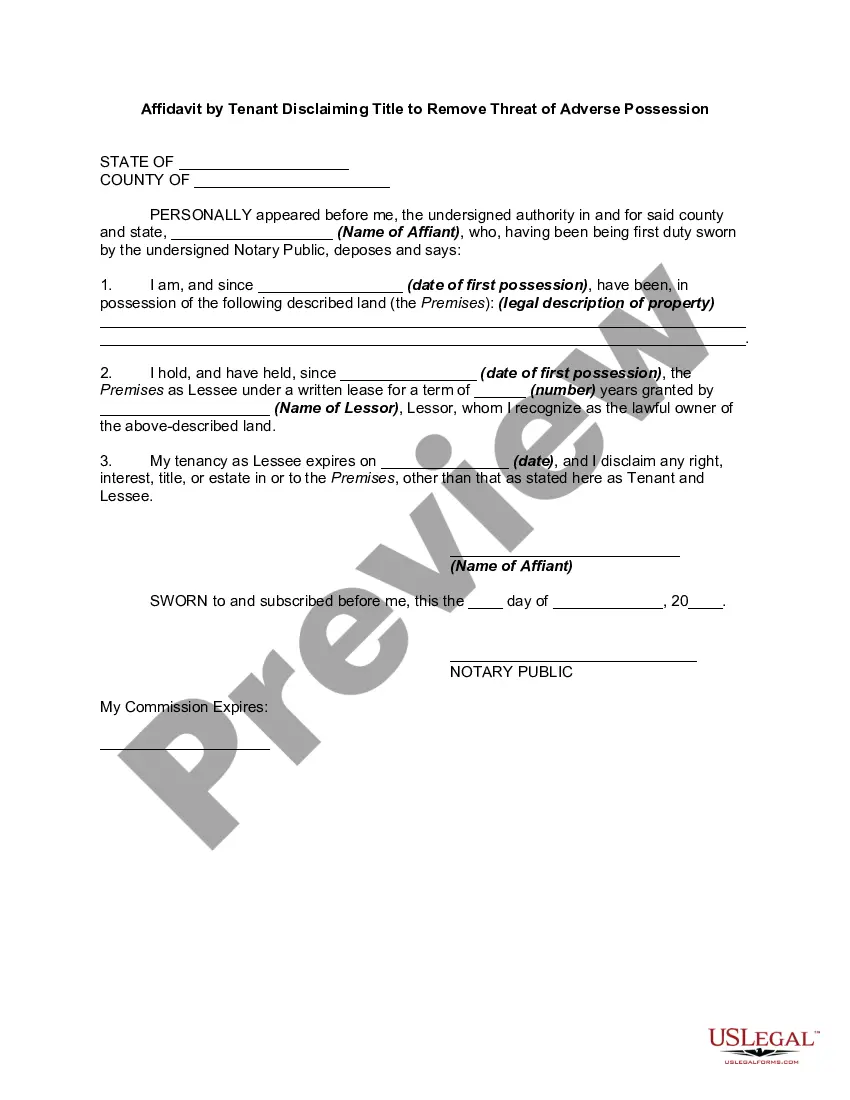

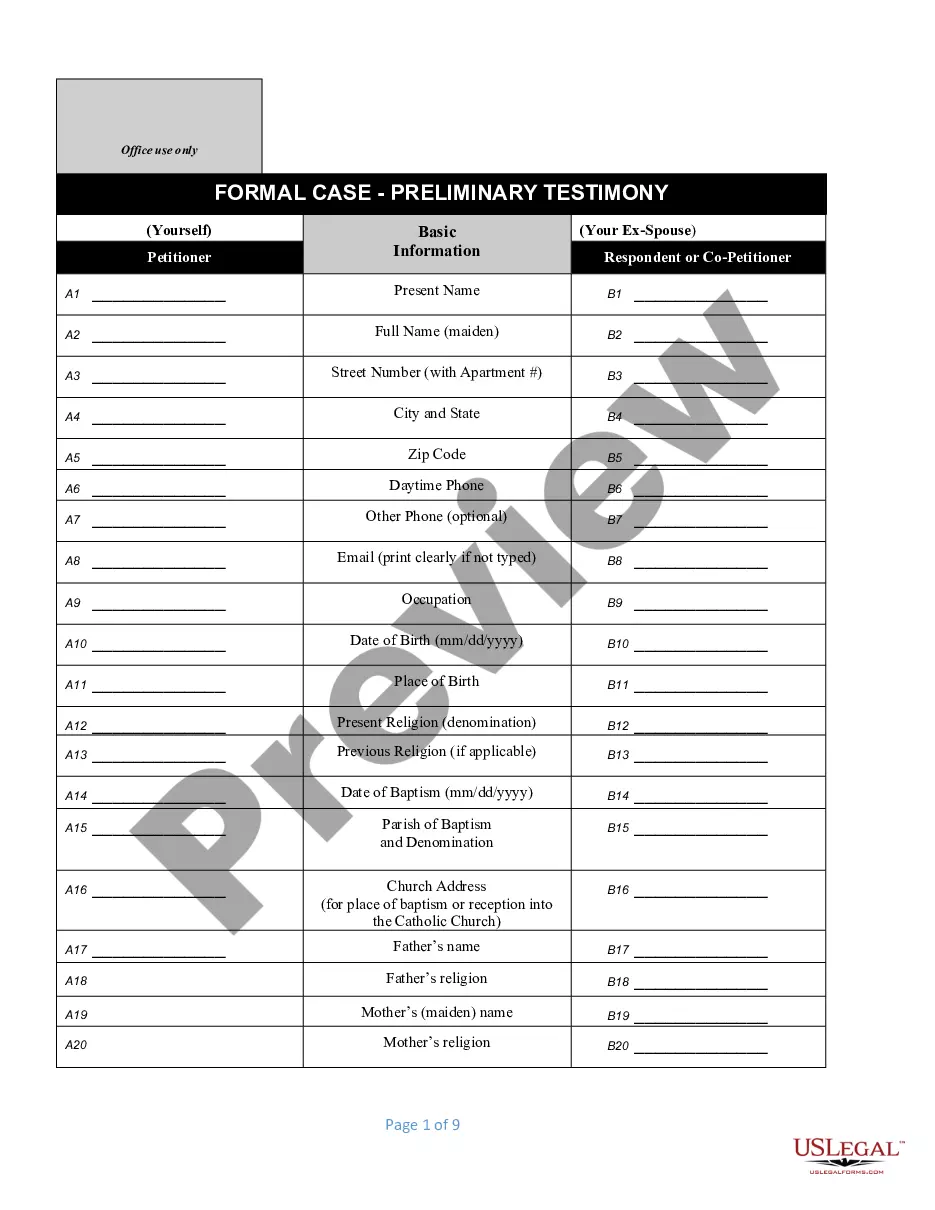

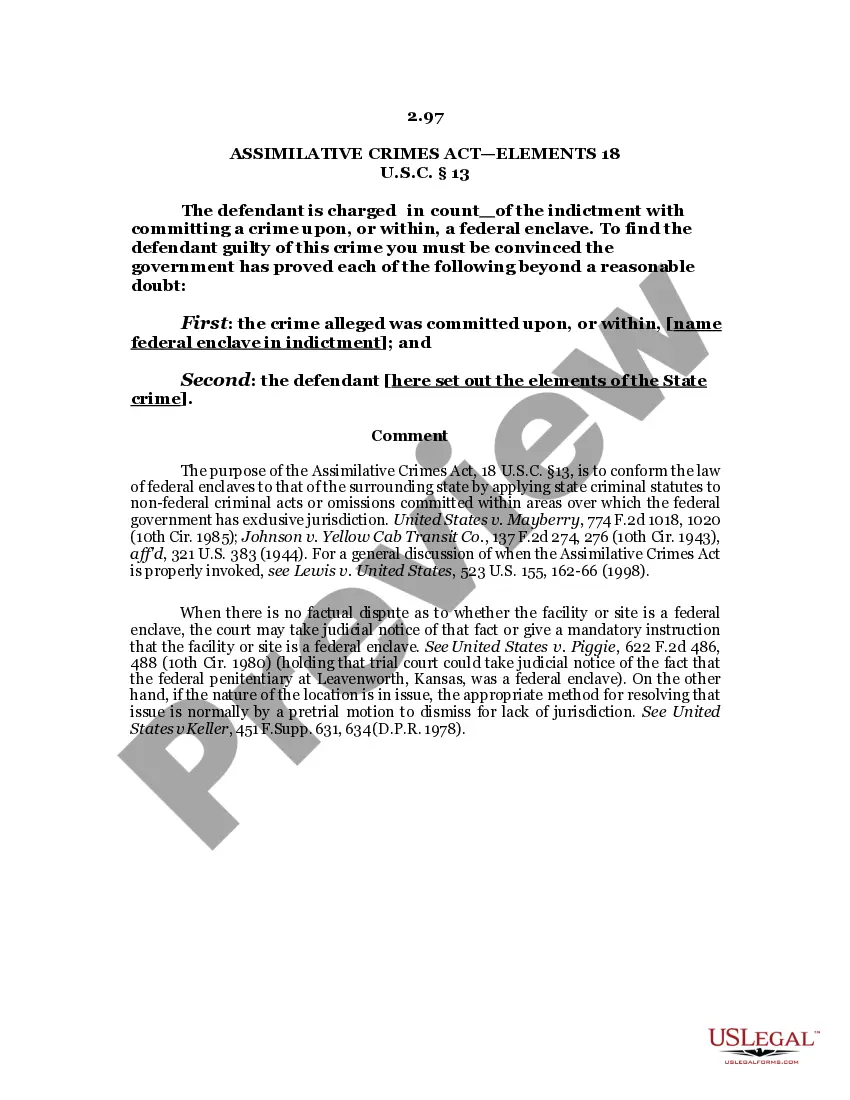

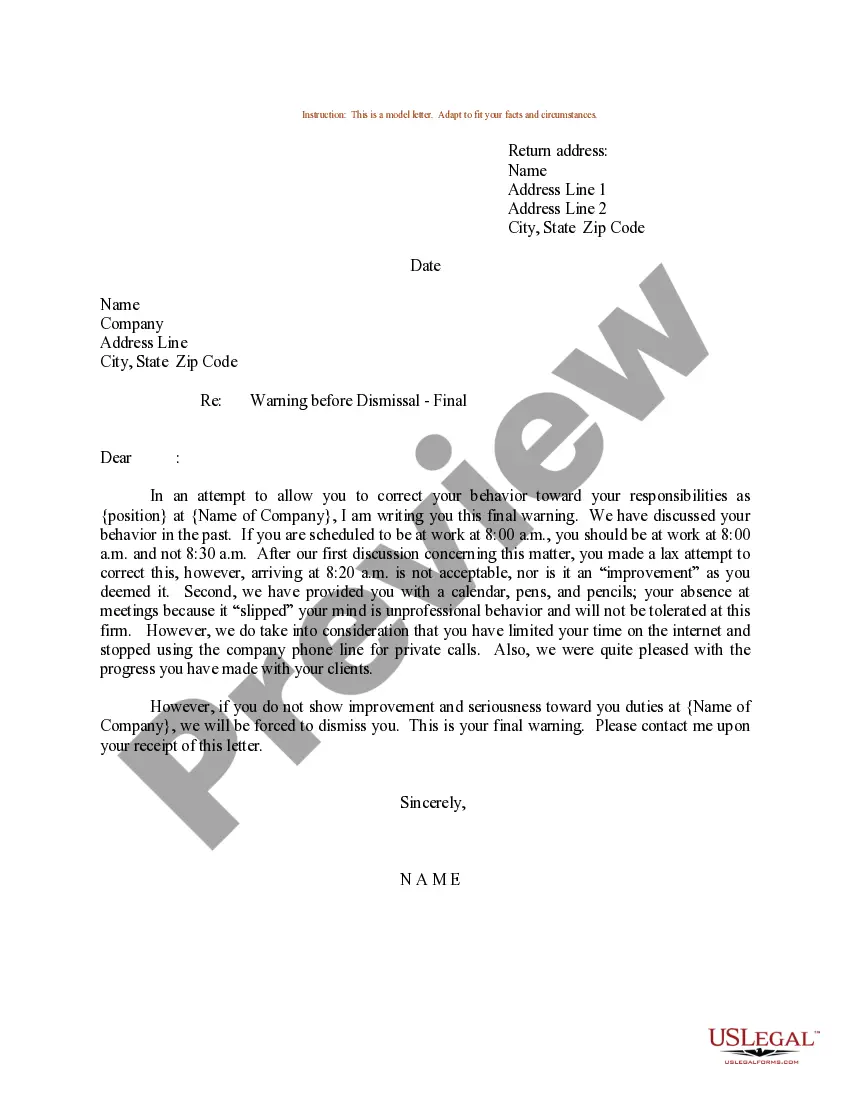

- Use the Preview option to analyze the form.

- Look at the outline to ensure that you have chosen the appropriate form.

- When the form is not what you`re searching for, utilize the Lookup area to find the form that meets your needs and requirements.

- Once you get the right form, click on Purchase now.

- Choose the pricing strategy you would like, fill in the specified info to generate your money, and pay money for the transaction making use of your PayPal or bank card.

- Select a handy document formatting and download your duplicate.

Discover all the document layouts you might have purchased in the My Forms menus. You may get a further duplicate of Missouri Shared Earnings Agreement between Fund & Company anytime, if required. Just go through the needed form to download or print out the document design.

Use US Legal Forms, by far the most considerable variety of lawful kinds, to save efforts and prevent faults. The service delivers expertly created lawful document layouts that can be used for a selection of purposes. Make an account on US Legal Forms and initiate making your way of life a little easier.

Form popularity

FAQ

What is the tax rate for pass-through entity tax? For the tax year ending December 31, 2022, the tax rate is 5.3%. For the tax year ending December 31, 2023, the tax rate is 4.95%. The pass-through entity tax rate is equal to the highest rate used to determine individual income tax liability. Pass-Through Entity Tax FAQs Missouri Department of Revenue (.gov) ? faq ? taxation ? business ? entity-... Missouri Department of Revenue (.gov) ? faq ? taxation ? business ? entity-...

What is the tax rate for pass-through entity tax? For the tax year ending December 31, 2022, the tax rate is 5.3%. For the tax year ending December 31, 2023, the tax rate is 4.95%. The pass-through entity tax rate is equal to the highest rate used to determine individual income tax liability.

As noted above, qualifying owners of an electing pass-through entity are eligible for a credit equal to a taxpayer's pro rata share of the Missouri tax paid by the electing entity. The credit is nonrefundable and may be carried forward to subsequent tax years.

To claim the credit on a 1040: Select the Forms menu, then click Open Form. Type in 653 to highlight form IT-653 on the list. Press OK. Enter the entity name, EIN, and PTET credit amount for each K-1.

For LLCs electing to be taxed as corporations, Form MO-1120 must be filed in Missouri. A single-member LLC that is considered disregarded for federal taxation purposes must report income and expenses accrued by the LLC on the member's tax return. In Missouri, a state tax identification number is required.

Pass-Through Entity The Pass-Through Entity (PTE) Tax allows an entity to pay a tax on behalf of their partners, members, or shareholders. Pass-Through Entity (PTE) Tax | Minnesota Department of Revenue revenue.state.mn.us ? pass-through-entity-pt... revenue.state.mn.us ? pass-through-entity-pt...

If the credits are greater than the tax you owe, they'll reduce your tax to zero, but you won't receive the balance as a refund. If you qualify for a ?refundable? tax credit, you'll receive the entire amount of the credit. If the credit exceeds the tax you owe, you'll receive the remaining amount as a tax refund. 5 Things You Should Know about Refundable Tax Credits - TurboTax intuit.com ? tax-deductions-and-credits intuit.com ? tax-deductions-and-credits