Missouri Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank

Description

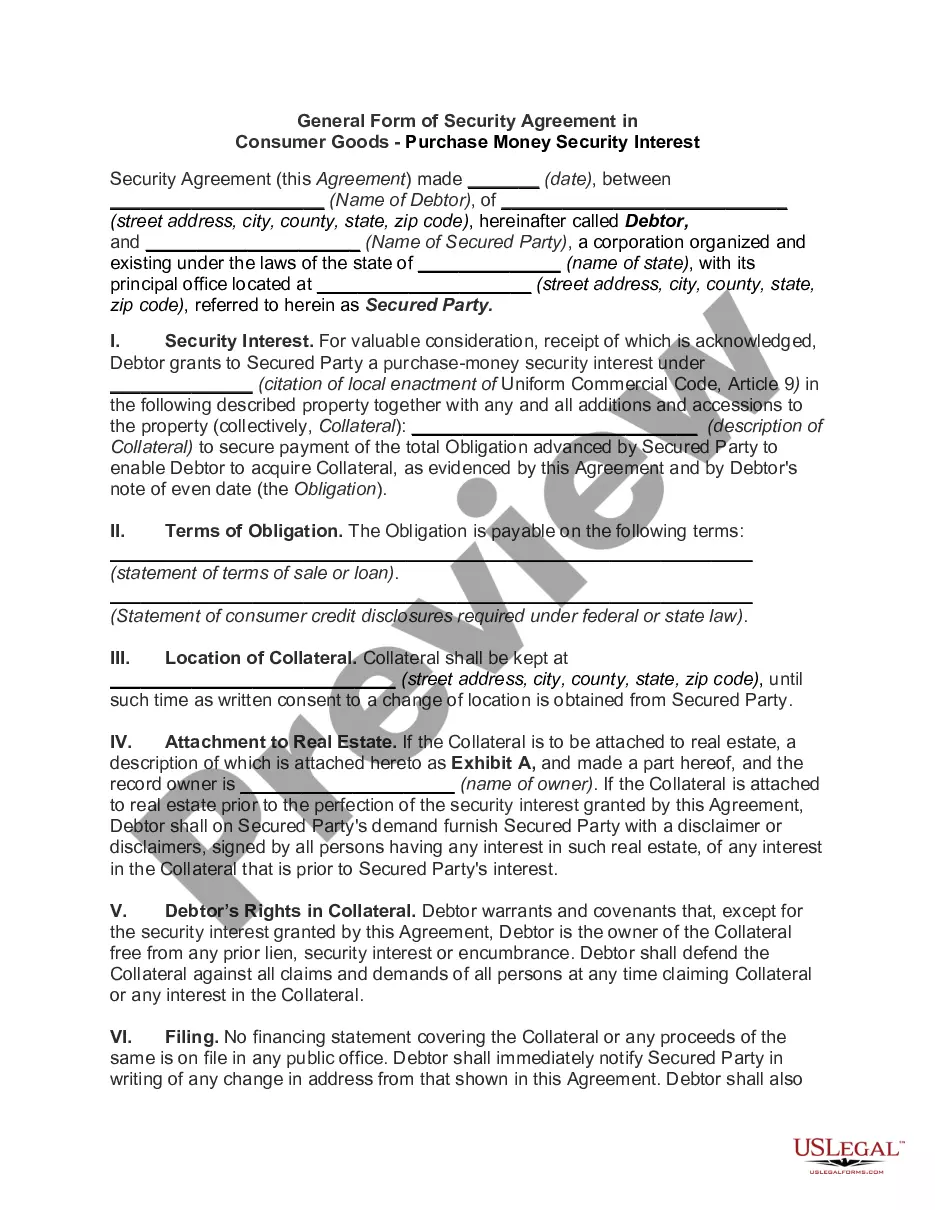

How to fill out Amended And Restated Credit Agreement Between ADAC Laboratories, Various Financial Institution And ABN AMRO Bank?

If you want to full, obtain, or print out legitimate record templates, use US Legal Forms, the greatest variety of legitimate varieties, which can be found on-line. Use the site`s simple and handy search to find the files you require. Numerous templates for company and person reasons are categorized by groups and says, or key phrases. Use US Legal Forms to find the Missouri Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank with a number of click throughs.

In case you are previously a US Legal Forms consumer, log in for your account and click the Obtain key to obtain the Missouri Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank. You may also gain access to varieties you formerly saved inside the My Forms tab of your account.

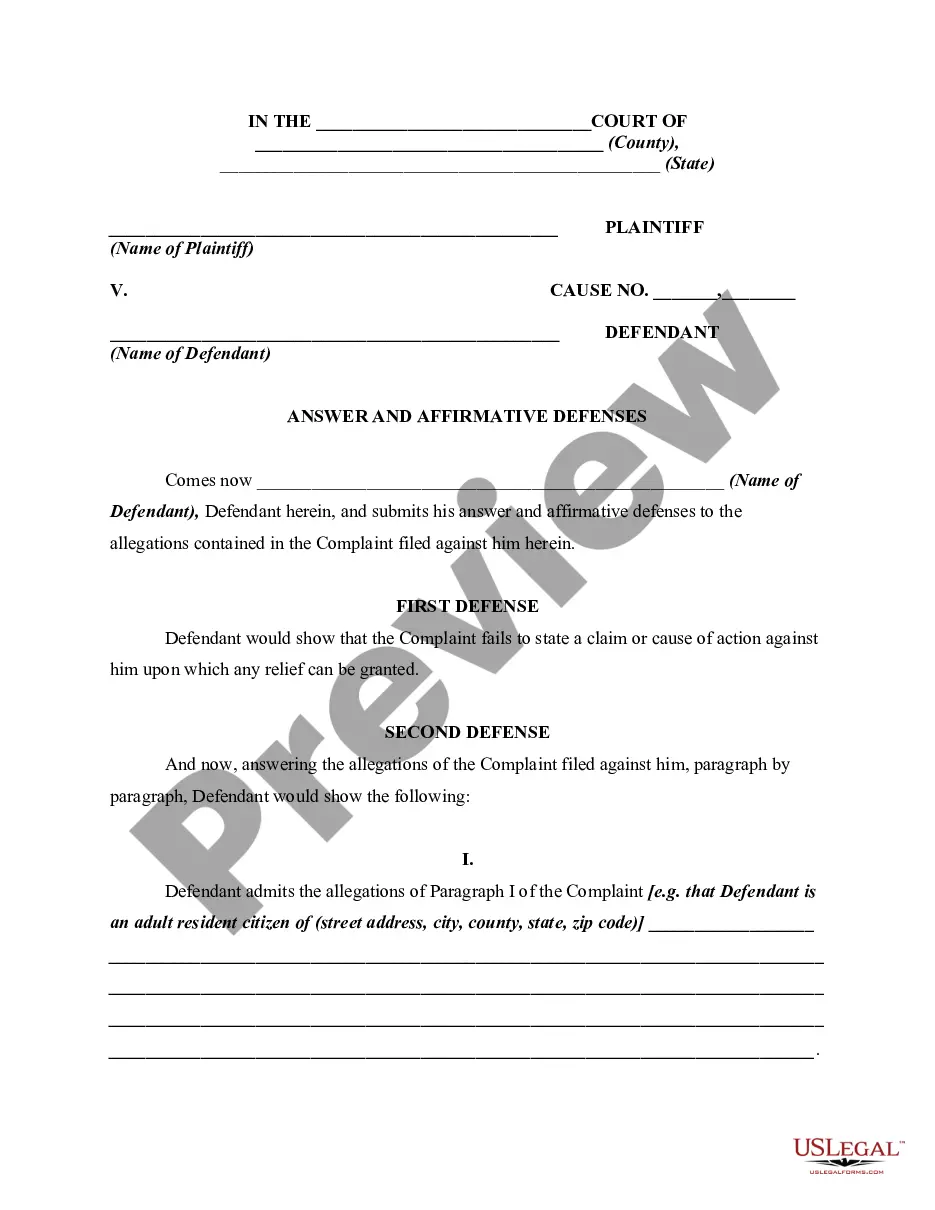

If you work with US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your correct city/land.

- Step 2. Make use of the Preview solution to examine the form`s information. Never neglect to read the explanation.

- Step 3. In case you are unhappy using the type, utilize the Look for discipline near the top of the screen to find other models of your legitimate type design.

- Step 4. Upon having found the form you require, go through the Purchase now key. Choose the prices prepare you choose and add your credentials to register for the account.

- Step 5. Approach the purchase. You can utilize your bank card or PayPal account to finish the purchase.

- Step 6. Choose the structure of your legitimate type and obtain it on your own system.

- Step 7. Comprehensive, modify and print out or indicator the Missouri Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank.

Every legitimate record design you purchase is the one you have eternally. You might have acces to every single type you saved inside your acccount. Click the My Forms section and decide on a type to print out or obtain yet again.

Be competitive and obtain, and print out the Missouri Amended and Restated Credit Agreement between ADAC Laboratories, various financial institution and ABN AMRO Bank with US Legal Forms. There are thousands of skilled and status-distinct varieties you can utilize for the company or person requirements.

Form popularity

FAQ

A credit agreement amendment is a modification or deletion to an existing credit agreement between a borrower and capital provider. Credit agreement amendments are a type of contract amendment that are common in debt capital.

?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document. ingly, ?amended and restated? means a complete document into which one or more changes have been incorporated.

An amended and restated credit agreement is a credit agreement where one or many changes have been applied and stated within the document. A credit agreement is a legal document that outlines the terms of a loan agreement and is made between a borrower and a lender.

If you believe your credit information (anything in the Contract Data area or the Performance Data area of your credit report) is incorrect, incomplete or not up to date, you may request an amendment with your lender directly or request an amendment to the Central Credit Register.

Thus, an amended and restated document includes all past amendments executed up to the date of the amended and restated agreement. The purpose of the amended and restated agreement is to simplify reading of the document, as one does not need to read the original document side-by-side with all subsequent amendments.

Restatement Loan means an Additional Term Loan made under the Commitments issued pursuant to the Restatement Supplement.