Missouri Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas

Description

How to fill out Fourth Amendment To Amended Restated Credit Agreement Between Raytel Medical Corp, Bank Boston, N.A. And Banque Paribas?

Discovering the right lawful document format could be a have a problem. Naturally, there are a lot of themes available on the net, but how would you obtain the lawful type you require? Make use of the US Legal Forms site. The service provides a large number of themes, like the Missouri Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas, that you can use for business and private demands. Every one of the forms are checked by specialists and satisfy state and federal needs.

When you are previously signed up, log in to your accounts and click the Obtain option to have the Missouri Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas. Utilize your accounts to search throughout the lawful forms you possess purchased formerly. Proceed to the My Forms tab of your respective accounts and have an additional copy from the document you require.

When you are a brand new user of US Legal Forms, here are easy instructions that you can follow:

- Initial, ensure you have chosen the correct type for your personal city/county. You are able to check out the form making use of the Preview option and read the form description to guarantee it is the right one for you.

- When the type fails to satisfy your expectations, take advantage of the Seach discipline to find the right type.

- Once you are positive that the form is acceptable, click on the Purchase now option to have the type.

- Choose the prices strategy you need and type in the essential info. Make your accounts and pay money for the transaction with your PayPal accounts or charge card.

- Choose the submit structure and obtain the lawful document format to your device.

- Complete, revise and printing and signal the attained Missouri Fourth Amendment to Amended Restated Credit Agreement between Raytel Medical Corp, Bank Boston, N.A. and Banque Paribas.

US Legal Forms is definitely the greatest local library of lawful forms in which you can discover different document themes. Make use of the service to obtain professionally-made papers that follow state needs.

Form popularity

FAQ

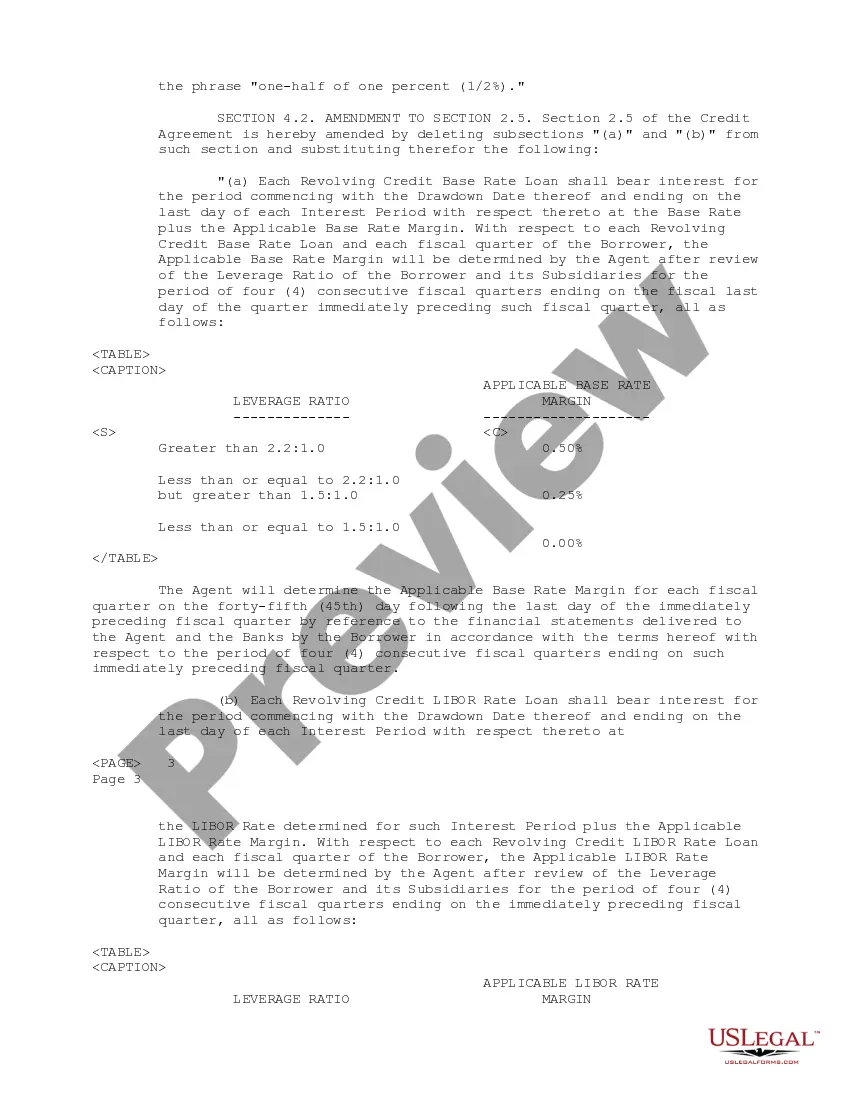

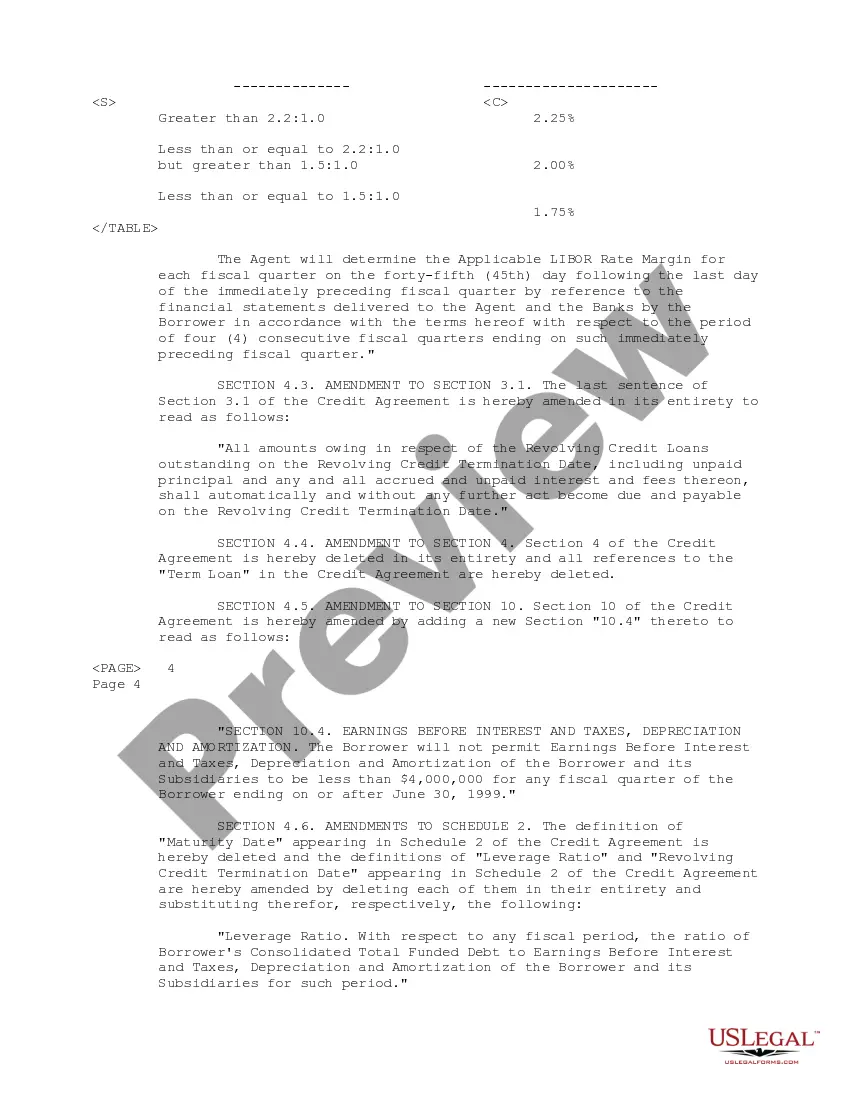

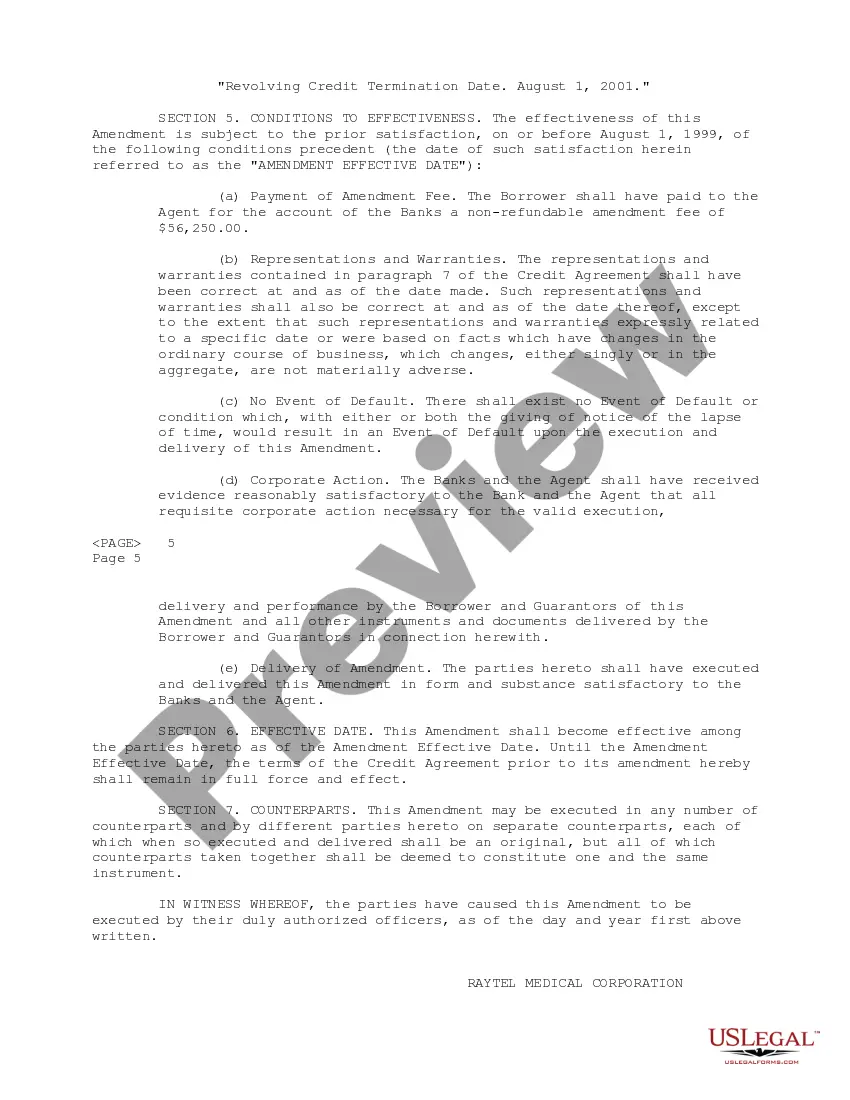

Thus, an amended and restated document includes all past amendments executed up to the date of the amended and restated agreement. The purpose of the amended and restated agreement is to simplify reading of the document, as one does not need to read the original document side-by-side with all subsequent amendments.

This is a standard form amending agreement for use where a borrower and its lender (or lenders) have agreed to modify their loan agreement by adding, changing or removing provisions and defined terms.

Amended and Restated Credit Facility Agreement means, solely with respect to the Reorganization Transaction, that certain credit agreement that amends and restates the Prepetition Credit Agreement, dated as of the Effective Date, among Reorganized Ditech, as borrower, the Amended and Restated Credit Facility Agent, ...

This Agreement is intended to and does completely amend and restate, without novation, the Original Agreement. All credit extensions or loans outstanding under the Original Agreement are and shall continue to be outstanding under this Agreement.

An amended and restated credit agreement is a credit agreement where one or many changes have been applied and stated within the document. A credit agreement is a legal document that outlines the terms of a loan agreement and is made between a borrower and a lender.