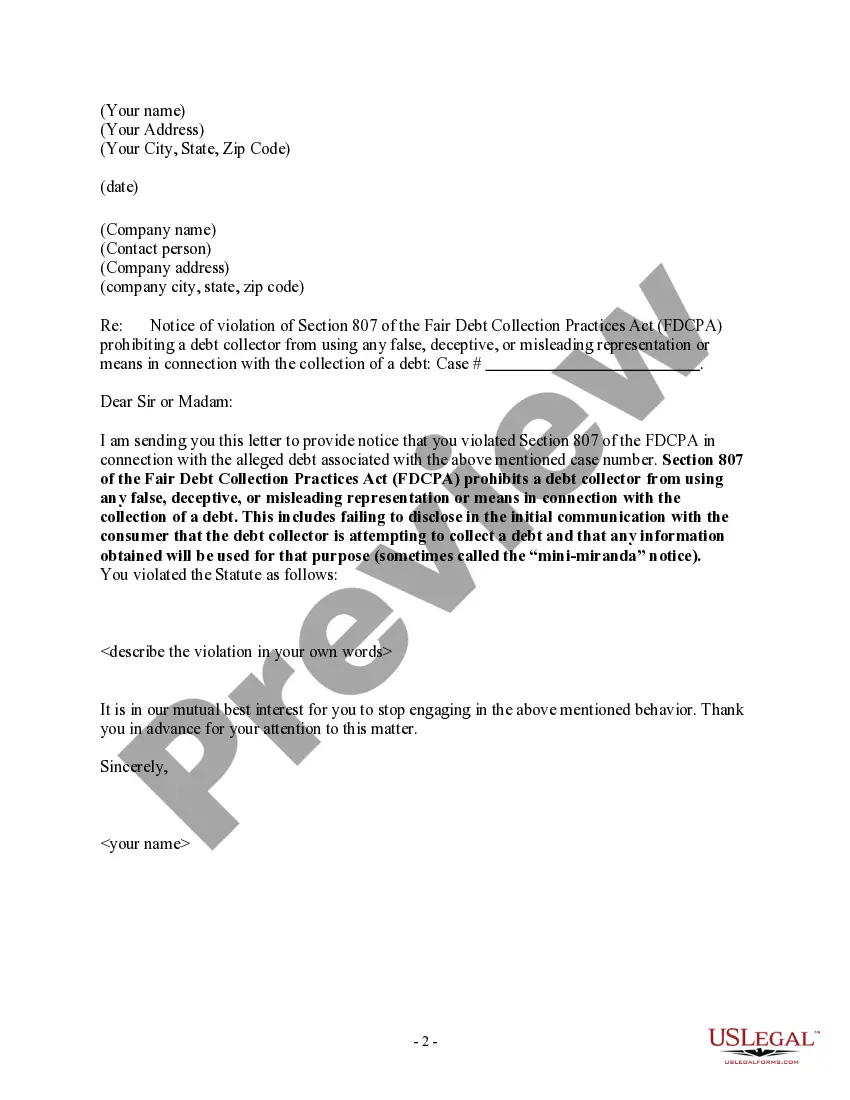

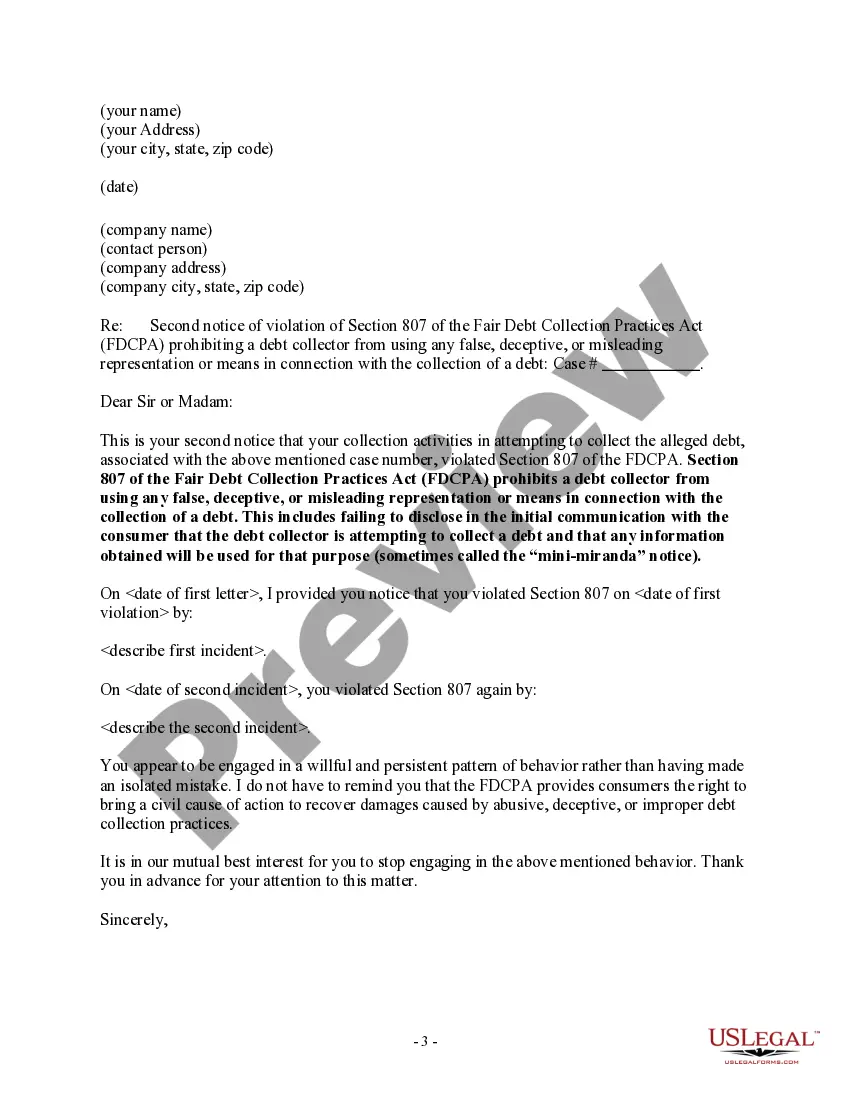

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes failing to disclose in the initial communication with the consumer that the debt collector is attempting to collect a debt and that any information obtained will be used for that purpose (Mini Miranda)

Missouri Notice to Debt Collector - Failure to Provide Mini-Miranda

Description

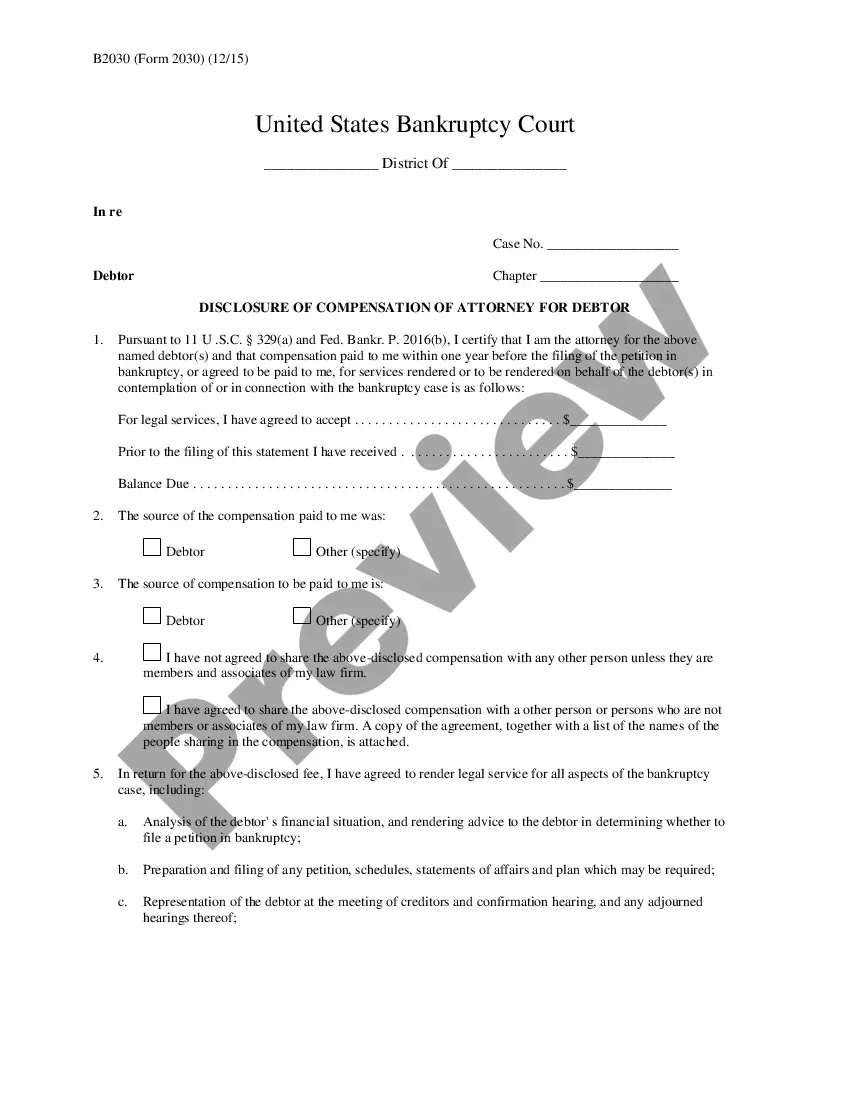

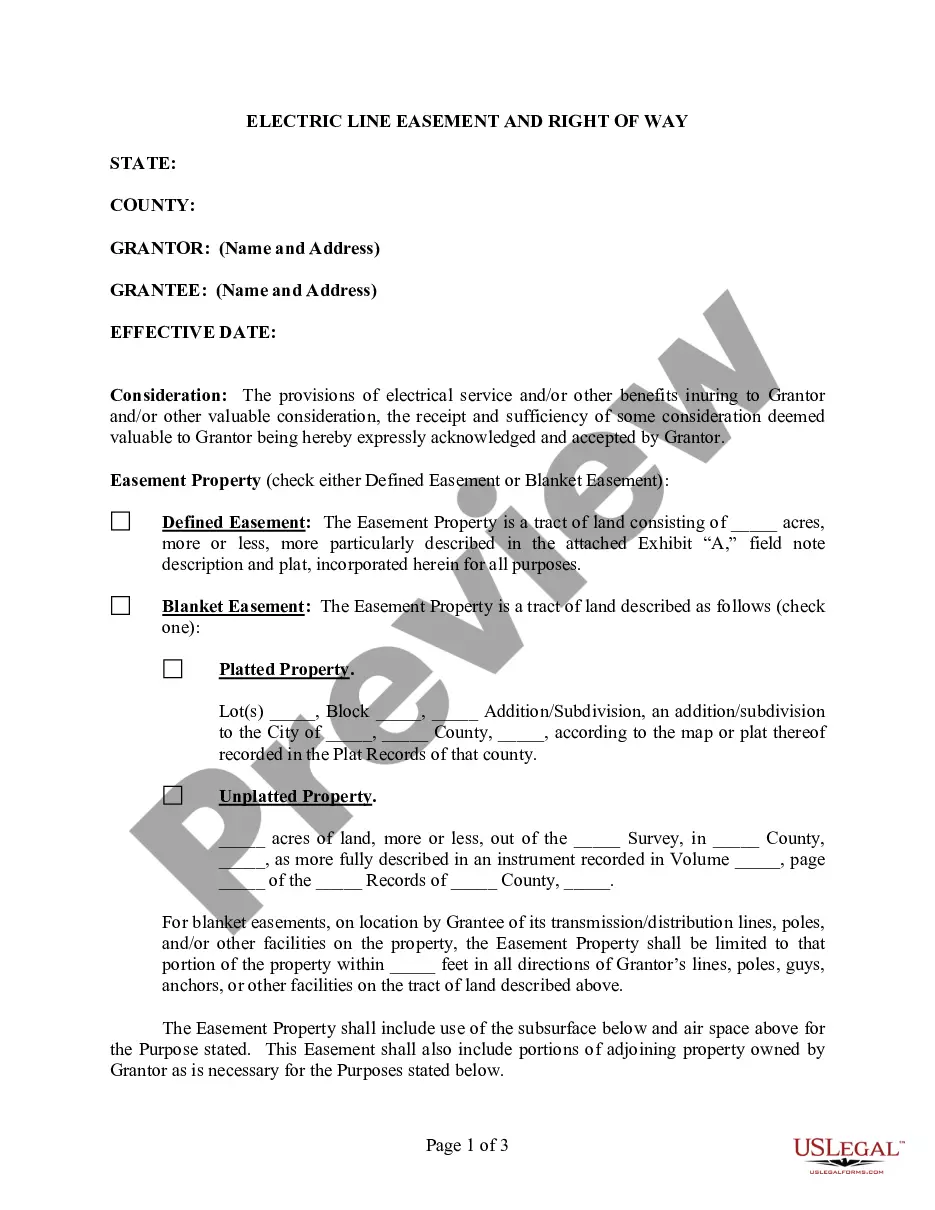

How to fill out Notice To Debt Collector - Failure To Provide Mini-Miranda?

US Legal Forms - one of the most extensive collections of legal documents in the United States - provides a variety of legal document templates that you can download or print. By utilizing the website, you can obtain numerous forms for business and personal purposes, organized by categories, claims, or keywords.

You can find the latest versions of forms such as the Missouri Notice to Debt Collector - Failure to Provide Mini-Miranda in just a few minutes.

If you have an account, Log In and download the Missouri Notice to Debt Collector - Failure to Provide Mini-Miranda from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Utilize your credit card or PayPal account to finalize the payment.

Download the form to your device, and make modifications. Fill out, edit, and print the downloaded Missouri Notice to Debt Collector - Failure to Provide Mini-Miranda. Every document you save in your account has no expiration date and is yours indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the form you need.

- If you’re using US Legal Forms for the first time, here are easy steps to get you started.

- Ensure you have selected the appropriate form for your city/state.

- Click the Review button to examine the content of the form.

- Read the form details to confirm you’ve chosen the correct one.

- If the form doesn’t meet your requirements, use the Search field at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Acquire now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

At the beginning of a collection call, a debt collector must recite wording that has come to be called the mini-Miranda disclosure. It informs the consumer that the call is from a debt collector, that they are calling to collect a debt, and that any information revealed in the call will be used to collect that debt.

Debt collectors are required to give the full mini Miranda in their initial communication with you, no matter what form. 1fefffeff The first time a third-party debt collector speaks with you on the phone or sends you a letter, the mini Miranda statement must be included.

At a minimum, proper debt validation should include an account balance along with an explanation of how the amount was derived. But most debt collectors respond with an account statement from the original creditor as debt validation and that's generally considered sufficient.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

The Basic Law: The first notice from the debt collector to the debtor must include a warning known as the "Mini-Miranda Warning," which must state that the communication is from a debt collector and that any information obtained may be used to collect the debt.

Does a Debt Collector Have to Show Proof of a Debt? Yes, debt collectors do have to show proof of a debt if you ask them. Make sure you understand your rights under credit collection laws.

Mini-Miranda rights are a set of statements that a debt collector must use when contacting an individual to collect a debt. Mini-Miranda rights have to be recited, by law, if the debt collection effort is being made over the phone or in-person and outlined in written form if a letter is sent to the debtor.

When a debt collector contacts you, they have to identify themselves as a collector and tell you they're trying to collect on a debt. This is sometimes called a "Mini Miranda requirement. This requirement was created to prevent unfair questioning and practices in the debt collection process.