Missouri Complex Will - Credit Shelter Marital Trust for Spouse

Description

How to fill out Complex Will - Credit Shelter Marital Trust For Spouse?

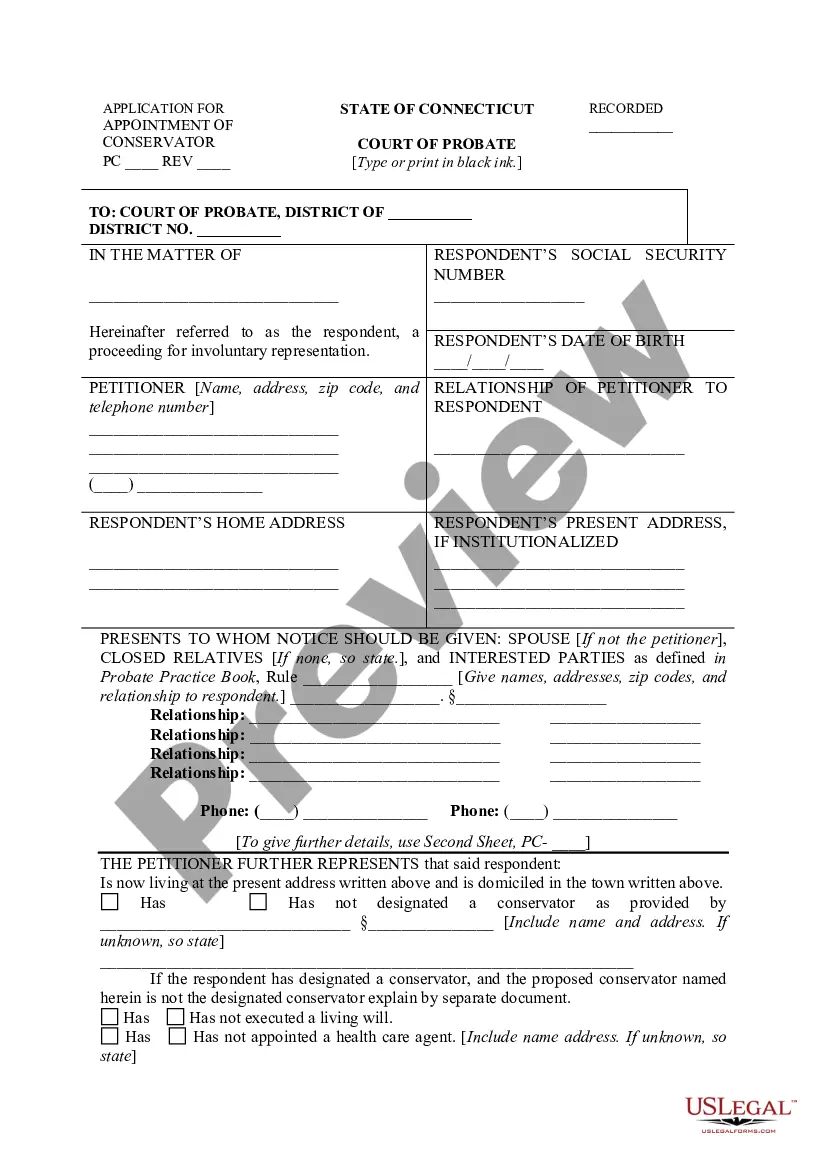

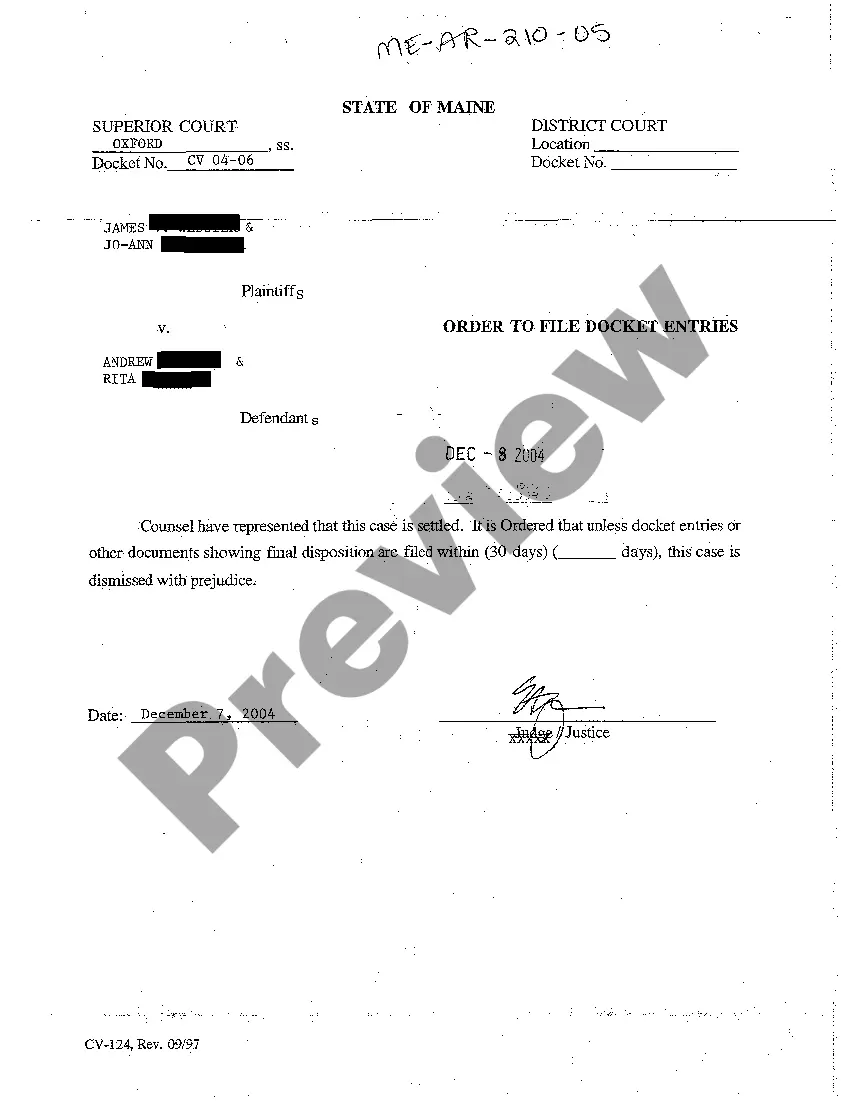

Finding the right authorized document template can be a struggle. Obviously, there are a variety of web templates available on the Internet, but how do you obtain the authorized kind you need? Use the US Legal Forms site. The service delivers a huge number of web templates, including the Missouri Complex Will - Credit Shelter Marital Trust for Spouse, which can be used for enterprise and personal requirements. All of the forms are checked out by specialists and meet federal and state requirements.

When you are presently listed, log in to your bank account and click on the Download button to have the Missouri Complex Will - Credit Shelter Marital Trust for Spouse. Make use of bank account to look throughout the authorized forms you might have bought earlier. Proceed to the My Forms tab of the bank account and get another version from the document you need.

When you are a new consumer of US Legal Forms, listed here are basic recommendations that you can comply with:

- Initially, be sure you have selected the appropriate kind to your town/area. You may examine the shape using the Preview button and read the shape explanation to guarantee it will be the right one for you.

- In case the kind fails to meet your needs, take advantage of the Seach field to obtain the right kind.

- Once you are positive that the shape is acceptable, click on the Buy now button to have the kind.

- Pick the prices strategy you desire and enter the necessary details. Create your bank account and buy the order utilizing your PayPal bank account or charge card.

- Opt for the document file format and down load the authorized document template to your device.

- Complete, revise and printing and indication the obtained Missouri Complex Will - Credit Shelter Marital Trust for Spouse.

US Legal Forms is definitely the greatest local library of authorized forms in which you can discover a variety of document web templates. Use the service to down load appropriately-created paperwork that comply with state requirements.

Form popularity

FAQ

The marital trust also gets a new basis upon the death of the grantor. Because the assets are also included in the surviving spouse's estate upon death, however, the assets receive a new basis at the time they are transferred to the remaining beneficiaries.

Upon the death of the surviving spouse, the trust transfers to the heirs, who are exempt from the estate tax that would have resulted from a combined inheritance. Disadvantages of a CST include formation costs and the surviving spouse's lack of control.

This trust is irrevocable and will pass to beneficiaries other than the surviving spouse (usually their children). The surviving spouse must follow the trust's plan without overly benefiting from its operation, but this trust often passes income to the surviving spouse to live on for the rest of their life.

There are three types of marital trusts: a general power of appointment, a qualified terminable interest property (QTIP) trust, and an estate trust.

Credit shelter trusts are also commonly known as bypass, family, or exemption trusts.

Unlike a QTIP trust, the assets of the credit shelter trust are not included in the beneficiary's gross estate and, as a result, are not subject to estate tax at the beneficiary's death (in other words, the assets bypass the beneficiary's estate).

No. Credit Shelter Trusts are a popular tool for estate planning, and there are two main types of CSTs, the Marital Gift Trust and the Qualified Terminable Interest Property Trust (QTIP). Both of these Trusts preserve wealth via estate tax exemptions.