Missouri Form of Convertible Promissory Note, Preferred Stock

Description

How to fill out Form Of Convertible Promissory Note, Preferred Stock?

US Legal Forms - one of several biggest libraries of lawful forms in the United States - offers a variety of lawful papers layouts you may download or printing. While using website, you will get thousands of forms for enterprise and specific uses, sorted by groups, states, or search phrases.You can find the latest types of forms much like the Missouri Form of Convertible Promissory Note, Preferred Stock in seconds.

If you already possess a membership, log in and download Missouri Form of Convertible Promissory Note, Preferred Stock in the US Legal Forms local library. The Download key will show up on every kind you look at. You get access to all previously acquired forms in the My Forms tab of your own accounts.

If you would like use US Legal Forms initially, here are simple guidelines to help you get started off:

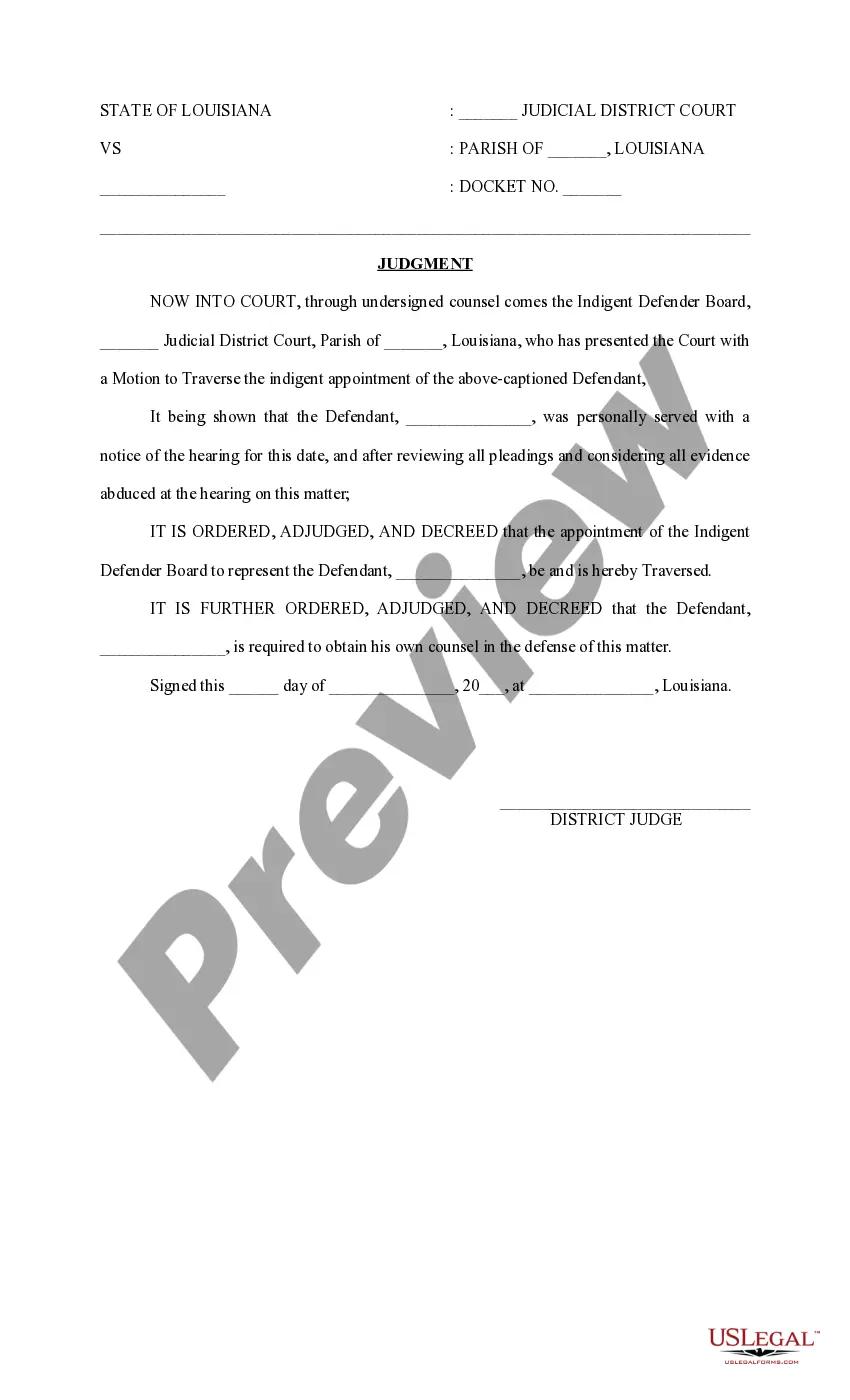

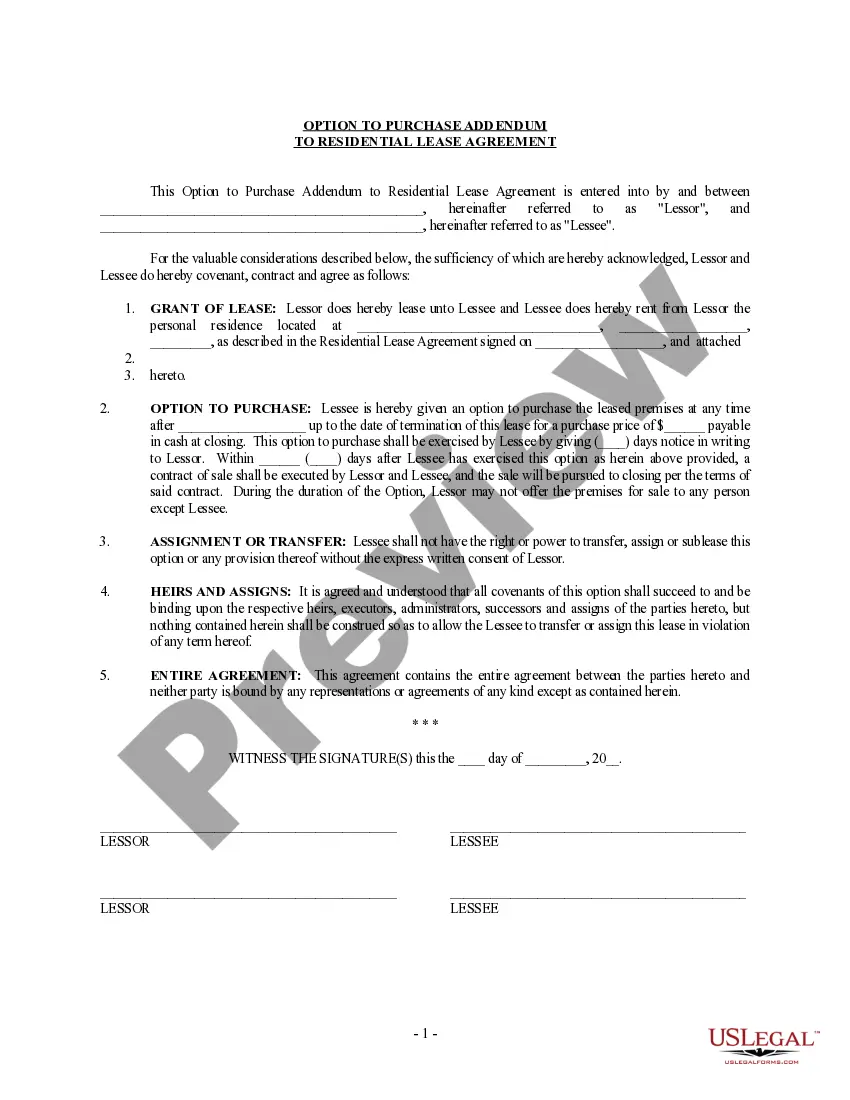

- Make sure you have selected the correct kind to your town/county. Go through the Preview key to review the form`s content. Browse the kind description to actually have chosen the appropriate kind.

- If the kind does not satisfy your demands, use the Look for area towards the top of the screen to find the one which does.

- In case you are content with the shape, affirm your option by clicking the Get now key. Then, opt for the rates prepare you like and offer your references to register on an accounts.

- Method the financial transaction. Make use of Visa or Mastercard or PayPal accounts to finish the financial transaction.

- Choose the format and download the shape on your own gadget.

- Make alterations. Fill out, change and printing and indicator the acquired Missouri Form of Convertible Promissory Note, Preferred Stock.

Every single format you put into your bank account lacks an expiry particular date and it is your own property permanently. So, if you want to download or printing yet another backup, just check out the My Forms section and then click around the kind you need.

Gain access to the Missouri Form of Convertible Promissory Note, Preferred Stock with US Legal Forms, probably the most comprehensive local library of lawful papers layouts. Use thousands of expert and express-specific layouts that satisfy your organization or specific requires and demands.

Form popularity

FAQ

A promissory note is a form of debt that companies and individuals sometimes use, like loans, to raise money. The issuer, through the notes, promises to return the buyer's funds (principal) and to make fixed interest payments to the buyer in exchange for borrowing the money.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

A convertible note is a debt instrument often used by angel or seed investors looking to fund an early-stage startup that has not been valued explicitly. After more information becomes available to establish a reasonable value for the company, convertible note investors can convert the note into equity.

The SAFE is legally a contract of the issuer, constituting an agreement to issue equity in the future at a purchase price paid in advance. It is not debt and, unlike a convertible promissory note, accrues no interest and has no maturity date.

Advantages of convertible notes for capital raising: Flexibility: Convertible notes provide flexibility for both the investor and the startup. Investors can convert their debt to equity if the company meets certain conditions, and startups can avoid setting an initial valuation until later rounds of funding.

A convertible note is a short-term debt agreement that converts into equity at a future date. Usually, this happens when one of these events takes place: The company raises enough capital to reach a pre-determined benchmark. The term of the loan expires.

Also known as convertible promissory notes, bridge notes, or convertible debt. Since convertible notes are securities, they must be registered, or qualify for an exemption from registration, under the Securities Act.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.